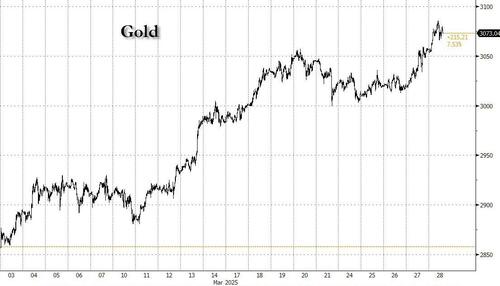

US equity and global stock markets slumped while gold topped a fresh all time high as investors braced for today's core PCE report, the Fed's preferred inflation metric, and continued to worry about the lasting economic damage of the trade war amid daily tariff news and a halt in progress on the geopolitical front, as the market now awaits the April 2 tariff announcements. As of 8:00am ET S&P futures are down 0.2% but off session highs, with the Nasdaq lagging -0.4% and small caps modestly higher; Mag 7 names are mostly lower premarket: AAPL -0.7%, AMZN -0.5%, while TSLA +1.6%. European and Asian stocks are also lower: Bond yields are lower and the USD trades near session highs. Commodities are mixed with base metals all lower this morning, but gold is making a new record high rising above $3,080 per ounce. Brent trades near session highs above $74/bbl. Looking ahead today, we will get PCE data for February at 8:30am (consensus expects headline and core PCE up 0.3% MoM, and 2.7%/2.5% YoY headline/core) followed by UMich survey data at 10am. Following the data, we will hear from Fed voter Barr and non-voter Bostic.

In premarket trading, Lululemon plunged 13% after the activewear maker’s annual forecasts for sales and profit disappointed, stoking worries that growth will continue to be weak in its American markets. Tesla is the top gainer among the Magnificent Seven (Alphabet -0.1%, Amazon -0.5%, Apple -0.7%, Microsoft -0.3%, Meta -0.1%, Nvidia +0.5% and Tesla +1.2%). US Steel (X) gains 5% after Semafor reported that the company is in active talks with Nippon Steel about a deal that would preserve their proposed merger citing unidentified people familiar with the matter. Here are some other notable premarket movers:

Overnight, Defense Sec Hegseth said to allies in his first official trip to Asia that the Trump Administration is set to "truly prioritize and shift to this region...in a way that is unprecedented." China's Xi continued to try woo international investors noting in a meeting with 40+ global business leaders that "we are providing a transparent, steady and predictable policy environment,” calling the nation a “favorite destination” for foreign investors. “Embracing China is embracing opportunities.” (BBG). After the close yesterday, Fed voter Collins said it looks “inevitable” that tariffs will boost inflation, at least in the near term, adding it’s likely appropriate to keep interest rates steady for longer (BBG). A 7.7 magnitude earthquake has struck in Myanmar, the most powerful in a century, causing buildings to shake and triggering evacuations in Vietnam and Thailand, with at least one tower collapsing in Bangkok.

It’s been a rough quarter for US equities, with the S&P 500 getting ready to close out the first three months of the year with a 3.2% loss, the worst performance since 2023. Today's reading for the US core personal consumption expenditures price index is expected to rise 0.3% in February, an unchanged pace compared with the previous month, according to the median economist forecast. With President Trump threatening to unleash so-called reciprocal tariffs next week, money managers say they’re turning neutral, stepping back or de-risking their portfolios.

“Tariffs are creating a lot of fears in the market, not just the level of the tariffs but the way they are implemented as well,” Valerie Genin, head of investments at Barclays Private Bank Monaco told Bloomberg TV. “It seems like investors are just digesting now that tariffs have lose-lose implications for all parties.”

Meanwhile in Europe, stocks are set for their third week of losses this month, as investors brace for US tariff announcements next week pushing the Stoxx 600 index 0.4% lower on Friday. Most sub-indexes on the Stoxx 600 regional benchmark notch declines. Banks lead the underperformance, while the real estate sector is a rare outperformer. Still, banks are the standout winner this quarter with a 26% advance as investors are counting on more strong earnings, share buybacks and M&A to drive gains. Here are the biggest movers Friday:

Earlier in the session, Asian equities suffered their biggest drop in a month, as concerns increased over a possible growth slowdown in the US stemming from new tariffs. Trading was halted in Thailand following an earthquake. The MSCI Asia Pacific Index fell as much as 1.4%, with most markets in the red. Toyota, Samsung Electronics and Mitsubishi UFJ were among the biggest drags. South Korean and Japanese stocks led the selloff, as ex-dividend trading exacerbated the impact of the hit to sentiment from US taxes on imports. President Donald Trump’s imposition of a blanket 25% levy on auto imports, and threats for similar action in other areas, have ramped up investor anxiety over the scope of the reciprocal tariffs that he intends to announce next week. The Hang Seng Tech Index, which has rallied this year on the back of Chinese technology advancements, fell to the brink of a correction amid broad risk-off sentiment.

In FX, the Bloomberg Dollar Spot Index is flat. JPY and GBP are the strongest performers in G-10 FX; SEK and NZD underperform. The greenback supported by month-end demand while it also modestly enjoys haven dynamics amid escalating trade tensions, a Europe-based trader says. The euro sank to session lows around 1.077 after traders ramped up bets on ECB interest-rate cuts as Spanish and French CPI undershot expectations. Money markets now price in about 60bps of easing by December.

In rates, treasuries hold gains in early US session led by long-end tenors with yields lower by about 4bp, arresting this week’s dramatic curve steepening. US yields are richer by at least 1bp across maturities with 2s10s curve flatter by ~2.5bp, 5s30s by ~2bp; 10-year near 4.33% is ~3bp lower on the day, with bunds and gilts in the sector outperforming by 1bp and 3bp. Core European bond markets lead after Spanish and French CPIs rose less than estimated, prompting traders to price in more easing by ECB. Focal point of US session is February personal income and spending data, which embeds PCE price index, inflation gauge targeted by the Fed.

In commodities, the non stop record highs in gold are the big story again: spot gold rose roughly $15 to trade near $3,072/oz after it hit a fresh record. Crude futures are steady. WTI drifts 0.1% lower to trade near $69.88. Brent is flat at $74.02.

Today's US economic calendar includes February personal income/spending (8:30am), March final University of Michigan sentiment (10am) and March Kansas City Fed services activity (11am). Fed speaker slate includes Barr (12:15pm) and Bostic (3:45pm)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly pressured amid the ongoing themes of tariffs and growth concerns heading closer to next week's 'Liberation Day' and with markets also bracing for the latest US PCE Price Index. ASX 200 traded rangebound and was just about kept afloat by strength in consumer staples and the commodity-related sectors with gold miners rejoicing after the precious notched another fresh record high. Nikkei 225 underperformed and dipped beneath the 37,000 level as automakers continued to suffer from Trump's recent auto tariff proclamation and with firmer-than-expected Tokyo CPI data supporting the case for the BoJ to continue with future policy adjustments. Hang Seng and Shanghai Comp failed to sustain the early resilience and slipped into negative territory amid a deluge of earnings and tariff uncertainty, while it was also reported that China rejected US President Trump's offer of tariff waivers in exchange for a TikTok deal.

Top Asian News

European bourses started Friday trade on a cautious note, Euro Stoxx 50 -0.6%, after APAC stocks were pressured on tariff and growth concerns overnight, and ahead of next week’s "Liberation Day", and with markets also bracing for US PCE inflation data later today. Note, the risk tone took a hit generally on the morning's earthquakes in Myanmar. Sectors are mainly in the red, Banks lag with German names lagging while softer yields assist Real Estate names.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event calendar

DB's Jim Reid concludes the overnight wrap

Markets struggled yesterday as tariff fears remained at the forefront of investors’ minds, with concern mounting ahead of the April 2 deadline for reciprocal tariffs. Notably, several automakers took a hit given the 25% tariff announcement on Wednesday night. But more broadly, there were signs that investors were becoming increasingly concerned about the stagflationary consequences. Indeed, yesterday saw the US 1yr inflation swap (+9.1bps) hit a 2-year high of 3.11%, even as the real yield on 2yr Treasuries (-11.1bps) fell to its lowest since August 2022 at 0.73%. This combination of elevated growth uncertainty and inflation fears saw gold prices hit a new closing record of $3,057/oz yesterday, and overnight they’ve seen further gains up to $3,074/oz.

In terms of the last 24 hours, one of the main fears is that the reciprocal tariffs could lead to a big round of escalation beyond the initial US tariffs. For example, shortly before we went to press yesterday, President Trump said in a post that if the EU worked with Canada “in order to do economic harm to the USA, large scale Tariffs, far larger than currently planned, will be placed on them both”. Separately, Japan’s Prime Minister Ishiba said yesterday that “We must consider appropriate responses, and naturally all options are on the table”. And Canadian Prime Minister Carney said that he’d convened the Cabinet Committee on Canada-US relations “in response to President Trump’s attack on our workers and our industries.” Carney said that “nothing is off the table” but that the Canadian government would respond based on what the US does on April 2.

Against that backdrop, automakers struggled yesterday, with Ford (-3.88%) and General Motors (-7.36%) both losing significant ground. That was echoed across the world, and in Europe, the tariff announcement meant the STOXX Automobiles and Parts Index fell -1.09% to a fresh two-month low. That tariff uncertainty also dragged down equities more broadly, with both the S&P 500 (-0.33%) and the STOXX 600 (-0.44%) losing ground for a second day running. And with just two business days of Q1 left, the S&P 500 is on track to post its first quarterly decline in six quarters, having shed -3.20% since the start of the year.

The tariffs also meant that US Treasuries faced several hurdles, particularly with investors moving to price in more inflation. In fact by the close, the 10yr yield (+1.1bps) was up to a one-month high of 4.36%, as was the 30yr yield (+2.1bps) at 4.72%. By contrast, fears about the growth impact led investors to price in more Fed rate cuts this year, and the 2yr yield fell -2.6bps to 3.99%, even as inflation breakevens rose. In turn, that meant the 2s30s yield curve moved up to its steepest level in over 3 years. And this pattern was evident elsewhere, with the German 2s30s yield curve also up to its steepest since July 2022, at 106bps.

Despite the weakness among key assets, yesterday actually brought a respectable set of US economic data, which continued to point away from a sharp slowdown. For instance, the weekly initial jobless claims were at 224k over the week ending March 22 (vs. 225k expected), meaning there were still no obvious signs of a deterioration in the labour market. At the same time, we also got the third estimate of Q4 GDP, which was revised up a tenth, and now shows an annualised growth rate of +2.4%. So it continued the recent theme whereby the hard data is still holding up, even if some of the surveys have pointed to a weaker performance.

Here in the UK, gilts sold off in the aftermath of the government’s Spring Statement, with the 10yr yield (+5.1pbs) moving up more than its global counterparts yesterday. The rise took it up to 4.78%, its highest level since mid-January, whilst the 10yr real yield (+2.7bps) hit a post-2009 high of 1.35%. So that added to concerns that the government would need to announce further fiscal tightening later this year to keep within their fiscal rules, potentially repeating the pattern from the Spring Statement where higher yields and lower growth wiped out the fiscal headroom. As a reminder, our UK economist (link here) thinks that likely economic downgrades later in the year will lead to further fiscal consolidation.

Elsewhere in Europe, sovereign bonds rallied as investors were more concerned about the negative growth impact from the tariffs. So that led investors to dial up the likelihood of further ECB rate cuts, with the amount of further cuts priced by the December meeting up +2.8bps on the day to 58bps. And in turn, yields fell across the curve, with those on 10yr bunds (-2.2bps), OATs (-2.2bps) and BTPs (-1.8bps) all moving lower.

Overnight in Asia, the major equity indices have seen sizeable losses, with the Nikkei (-2.34%) and the KOSPI (-2.14%) both slumping. In Japan, matters weren’t helped by the Tokyo CPI report for March, which came in stronger than expected at +2.9% (vs. +2.7% expected). In addition, the measure excluding fresh food and energy moved up to +2.2% (vs. +1.9% expected), the strongest in a year. In turn, that’s added to the momentum for further rate hikes from the BoJ, and the Japanese Yen has strengthened +0.10% this morning against the US Dollar. Elsewhere in Asia, the Hang Seng (-0.85%), the Shanghai Comp (-0.65%) and the CSI 300 (-0.42%) have all experienced losses as well.

To the day ahead now, and there are several data releases to look out for. In the US, there’s PCE inflation for February, along with the University of Michigan’s final consumer sentiment index for March. Meanwhile in Europe, we’ll get the French and Spanish flash CPI prints for March, along with German unemployment for March and UK retail sales for February. From central banks, we’ll hear from the Fed’s Barr and Bostic, along with the ECB’s Nagel, and Muller.