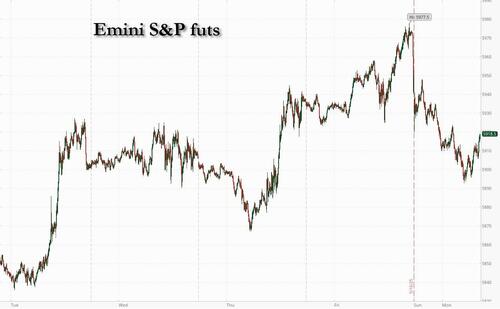

US equity futures and bond yields are sharply higher across the curve as market react to Moody's greatly delayed downgrade to US credit on Friday (it follows 14 years after S&P did the same in August 2011), with the USD trading broadly lower, gold higher and macro credit trading notably wider. As of 8am ET, S&P 500 contracts fell 1.0% and Nasdaq 100 futures down 1.4%, with investors cooling on equities after a five-day winning streak, and up 7 of the past 8 days. Pre-mkt, MegaCap Tech names are down 2-4% with Semis/Cyclicals under pressure. European and Asian shares also dropped. The yield curve is bear steepening with the 30Y yield surpassing 5% and hitting its highest level since Nov 2023 and the USD selling off: the euro rose as much as 1.1% as all major currencies advanced against the greenback. Commodities are mixed with energy/base lower and precious/ags higher. Looking ahead today, there are no major economic data releases. Fed voters Williams, Jefferson, and non-voters Logan, Kashkari and Bostic are scheduled to speak today.

In premarket trading, Mag 7 stocks are lower as risk appetite broadly falters (Tesla -3.5%, Nvidia -2.7%, Meta Platforms -1.9%, Alphabet -1.8%, Amazon -1.8%, Apple -1.5%, Microsoft -0.9%). Nvidia is in focus after CEO Jensen Huang showed new technologies from faster chip systems to software aimed at sustaining the AI boom at Computex in Taiwan. Alibaba shares slumped in Asia after a report that the Trump administration has raised concerns over its potential AI deal with Apple. Cryptocurrency-linked stocks including Coinbase, Robinhood and MicroStrategy fall, tracking the price of Bitcoin lower amid the risk-off mood. Here are some other notable premarket movers:

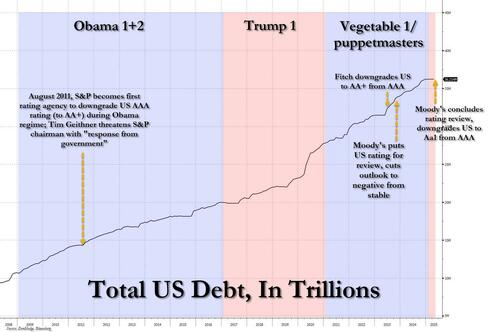

Global markets are slower after Friday's Moody's downgrade of the US credit rating to Aa1 (vs AAA prev), which was attributed to "increased interest payments on debt, rising entitlement spending, and relatively low revenue generation. While markets have reacted this AM, Goldman notes that Moody’s has had a negative rating outlook since November 2023, and has lagged the other two major rating agencies, S&P and Fitch, in the downgrade to AA+. Bessent comments yesterday are also helping price action, with the Treasury Sec noting that Liberation Day tariffs may be reimposed if countries do not negotiate "in good faith" before the 90 day pause expires on July 9th.

Monday’s pullback comes after the S&P 500 saw a nearly 20% rally from April lows, and the market was probably ripe for a retreat after such a V-shaped bounce.

Besides the sellin in stocks, we have also seen a concurrent slide in rates, with 30-year Treasury yields hitting 5.03%, at the highest since November 2023. As Bloomberg notes, the 30-year yield is in an uptrend since the March 2020 low, broke the long-term channel downtrend dating back to 1987 peak in December 2022.

Morgan Stanley’s Michael Wilson said investors should buy dips triggered by rising yields, as the trade truce between China and the US has lowered the odds of a recession. Among other strategists, Goldman’s David Kostin said Mag 7 stocks are likely to outperform this year, driven by robust earnings growth. RBC’s Lori Calvasina, however, sees more cuts to S&P 500 earnings estimates ahead, and said the market may be “a little ahead of itself from a fundamental perspective.”

“The current level of yields on US Treasuries doesn’t feel out of touch with economic fundamentals,” said Stephane Deo, senior portfolio manager at Eleva Capital in Paris. As for equities, “it feels very normal to me that the market needs a breather and the Moody’s downgrade is good excuse for doing just that.”

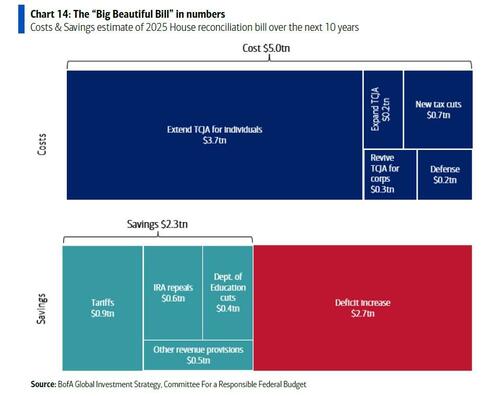

With the US deficit in focus, investors will also be parsing Trump’s giant tax and spending package. A key House committee advanced the legislation late Sunday night after Republican hardliners won agreement from party leaders to speed up cuts to Medicaid coverage.

In Europe, the Stoxx 600 falls 0.7% with technology shares the worst performers, followed by mining and real estate names; Estoxx 50 is down 0.7% with underperforming sectors including consumer discretionary and info tech. Here are some of the biggest European movers:

Earlier in the session, Asian stocks were set for their longest run of losses in over a month, with tech shares leading the retreat following Moody’s downgrade of the US’ credit rating. The MSCI Asia Pacific Index dropped 0.2% to head for a third day of declines, the longest streak since April 7. Chipmakers TSMC and Samsung were among the biggest drags as Treasury yields advanced. Alibaba’s shares slid after a report said that the Trump administration has raised concerns over Apple’s potential deal with the company on AI features. South Korea’s benchmark fell the most in a month, while gauges in Taiwan and Australia also slipped.

Moody’s downgrade “hammers home questions about the appropriate value of US government debt and begs the question whether the downgrade may shift investment mandates by portfolio managers, treasurers and other investors,” said Kyle Rodda, a senior market analyst at Capital.com. “A weak batch of Chinese economic data weighed on market sentiment slightly.”

In FX, the Dollar is starting off the week on the backfoot, weighed on by the Moody downgrade on Friday and weekend headlines from Bessent. EUR is leading gains, trading 100 bps higher as FX vols turn bid across G10 pairs with EUR 1m now trading at 8.4vols (+0.9v overnight). JPY is also gaining this morning (+60bps vs USD) as short dated downside remains bid while people add positions over the Kato-Bessent meeting later this week with ~35bp implied gap in USDJPY. Despite the broadly weaker Dollar this morning and the lowest USDCNY fix since early April (7.1916), USDCNH is trading flat after local data came in weaker than expected. Activity weakened in April, reflecting both the negative impact of increased US tariffs and still-soft domestic demand. Our economists now forecast USDCNY to gradually move lower through the year, shifting from a headwind to a tailwind to many EM currencies, for which the cross is an important anchor. EM currencies that can benefit the most in this environment are those (i) with a larger undervaluation signal, (ii) with a positive beta to CNY and to risk more broadly, (iii) where conversion of USD deposits can have large flow impacts, and (iv) where carry contributes positively to total returns.

In credit, macro credit is opening the first trading session of the week notably wider in sympathy with equity futures, after closing Friday a touch firmer in an underperformance relative to equities in the risk-on tape. As a whole, last week saw CDX IG move over -7bps tighter and CDX HY rise nearly +1.75pt following positive developments on the US/China trade tariff negotiations front. Sharp downward price action in the distressed credit universe (NFE Inc, LINTA, SAGLEN) were front and center throughout the week on the micro front, some of which impacted CDX HY curves and led to some curve steepening. With CDX spreads back in the ~55bps neighborhood, the desk saw a resumption of hedge-setting demand both in one-delta and vol -- with the latter continuing to be better bid, particularly tail.

In rates, treasuries near lows into the early US session, after extending Friday’s late selloff on the back of Moody’s Ratings stripping the US government of its top credit rating. Leading the selloff, 30-year yields top 5%, steepening the curve. 10-year Treasury yields advanced seven basis points to 4.54% and their 30-year equivalents rose about eight basis points to 5.02%. European rates are also higher while stock futures are under pressure ahead of the cash open. US yields are 1bp to 8bp cheaper across maturities, with 2s10s curve steeper by ~6bp, 5s30s by ~4bp; 10-year is near 4.55%, higher by 7bp since Friday’s close, with Gilts faring worse than their German peers. UK 30-year yields rise 9 bps to 5.49%. This week’s Treasury auctions include $16 billion 20-year new issue Wednesday and $18 billion 10-year TIPS reopening Thursday.

In commodities, oil prices are lower ahead of a phone call between US President Trump and Russian President Putin later on Monday. WTI is down 0.6% at $62.10 a barrel. Meanwhile, gold rose 1.2% or $36 to around $3,240/oz, with appetite for the haven asset boosted by concerns about the US economic outlook.

Today's US economic data calendar includes April leading index (10am). Fed speaker slate includes Bostic (8:30am, 2:45pm), Jefferson and Williams (8:45am), Logan (1:15pm) and Kashkari (1:30pm)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued following the US sovereign rating downgrade by Moody's which spurred a mild 'sell America' impulse, while participants also digested mixed Chinese activity data. ASX 200 declined with underperformance in the commodity-related sectors but with the downside stemmed ahead of tomorrow's RBA rate decision in which money markets are pricing around a 99% likelihood of a 25bps cut. Nikkei 225 retreated amid currency-related headwinds while the data calendar for Japan is very light to start the week and BoJ Deputy Governor Uchida stuck to the script in which he maintained the rate hike signal should prices improve as forecast. Hang Seng and Shanghai Comp were lacklustre amid the glum mood across the Asia-Pac region but with the downside in the mainland limited after mixed Chinese data in which Industrial Production topped forecast but Retail Sales disappointed, while the latest House Prices continued to contract Y/Y albeit at a slightly slower than previous pace.

Top Asian News

European bourses (STOXX 600 -0.5%) opened lower across the board and have been trading sideways throughout the morning. Pressure which follows on from a mostly negative APAC session, stemming from Moody's downgrading the US. European sectors opened mixed but now display a mostly negative picture. Optimised Personal Care tops the pile, joined closely by Insurance and then Healthcare. Real Estate lags given the yield environment.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

Central Banks Speakers

DB's Jim Reid concludes the overnight wrap

In terms of heartwarming domestic news this morning, regular readers will remember my daughter Maisie suffered from Perthes disease between the ages of 5 and 7, spending months on crutches and then over a year in a wheelchair after a major operation. Her hip ball had disintegrated and there was no guarantee it would regrow or would regrow in the right shape. It could have been a childhood of limping and constant pain. However we were fortunate it did regrow while in the chair and over the last 2 and a half years she’s got stronger and stronger with the only thing we don’t allow being trampolining. Therefore imagine our immense surprise when last week she got picked to represent her school at the long jump in an U9 event with five other schools! I couldn’t have imagined anything less likely three years ago. My wife and I were a bit nervous about letting her do it but in the end she came second. She swims four times a week for her artistic swimming club and I can only think this has done her a world of good in terms of strength. So we were delighted for her, especially given all she went through.

In terms of what the market has been through in recent weeks, I think we could all do with a lie down and there are some hopes of that this week given the scarcity of front line data. However as we know the headlines will keep coming, especially with regards to trade.

It‘s likely that fiscal developments in Washington will take centre stage with the House expected to vote on its reconciliation package this week just as Moody's removed the US's last remaining triple-A rating late on Friday night. As our economists discussed last week (see "Tax bill details suggest still-elevated deficits in the near term'), though the specific components of additional tax cuts on top of the TCJA extension differed from what they had previously outlined (see "US outlook: Tariff-struck"), the JCT score of the Ways and Means mark-up was largely in line with our top-line deficit assumptions. Assuming House Republicans are able to resolve their outstanding policy disagreements and vote on the tax package this week, the Senate will then start to mark up the bill, where even more policy disagreements await. One thing stands out though, and that is that at this stage there are no signs of any serious deficit restraint.

On that topic, Moody's cut the US credit rating on Friday night from Aaa to Aa1 (stable outlook). This is a major symbolic move as Moody's were the last of the major rating agencies to have the US at the top rating. Moody's have had them on watch since November 2023 and if there is going to be a change then it tends to happen within 12-18 months so this news shouldn't have been unexpected. Remember S&P was the first to downgrade the US from AAA back in August 2011 which brought a brief market panic at the time. The S&P 500 fell -6.7% on August 8th (the Monday after the cut) while Treasuries actually rallied 20bps on a flight to quality bid. A slightly different reaction this time given they are "only" playing catch-up on one hand, but with debt sustainability now more of a concern on the other. 10yr USTs spiked +4bps in very late trading on Friday on the news. This morning 10 and 30yr USTs are another +3.8bps and +5.2bps higher, respectively, with the latter now at 5% again and +10bps higher than just before the announcement late on Friday. If we stay at these levels this would be a higher yield than that seen at the worst close after Liberation Day. In fact it's only just over 10bps below the highest point in 2023 when inflation concerns were still bubbling. Prior to that you'd have to go back to 2007 to see 30yr yields higher than current levels.

S&P 500 (-1.0%) and NASDAQ (-1.27%) futures are also weaker on the news along with the Dollar (-0.26%). Mixed China data isn't helping the general Asia mood with Retail Sales growth slowing to +5.1% y/y in April, falling short of Bloomberg's forecast of +5.8% and down from +5.9% in the previous month. Fixed-asset investment for the first four months of this year increased by +4.0%, slightly below the anticipated +4.2%. The real estate sector continues to exert downward pressure on fixed asset investment, with a year-on-year decline of -10.3% as of April. Nevertheless, industrial production has exceeded expectations, growing by +6.1% y/y in April, compared to the expected +5.7%, although this represents a slowdown from the +7.7% increase recorded last month.

In the region, the KOSPI is the most affected equity market, down by -1.23% this morning, while the Nikkei (-0.74%), the Hang Seng (-0.49%), the CSI (-0.38%), and the S&P/ASX 200 (-0.62%) are also lower.

The flash global PMIs for May released on Thursday will be the main data focal point this week given that it should fully cover a period of trade uncertainty. European numbers are expected to edge up with US numbers broadly flat.

Elsewhere inflation in Canada (tomorrow), the UK (Wednesday - preview here) and Japan (Friday - preview here) will be of note. Other things to watch are the RBA decision tomorrow, where DB expect a 25bps cut (preview here), the account of the April ECB decision, the German Ifo and US jobless claims, all on Thursday. This week’s jobless claims corresponds to payrolls survey week so it will allow us to refine our current +125k forecast for May. The full day-by-day week ahead is at the end as usual but there’s not a lot of high profile releases. There are though plenty of central bank speakers and these are also highlighted in that calendar. Many are speaking at the Atlanta Fed's annual Financial Markets Conference in Amelia Island, Florida which starts today through to Thursday. Other things to note are the UK-EU summit will be in London today. Then tomorrow, G7 finance ministers and central bankers convene in Canada (through May 22) and the EU's foreign and defence ministers meet in Brussels.

Recapping last week now and risk markets had another strong run with the S&P 500 up +5.27% as it advanced for all five days to post its second best weekly gain since 2023. The bulk of its gains came last Monday (+3.27%) as the US and China dramatically slashed their reciprocal tariff rates for 90 days. The Mag-7 (+9.30% on the week) led the recovery, with tech stocks also helped by a series of deals coming out of Trump’s Middle East tour. On Friday, Trump announced that the US would be “sending letters out” to 150 countries on its new tariff rates over the next two to three weeks. US equities responded positively to the news, with the S&P 500 up +0.70% on Friday. Although Bessent did explain to NBC over the weekend that those not negotiating in good faith will receive the letter with the rate announced on Liberation Day.

The positive backdrop last week saw the VIX index post a sixth consecutive weekly decline (-4.66pts) to its lowest level since mid-February at 17.24. Other risk assets also saw a strong week, with US HY credit spreads falling -38bps to 205bps. The gains were more moderate in Europe, with the STOXX 600 rising +2.10% (+0.42% Friday), while the DAX rose +1.14% (+0.30% Friday) to a new record high. By contrast, gold lost ground amid the risk-on mood, seeing its biggest weekly decline since November (-3.65%).

In the rates space investors pared back their expectations of Fed rate cuts, with the amount of cuts priced by December falling -16.5bps to 49bps on the week. This marks the first time since February that the market expects less than two Fed rate cuts in 2025 and the move came despite softer than expected US CPI and PPI data on Wednesday and Thursday. By contrast, the latest U. Mich survey data showed 1-year median inflation expectations shooting up to +7.3% (vs +6.5% expected), even as consumer sentiment fell to its second lowest level on record. 10yr Treasury yields rose for a third week running, up +10.0bps (+4.7bps Friday) to 4.48%, while 30yr yields rose +11.0bps to their highest weekly close since January at 4.94%. As discussed above, friday’s sell off in Treasuries was mostly due to a late spike on the Moody’s US downgrade news.

Lastly, European bonds saw more muted moves, with 10yr bund yields up +2.8bps to 2.59% (-3.1bps Friday), but OAT (-0.2bps) and BTP (-1.3bps) yields were marginally lower over the week as sovereign spreads continued to grind lower.