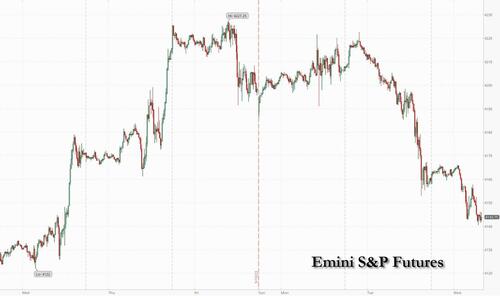

US equity futures drift drift lower for the second day following a deluge of bad news across global markets driving European stocks to their biggest drop in two months, pushing copper below $8,000 and snuffing out this year’s gains in China equities. As of 730am ET, S&P futures were down 0.4% to 4,143 following Tuesday’s 1.1% drop with Nasdaq futures sliding the same amount. Treasury yields are flat trading around 3.67%, the USD is slightly stronger, and bitcoin got the usual Asian session trapdoor as gold rose. Commodities are mixed: energy rallied (WTI + 2.1%) while metals are falling on concerns about China's fading recovery. Yesterday, we saw de-risking in crowding stocks with Momentum Winners and MegaCap Tech being the biggest laggards. On debt ceiling negotiation, two parties have not come to an agreement. Today, we will receive the FOMC Minutes at 2pm ET; AI-leader Nviidia reports after the close.

In premarket trading, megacap tech was mixed with MSFT and AMZN recovering, while the rest are lower. Nvidia Corp., a stock at the center of the artificial intelligence frenzy, lost almost 1%. Regional banks are mostly higher as Pacwest continues to sell more assets to meet liquidity needs (why this is positive remains unclear) while large-cap banks lagging. Here are the most notable premarket movers:

There were plenty of reasons for investors to be pessimistic according to Bloomberg: in the US, there was little progress in debt-ceiling talks and investors are increasingly worried about a default. Yields on securities maturing June 6 topped 6% Tuesday, compared with bills maturing May 30 that are yielding about 2%. China’s sputtering economy and worsening geopolitical ties also hurt sentiment, and UK inflation came in higher than all economist predictions setting the stage for painful encounter with stagflation. Meanwhile, as discussed earlier, Europe's luxury bubble indeed appears to be bursting as Luxury stocks, one of this year’s most popular trades, extended losses, with LVMH and Gucci owner Kering SA sliding about 2%. European real estate and carmakers slumped on concern that UK interest rates are heading higher.

“Right now we’re defensively positioned,” said Janet Mui, head of market analysis at RBC Brewin Dolphin, in an interview on Bloomberg TV. “We expect a US recession. We have pushed back the date of that recession to 2024 but we think it’s inevitable. Interest rates will stay high in the US, contrary to what the market is currently pricing, so I think that is negative for the economy and corporate profits. This will drive equity markets lower.”

In Europe stocks are firmly in the red as investors contemplate the prospect of additional monetary policy tightening. The Stoxx 600 Index lost 1.7%, the biggest intraday loss since March 24 as gilts slid, lifting the yield on the 10-year note was up five basis points at 4.21% following a blazing hot UK CPI print; travel, autos and consumer products the worst-performing sectors. Here are the most notable European movers:

“Inflation continues to dominate - from boardrooms to shop floors - especially after stickier than expected UK inflation cemented bets of more BoE rate hikes ahead,” said Angeline Ong, a financial analyst at IG Group.

Asian stocks were mostly lower following the negative lead from Wall St where sentiment was weighed on by the ongoing debt limit impasse with just 9 days left to the X-date and amid US-China frictions after the US House China Select Committee Chair called for retaliation against China’s ban on Micron.

In FX, the Bloomberg dollar index is unchanged erasing an earlier spike. Sterling extends gains in the immediate aftermath after UK CPI came in hotter than the highest estimate, but has since turned lower versus the greenback. The New Zealand dollar dropped as much as 1.3% after the central bank unexpectedly signaled that no further policy tightening will be needed. Policymakers hiked interest rates to 5.5%, in line with projections.

In rates, Treasuries were slightly richer across the curve after unwinding early losses that were spurred by selloff in gilts following upside surprise by UK inflation data. Subsequently 2-year UK yields remained higher by around 20bp into early US session, sharply underperforming among core European rates. US 10-year yields around 3.675%, richer by ~2bps vs Tuesday close and outperforming gilts by 7bp in the sector; long-end slightly outperforms, flattening 5s30s spread by ~1.5bp ahead of belly supply at 1pm New York time. The 10-year UK bond yield jumped as much as 21 basis points to 4.37%, the highest since October, after data showed the UK inflation rate at 8.7% in April, higher than any of the 36 estimates from economists or the 8.4% forecast by the central bank. UK money markets priced in a peak BOE rate of as high as 5.5%, compared with around 5.1% on Tuesday. Back in the US, there is a $43bn 5-year note auction follows strong demand for Tuesday’s 2-year sale, which stopped 1.5bp through the WI level. WI 5-year around 3.702% is ~20bp cheaper than April’ stop- out, which. US session highlights include 5-year note auction and FOMC minutes release.

In commodities, metals were broadly lower. A new wave of Covid is threatening to set back the country’s economy, and investors have been rattled by Beijing’s move to ban purchases of Micron Technology Inc.’s products. Crude futures meanwhile extended their recent advance with WTI rising 2% to trade near $74.40. Spot gold is little changed around $1,975.

Bitcoin fell 1.6%, back under $27K, under pressure as the risk tone remains downbeat as the clock ticks down to the US X-date.

Looking to the day ahead now, and we’ll get the release of the Fed’s minutes from their last meeting in May. Other central bank speakers will include ECB President Lagarde, BoE Governor Bailey and the Fed’s Waller. Data releases include the UK CPI reading for April and Germany’s Ifo business climate indicator for May.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower following the negative lead from Wall St where sentiment was weighed on by the ongoing debt limit impasse with just 9 days left to the X-date and amid US-China frictions after the US House China Select Committee Chair called for retaliation against China’s ban on Micron. ASX 200 declined with the resilience in the commodity-related sectors offset by weakness across the broader market and after the Westpac Leading Index remained depressed. NZX 50 was underpinned after a dovish RBNZ rate hike which signalled the end of its rate increases. Nikkei 225 was pressured after its recent pullback to beneath the 31,000 level despite reports that the government is to consider childcare handouts for those up to 18 years old, while the first positive reading this year in the monthly Reuters Tankan manufacturing survey did little to spur risk appetite. Hang Seng and Shanghai Comp. were lower amid US-China frictions after the White House spoke out against the Micron ban, while a lawmaker called for the Commerce Department to add Changxin Memory Technologies to the entity list and ensure no US export licenses are granted to firms operating in China which are used to backfill Micron.

Top Asian News

European bourses are pressured as headwinds mount, Euro Stoxx 50 -1.6%; attention on debt talks, UK CPI, poor Ifo, US-China tensions and continued luxury sector downside. Sectors are pressured across the board with Real Estate lagging on hawkish BoE pricing while Luxury names continue to slip with analysts citing an MS luxury conference pointing to relatively more subdued performance in the US. US futures are softer but much more contained as we await more concrete developments on the debt ceiling, ES -0.2%, with updates this morning via multiple journalists skewed to the downside overall on a near-term agreement.

Top European News

FX

Fixed Income

Commodities

Debt Ceiling headlines

Geopolitics

US Event Calendar

Central bank speakers

DB's Jim Reid concludes the overnight wrap

AI hasn’t yet been able to solve the debt ceiling problem and markets struggled yesterday, with front end bonds and equities selling off together as investors grew increasingly concerned about the debt ceiling. It’s true that both sides are still talking and the mood music sounds (mostly) positive, but we might only be days away from the deadline in early June, and any deal that’s reached is still going to need to be passed through both houses of Congress. So there are real concerns that this could go right down to the wire, and investors are slowly gearing up accordingly. There’s also been talk about whether a short-term extension might now be needed to get this over the line, but for the time being, Speaker McCarthy has continued to downplay the prospect that will happen. So investors continue to wait nervously with no signs of a deal emerging just yet.

When it came to the last 24 hours, it was reported by Punchbowl News that McCarthy had told Republicans in a closed-door meeting that “we are nowhere near a deal yet”. But later on, McCarthy told reporters that a deal could still be reached by June 1. By last night, GOP Representative Graves, who has been one of McCarthy’s lead negotiators, said some progress had been made but then added that “we’re going to have to see some movement or some fundamental change in what they’re doing,” and that there was not an additional meeting currently set up. House Majority Leader Scalise also questioned how the June 1st x-date was calculated, which prompted markets to believe the two sides were still some ways apart. Speaker McCarthy has said he would not waive a rule allowing Congress to review a bill for 3 days before a vote, if he holds that line it will further compress the timetable to get a deal done before early-June.

Those issues surrounding the debt ceiling have put serious pressure on US Treasuries over recent days. At the front end, yesterday a Treasury auction of a 21-day cash management T-bill yielded 6.2%, which is above what last week’s 4W bill received (5.84%). The bill is due June 15 and would fully capture Treasury Secretary Yellen’s projected x-date period of “early-June”, furthermore there is an expected influx of corporate tax revenue around that date and so the risk of default remains very much prior to that point. That said there is typically lower demand for the cash management bills than benchmark issues but the fact remains that we have not seen a 6-handle on US Treasury security since 2000 when 2, 10 and 30yrs traded at that level.

In terms of other benchmarks, the 1M and 3M US T-bills were flat after a late rally with the latter rising marginally (+0.2bps) to a fresh post-2001 high of 5.226% - eclipsing last Thursday’s close. And when it came to longer maturities, rising 10yr Treasury yields ran out of steam after having risen for 7 consecutive session as they fell back -2.3bp, taking them to 3.692%. They did hit 3.75% earlier in the session but risk-off seemed to provide a bid after Europe went home. Overnight, they are -1.2bps lower at 3.68% as I type.

Whilst investors might be worried about a US default, another factor behind those Treasury declines has been growing scepticism that the Fed are actually going to cut rates this year. Indeed, only yesterday we got some better-than-expected data from the US, since the flash composite PMI hit a 13-month high in May of 54.5 (vs. 53.0 expected). Then 15 minutes later, the data on new home sales for April came in 683k on an annualised basis (vs. 665k expected), which was also a 13-month high. So that added to the signs that the economy was proving resilient as we move deeper into Q2, and helped to push back fears of an imminent recession.

With that strong data in hand, investors dialled back their expectations for rate cuts from the Fed over the course of 2023. For instance, the rate priced in by the December meeting was up another +1.2bps to 4.71%, which is its highest level since SVB’s collapse in early March. Bear in mind that on March 15, when the market turmoil was at its height, the rate expected in December hit a closing low of 3.75%, so we’ve now recovered a full 100bps from that point, which shows how the market has increasingly put that turmoil behind it. And although fears about the debt ceiling are rising, the underlying base case for investors is still that a deal or an extension will be agreed as on previous occasions, allowing investors to look through this current crisis too.

For equities, the tone was downbeat yesterday as the S&P 500 finished near the lows of its daily trading range down -1.12%. The NASDAQ largely matched the broader index, falling -1.26% yesterday, with megacap tech stocks giving way in the US afternoon as the FANG+ index (-1.29%) saw its largest pullback in nearly a month. Look out for Nvidia’s (-1.57%) earnings after the bell today. The stock (up +110% in 2023) is the fifth largest in the S&P 500 and now has a market cap of $758.9bn, which for context is double the biggest company in the Stoxx 600 (Nestle – EUR 310bn) and nearly 5x larger than the biggest corporate in the DAX (SAP – EUR 151bn).

The tone was a bit better in Europe given the late selloff in the US, and the STOXX 600 fell -0.60%, whilst the CAC 40 (-1.33%) saw the biggest underperformance as luxury good stocks struggled. That came as the flash PMIs were broadly in line with consensus across the continent, with the composite Euro Area print at 53.3 (vs. 53.5 expected).

Sovereign bonds in Europe broadly followed the US, with yields on 10yr bunds (+1.0bps), OATs (+0.1bps) and BTPs (+0.7bps) rising on the day. The big underperformer were UK gilts however, where 10yr yields (+9.4bps) rose to their highest level since Liz Truss was PM last October, at 4.158%. That followed comments from BoE officials before MPs, including Governor Bailey who said that “there are risks of persistence” on inflation. Meanwhile Catherine Mann, the most hawkish member of the MPC, commented that “tightening and tight are not the same” and said “real rates are still below zero”. That prompted investors to dial up their expectations for rate hikes over the months ahead, with terminal now priced above 5%. Keep an eye out for the April CPI release shortly after this goes to press as well, where the headline reading is expected to come out of double-digits (8.2% expected vs. 10.1% last month) as last year’s spike in energy prices drops out of the annual comparison.

Speaking of inflation, there was some further good news from Europe as natural gas prices fell to their lowest level in nearly 2 years. That was thanks to a -1.97% decline yesterday, taking futures down to €29.13/MWh, which also leaves prices on track for their 8th consecutive weekly decline. It’s true that Brent crude oil prices (+2.17%) hit a 2-week high yesterday of $77.64/bbl. But more broadly the trend for commodities has been continuously lower over recent months, and Bloomberg’s Commodity Spot Index fell to its lowest level since December 2021.

Asian equity markets are tracking overnight losses on Wall Street with the Hang Seng (-1.10%) leading losses followed by the Nikkei (-1.08%), the CSI (-0.56%), the Shanghai Composite (-0.54%) and the KOSPI (-0.23%). In overnight trading, US equity futures are indicating a small rebound though with those tied to the S&P 500 (+0.11%) and NASDAQ 100 (+0.10%) printing mild gains.

In terms of monetary policy action, the Reserve Bank of New Zealand (RBNZ) raised its benchmark rate by 25bps to the highest in more than 14 years to 5.5%, in line with expectations, but signalled it may be done with tightening. Following the decision, the New Zealand dollar slumped more than -1%, to a three-week low of $0.617 as the central bank decided not to keep the door open for further policy tightening. Meanwhile, benchmark 2yr yields fell sharply (-32.1 bps) to 4.78%, dropping the most in 6 months with 10yr yields dropping (-15.3 bps) to 4.30% as we go to print.

To the day ahead now, and we’ll get the release of the Fed’s minutes from their last meeting in May. Other central bank speakers will include ECB President Lagarde, BoE Governor Bailey and the Fed’s Waller. Data releases include the UK CPI reading for April and Germany’s Ifo business climate indicator for May.