Futures are lower, tracking European bourses and Asian markets, but well off session lows as a brief burst of China-linked optimism promptly following a Monday surge in property stocks and hopes of a Chine recovery turned to bust, as China reported the slowest service sector monthly growth so far this according to the August PMI survey, adding to a series of disappointing data. As of 7:50am ET, S&P futures were down 0.1% to 4,517 reversing the 0.2% gain during the Monday Labor Day holiday session; Nasdaq 100 futures dropped 0.4%. The US currency gained as much as 0.5% against its Group-of-10 peers, touching the highest level since March, sending commodities, gold and bitcoin lower. 10Y Yields are up to 4.22% and once again approaching the key resistance level of 4.25%, pressured not just by oil trading near 2023 highs but also in anticipation of a surge in corporate bond sales this week. Also, UK and euro-zone yields rose Monday and are extending that move. Today’s macro data focus is Durable Goods/Cap Goods plus Factory Orders. Later in the week we receive ISM-Srvcs and Jobless Claims.

In premarket trading, NextGen Healthcare jumped 8% after Bloomberg News reported that Thoma Bravo is in advanced talks to buy the health-records software company. US-listed Chinese stocks dropped following their best weekly performance since July, as August data pointed to a slowdown in China’s services sector. Alibaba -1%, Baidu -1.7%. Blackstone and Airbnb rose after the S&P Dow Jones Indices said the stocks will join the S&P 500 index prior to the opening of trading on Sept. 18. Manchester United fell as much as 9.2% amid ongoing speculation over a possible deal for the Premier League team. Here are some other notable premarket movers:

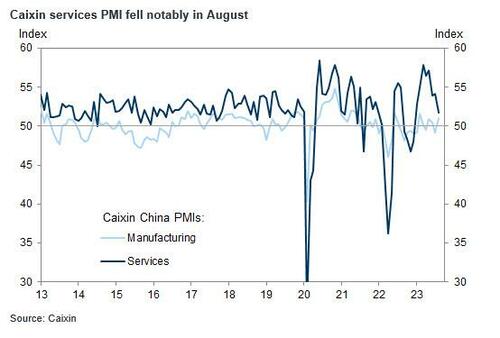

Overnight, China’s services sector saw the slowest growth this year in August, an industry survey showed, adding to evidence the economic recovery is losing traction and damping earlier optimism over government stimulus.

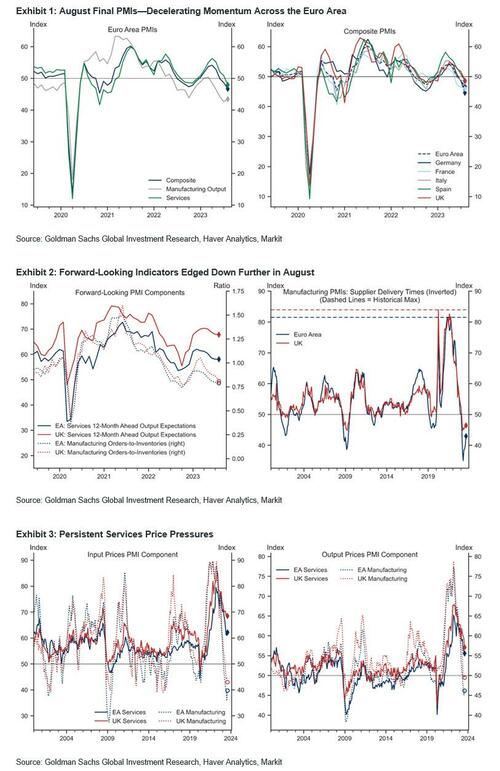

Similarly in Europe, the composite purchasing managers’ index undershot expectations, posting a contraction for a third straight month.

As we enter Sept, JPM's market intel team writes that there is much discussion on seasonality; while Sept’s average return is negative, its median return is ~0%. When SPX is update double-digits into Sept, then Sept tends to be positive, too. We may also see a surge of capital markets activity over the next couple weeks.

The European Central Bank, which meets next week, faces a quandary over interest rates, given recession fears and above-target inflation. "There is real concern for the euro-area picture, with survey data suggesting the economy is sliding into recession," said Sarah Hewin, head of Europe and Americas research at Standard Chartered. “It raises questions over how aggressive the ECB can be going forward.”

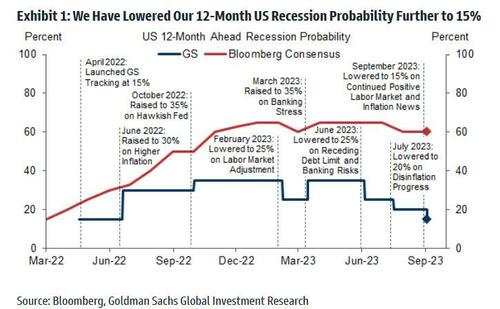

By contrast, recent data shows the US economy is holding up well and rate cuts may not come any time soon, even though many economists say the Federal Reserve has come to the end of its 18-month long policy-tightening campaign. Goldman Sachs now sees just a 15% probability of a US recession in the coming year, down five percentage points from their previous estimate.

Europe’s Stoxx 600 traded flat, after paring a drop of as much as 0.8% with luxury goods among the worst performers. Here are the most notable European movers:

Earlier in the session, Asian stocks fell, with the key regional benchmark on track to snap a six-day winning streak, as a property-led rally in Chinese equities fizzled amid disappointing economic data. The MSCI Asia Pacific Index fell as much as 0.8%, dragged by weakness in the financial sector. China equities declined, retreating after Monday’s strong gains as a gauge of services activity printed well below estimates. China led the rally in Asian stocks on Monday after authorities rolled out more stimulus for the embattled property sector. The decline on Tuesday shows investor sentiment toward Chinese shares remains fragile, casting a pall on the outlook for regional equities. Even after its latest rally, the Asian benchmark is trailing key gauges of peers in the US and Europe this year.

“It’s the typical post-party reality check that’s cooling down China’s rally today, as the services PMI notably missed expectations, suggesting further economic downtrend ahead,” said Hebe Chen, an analyst at IG Markets Ltd. “Meanwhile, investors are cautiously awaiting the RBA’s meeting decision, which is poised to raise the curtain for a new round of central bank talks.”

In FX, the US dollar rose to the strongest since July against the euro and the pound. Against the yen, it’s approaching the highest since November, and BOJ intervention is looking increasingly inevitable. The Bloomberg Dollar Index jumped 0.4% to 1250.81, its highest since mid-March as China data pointed to sputtering economic recovery. The US currency posted the biggest gains against the Australian dollar, down 1.3%. Australia’s central bank kept its key interest rate unchanged and maintained a tightening bias. “With RBA already acknowledging that the economy is already experiencing below-trend growth, surely any further tightening should crimp on growth momentum further down the road,” said Fiona Lim, senior FX strategist at Malayan Banking Bhd. in Singapore. “AUD could still remain under pressure." EUR/USD fell 0.5% to $1.0747 as data showed consumer inflation expectations rose in July even as demand for services cooled

In rates, treasuries were lower with US 10-year yields rising 4bps to 4.22%. US yields are higher by 3bp-54bp across the curve led by intermediate tenors, leaving curve spreads narrowly mixed, and extending a slide that began Friday in anticipation of a surge in corporate bond sales this week. At least six US high-grade corporate bond issuers have slated offerings for Tuesday; sales are expected to total about $120b this month, a seasonally heavy month that normally sees issuance concentrated in the week or so after US Labor Day. Treasury coupon supply is on hiatus until Sept. 11, when cycle including new 3-year and 10- and 30-year reopenings is slated to begin. Also, UK and euro-zone yields rose Monday and are extending that move. Bunds are also in the red with little reaction shown to a downward revision to euro-area service PMI.

In commodities, crude futures decline, with WTI falling 0.2%. Spot gold drops 0.6%.

Bitcoin is under modest pressure, -0.2%, as the USD continues to climb higher and the overall tone remains a subdued one after the APAC handover. Currently, BTC resides at the mid-point of USD 25.55-25.83k parameters.

To the day ahead now, and data releases include the global services and composite PMIs for August, along with Euro Area PPI for July and US factory orders for July. From central banks, we’ll get the ECB’s Consumer Expectations Survey, and hear from the ECB’s Schnabel and Visco.

Market Snapshot

Top overnight news from Bloomberg

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly subdued after the holiday lull stateside and as the region digested disappointing data releases including the weaker-than-expected Chinese Caixin Services PMI. ASX 200 was lower amid underperformance in the commodity-related sectors and as participants braced for the conclusion of RBA Governor Lowe’s final policy meeting in which the central bank kept rates unchanged as expected. Nikkei 225 stalled on its approach to the 33,000 level and with headwinds from disappointing household spending data which suffered its worst drop since February 2021. Hang Seng and Shanghai Comp were pressured after Chinese Caixin Services PMI data missed forecasts and with the property sector dampened by default fears with about a third of 50 major private builders said to face around USD 1.5bln dollars of payments this month, while Country Garden narrowly averted a default and paid USD-denominated coupons hours before the end of the grace period.

Top Asian News

European bourses are in the red, Euro Stoxx 50 -0.2%, but have been gradually making their way higher after a subdued open given the downbeat APAC handover. A handover that was negatively affected by soft Chinese Caixin PMI data. Since action has been influenced by Final PMIs though the metrics provided little to lift the overall tone with the recovery off lows occurring gradually and without a specific fundamental driver. Sectors are mixed after beginning the morning firmly in the red. Personal Care, Drug & Household names alongside Consumer Products/Services continue to lag given broker activity and data while Financial Services, Energy, Insurance and Banking are now modestly firmer on the session; the latter components perhaps benefitting from yield support. Stateside, futures have been directionally in-fitting with the above though magnitudes have been more contained thus far. ES -0.2% has lifted off of lows with the NQ -0.3% following suit but to a slightly lesser extend given yield upside. Action which comes ahead of Final PMIs and a handful of other data points.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

The last 24 hours have been fairly quiet for markets given the US holiday, but the overall tone was slightly negative after what was earlier a very good handover from a strong China market on Monday. However this faded as the day progressed with losses for bonds and equities in Europe, just as oil prices hit a new high for 2023. The recent run-up in oil prices is already setting us up for some hotter August CPI prints, so any further gains there are going to be a fresh hurdle for central banks in their quest to get inflation back to target.

That concern was evident among sovereign bonds, which sold off mainly thanks to higher inflation expectations. For instance, the 10yr bund yield was up +3.1bps on the day to 2.57%, of which +2.5bps was a result of higher inflation expectations. Yields moved higher in other countries as well, with those on 10yr OATs (+2.8bps), BTPs (+5.4bps) and gilts (+3.5bps) all rising.

Unsurprisingly, that rise in inflation expectations led to a bit more speculation about whether the ECB might deliver another hike next week. Currently, overnight index swaps still consider that an unlikely prospect and are pricing in a 25.7% chance, but that’s up from 23% the previous day, so clearly investors aren’t entirely discounting the prospects of another move.

When it comes to that meeting, ECB President Lagarde provided no clues on what the ECB might do in a speech yesterday. That focused on communication and monetary policy, although Lagarde did say “actions speak louder than words” and referenced the 425bps of hikes that the ECB had already delivered. If they were to pause, that would end a run of 9 consecutive rate hikes, so it could be a big moment. However, markets think there’s also a decent probability they might do a “skip” like the Fed did in June, since they’re also pricing in a 50% chance of a hike by the time of the December meeting.

This backdrop saw European equities lose ground throughout the session, despite a fairly strong performance at the open. Indeed, the STOXX 600 was initially up +0.88%, with China related stocks in the ascendency. These gains were pared back with the index ending the day -0.04% lower. It was a similar story across the continent, with modest losses for the FTSE 100 (-0.16%), the CAC 40 (-0.24%) and the DAX (-0.10%) as well. US markets were closed yesterday, but S&P 500 (-0.17%) and NASDAQ 100 (-0.11%) futures have edged lower overnight. 10yr USTs yields (+3.15bps) have edged up trading at 4.21% as trading has resumed.

The other big development yesterday came from oil prices, which hit a new closing high for 2023. The latest moves saw Brent crude up +0.51% yesterday to $89.0/bbl, whilst WTI is up +0.47% this morning trading at $85.95/bbl as we go to press. The last time Brent traded above $90/bbl was last November, and even a temporary uplift could prove challenging for policymakers and markets, since inflation is still running above target. So any pivot away from restrictive policy is going to be hard so long as it remains there, and it's going to heighten the dilemmas they might face if we do end up with a noticeable downturn in growth.

Asian equity markets are lower this morning reversing some of yesterday's gains. Chinese equities are leading losses with the Hang Seng (-1.55%) the biggest underperformer followed by the Shanghai composite (-0.63%) and the CSI (-0.57%). The Nikkei (-0.21%) and the KOSPI (-0.12%) are also slightly lower as I type.

Coming back to China, services sector activity expanded at the slowest pace in eight months as the Caixin/S&P Global services PMI dropped to 51.8 in August (v/s 53.5 expected) from 54.1 in July, bringing it more in line with the official services PMI.

In company news, China’s former largest builder Country Garden managed to avoid default by paying $22.5 million of US bond interest due on August 07, just within a 30-day grace period ending. It's also looking to extend the principal of 8 Yuan bonds by 3 years. So they are obviously doing what they can to avoid default.

In monetary policy action, the Reserve Bank of Australia (RBA) decided to keep its benchmark policy rate unchanged at 4.1% for the third straight month with the statement seemingly very similar to last month. It is the last meeting chaired by RBA governor Philip Lowe, whose seven-year term ends next week.

Elsewhere, household spending in Japan (-5.0% y/y) posted its biggest decline in nearly 2.5 years in July, sliding for the fifth consecutive month and worse than market expectations of -2.5% and against the prior month’s -4.2%. South Korea CPI reaccelerated in August after six months of cooling, coming in at +3.4% y/y in August (v/s +2.9% expected; +2.3% in July) on the back of upside surprises coming from fresh food and energy.

To the day ahead now, and data releases include the global services and composite PMIs for August, along with Euro Area PPI for July and US factory orders for July. From central banks, we’ll get the ECB’s Consumer Expectations Survey, and hear from the ECB’s Schnabel and Visco.