US equity futures dropped, extending the recent selloff into its fifth day, as traders stayed guarded ahead of the Federal Reserve’s gathering at Jackson Hole. As of 8:00am, S&P 500 futures fell 0.2%, while Nasdaq 100 futures were flat after a two-day selloff that erased 2% off the index. In premarket trading, Nvidia rose 0.8% while most Magnificent Seven peers posted losses. Retail giant Walmart brought Q2 earnings season to an unofficial close after reporting an EPS miss (68c vs exp. 74c) and even though it lifted guidance (now expects net sales to rise 3.75% to 4.75% this year, versus previous forecast of a 3% to 4%) that wasn't enough for the market, however, and the stock dropped in premarket trading. European stocks dropped 0.3%, erasing an earlier gain, and snapping a three-day winning streak. US treasuries fell, pushing the yield on the 10-year higher to 4.31%. The dollar strengthened and reversed all of yesterday's losses while Brent crude rose to the highest in two weeks even as the rest of the commodity complex was mixed. It's a busy economic calendar: we get weekly jobless claims and August Philadelphia Fed business outlook (8:30am), S&P Global US PMIs (9:45am) and July leading index and existing home sales (10am). The Fed speaker slate includes Atlanta Fed President Bostic at 7:30am, the last central bank official slated to speak before Chair Powell’s discourse at Jackson Hole Friday

In premarket trading, Mag 7 stocks are mostly lower (Nvidia +0.8%, Tesla unchanged, Microsoft -0.1%, Alphabet -0.2%, Amazon -0.3%, Meta -0.3%, Apple -0.5%). Here are some other notable premarket movers:

In corporate news, FanDuel, the online gambling division of Flutter Entertainment, is teaming up with CME Group, the largest US derivatives exchange, to offer bets on stocks, commodity prices and even inflation. Google introduced a new slate of consumer gadgets, including several smartphones, a watch and new wireless earbuds, all meant to show off the company’s latest advances in artificial intelligence. Musk‘s Starlink service is said to be in conversation with Emirates and other Middle Eastern airlines, with winning business in the region potentially marking a watershed moment in Starlink’s global competition.

This week has seen pressure on momentum names (read tech stocks) particularly the largest names, amid worries that their sharp rally since April has moved too far, too fast. Traders are also cautious as the Jackson Hole symposium kicks off later today, with investors awaiting Fed Chair Jerome Powell’s speech at 10am ET Friday for guidance on the path for interest rates. Despite the pullback in stocks this week, the VIX hasn’t really budged, and Goldman said it’s time to buy the dip in momentum stocks (and the overall market according to JPMorgan).

The market’s direction today will also be shaped by PMIs, home sales data and Walmart earnings (which missed but boosted its revenue forecast). For the euro area, the Composite Purchasing Managers’ Index compiled by S&P Global grew at the quickest pace in 15 months as manufacturing exited a three-year downturn.

“What we are currently seeing is profit-taking and a natural flight to quality ahead of Jerome Powell’s speech in Jackson Hole,” said John Plassard, head of investment strategy at Cité Gestion. But “let’s not beat around the bush: this is not the end of tech, and even less so for stocks linked to artificial intelligence.”

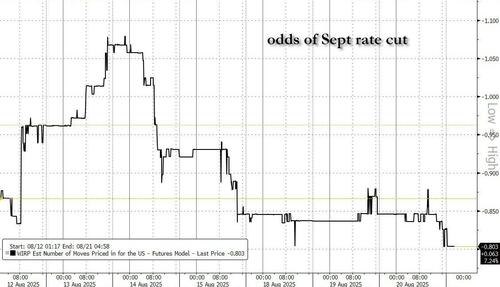

Swaps are currently pricing in 80% chance of a Fed quarter-point cut in September, and at least three more over the next year, some strategists warned that the market may be too optimistic about the pace and depth of easing.

“All it’s going to take is a bit of stickiness in inflation and actually a labor market print which shows it’s not falling off a cliff for the market to say, ‘hang on,’” Karen Ward, chief market strategist for EMEA at JPMorgan Asset Management, told Bloomberg TV.

In his latest effort to stack the Fed board, Trump and his allies are demanding Fed Governor Lisa Cook resign over alleged owner-occupancy fraud. For her part, Cook signaled her intention to remain at the central bank.

Yesterday, the latest FOMC Minutes for the July 29-30 meeting showed most officials viewed inflation risks as outweighing labor-market concerns, with tariffs fueling a growing divide within the rate-setting committee, though the discussions came before subsequent dramatic dire revisions to jobs data.

On the geopolitical front, US Vice President JD Vance said negotiations over ending Russia’s war in Ukraine are focused on security guarantees for Ukraine and territory Russia wants to control — including Ukrainian territory that Russia isn’t occupying — as the US tries to broker a peace deal between the two nations. Brent crude rose 0.8%.

The Stoxx 600 falls 0.2% with media, consumer product and chemical shares leading declines. Nordics represented several of the region’s biggest movers, with hearing-aid maker GN Store Nord surging 19% after reporting earnings, while Norwegian oil firm Aker BP jumped after a large oil find in the North Sea. UK retailer WH Smith plunged after signaling North American profit will be much weaker than previously hoped. Here are the biggest movers Thursday:

Earlier in the session, Asian stocks traded in a tight range, as a rebound in some tech stocks was offset by declines in Japan. The MSCI Asia Pacific Index fell 0.2%, with Japan’s Daiichi Sankyo among the top drags after a series of block trades at a discount. Hon Hai and TSMC were among the biggest boosts for the gauge. Shares hit a record high in Australia, while those in South Korea and Taiwan also advanced. Investors are awaiting cues from the Jackson Hole symposium, where Federal Reserve Chair Jerome Powell is expected to speak on Friday. Nvidia’s results next week will be another key test, with expectations for improving global tech earnings having bolstered sentiment. Equities also traded higher in mainland China, Vietnam and New Zealand on Thursday. MSCI equity gauges for every nation in the region are trading above their 200-day moving averages for the first time since 2021, according to Sentimentrader.com.

In FX, the euro and pound both edge higher against the greenback after the better-than-expected PMI data. The Norwegian krone is the best-performing G-10 currency, rising 0.5% after Norway’s GDP grew more than forecast in the second quarter.

In rates, treasuries are under pressure in early US trading amid steeper losses for most European bond markets sparked by stronger-than-anticipated August preliminary PMI gauges. US yields are higher by 1bp-2bp, the 10-year by about 1.8bp at 4.31%, vs increases of 3bp-4bp for UK and most euro-zone counterparts. US session features 30-year TIPS reopening auction at 1pm New York time. Week’s major focal point is Fed Chair Powell’s Jackson Hole speech on Friday. UK gilts are leading declines in European government bonds after the UK private sector expanded at the strongest pace in 12 months. UK 10-year yields rise 3 bps to 4.70%. German 10-year borrowing costs add 2 bps to 2.73% after the euro area’s private sector grew at the quickest pace in 15 months.

Looking at today's calendar, US economic data calendar includes weekly jobless claims and August Philadelphia Fed business outlook (8:30am), August preliminary S&P Global US PMIs (9:45am) and July leading index and existing home sales (10am). Fed speaker slate includes Atlanta Fed President Bostic at 7:30am, the last central bank official slated to speak before Chair Powell’s discourse at Jackson Hole Friday

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed, albeit with a mildly positive bias as the region attempted to shrug off the lacklustre lead from Wall St, where sentiment was dampened amid continued tech weakness and hawkish-leaning FOMC Minutes. ASX 200 outperformed amid a slew of earnings releases and breached the 9,000 level for the first time in history. Nikkei 225 was dragged lower by weakness in pharmaceuticals and automakers, with the latter not helped by reports that Japanese automakers are passing some of the expense of US tariffs through to American car buyers, which is a change from their strategy of absorbing the impact. Hang Seng and Shanghai Comp were mixed with the Hong Kong benchmark led lower by underperformance in tech stocks including Baidu and Xiaomi, despite both recently reporting a jump in profits, while the mainland remained propped up following the PBoC's liquidity efforts.

Top Asian News

European bourses (STOXX 600 -0.2%) are trading with little in the way of a clear bias. Geopolitical tensions resurfaced early doors after Ukraine's Air Force stated that Russia used 574 drones and 40 missiles in an overnight attack. Focus also on EZ PMIs which saw the saw the composite move further into expansionary territory. European equity sectors show a mostly negative tilt with stock-specific updates relatively light. Energy names sit at the top of the leaderboard amid upside in underlying crude prices. To the downside, Media names lag with Wolters Kluwer (-2.2%) a notable underperformer in the sector following a PT reduction at Morgan Stanley.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: UKRAINE

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

While the headline market moves were fairly muted over the past 24 hours, investors had to navigate a couple of major narratives. One was renewed concerns over Fed independence as President Trump suggested that Fed Governor Cook should resign, which pushed gold (+0.98%) to its best day since the weak July payrolls report on August 1. The other was continued pressure on tech stocks as the Mag-7 (-1.11%) posted consecutive declines of more than 1% for the first time since the post-Liberation Day sell-off in early April. This sent the S&P 500 (-0.24%) lower for a fourth session running even as the index recovered most of its -1% intra-day decline.

The topic of the US administration’s influence over the Fed came back into the headlines as Trump posted that Fed Governor “Cook must resign, now!!!”. His post followed news that Federal Housing Finance Agency (FHFA) Director Bill Pulte had written a criminal investigation referral letter to Attorney General Pam Bondi alleging that Governor Lisa Cook may have committed mortgage fraud. Pulte has been one of the staunchest Fed critics within the administration, earlier calling for an investigation into Chair Powell over the Fed’s building renovations. Yesterday Pulte claimed that the allegations give Trump “cause to fire” Governor Cook. Later in the day, Cook said in a statement that she had “no intention of being bullied to step down from my position”.

Governor Cook was nominated to the Federal Reserve Board by Joe Biden in 2022 and our US economists see her as leaning slightly towards to dovish end within the FOMC. Were Governor Cook to resign or be fired, that would create another opening for Trump to fill on the seven-person Board. With Stephen Miran nominated to take the seat recently vacated by Governor Kugler and two Fed Governors – Bowman and Waller – dissenting to vote for a rate cut at the July meeting, this would increase the prospects of a dovish majority emerging on the Board, especially if Chair Powell relinquishes his seat next year. That said, if concerns over threats to Fed independence increase, Powell could choose to serve out the rest of his board term (which ends in 2028) even after his term as Chair ends next May.

The news was a reminder of the lingering concerns over future Fed independence and risks of fiscal dominance, though the extent of the market reaction was fairly modest. The most sustained reaction was in gold (+0.98%) as mentioned at the top. The dollar index fell by a couple of tenths following the news but was back to little changed (-0.05%) by the close. Front-end yields fell by 3-4bps, but that move came amid a broader risk-off mood early in the session and also reversed later on.

By the close, 10yr Treasury yields were -1.5bps lower at 4.29% but 2yr yields were unchanged at 3.75%. This curve flattening was also supported by hawkish-leaning minutes of the July FOMC meeting. These showed that most of the FOMC “judged the upside risk to inflation” as greater than the “downside risk to employment”, with several participants noting the “risk of longer-term inflation expectations becoming unanchored”. That said, the minutes did suggest easing would be warranted “if labor market conditions were to weaken materially", and given the weak jobs report that followed the July decision, the relative focus on employment versus inflation risks will likely have shifted since. So, while pricing of September rate cut inched down yesterday to its lowest since the August 1 jobs report, a 25bp cut was still 83% priced.

US equities saw an even larger round trip, with a rout for tech stocks early in session leaving the S&P 500 more than -1% down intra-day but recovering to -0.24% by the close. The NASDAQ fell -0.67%, having been almost -2% down early on, while the Mag-7 slid by -1.11% after a -1.67% drop on Tuesday. The last time the Mag-7 saw consecutive declines of more than 1% was during the post-Liberation Day collapse in early April. The tech sell-off may have been exacerbated by reporting of an MIT study claiming that 95% of enterprises adopting AI saw no measurable increase in profits. Here at DB research, we remain optimistic on the productivity impact of AI but the report is a reminder that successful integration of new technologies takes time and that it’s still uncertain who will be the biggest end beneficiaries of the AI wave. Outside of tech, US equities had a decent day, with most of the S&P 500 sectors advancing, led by energy (+0.86%) which benefited as Brent crude prices rose +1.60% to $66.84/bbl.

Turning to Europe, we saw the latest rate decision from Sweden’s Riksbank, which kept rates on hold at 2.00% as expected while continuing to signal “some probability of a further interest rate cut this year”. Market pricing of another rate cut by year-end inched down to 88% from 91% the day before. We also heard from ECB President Lagarde, who said that “Recent trade deals have alleviated, but certainly not eliminated, global uncertainty” and noted that the euro area economy was likely to see slower growth this quarter. So that was arguably a bit more dovish in tone than her press conference last month, though Lagarde gave away little on the policy outlook.

Expectations of ECB easing ticked up on the day, with 21bps of cuts now priced by next June, the highest this has been in almost two weeks. In turn, European government bonds rallied with 10yr bund yields falling -3.2bps to 2.72%, and OAT (-2.2bps) and BTP (-3.0bps) yields similarly moving lower. Bunds were also supported by Germany’s PPI inflation print (-1.5% yoy vs -1.4% expected) falling to a 13-month low in July. Meanwhile, the euro area final headline CPI for July came in line with the flash reading at 2.0%.

Over in the UK, gilts yields saw a larger rally, with 10yr yields down -6.8bps to 4.67%. This came despite July CPI coming in slightly stronger than expected at +3.8% yoy for both headline and core inflation (vs +3.7% expected), which marked the highest headline reading since January 2024. A saving grace noted by our UK economist Sanjay Raja is that with the volatile transport and travel services components driving the upside, most core services metrics ticked down on the month (see Sanjay’s reaction here). Money markets moved to price in more BoE easing for early 2026 following the release, with the amount of cuts priced by next June rising +5.5bps to 38bps.

The repricing in UK rates helped the FTSE 100 outperform (+1.01%). The Stoxx 600 rose +0.24% but continental indices were more subdued, with the CAC (+0.06%) posting a marginal gain but the DAX (-0.69%) and FTSE MIB (-0.36%) losing ground.

Overnight, sentiment has turned risk-on again in most Asian equity markets. The KOSPI is up +0.73%, while the S&P/ASX 200 (+0.90%) is leading the way after a strong flash PMI print. Australia's composite PMI rose from 53.8 to 54.9 and the manufacturing index reached a 35-month high of 52.9. Chinese stocks are on also the rise, with the CSI (+0.72%) and the Shanghai Composite (+0.33%) higher though the Hang Seng (-0.10%) is lagging. Meanwhile, US equity futures on the S&P 500 and NASDAQ 100 are little changed after yesterday’s decline.

The one Asian market defying the regional positive trend is Japan, with the Nikkei down -0.58%. That comes despite Japan’s composite PMI rising to a 6-month high of 51.9 in the August flash reading (up from 51.6 in July), as stabilization in manufacturing (49.9 vs 48.9 in July) has offset slowing services growth (52.7 vs 53.6 in July). However, long-end JGB yields are inching higher to new multi-decade highs ahead of the July inflation print tomorrow morning, with the 30yr yield up +0.7bps to 3.18%, a new all-time high since this tenor was introduced in 1999.

To the day ahead, the main highlight will be the August flash PMI prints in Europe and the US. Other data releases include the August Philadelphia Fed business outlook, July existing home sales and weekly jobless claims in the US as well as August Eurozone consumer confidence. Earnings include Walmart, Intuit, and Workday. The Fed’s Bostic is due to speak, while the Kansas City Fed’s Jackson Hole symposium begins this evening with the main events on Friday and Saturday.