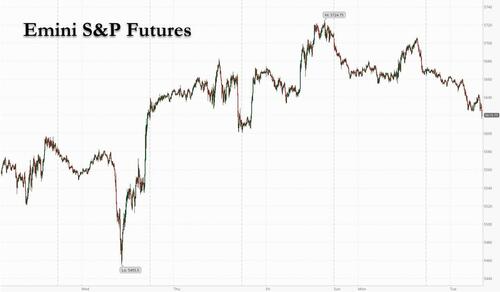

US equity futures slumped for the second day, dragged down by earnings and a lack of positive news on trade negotiations. As of 8:00am, S&P 500 futures dropped 0.9% as risk is pared into tomorrow's Fed announcement and the index failed to breach through technical resistance; Ford slumped after suspending its guidance and warned tariffs will reduce 2025 adjusted EBIT by about $1.5 billion; Nasdaq futures 100 dropped 1.1%, with all Mag7 stocks lower as Tesla and Meta led declines. Palantir tumbled 8% after the software firm’s results failed to meet investors’ expectations, while Ford slipped 3% after the carmaker pulled its financial guidance and flagged a tariff impact of about $2.5 billion on 2025 earnings. German stocks tumbled Estoxx 50 after incoming German chancellor Friedrich Merz suffered a shock setback when he fell short of a majority in an initial vote in the lower house of parliament to confirm him as Germany’s next chancellor. The yield curve is twisting steeper as USD comes for sale. Commodities are higher with WTI crude oil futures rebounding more than 2% from Monday’s YTD low close and gold is marching back to its ATHs. Trade Balance data is the macro data focus.

In premarket trading, Ford slips 2% as the automaker suspended its full-year financial guidance and said President Trump’s tariffs will take a toll on profit, joining rivals stung by volatile global trade policies. Palantir Technologies dropped 7% after the data-analysis software company posted financial results failed to meet investors’ expectations. Magnificent Seven stocks were all in the red: Tesla slips 1.6% as sales kept sliding across Europe’s biggest electric-car markets in April, despite the company rolling out an updated version of its most popular vehicle (Amazon -0.9%, Nvidia -1.4%, Meta -1.2%, Microsoft -0.7%, Apple -0.4%, Alphabet -0.8%). Here are the other notable premarket movers:

In Europe, the Stoxx 600 benchmark snapped a 10-day run of gains to drop 0.6%, its losses accelerating after incoming German chancellor Friedrich Merz failed suffered a shock setback when he fell short of a majority in a parliamentary vote to confirm him as Germany’s next chancellor, preventing his swearing in on Tuesday and pitching Europe’s biggest economy into uncharted territory. While the conservative leader is still expected to take charge of a ruling coalition of his CDU/CSU bloc and the Social Democrats, it was the first time since World War II that an incoming chancellor failed to secure backing from lawmakers in the first round of voting in the Bundestag and triggered chaos in Berlin’s government quarter. Meanwhile, European companies such as Royal Philips NV and Vestas Wind Systems A/S warned of uncertainty fueled by President Donald Trump’s trade tariffs; mining and industrial goods shares leading declines, while food beverage and energy stocks are the biggest outperformers. Here are the biggest movers Tuesday:

The slide in futures suggest that a recent burst of optimism fueled by some US trade concessions may already be fading. On Monday, the S&P 500 halted a nine-day rally that was its longest in about 20 years. While Ford’s warning served as a reminder that damage from the tariff war will become evident over the coming months, a run of firm economic data in recent days has caused traders to dial back bets on Federal Reserve interest-rate cuts.

“For us, it’s not the moment to add on risk,” said Nicolas Sopel, a strategist at Quintet Private Bank. “Even if there are successful negotiations between the US and China, tariffs will most likely be a lot higher than they were before Trump came into power. We will need time to see how deeply these increases impact the US economy,” according to Sopel, who has reduced US equity exposure.

Meanwhile, investors are coming around to the view that the Fed won’t cut interest rates as early or as deeply as earlier anticipated. While it’s expected to leave interest rates on hold this week, money markets have pushed back the timing of the first reduction to July and see three cuts by year-end, rather than the four they had expected a week ago.

“Recent comments from Fed Chair Powell suggest that the Fed will remain in wait-and-see mode over the near term,” Michael Krautzberger, AllianzGI’s chief investment office for fixed income, told clients. He also sees headwinds to the US dollar, and maintains “a short dollar footprint” in portfolios, he added.

Financial leaders at the Milken Institute Global Conference in Beverly Hills said they can live with tariffs and a reworking of trade, but want progress and an end to the chaos soon.

Meanwhile, the Bank of England is set to cut rates this week and may even pave the way for a series of back-to-back reductions in response to the trade war. The European Central Bank will also cut rates further, Governing Council member Yannis Stournaras, said.

Earlier in the session, Asian stocks advanced, as mainland Chinese shares rose on resilient holiday spending data and signs of easing trade tensions with the US. The MSCI Asia Pacific Ex-Japan Index gained as much as 0.7% before paring earlier gains. Communication services and consumer discretionary were among the best performing sectors.

Chinese stocks outperformed in the region, as investors’ mood was lifted by strong retail sales and robust airline traffic results during the Labor Day holiday in early May. Traders also dialed up bets on easing tensions after Treasury Secretary Scott Bessent said the US could see “substantial progress in the coming weeks” in trade talks with China. The benchmark CSI 300 Index gained 1% on Tuesday. Hong Kong’s Hang Seng Index rose 0.7

In FX, the Bloomberg’s dollar index steadied after two days of losses, as the news on Merz weighed on the euro. However, the greenback is down nearly 7% this year and data shows traders have been adding to bearish bets. The fallout is being felt worldwide, with wild swings in recent days across Asian currencies, while Hong Kong has ramped up sales of its local currency to protect its foreign-exchange peg. China’s central bank kept the yuan’s daily reference rate little changed at 7.2008 per dollar as local markets reopened on Tuesday; the Taiwan dollar fell after gaining for six straight sessions

In rates, treasuries are mixed, with outperformance at the shorter-end of the curve. US 10-year yields rise 2 bps to 4.36% while two-year yields fall 1 bp; the front-end outperformance has 2s10s spread about 2bp wider on the day, off session highs reached during London morning. Bunds and gilts lag by 1bp and 2.5bp in the sector. The Treasury auction cycle continues with $42 billion 10-year new issue, following good demand for Monday’s 3-year note sale; WI 10-year yield near 4.355% is ~8bp richer than last month’s, which stopped through by 3bp; a $25b 30-year new issue Thursday will complete the cycle

In commodities, oil prices jump, with WTI rising 2.9% to $58.80 a barrel. Spot gold rises $40 to around $3,375/oz. Bitcoin is flat just above $94,000.

Looking at the US calendar, data releases will include US March trade balance data, the final April services and composite PMIs in the Eurozone, as well as March Eurozone PPI and France industrial production. The ECB’s Panetta is due to speak, while earnings releases include AMD, Arista Networks, Ferrari, Constellation Energy and Rivian.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher as Chinese participants returned from the Labor Day holiday but with the gains capped following disappointing Chinese Caixin Services PMI data and as markets in Japan and South Korea remained closed. ASX 200 traded little changed as strength in the commodity-related sectors were predominantly offset by underperformance in financials and defensives, while the larger-than-expected contraction in building approvals clouded over risk appetite. Hang Seng and Shanghai Comp gained on return from the extended weekend and took their opportunity to react to the recent China tariff rhetoric from US President Trump who said that he is willing to lower tariffs on China at some point, while the miss on Caixin Services PMI data did little to derail the positive sentiment in China.

Top Asian News

European bourses (STOXX 600 -0.6%) opened mostly firmer/flat and traded tentatively on either side of the unchanged mark. Thereafter, the risk tone soon slipped after the HKMA said it says has been lowering its duration in US treasury holdings and as Germany's Merz failed to secure enough votes to become Chancellor; DAX 40 -1.8%. The HKMA update sparked some modest pressure in US equity futures (ES -0.9%, NQ -1%); ahead of a handful of earnings and meetings between the US and Canadian Presidents. As for sectors, its a mixed picture in Europe. Food Beverage & Tobacco takes the top spot, joined closely by Utilities. To the downside, Basic Resources sits right at the foot of the pile – losses largely driven by Anglo American after Peabody said it may terminate its deal for its coal mine assets. For the Pharma industry; US President Trump said he will announce pharmaceutical tariffs over the next two weeks, while he signed an order to reduce regulatory barriers to domestic pharmaceutical manufacturing and will have an announcement next week related to the cost of medicines.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

US Event Calendar

DB's Jim Reid concludes the overnight wrap

As those of us in the UK were enjoying a wet, cold and windy bank holiday yesterday, just 4 days after record temperatures, the strong market recovery of the past two weeks ran out of steam, with the S&P 500 (-0.64%) declining for the first time in ten sessions, while 30yr Treasury yields (+4.5bps) rose for a fourth session running. These moves came amid a more cautious tone on the trade risks that Peter Sidorov had mentioned here yesterday, while still solid US economic data saw investors pare back expectations of near-term Fed cuts ahead of Wednesday’s FOMC meeting.

A sense that the tariff relief trade was losing momentum came amid little concrete progress on trade talks as well as Trump’s post late on Sunday calling for 100% tariffs on movies produced outside the US. While there are no details yet on how the latter plan would be implemented, it marked the administration’s first foray into tariffs on services. Later on Monday, Trump also said that pharma tariffs would be announced over the next two weeks.

This backdrop saw the S&P 500 (-0.64%) end its longest winning run since 2004 that had seen the index rise by +10.25% over the previous nine sessions to end last week above its pre-Liberation Day levels. Underperformance by tech stocks saw the Mag-7 decline by -0.99%, while Netflix fell -1.94% after Trump’s movie tariff comments. After the close, the latest earnings releases saw Ford suspend its full-year financial guidance as it warned that auto tariffs will weigh on profits. And Palantir, which has been strongest advancer in the S&P 500 so far this year, saw its shares fell more than -9% in after-market trading as the software platform maker’s projected revenue growth fell shy of very lofty expectations. S&P 500 (-0.25%) and NASDAQ 100 (-0.45%) futures are edging lower as I type.

Yesterday’s reversal in equities came despite a decent ISM services release for April that pointed to a still resilient US economy and followed a solid payrolls print last Friday. The headline index unexpectedly rose from 50.8 to 51.6 (vs. 50.2 expected), with new orders rising to a 4-month high of 52.3. The ISM survey also pointed to elevated price pressures, with the prices paid index rising to 65.1, its highest level since January 2023.

The stronger data saw markets pare back their expectations of near-term Fed rate cuts. Notably, only 23bps of cuts are now priced by the July meeting, which is the first time since late February that the next cut is less than fully priced by July. The amount of cuts priced by year-end fell by -4.0bps to 76bps. Treasury yields moved higher, especially at the long end, with the 10yr up +3.5bps to 4.345% and the 30yr up +4.6bps to 4.835%. An +18.2bps rise in 10yr yields over the past three sessions may place some extra attention on today’s 10yr auction. There has been no trading overnight due to a Japanese holiday.

Those moves come ahead of tomorrow’s Fed decision, where our US economists expect the FOMC to keep rates steady and avoid explicit forward guidance about the policy path ahead. They continue to see the next rate cut coming in December and while risks are tilted towards earlier easing, in their view this would require a clear weakening of the labour market. See our economists’ full preview here. Central banks will also be in focus in Europe this week, with policy decisions from the UK, Norway and Sweden all due on Thursday. Our UK economist expects the BoE to deliver a 25bp cut (see preview here), while Norges and Riksbank are expected to keep rates on hold.

In Europe, while the UK was off for the May bank holiday, it was a more positive session, with the STOXX 600 (+0.16%) posting a tenth consecutive advance, the longest such run since 2021. The DAX (+1.12%) outperformed, moving to within half a percent of its all-time closing high on March 6. Italy’s FTSEMIB (+0.39%) and Spain’s IBEX (+0.55%) also gained but France’s CAC fell back (-0.55%).

European bonds saw muted moves, with the yields on 10yr bunds (-1.6bps), OATs (-1.3bps) and BTPs (-3.4bps) all seeing modest declines. The ECB’s Stournaras said “it seems we will continue” with rate cuts, but that amid the high uncertainty “you don’t take big steps or make big promises”.

In the commodity space, oil prices fell to their lowest level in four years following the OPEC+ agreement over the weekend to deliver another sizeable production increase in June which added to concerns of an oversupplied market. Brent crude fell by -1.73% to $60.23/bbl, its sixth consecutive daily decline of more than 1%, though it partially recovered after opening as low as $58.50/bbl in Asia yesterday. Meanwhile, gold rebounded by +2.89% on Monday to $3,334/oz, erasing last week’s -2.39% decline.

Asian equity markets are gaining this morning in thin trading with markets in Japan and South Korea remaining shut for public holidays. Chinese markets are ticking higher after resuming trading following the Labour-day holidays on signs of renewed momentum in trade negotiations between the world’s two largest economies. As I type, the CSI (+0.95%), Shanghai Composite (+0.94%), and the Hang Seng (+0.69%) are leading the way while the S&P/ASX 200 (+0.11%) is lagging a touch.

In FX, the Taiwanese dollar is retreating a touch this morning following an epic two-day rally that saw it at a near three-year high of 29.606 on Monday. The currency's appreciation was influenced, in part, by speculation surrounding a possible US trade deal that could necessitate Taiwan strengthening its currency. However, both Taiwan's central bank and the Cabinet's Office of Trade Negotiations have denied that the US has requested currency appreciation or that the issue is even part of trade talks.

Coming back to China, services sector growth slowed significantly in April, reaching a seven-month low. The Caixin services PMI dropped to 50.7 from 51.9 in March, and 51.8 expected, reflecting weaker new orders and uncertainty stemming from US tariffs.

To the day ahead, data releases will include US March trade balance data, the final April services and composite PMIs in the Eurozone, as well as March Eurozone PPI and France industrial production. The ECB’s Panetta is due to speak, while earnings releases include AMD, Arista Networks, Ferrari, Constellation Energy and Rivian.