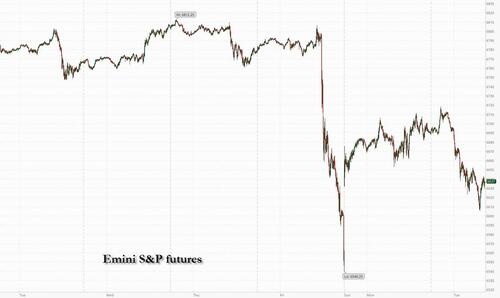

The market rollercoaster continues: after Monday's faceripping bounce, US equity futures are lower again led by tech, part of a global risk-off tone as the US/China trade war returned after Beijing vowed to “fight to the end” in the tariff and trade war, while acknowledging that the door for negotiation is open and trade talks between the two countries had resumed yesterday. Beijing also imposed curbs on the American units of Hanwha Ocean, one of South Korea’s biggest shipbuilders, as it targets US measures against the Chinese shipping sector. As of 8:00am ET, S&P futures are down 0.9% and near session lows as market may be reading the latest response by China as an ‘escalate to de-escalate’ ahead of the Trump / Xi mtg later this month. Nasdaq 100 futs were 1.1% lower with all members of the Magnificent Seven sliding in premarket trading, while European stocks slipped 0.7%. Bond yields are lower as the curve bull steepens, pushing 10Y yields briefly below 4.0%, with USD flat as the bond market returns from holiday. In addition to MegaCap Banks we have the Small Business Survey which printed below estimates, and where the section on hiring plans will be under scrutiny given the gov’t shutdown. The biggest highlight of the session is Fed Chair Powell speaking on the Economic Outlook and Monetary Policy at 12:20pm ET.

In premarket trading, Mag 7 stocks are all lower (Nvidia -1.8%, Tesla -2.5%, Alphabet -1.6%, Apple -0.7%, Microsoft -0.7%, Meta -1.4%, Amazon -1.4%).

Global equities retreated after China upped the ante in its trade standoff with the US, stirring fresh concerns over tensions between Beijing and Washington at a time when stocks look stretched after a relentless rally. Besides hammering global stocks and marking a third day of wild stock swings, the latest standoff also sparked a rally in global bonds as investors pulled back from risk, sending the 10-year US Treasury yield down two basis points to 4.01%. Gold swung between gains and losses, while silver dipped after hitting a record over $53/oz.

“The sharp reversal shows how quickly sentiment can shift,” said Florian Ielpo, head of macro at Lombard Odier Investment Managers. “With elevated valuations already making markets vulnerable, expect continued volatility.”

Traders’ attention is also turning to the unofficial start of earnings season. JPMorgan fluctuated premarket after beating estimates for trading and investment-banking fees. Goldman Sachs fell despite posting record third-quarter revenues, on concerns about rising expenses.

Alongside renewed trade concerns, the surge in AI stocks is stoking bubble fears. In the October edition of BofA's Fund Manager Survey survey, 54% of investors think there’s a bubble in the sector with concerns over global equity prices also at a record.

Bank earnings will be key for market direction later, with Citigroup, Goldman Sachs and JPMorgan all reporting this morning. Fed’s Powell is due to speak at 12:20pm ET, and his commentary will be crucial amid a lack of hard data.

Going back to the AI story that has rescued the market from other dips, BBG warns that it may be losing steam. Samsung shares fell, despite the company reporting its biggest quarterly profit in more than three years, with some investors cashing in on its recent AI-mania fueled gains.

In other assets, cryptocurrencies continued to lose ground after a historic round of liquidations that triggered a sharp selloff over the weekend, with Bitcoin slumping as much as 3.7%. Oil fell after the IEA raised its estimate for a record oversupply.

In Europe, the Stoxx 600 falls as much a 1% after a broadly negative Asian session. European stocks fell on renewed trade jitters as China sanctioned the US units of a South Korean shipping giant Hanwha Ocean. Telecommunications and real estate equities are the biggest gainers, while mining and automobile shares led the declines. Here are the biggest movers Tuesday:

Earlier in the session, Asian stocks slipped on Tuesday, hurt by broad worries over US-China trade frictions as well as losses in Japan, where political uncertainty dragged shares lower after a long weekend. The MSCI Asia Pacific Index fell as much as 1.5%, to head for a third day of declines, with Chinese tech names Alibaba and Tencent among the biggest drags. The Hang Seng Tech Index entered a technical correction after the gauge fell more than 10% from a high on Oct. 2 following a blistering five-month rally through September.

“China’s new tit-for-tat move against Hanwha Ocean’s US units marks another escalation in the strategic supply chain rivalry, deepening cracks in an already fragile risk backdrop,” said Hebe Chen, an analyst at Vantage Markets in Melbourne. “In essence, it reinforces the de-risking narrative.”

Australian mining companies with critical minerals projects jumped, fueled by signs of US interest in equity stakes as Trump and China intensify their strategic competition. In Japan, the Topix and Nikkei both slumped at least 2% each as trading resumed following Monday’s holiday. Japan’s governing coalition abruptly collapsed Friday in a major blow to new ruling party leader Sanae Takaichi, plunging the country into one of its biggest political crises in decades. Meanwhile, LG Electronics India soared in its Mumbai trading debut after investors flocked to the firm’s initial public offering, one of India’s biggest this year.

In FX, the Bloomberg Dollar Spot Index reverses losses to rise as much as 0.3% to its highest since Aug. 1; the pound drops 0.4% while the Aussie dollar is the weakest of the G-10 currencies, down 0.9%. Hedge funds in Asia and Europe are buying vanilla dollar call options versus a range of currencies amid a pickup in risk-off sentiment, according to European and Asian traders, BBG reports.

In rates, treasuries climb, pushing US 10-year yields down 3 bps to 4.01%. Gilts lead an advance in European government bonds after the UK unemployment rate unexpectedly rose, prompting traders to boost BOE easing bets. UK 10-year yields fall 7 bps to 4.59%.

In commodities, spot gold has recovered to add $30 after an abrupt selloff saw it briefly turn negative. Silver also fell sharply from a record and is still down 2%. Bitcoin falls 3.5% below $112,000.

Looking to the day ahead now, data releases include UK unemployment for August, the German ZEW survey for October, and the US NFIB small business optimism index for September. Central bank speakers include Fed Chair Powell, the Fed’s Bowman, Waller and Collins, the ECB’s Cipollone, Makhlouf, Kocher and Villeroy, BoE Governor Bailey, and the BoE’s Taylor. Finally, earnings releases include JPMorgan Chase, Johnson & Johnson, Wells Fargo, Goldman Sachs, BlackRock and Citigroup.

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed following the rebound on Wall St and with underperformance in Japanese markets as they reopened from the extended weekend and reacted to the recent US-China tariff tensions, as well as the Japanese ruling coalition split. ASX 200 struggled for direction as weakness in the financial and consumer-related sectors offset the gains in materials and miners, with the latter helped by the recent upside in metal prices and with Rio Tinto gaining following its quarterly activity update. Nikkei 225 underperformed as participants returned from the holiday closure and reacted to the recent US-China trade frictions and political uncertainty in Japan, while there were late headwinds after reports of China trade-related actions against the US. Hang Seng and Shanghai Comp are lower amid the backdrop of the tumultuous trade/tariff related headlines in which the recent softening in tone by the US on China was followed by reports overnight that China's MOFCOM is taking countermeasures against five US-linked firms and that China's Transport Ministry opened an investigation into US 301 tariffs impact on China shipping industry.

Top Asian News

European bourses (STOXX 600 -0.4%) are broadly lower across the board, with sentiment hampered by the ongoing US-China spat; overnight, China's MOFCOM announced that it is taking countermeasures against five US-linked firms. European sectors hold a strong negative bias. Telecoms takes the top spot, boosted by post-earning strength in Ericsson (+13%) after it beat on profits and raised guidance. To the bottom of the pile resides Basic Resources, hampered by broader weakness in underlying metals prices. US equity futures (ES -0.8%, NQ -1.1%, RTY -0.9%) are lower across the board, following a similar theme seen in Europe. All focus today on a number of bank results, to kick off Q3 earnings seasons. BP (BP/ LN) Q3'25 Trading Statement: Upstream Production in Q3 is now exp. to be higher vs prior quarter, but flagged weaker trading into Q3. BlackRock Inc (BLK) Q3 2025 (USD): Adj. EPS 11.55 (exp. 11.24), Revenue 6.51bln (exp. 6.23bln); AUM 13.464tln (exp. 13.37tln).

Top European News

FX

Fixed Income

Commodities

Geopolitics

US event calendar

DB's Jim Reid concludes the overnight wrap

As was looking likely in Asian trading yesterday morning, markets have recovered over the last 24 hours, with the S&P 500 (+1.56%) last night bouncing back from its tariff-induced selloff on Friday. A little momentum has been lost in the Asian session this morning but we're still in a better place than Friday.

As we discussed this time yesterday, the biggest driver to Monday's rally was more positive rhetoric on trade over the weekend, which suggested that the US was more open to a compromise than Trump’s initial posts from Friday had indicated. But markets also got another boost from the latest AI news, as OpenAI signed a deal with Broadcom (+9.88%) to purchase 10 gigawatts of computer chips. So by the close, it meant the S&P 500 had recovered more than half of its Friday losses, and other assets like Brent crude oil (+0.94%) also managed to pare back last week’s declines.

Stand by for the start of US earnings season today with JPMorgan Chase, Johnson & Johnson, Wells Fargo, Goldman Sachs, BlackRock and Citigroup all reporting. S&P 500 (-0.38%) and NASDAQ (-0.57%) futures are lower this morning ahead of what will soon be a deluge of earnings in a market starved of macro data due to the shutdown. Japanese markets are being hit the most this morning with the Nikkei down -2.80% with continued reverberations around the collapse of the ruling coalition late last week which puts some concerns as to whether new LDP leader Sanae Takaichi can still get enough votes to be elected PM.

In terms of the latest on the trade war, the news over the last 24 hours has continued to sound much more emollient. For instance, US Treasury Secretary Bessent was on Fox Business yesterday, and he said on the Trump-Xi meeting in South Korea, that “I believe that meeting will still be on”. Polymarket has the probability at such a meeting at 74% this morning from 62% as we went to print yesterday, 35% at the lows on Friday and 88% at the recent highs last week. Although as we go to print Bessent has been interviewed by the FT and his words seem more hawkish, accusing the Chinese of trying to hurt the world economy.

A reminder of Trump’s weekend posts, including his comment that Chinese President Xi “doesn’t want Depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it!!!” That backdrop led to a decent rebound for the most trade-sensitive stocks. So the NASDAQ Golden Dragon China index was up +3.21%, and that’s an index made up of companies publicly traded in the US, but who do a majority of their business in China. Similarly, the Philadelphia Semiconductor Index (+4.93%) posted its strongest daily performance since May, admittedly with a boost from the Broadcom headlines as well.

That unwind was clear across multiple asset classes, as the initial reaction from Friday was pared back. For instance, oil prices posted a decent recovery, with Brent crude (+0.94%) moving back up to $63.32/bbl, as investors lowered the chances of a wider breakdown in trade. Meanwhile US bond markets were closed for the Columbus Day holiday, but Treasury futures pointed to higher yields all day but 10yr yields are only +0.6bps higher this morning from Friday's close at 4.038% after having approached 4.07% at the reopen in Asia. 2yr yields are actually -1.3bps lower now than Friday's close.

Whilst the focus was mainly on trade yesterday, we’re also now two weeks into the US government shutdown, with no sign of a resolution as it stands. Indeed, if we look at prediction markets, it’s clear that a growing risk of an extended shutdown is being priced in, with Polymarket saying there’s a 27% chance now of it lasting beyond November 16. So that would still be another month from here and take it well over the 35-day record set in 2018-19. And if it did last that long, then it would continue to impact the flow of data like the jobs reports and have an increasing macroeconomic impact as federal workers remain without pay for the shutdown period.

Over in Europe, political uncertainty was also a key theme yesterday as investors remain focused on the French budget situation. In terms of the next steps, PM Lecornu will be delivering the general policy statement today after his reappointment as PM, but the same issue remains in that the National Assembly is completely fractured between the different groups, who each have their own red lines. For now, however, markets haven’t seen much reaction, with the Franco-German 10yr spread holding broadly steady at 83bps. So it’s still beneath its peak of 86bps last week, when there was briefly a lot of speculation about another snap legislative election. Polymarket suggests the probability of an election being called by the end of the month and the end of the year stands at 36% and 57% respectively this morning but both down over 10pp from Sunday's highs.

Elsewhere in Europe, markets generally put in a solid performance yesterday, with the STOXX 600 up +0.44%, alongside gains for the DAX (+0.60%), the CAC 40 (+0.21%) and the FTSE 100 (+0.16%). Similarly, bonds rallied across the continent, with yields on 10yr bunds (-0.8bps), OATs (-0.9bps) and BTPs (-2.8bps) all moving lower, whilst Spain’s 10yr yield (-1.6bps) hit a 3-month low.

In the rest of Asia, outside of the politically motivated slump in Japan, markets are on the softer side led by the KOSPI (-1.36%) which has turned sharply lower as I've been typing this morning even with decent results from Samsung. China has imposed curbs on five US units of Hanwha Ocean after the US probed Chinese maritime, logistics and shipbuilding industries. Elsewhere, the Hang Seng (-0.18%) is also lower for the seventh consecutive session with the Shanghai Composite (+0.21%) holding onto its gains alongside the S&P/ASX 200 (+0.16%). The minutes from the Reserve Bank of Australia’s latest meeting revealed that the central bank remains cautious regarding future interest rate cuts due to persistent local inflation, while largely reiterating its data-dependent approach to future rate adjustments, noting that it is also awaiting the full impact of its monetary easing to be reflected in the economy.

Finally, yesterday brought another surge in gold prices (+2.30%), which continued their rally to close at $4,1110/oz. So that now takes their YTD gain up to +56.6%, still on track for their strongest annual performance since 1979. This morning we're up another +1.38% as I type. Meanwhile, silver (+4.44%) moved up to $52.37/oz yesterday, with its own YTD gains now standing at +82%. The London short squeeze continues to have an impact.

To the day ahead now, and data releases include UK unemployment for August, the German ZEW survey for October, and the US NFIB small business optimism index for September. Central bank speakers include Fed Chair Powell, the Fed’s Bowman, Waller and Collins, the ECB’s Cipollone, Makhlouf, Kocher and Villeroy, BoE Governor Bailey, and the BoE’s Taylor. Finally, earnings releases include JPMorgan Chase, Johnson & Johnson, Wells Fargo, Goldman Sachs, BlackRock and Citigroup.