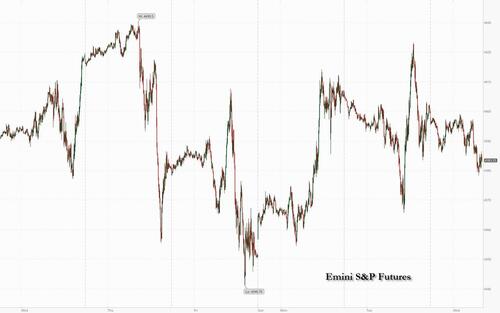

US equity futures and global markets dropped, while gold surged and crude oil futures spiked as much as 3% to fresh weekly highs as the conflict in the Middle East escalated sharply despite Biden's visit to Israel seeking a normalization in tensions, as Arab leaders canceled a summit with US President Biden and as Iran intensified its war of words against Israel. As of 7:45am, S&P 500 and Nasdaq 100 futures lost more than 0.4%, after yesterday's flat close. Crude’s surged after the foreign minister of Iran, a major oil exporter albeit embargoed, called for an embargo against Israel. Gold prices rose as investors snapped up haven assets.

Amid the geopolitical concerns, traders are also tracking the latest earnings. Morgan Stanley dropped 2.9% in premarket after third-quarter wealth management revenue missed estimates. Elsewhere in the premarket, Nvidia shares are on track for a second day of declines, down 1.6% and extending its 4.7% slump in the previous session, after a Morgan Stanley downgrade (note available to pro subscribers) as the US steps up efforts to keep advanced chips out of China; Procter & Gamble gained after organic sales topped expectations. In other individual stock moves, United Airlines fell 6%, leading declines for other carriers, after the company warned of a potential sharp profit impact from suspended flights to Tel Aviv. Here are some other notable premarket movers:

US President Joe Biden met Prime Minister Benjamin Netanyahu in Israel on Wednesday, hours after the hospital blast killed hundreds and threatened to plunge the region into chaos. Leaders of Jordan, Egypt and the Palestinian Authority canceled a summit with Biden, who planned to use the trip to reinforce the US commitment to Israel.

"The risks of an escalation have risen on the back of the latest news reports regarding the hospital bombing,” said Jane Foley, head of foreign-exchange strategy at Rabobank. While there have been few signs of panic, “on any clear escalation, we can expect to see a ratcheting up of risk aversion,” she said.

European stocks are also in the red, although off their worst levels, with the Stoxx 600 down 0.2%. Among other individual movers, ASML Holding NV, Europe’s most valuable technology company, slumped 1.7% after the company reported the lowest quarterly order intake since 2020 and revenue that missed estimates for the first time in seven quarters. Adidas AG advanced 5.3% after the sportswear maker boosted its guidance, helped by sales of more Yeezy sneakers from its canceled partnership with the rapper Ye. Nexi SpA jumped as much as 19% after people with knowledge of the matter said CVC Capital Partners is in the early stages of considering a potential bid for European payments firm. Here are the most notable European movers:

Traders also sifted through data showing UK inflation exceeded forecasts, leaving open the possibility of a further rate hike from the Bank of England. Ten-year gilt yields rose for a third day, adding six basis points to 4.58%. The pound added 0.2% to $1.22, before paring its gains.

Earlier in the session, Asian equities declined as strong economic data in China failed to lift investors’ cautious mood amid fears of an escalation in the Middle East geopolitical crisis. The MSCI Asia Pacific Index fell as much as 0.5%, with TSMC and Tencent Holdings among the biggest drags.

In FX, The Bloomberg Dollar Spot Index falls 0.1%. The Aussie is the best performer among the G-10’s, rising 0.3% after Chinese data topped estimates. GBP/USD climbed as much as 0.23% to 1.2211 after data indicated inflation failed to slow in September as oil prices rose; gilts fell as money markets raised BOE policy tightening wages.

In rates, the treasuries curve twist-steepened with yields on the two-year down 2bps to 5.19% and 10-year yields up 2bps to 4.85%. US yields are cheaper by up to 2bp across long-end of the curve while 2-year yields are richer by 3.5bp on the day; steepening move pushes 2s10s, 5s30s spreads wider by 2.5bp and 5bp; 10-year yields shed around 1bp to 4.82%, outperforming gilts by 6.5bp in the sector. Gilts underperform across core European rates, as money markets raise BOE policy-tightening premium after UK inflation exceeded median estimates. UK 10-year yields rise 7bps to 4.58%. US session focus includes 20-year bond auction and six scheduled Fed speakers. Treasury auction slate includes $13b 20-year bond reopening at 1pm New York time; WI yield at around 5.16% is ~57bp cheaper than last month’s, which stopped 0.3bp through.

In commodities, US crude futures rise 3.4% to trade near $89.70. Spot gold gains 1.1% to around $1,945.

Bitcoin is marginally firmer on the session, currently residing around the mid-point of USD 28.33-28.98k parameters with specific newsflow somewhat light amid numerous broader macro/geopolitical developments.

To the day ahead, and data releases include UK CPI for September, along with US housing starts and building permits for September. From central banks, we’ll hear from the Fed’s Waller, Williams, Bowman, Barkin, Harker and Cook, whilst the Fed will also release their Beige Book. Finally, earnings releases include Netflix, Tesla, Morgan Stanley and Procter & Gamble.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mixed following a similar performance on Wall St where the focus was on retail sales data, earnings releases and geopolitical headlines including a deadly strike at a Gaza hospital which both sides blamed each other for, while the region also digested the latest Chinese GDP and activity data which topped forecasts. ASX 200 was positive as strength in healthcare, financials and the commodity-related sectors atoned for the losses in tech and utilities but with gains limited amid a higher yield environment. Nikkei 225 was indecisive after a recent source report noted potential hawkish revisions to the BoJ’s Core CPI forecasts, while the rise in yields prompted an unscheduled purchase operation by the BoJ. Hang Seng and Shanghai Comp. were varied despite better-than-expected Chinese GDP, Industrial Production and Retail Sales with several tech stocks hit after the US expanded chip restrictions and amid property sector woes as Country Garden is seen to likely have defaulted and with China property stocks gauge on course for its lowest since 2009.

Top Asian News

European bourses have been relatively steady amid a ramp-up in earnings, Euro Stoxx 50 -0.5%, but with an underlying negative bias increasing in magnitude as geopolitical tensions overshadow stronger than expected Chinese activity data. Sectors are mixed, Telecom names outperform following Tele2 while Retail derives support from Adidas. On the flip side, Real Estate lags after Barratt Developments commentary. More broadly, European heavyweight ASML is lowered after a miss on revenue and bookings alongside cautious commentary for FY23. Stateside, futures are in-fitting with European performance and as such reside in the red, ES -0.4%; focus remains on the yield environment, though action is steady at present ahead of numerous Fed officials, data points and key earnings including NFLX, TSLA & MS. ASML Q3 (EUR): Revenue 6.67bln (exp. 6.71bln), Bookings 2.6bln (exp. 4.5bln), Net Income 1.9bln (exp. 1.8bln), Gross Profit 3.46bln, Margin 51.9%. Click here for more.

Top European News

FX

Fixed Income

Commodities

Geopolitics

Central Bank Speakers

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Macro data was the main market driver yesterday, as very strong US data led investors to dial up the chances of another rate hike from the Fed. In turn, that sent global yields sharply higher, and there were several new milestones across the Treasury curve. For instance, the 10yr yield closed at a new high for the cycle of 4.84%, and the 2yr yield also hit a new cycle high of 5.21%. So that marks a big turnaround relative to last week, since it was only last Thursday that the 10yr yield hit an intraday low of 4.52%, when concerns about geopolitical risk saw a big rally for haven assets like sovereign bonds. That said, overnight we’ve seen a fresh risk-off tone because of the geopolitical situation, and a summit has been cancelled between President Biden and Arab leaders in Jordan following an explosion at a hospital in Gaza. That has led to a clear reaction in markets, with Brent Crude oil prices up +2.22% overnight to $91.90/bbl, whilst gold prices (+0.79%) are up at a one-month high of $1938/oz .

We’ll start with the bond selloff, which was mainly driven by a very strong retail sales print for September. The headline measure was up by +0.7% (vs. +0.3% expected), and there was an upward revision to the August number as well. Furthermore, it marked the 6th consecutive month that retail sales had risen, whilst the measure excluding autos and gas stations was up by +0.6% (vs. +0.1% expected). In the meantime, industrial production was stronger than expected too, with a +0.3% gain in September (vs. unch. expected), albeit with a downward revision to the August figure. So the releases add to the run of positive data out of the US recently, including the September jobs report, which showed nonfarm payrolls up by +336k.

Those positive signs on the economy meant that investors priced in a growing chance of another rate hike from the Fed. In fact, futures were pricing in a 59.5% chance of another hike by the close yesterday, which is the first time that’s been above 50% since October 3. In addition, they moved to price out the chances of cuts in 2024, with the rate priced in by the December 2024 meeting up +11.9bps on the day to a new cycle high of 4.78% .

With markets pricing in higher rates for longer again, that led to a major selloff among sovereign bonds. Most notably, the 10yr Treasury yield ended the day up +12.9bps at 4.84%, which is its highest closing level since 2007. Those increases were evident across the curve as well, with the 2yr yield up +11.1bps to a post-2006 high of 5.21%, and the 5yr yield rose +15.2bps to a post-2007 high of 4.87%. Real yields led the moves higher, but they didn’t quite hit their recent highs, with the 10yr real yield (+10.1bps) closing at 2.42%, which is beneath its closing high of 2.48% on October 6 after the jobs report .

Over in Europe, there was a similar shift in long-term borrowing costs, with yields on 10yr bunds (+9.8bps), OATs (+9.8bps) and BTPs (+12.5bps) all moving higher. UK gilts were the main outperformer, with 10yr yields only up +3.1bps after the employment data out yesterday was a bit weaker than expected. For instance, the number of payrolled employees fell -11k in September (vs. +3k expected), vacancies fell to a two-year low over the July-September period, and wage growth was also beneath expectations. That led investors to lower the chances of a hike at the BoE’s next meeting, which dropped from 31% to 25%, and the focus will now turn to the CPI release this morning, which is out shortly after we go to press.

Equities were largely flat yesterday despite sizeable intra-day moves. There was initially a sharp selloff as markets priced in a more hawkish path for the Fed, but that reversed as the session went on. For instance, the S&P 500 was down -0.83% within the first half hour, before recovering to trade nearly half a percent higher on the day but then ending the session flat at -0.01%. It was a similar story in Europe, where the STOXX 600 pared back most of its afternoon losses to close -0.10% lower. The small-cap Russell 2000 outperformed, advancing +1.09%, bringing its gains to +2.69% over the last two sessions. By contrast, megacap tech stocks were an underperformer, and the FANG+ index shed -0.64%. The was led by a -4.68% decline for chipmaker Nvidia as the US announced new restrictions on chip exports to China.

Overnight, we’ve seen more of a risk-off tone return in light of the latest geopolitical developments, with a summit cancelled between President Biden and Arab leaders in Jordan following an explosion at a hospital in Gaza.. That’s led to growing market concern, which has been evident in the sharp rise in oil prices overnight, with Brent crude up +2.22% to $91.90/bbl. In the meantime, investors have moved into haven assets, with gold up +0.79% to $1938/oz.

The other main story overnight has been the Q3 GDP release from China, which showed year-on-year growth running at +4.9% (vs. +4.5% expected). Furthermore, the monthly data for September also looked better than expected, with industrial production up +4.5% year-on-year (vs. +4.4% expected), and retail sales up +5.5% year-on-year (vs. +4.9% expected). The jobless rate was also down to a 22-month low of 5.0% (vs. 5.2% expected). But in spite of the positive data, the global risk-off tone has prevailed and several equity indices have seen losses in Asia. That includes the Shanghai Comp (-0.61%), the CSI 300 (-0.57%), the Nikkei (-0.12%) and the Hang Seng (-0.10%). The exception to that is the KOSPI, which has advanced +0.09%.

Separately, t he Bank of Japan announced another unscheduled bond buying operation overnight, which comes as yields on 10yr JGBs hit their highest level in over a decade, with an intraday peak of 0.815%. They’re currently a bit lower again at 0.808%.

When it comes to US politics, there was no sign of a new Speaker in the House of Representatives yesterday, as Republican nominee Jim Jordan failed to win a majority on an initial vote. 20 Republicans voted against Jordan, and no further votes were held yesterday.

Looking at yesterday’s other data, in the US there was the NAHB’s housing market index for October, which fell to 40 (vs. 44 expected). That marks a third consecutive monthly decline for the index, and takes it down to its lowest level since January. Meanwhile in Canada, CPI fell to +3.8% in September (vs. +4.0% expected), which led investors to lower the chance of a hike at the Bank of Canada’s next meeting from 43% to 16%. Finally in Germany, the ZEW survey for October saw the expectations component rise to a 6-month high of -1.1 (vs. -9.0 expected).

To the day ahead, and data releases include UK CPI for September, along with US housing starts and building permits for September. From central banks, we’ll hear from the Fed’s Waller, Williams, Bowman, Barkin, Harker and Cook, whilst the Fed will also release their Beige Book. Finally, earnings releases include Netflix, Tesla, Morgan Stanley and Procter & Gamble.