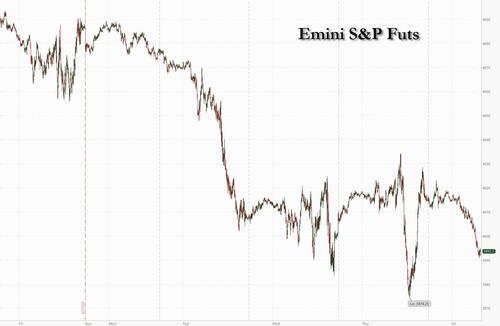

US index futures reversed Thursday's rebound, and dropped as investors braced for data that may show accelerating inflation in the world’s largest economy. European stocks erased an earlier gain, while Asian equities fell on a quiet day for global markets. Contracts on the S&P 500 slipped 0.6% while those on the Nasdaq 100 fell 0.7% by 7:45a.m. ET. Friday sees the release of the personal consumption expenditures index, the Fed’s preferred price gauge, which is expected to show acceleration amid robust income and spending growth. The dollar rose amid concern over disappointing earnings and geopolitical tensions, and as the Yen tumbled after the confirmation hearing of Ueda's proved to be far less hawkish than some expected.

In premarket trading, Beyond Meat jumped after its fourth-quarter net revenue topped analyst expectations, Boeing slipped after the planemaker paused deliveries of its 787 Dreamliner due to a documentation issue although analysts said they expect this to be a short-term issue, noting that it was due to non-compliance with paperwork. Warner Bros Discovery shares fell 5% in premarket trading on Friday after the parent of TNT, CNN and other TV networks reported quarterly sales that came in below analysts’ estimates. While the advertising market remains challenging, the worst of the merger integration period is behind them, analysts say.

Warner Bros Discovery fell after reporting quarterly sales that missed analysts’ estimates. Alibaba and NetEase lead a decline in US-listed Chinese stocks, with both internet companies’ results failing to offer a fresh boost as the rally spurred by China’s reopening wears off. Here are the other notable premarket movers:

After hot prints on consumer and producer prices, a high reading in today’s PCE report could weigh on markets. The S&P 500 is headed for a third week of declines, with traders taming their optimism about the outlook for the economy as Fed officials promise further rate hikes to subdue soaring inflation.

“In the context of an inflation shock, a global energy crisis and the fastest rate-hike cycle in history, we have to assume that with a time lag there will be an economic consequence,” Sonja Laud, chief investment officer at Legal & General Investment Management, said on Bloomberg Television.

But central banks’ determination to take rates for higher for longer is not their only worry: decelerating growth, sluggish corporate performance, geopolitical tensions from Russia to North Korea, and centralization of power in China all complicate the investment landscape.

“Investors worry that this unexpected strength in the US economy, coupled with a steady reopening of the Chinese economy, will fuel further inflation which would lead the Fed to pursue a more aggressive tightening cycle,” said Geir Lode, the head of global equities at Federated Hermes. “Looking ahead, we see mixed signals: leading economic indicators continue to point to a recession, but lagging economic indicators show no signs of weakness, yet.”

European equity indexes faded earlier gains, with outperformance in the construction, utility and energy sectors while chemicals and travel lagged. The Stoxx 600 was down 0.1% after gaining 0.3%, but the DAX falls 0.6% after data showed the German economy contracted more than previously thought in the fourth quarter. BASF shares slide as much as 6% after the global chemicals giant halted share buybacks and gave an outlook that analysts deemed as muted. Here are the biggest European movers:

Earlier in the session, Asia’s stock benchmark dropped, heading for a fourth-straight weekly loss, as disappointing tech results dragged down China’s equity market and investors remained vigilant before the release of key US economic data. The MSCI Asia Pacific Index slipped as much as 0.7%, reversing earlier gains. Stocks in Hong Kong continued to drop after entering a technical correction Thursday; a gauge of Chinese technology stocks listed in Hong Kong tumbled 3.3%. NetEase Inc. slumped after a profit miss, while Alibaba Group Holding Ltd. fell as analysts remained cautious about its sales growth prospect. Meanwhile, Chinese President Xi Jinping was set to bring decision-making of the financial system further under his control with the revival of a powerful committee.

“A lot of the momentum in China has come in so it’s important to be discerning and look for the quality stocks that are more reasonably valued,” Julie Ho, an Asia ex-Japan equities portfolio manager at JPMorgan Asset Management, told Bloomberg Television. Japanese stocks advanced as Bank of Japan Governor nominee Kazuo Ueda said current policy easing was appropriate. He spoke at a parliamentary hearing in the approval process for his appointment. South Korean stocks slid as foreign investors turned net sellers for the first week this year amid concerns over the impact of tighter global monetary policy on the nation’s tech-heavy equity market. Malaysian stocks pared losses ahead of the annual budget presentation. Traders in Asia are awaiting US inflation numbers due today, after mixed data Thursday muddied the outlook for Federal Reserve policy. Gains in Asian stocks have stalled this month amid renewed worries of US policy tightening and a lack of positive catalysts for heavyweight Chinese shares. The MSCI Asia gauge is down almost 2% this week.

Japanese stocks rose as Bank of Japan governor nominee Kazuo Ueda backed continued easing in his confirmation hearing in parliament. Ueda said it will still take time to hit the central bank’s target for stable 2% inflation, adding that continuing with stimulus is appropriate for now. “Comments by Ueda came as no surprise — since he didn’t signal policy would change abruptly, the market is relieved,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank Ltd. “Ueda is taking taking a very cautious stance, which is very positive for the stock market.” The Topix rose 0.7% to close at 1,988.40, while the Nikkei advanced 1.3% to 27,453.48. Banks dropped while real estate stocks rose. Tokyo Electron contributed the most to the Topix gain, gaining 7.1%. Out of 2,161 stocks in the index, 1,571 rose and 507 fell, while 83 were unchanged.

Australia's S&P/ASX 200 index rose 0.3% to close at 7,307.00, as all sectors aside from mining advanced. Banks and industrials boosted the benchmark most. Still, the benchmark caped its third straight weekly loss, dropping 0.5%. In New Zealand, the S&P/NZX 50 index rose 0.2% to 11,905.

Key stock gauges in India posted their biggest weekly drop in eight months as investors continue to avoid riskier assets globally on the prospect of higher interest rates. Most stocks related to the Adani Group declined on Friday as the monthlong selloff in the conglomerate’s shares neared $150 billion. Selling in shares of the ports-to-power conglomerate has continued despite its efforts to reassure investors about its strategy and debt reduction plans. The S&P BSE Sensex fell 2.5% for the week, its biggest retreat since June 19, while the NSE Nifty 50 Index declined 2.7%. On Friday, the benchmark Sensex fell 0.2% to 59,463.93 in Mumbai, while the Nifty declined 0.3%.

In FX, the Dollar Index is up 0.1%, advancing for the third time in four days. The Australian dollar and Japanese yen are the weakest among the G-10’s.

In rates, treasuries are under pressure as US trading day begins, with yields inside Thursday’s rally ranges but near YTD highs reached this week. Yields are higher by 2bp-4bp, 10-year by 3bp at 3.91%; the 10-year yield is ~10bp higher on week and ~40bp higher over past five weeks. Thursday’s ranges included YTD highs for 5- and 10-year. The market is headed for its fifth straight weekly loss, having all but erased January’s gains amid hawkish repricing of Fed policy outlook. UK and German 10-year yields are little changed.

Fed swaps nearly fully price in a third 25bp rate increase in June, following expected moves in March and May. Next week brings a large quarterly month-end index rebalancing with the potential to drive buying, and Treasury coupon auctions resume March 7.

In commodities, oil extended Thursday’s advance amid strength in commodity currencies and optimism over China’s reopening. Crude futures advance with WTI rising 1.2% to trade near $76.30. Spot gold is little changed around $1,822.

Bitcoin was on pace for its second monthly advance, breaking with stocks and other riskier assets

Looking at the day ahead now, there’s a heavy data calendar in the US with personal income and spending data, along with the Federal Reserve’s preferred inflation measure, coming at 8:30 a.m. Later, there are reports on new home sales and sentiment as well as a number of Fed comments, including from Loretta Mester and James Bullard.

Market Snapshot

Top Overnight News from Bloomberg

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly rangebound after the choppy but positive performance on Wall St where markets spent most of the session recovering from the initial data-induced selling. ASX 200 was positive with the index led by outperformance in tech although gains are limited amid another batch of earnings releases and continued weakness in the mining industry. Nikkei 225 outperformed as the focus centred on comments from BoJ Governor nominee Ueda at the lower house confirmation hearing in which he noted that current monetary policy is appropriate and that Japan still needs more time for inflation to sustainably hit the 2% target. Hang Seng and Shanghai Comp. were lower after a substantial liquidity drain by the PBoC and as the US looks to include Chinese companies in a fresh round of Russian sanctions, while Hong Kong underperformed amid heavy losses in tech owing to weaker earnings from NetEase.

Top Asian News

European bourses are contained/slightly firmer, Euro Stoxx 50 +0.1%, with fresh drivers limited as the focus is on geopolitics and upcoming US data. Sectors are predominantly in the green, with Construction names bolstered post-Saint Gobain while Basic Resources lag slightly given recent commodity action. Stateside, futures are softer but with the ES still above 4k, the NQ -0.7% is the laggard following some recent pressure in the fixed income complex.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Fed speakers

DB's Jim Reid concludes the overnight wrap

It’s a sobering double anniversary today as it marks 1 year to the day that Russia invaded Ukraine and 3 years to the day that we saw the first big covid related sell-off after Italian cases spiked over the prior weekend. The world has been forever changed by those events with the full implications likely to reverberate for many years to come.

Indeed the aftershocks are still being felt every day in markets (good and bad). This has continued this week, with intraday volatility remaining high. Risk assets whipsawed yesterday, with the S&P 500 up nearly +1.0% in early trading before selling off -1.5% in the late US morning following further upward revisions to inflation data in the US and Europe. However that marked the high in yields for the day and a fixed income rally back lifted tech stocks, and in the end the S&P broke a 4-day losing streak to close up +0.53% with the NASDAQ at +0.72% ahead of today’s important PCE print.

There was some speculation that a portion of the post US midday rally was due to delta hedging effects as the S&P 500 traded through the 4000 level, with 0DTE (zero days to expiry) options being partially blamed. There is increasingly higher trading volumes of options on their expiry days than in the past. These options may have been listed at any point but trading activity has increased in options that are set to expire on the day recently. The uptick in interest of these contracts seems to be able to move markets considerably in both directions.

The rally also came as the terminal fed funds rate fell -2.0bps off its cycle highs to finish at 5.347 and US yields continued to fall lower after trading above 3.97% on an intraday basis for the first time since November. They then reversed course to end the day -3.9bps lower at 3.877%. And it was a similar story in Europe, with yields on 10yr bunds (-4.2bps), OATs (-4.5bps) and BTPs (-7.8bps) all moving lower.

Back to equities and Nvidia (+14.02%) was the strongest performer in the entire S&P 500 following their revenue forecast the previous day that beat estimates. On the back of Nvidia’s results, Semiconductors (+5.13%) were the best performing S&P industry followed by cyclicals such as Transports (+1.46%) and Energy (+1.27%). In the meantime, European equities managed to post a small gain for the day, with the STOXX 600 up +0.06%.

In terms of the various data releases yesterday, the first was in the Euro Area, where the core inflation print for January was revised up to +5.3% (vs. +5.2% previously). That’s a new record since the Euro Area’s formation back in 1999, and offers further support for the ECB’s hawks as they look to take rates higher. Indeed, it also leans into our economists’ new ECB call from earlier in the week (link here), where they now see the terminal deposit rate going up to 3.75% at the June meeting.

Just as European inflation was being revised higher, there were also positive upward revisions to the Q4 numbers from the US. For instance, the PCE inflation measure targeted by the Fed rose by an annualised +3.7% in Q4, up from +3.2% previously. So just as with the CPI revisions, this is confirming that the inflation slowdown in Q4 was much smaller than previously thought. Likewise with the core PCE print, the Q4 number was revised up to an annualised +4.3% (vs. +3.9% before). The more important release on this front is today’s US core PCE deflator with DB and consensus at +0.5% m/m compared to a +0.3% reading last month. The accompanying personal income data sees a very a strong +1.0% m/m consensus expectation, while our economists are expecting growth of +0.6% m/m vs. +0.2% previously. DB’s economists expect a +1.3% monthly increase in consumption compared to a 1.4% consensus estimate and -0.2% reading last month.

Also yesterday we received the latest US initial jobless claims data with the week ending February 18 coming in at 192k (vs. 200k expected), while continuing claims was at 1654k (vs. 1700k expected). The rolling 3-month level of continuing claims is now back to rather benign levels, which puts further pressure on the Fed as the labour market continues to look robust through various lenses.

Gilts were a bit of an underperformer yesterday, with the 10yr yield ‘only’ down -1.3bps on the day after spending nearly the entire session in positive territory. That was after comments from the BoE’s Mann, one of the biggest hawks on the MPC, who said “I believe that more tightening is needed, and caution that a pivot is not imminent”. In addition, she said that “I don’t think we are in a restrictive stance particularly”. That led investors to almost fully price in a 25bp move at the next meeting in March, which would take the Bank Rate up to 4.25% if realised.

Asian equity markets are mostly struggling this morning even with the rally back in the US. As I type, the Hang Seng (-1.41%) is the biggest underperformer, dragged lower by declines in Chinese listed tech stocks while the CSI (-1.01%), the Shanghai Composite (-0.70%) and the KOSPI (-0.55%) are also edging lower. Elsewhere, the Nikkei (+1.10%) is bucking the regional negative trend after the incoming Bank of Japan (BOJ) head Kazuo Ueda, in his statement to lawmakers, lent his support for the current monetary policy stance while indicating that inflation is likely to rise gradually. Outside of Asia, US stock futures are indicating a slightly negative bias with those on the S&P 500 (-0.11%) and NASDAQ 100 (-0.24%) edging lower. Meanwhile, yields on the 10yr USTs (-1.16bps) are slightly lower, trading at 3.87%.

Coming back to Japan, data this morning showed that the core consumer inflation excluding food hit a 41-year high of +4.2% y/y in Japan (v/s +4.3% expected), rising from a +4.0% annual gain seen in December. It was the 9th consecutive month that core consumer inflation stayed above the BOJ’s 2% target. Headline came in as expected at 4.3%. So no surprises and an on message Kazuo Ueda probably reduces the near-term risk of an imminent surprise BoJ YCC move.

In other news yesterday, Bloomberg reported that the search for the Fed’s next Vice Chair was narrowing as the Biden administration looks to replace Lael Brainard, who’s now director of the National Economic Council. According to Bloomberg, the “top tier” candidates were Harvard professor Karen Dynan and Northwestern professor Janice Eberly, with an announcement “possible in the coming weeks.” Both have previous experience in government too, with each having served as Assistant Secretary of the Treasury for Economic Policy under President Obama. However, the article also mentioned that others were in “serious contention”, including the new Chicago Fed President, Austan Goolsbee, who previously served as Chair of the Council of Economic Advisers under President Obama.

On that theme of appointments, it was separately announced that the United States would be nominating Ajay Banga to be the next President of the World Bank. Banga previously served as CEO of Mastercard for a decade. The US has usually chosen the World Bank President and is the largest shareholder of the World Bank, but in practice they require support from other countries, so it could be some months before we officially know the next president.

To the day ahead now, and data releases from the US include January numbers on personal income, personal spending for January, the core PCE deflator and new home sales. We’ll also get the University of Michigan’s final consumer sentiment index for February. Otherwise from central banks, we’ll hear from the Fed’s Jefferson, Mester, Bullard, Collins and Waller, along with the BoE’s Tenreyro.