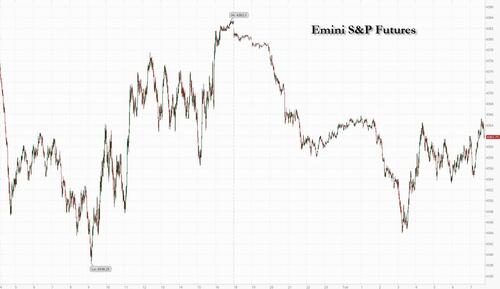

US equity futures are weaker, reversing Monday's modest gains amid a global risk-off tone that has sent European and Asian markets sliding, and which JPM's market intel team says is "a trend that may continue throughout the week." As of 7:30am, S&P futures were down 0.4%, off the worst levels of the session, while Nasdaq 100 futures are down 0.5%. Yields on TSYs and European govvies dropped after hitting decade highs even as the Bloomberg dollar index extended gains following its strongest close since December. Oil retreated as the impact of a rising dollar sapped demand. There is a $48bn auction for 2Y bonds today; this likely requires some concession to be digested and is the first of several auctions this week that are larger than normal size. Today’s macro data focus includes housing prices, new home sales, regional Fed activity surveys, and consumer confidence.

In premarket trading, Tesla shares were 1.5% lower, after Bloomberg reported that during the evidence-gathering that precipitated this month’s surprise announcement of an EU anti-subsidy probe into Chinese EVs, the US carmaker was among the companies found to have likely benefited, according to people familiar with the matter. Coty was down 3.3% after offering 33 million shares as part of a plan by the beauty company to add a Paris stock listing. Thor Industries dropped 2.4% even after the recreation vehicle firm reported net sales that beat estimates, with analysts citing potential slower production and revenue rebound pace as well as a challenging macroeconomic backdrop. Here are some other notable premarket movers:

Overnight, JPM CEO Jamie Dimon warned the world may not be ready for a worst-case scenario of the Fed raising rates to 7% along with stagflation; at the same time Minneapolis Fed chief Neel Kashkari said he expects one more hike this year.

The threat of tight policy is undoing some of the market’s biggest gains this year, in high-flying tech stocks. These growth companies are prized for their long-term prospects but hold less appeal when future profits get discounted at higher rates. That’s reflected in growing short positions against the technology-heavy Nasdaq 100 Index. According to Citi, positioning in the Nasdaq 100 is now one-sided net short at $8.1 billion, with all long positions unwound.

“With weak but positive growth holding recession at bay on both sides of the Atlantic, central banks will not be able to ease financial conditions between now and the end of the year,” said Nadège Dufossé, global head of multi asset funds at Candriam. “With positive surprises now largely priced in, there seems to be little room for further appreciation in equity markets, suggesting a degree of caution on risky assets.”

One Fed speaker after another in the past week has delivered emphatic messages that they will keep policy tighter for longer if the economy is stronger than expected. Federal Reserve Bank of Minneapolis President Neel Kashkari said he expects the US central bank will need to raise interest rates one more time this year. Data on US consumer confidence and manufacturing activity expected later Tuesday could provide more clues on the outlook for the economy and monetary policy.

Elsewhere, Bloomberg reported that Senate Republicans and Democrats are closing in on a deal for a short-term spending measure designed to avert a government shutdown. The legislation would extend funding for four to six weeks, a shorter timeframe than Democrats had pushed for, although it may cost speaker Kevin McCarthy his job. Moody’s warned that a government shutdown would be credit-negative.

In the latest development surrounding the Detroit-3 strikes, Joe Biden will visit a UAW picket line in Michigan later today. His trip comes as Ford’s largest labor union blasted it for halting construction on a $3.5 billion battery plant in the state. Adding to labor woes, performers in the video-game industry voted to authorize a strike.

European stocks dropped for a second day, with the Stoxx 600 down 0.4% as China property worries persist and investors process sharply higher bond yields. Technology and consumer shares fall the most while insurance and health care gain. Luxury stocks including Richemont and LVMH drop after Morgan Stanley lowered its earnings estimates on the sector, while Barclays is the Stoxx 600 index’s best performer after an upgrade. Here are the biggest movers on Tuesday:

Earlier in the session, Asian stocks declined for a second day as surging Treasury yields and the ongoing property crisis in China dampened risk appetite. The MSCI Asia Pacific Index falls as much as 0.7%, with technology firms among the biggest drags on the gauge amid worries over higher-for-longer interest rates. Chinese stocks extended their slide, with a gauge of property developers slumping by the most in nine months as Evergrande missed a debt payment and former executives were detained. Former executives at the company have also been detained, while there are issues facing other developers like China Oceanwide and Country Garden too. The new turmoil engulfing property developers could jeopardize the latest efforts by authorities in the country to end the housing crisis.

“Ongoing China Evergrande’s debt-restructuring woes suggest that the worst-is-over for China’s property sector is far from being seen,” Yeap Jun Rong, market strategist at IG Asia, wrote in a note. High bond yields and a firmer US dollar “did not provide much conviction for risk-taking for now,” he said.

In FX, the Bloomberg Dollar Spot Index rose as much as 0.3% to a nine-month high. USDCHF rose as much as 0.3% to 0.9151, the highest since April; franc’s selloff enters a 11 day, the longest losing streak since 1975. USDJPY little changed at 148.84; it rose earlier to 149.19 and fell sharply after Japanese Finance Minister Shunichi Suzuki’s warnings.

In rates, Treasury futures are higher on the day, unwinding a portion of Monday’s losses and following similar gains in core European rates. Curve has broadly held recent steepening move with 5s30s spread trading at around 4bp, near top of Monday’s range, while 2s10s spread is slightly flatter on the day. US session includes housing market and consumer confidence data, while auctions recommence with 2-year note sale. US yields are richer by 1bp to 3bp across the curve with gains led by 10-year sector, which trades around 4.505%, near day’s low; bunds trail by ~1bp in the sector while gilts trade broadly in line. The US 5s30s spread is steeper by 0.5bp on the day, while 2s10s is flatter by almost 2bp, unwinding portion of Monday’s sharp widening. Treasury auctions resume with $48b 2-year note sale at 1pm, with $49b 5-year and $37b 7-year notes scheduled later this week.

In commodities, crude futures decline with WTI falling 1.1% to trade bear $88.70. Spot gold falls 0.2%.

Looking to the day ahead now, and data releases from the US include the Conference Board’s consumer confidence for September, the Richmond Fed’s manufacturing index for September, new home sales for August, and the FHFA house price index for July. Central bank speakers include the Fed’s Bowman, and the ECB’s Lane, Simkus and Holzmann.

Market Snapshot

Top Overnight News

A More detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower with headwinds from the rising global yield environment. ASX 200 was subdued by underperformance in real estate and tech as domestic yields climbed. Nikkei 225 was pressured following the acceleration in Services PPI data and as recent currency moves keep participants on their toes regarding FX intervention. Hang Seng and Shanghai Comp declined with sentiment not helped by trade frictions after the US imposed restrictions on additional Chinese and Russian companies related to supplying Russia with components to make drones, although losses in the mainland were stemmed by another substantial liquidity operation and hope that the approaching Mid-Autumn Festival and National Day Golden Week holidays would provide a boost to consumption and economic activity.

Top Asian News

European bourses are on the backfoot but off the worst levels seen at the cash open despite a lack of fresh fundamental headlines, with the UK's FTSE outperforming on a weaker GBP. Sectors in Europe are mostly lower with a slightly more defensive bias vs the cash open, with Healthcare and Utilities towards the top of the bunch while Tech remains the laggard. US futures are pressured amid a generally negative risk tone across the market and a lack of any fresh catalysts.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Central Bank speakers

DB's Jim Reid concludes the overnight wrap

Morning from New York where it seems I've taken London type weather with me. It was another stormy day for duration yesterday with fresh milestones reached across several different asset classes. Just to give you a sense of what happened: the 10yr Treasury yields rose +10.0bps and closed comfortably above 4.5% for the first time since 2007; 10yr real yields were near 15yr highs; the 10yr bund yield traded above 2.8% for the first time since 2011; the VIX index of volatility flirted with its highest level since May intra-day; the US dollar index hit a YTD high; and European natural gas prices reached their highest level in almost 6 months. And if that weren’t enough, we remain days away from a potential US government shutdown, unless Congress can agree to pass funding beyond September 30. So a pretty tough backdrop for just about everything. Having said that, the S&P 500 recouped a little of its recent losses to close +0.40% higher, as positive AI demand rhetoric from Amazon and a likely end to the Hollywood writers’ strike boosted tech sentiment.

Of course, the biggest story yesterday was the dramatic rise in sovereign bond yields, which left them at multi-year highs on both sides of the Atlantic. For example, the 10yr US Treasury yield ended the day up +10.0bps at a post-2007 high of 4.53%, and overnight they’re up a further +1.6bps to 4.55%. Meanwhile, the 30yr yield rose +12.8bps to a post-2011 high of 4.65%, and is up +1.6bps overnight to 4.67%. Watch out for the latest 30yr mortgage rates! The recent rise in yields is partly because investors are pricing in that policy rates will remain higher for longer, particularly after the Fed’s dot plot last week. But it’s also been driven by the growing realisation that supply is set to remain elevated given mounting budget deficits, along with a small uptick in longer-term inflation expectations. Indeed, although real rates led the moves in longer-dated yields (10yr +11.7bps to 2.17%), the 30yr inflation breakeven was still up +1.0bps yesterday to 2.39%, which is its highest level in over 6 months. My CoTDs over the last two days have shown that 10yr USTs are now at their 230 plus year average again and that c.86% of time over that period, 10yr rolling inflation has averaged below 4.5%. So after a decade plus of having little value in historical terms, it is finally a competitive asset class again against others such as equities, which raises the question about what return equity investors should demand going forward. See the two here and here.

For European sovereigns it was a similar yield rising story yesterday. Yields on 10yr bunds (+5.6bps) closed at their highest level since 2011, at 2.79%, and those on 10yr OATs (+5.7bps) closed at their highest since 2012, at 3.34%. That said, there was a modest rally at the front end, with 2yr bunds yields down -2.1bps. The moves came with the backdrop of comments by ECB President Lagarde, who said to the European Parliament that rates “will be set at sufficiently restrictive levels for as long as necessary”. This reiterates the language from the ECB press conference back on September 14.

US equities showed resilience to the bond sell off, with the S&P 500 rebounding +0.40% from its 3-month low on Friday, and ending a run of four consecutive declines. Tech mega caps outperformed, with the Magnificent Seven index up +0.87%. Meanwhile, real estate, utilities and consumer staples were the underperformers in the S&P 500 with the higher rates story. As a reminder of the narrow nature of this year’s equity rally, the equal-weighted version of the S&P 500 is up only +1.28% YTD (+0.25% yesterday) compared to +12.97% for the headline S&P 500. Over in Europe, the equity moves were more definitively negative, and the STOXX 600 (-0.62%) fell to a one-month low.

Another important development yesterday was a fresh rise in European natural gas prices, which hit their highest level since April, at €44.44/MWh. Now it’s worth noting that the situation is far better than this time a year ago, when prices were still above €150/MWh, and European gas storage is also more plentiful and secure relative to 12 months ago. But clearly, the latest increase in natural gas prices is an unhelpful development when there’s been other signs that the European economy is slowing. Speaking of which, the Ifo’s business climate indicator from Germany came in at 85.7 in September. That was better than the 85.2 reading expected, but still beneath the revised 85.8 reading from August, which means that the index has fallen for 5 consecutive months now.

Whilst there were growing signs of a slowdown in Europe, the US Dollar continued to strengthen yesterday, with the dollar index (+0.39%) reaching its highest level of 2023 so far, and overnight it’s inched up another +0.02%. Conversely, that pushed the euro beneath the $1.06 mark for the first time since March, whilst sterling also fell to a 6-month low of $1.2212 just as I visit the Apple Store in Manhattan this week. That comes as US real yields have hit their highest in years, and the 30yr real yield (+11.7bps) surpassed its recent peaks in 2010 and 2011 yesterday to close at its highest level since 2009, at 2.27% .

Overnight in Asia we’ve seen more negative sentiment in markets, including losses for all the major equity indices. That includes the KOSPI (-1.22%), the Nikkei (-0.98%), the Hang Seng (-0.84%), the CSI 300 (-0.45%) and the Shanghai Comp (-0.33%). And as it stands, the Hang Seng is currently on track to close at its lowest level since November. We’ve also seen some headlines return about issues in the Chinese property sector, after Evergrande said yesterday that their mainland unit missed an onshore bond payment. Their shares fell by -21.82% yesterday, and overnight they’re down a further -6.98%. Looking ahead, US equity futures are pointing to renewed losses, with those on the S&P 500 down -0.32% this morning.

Looking at yesterday’s other data, the Dallas Fed’s manufacturing index unexpectedly fell to -18.1 in September (vs. -14.0 expected) even if the comments in the press conference were a little more upbeat.

To the day ahead now, and data releases from the US include the Conference Board’s consumer confidence for September, the Richmond Fed’s manufacturing index for September, new home sales for August, and the FHFA house price index for July. Central bank speakers include the Fed’s Bowman, and the ECB’s Lane, Simkus and Holzmann.