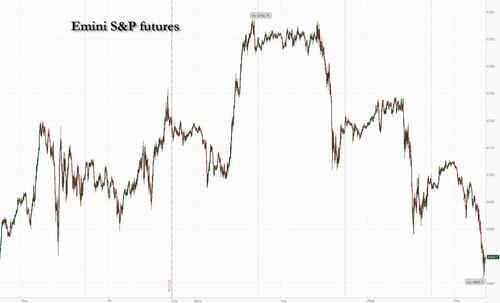

US equity futures are lower after giving up overnight gains with bond yields reversing earlier losses and rising by 1-2bp and the USD is at session highs; yesterday was the best USD performance since Sep 2. As of 8:10am ET, S&P futures are down 0.4% after concerns over stretched valuations and the pace of interest-rate cuts dragged the main gauge back from a record high. Nasdaq futures are down 0.6% with Mag7 and TMT stocks weaker pre-market, with Oracle falling more than 2%. Intel is higher on reports that it is seeking an investment from AAPL. Defensives are leading Cyclicals pre-market. Commodities are mixed with silver +2% and coffee +1.5% the standouts. US launches a Section 232 (sectoral tariffs) probe on Machinery, Med Devices, and Robotics. Today’s macro data focus is on Q2 GDP data, Durable / Cap Goods, Jobless data, Existing Home Sales, Adv. Goods Net-Exports, and Inventories. While none of these macro releases is expected to be market-moving, they may provide a holistic view of a stable / resilient economy that may be inflecting higher.

In premarket trading, Mag 7 stocks are lower (Amazon -0.1%, Microsoft little changed, Apple -0.1%, Tesla -0.5%, Nvidia -0.5%, Meta Platforms -0.6%, Alphabet -0.8%). Cipher Mining (CIFR) rises 9% as Google will receive warrants to buy about 24 million shares of the company’s stock as part of Cipher’s 10-year AI hosting agreement with Fluidstack.

There’s also a lot of corporate news: HSBC said it’s achieved a world-first breakthrough in deploying quantum computing in financial markets, using IBM’s Heron quantum processor to improve bond price predictions. Disney is preparing for a legal fight in case the Trump administration retaliates against the company for putting Jimmy Kimmel back on the air. Intel is set to extend Wednesday’s rally after the ailing chipmaker was said to have approached Apple about securing an investment.

Bullishness fueled by rate cut anticipation and the artificial intelligence boom culminated last week when the Federal Reserve signaled a faster pace of easing to support a weakening jobs market. Since then, higher oil prices and caution from some officials have tempered the optimism amid a lack of clear catalysts. Swaps currently imply around a 60% chance of two quarter-point US rate cuts for the rest of the year, down from 70% immediately after the Fed meeting. Policymakers penciled in two cuts in their projections. Friday’s release of the Fed’s preferred inflation gauge may offer clues on the path ahead, with consensus forecasts pointing to a slower pace of price growth last month.

“Prosperity targeting being the new mantra of the Federal Reserve, doesn’t mean the central bank is inflation-blind,” said Florian Ielpo, head of macro research at Lombard Odier Investment Managers. “Markets, being addicted to Fed cuts, could experience a temporary hangover.”

The coming corporate reporting season could offer the next trigger for stocks to move higher. S&P 500 earnings are facing limited risk from any potential disappointment in AI spending, according to Barclays Plc strategists. The team led by Venu Krishna said the AI theme is “on solid footing” as demand outpaces supply, even with major spending commitments.

“It would take a lot to derail this rally” Amundi SA Chief Investment Officer Vincent Mortier told Bloomberg News. “Whatever one may think about price-earnings ratios, the macro backdrop, geopolitics, fact is this market is technically well bought, notably by US retail.”

European stocks fall as a drag from health care and financials offsets continued strength in miners. Europe's Estoxx 50 trading down 0.5% with health stocks dragged down by a US probe on device imports, while miners get a further boost from copper holding gains after a force majeure at a major mine. Here are the biggest movers Thursday:

Earlier in the session, Asian stocks held steady, helped by an advance in technology stocks in China and Japan, while TSMC led a selloff in Taiwan. The MSCI Asia Pacific Index was mixed, with TSMC among biggest drags and Sony among gainers. Equity benchmarks rose in mainland China, while they declined in Taiwan, Singapore and India. BHP and other materials shares climbed, tracking copper after Freeport-McMoRan declared force majeure on contracted supplies from a mine in Indonesia following an accident. The AI theme has provided a fresh tailwind for China’s stock rally ahead of upcoming Golden Week holidays. Meanwhile, investors are also awaiting key US inflation data due Friday for clues on the Federal Reserve’s monetary policy.

In FX, the Bloomberg Dollar Spot Index rises 0.1% to trade at session highs and extends its previous day’s rally to a two-week high in response to strong data and rising Treasury yields. USD/JPY was flat at 148.83. Some leveraged long spot positions were trimmed after the Bank of Japan’s meeting minutes, but the majority are retaining risk carried over from New York, according to Asia-based FX traders. Swiss franc holds decline against most G-10 currencies after the SNB keeps rates at 0%, as widely expected, with the central bank also playing down tariff-related fallout.

In rates, treasuries are marginally cheaper across the curve, although yields remain within a basis point of Wednesday close. European bonds moving marginally higher, with UK gilts slumping across the curve, as market jitters started to impact demand at government auctions ahead of November’s budget. Treasury 10-year yields are rangebound overnight, trading at about 4.155% and near Wednesday’s closing levels — in the 10-year sector gilts lag by around 3bp on the day while bunds trade broadly inline. Treasury auctions conclude at 1 p.m. New York time with $44 billion 7-year note sale, follows solid 2- and 5-year note auctions seen so far this week. The WI 7-year at around 3.915% is ~1bp richer than August sale which tailed the WI by 0.3bp. IG dollar issuance slate empty so far and likely to ease after $54.4 billion of deals this week capped by Oracle’s $18 billion jumbo offering on Wednesday. September has seen the most high-grade supply this year and is just $5 billion shy of becoming only the fifth month to top $200 billion in issuance.

In commodities, Oil prices weaken, with Brent slipping back below $69 following its biggest jump since July in the previous session. Gold rallies again, though short of a record high, up by about $20 to $3,756/oz. Bitcoin and other cryptocurrencies weakened as the week neared a potentially volatile close, with $22 billion in large options expiries looming.

Looking at today's calendar, the US economic data slate includes 2Q third GDP print, August advanced trade balance, durable goods orders, weekly jobless claims (8:30 a.m.), August existing home sales (10 a.m.) and September Kansas City Fed manufacturing activity (11 a.m.). Fed speaker slate includes Miran (8:15 a.m.), Goolsbee (8:20 a.m.), Williams, Schmid (9 a.m.), Bowman (10 a.m.), Barr (1 p.m.), Logan (1:40 p.m.) and Daly (3:30 p.m.)

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed for most of the session following a softer Wall Street handover, with the breadth of the market narrow and price action uneventful amid a lack of fresh catalysts heading into quarter-end. The region then tilted into a modestly positive picture despite a lack of drivers. ASX 200 was initially in the red, pressured by gold miners as the yellow metal pulled back from near USD 3,800/oz levels, while notable gains in Energy helped offset some of the downside. Nikkei 225 moved between modest gains and losses and found some support at the 45,500 mark. BoJ minutes from two meetings ago suggested one member said rates should be raised when possible, as policy is still below neutral and the BoJ should not be too cautious, whilst one member added the BoJ could exit its wait-and-see mode as soon as this year if the US economy proves resilient. Hang Seng and Shanghai Comp were choppy, with Hong Kong and Mainland China initially trimming their modest opening gains before recouping. Participants overlooked reports that a non-principal-level Chinese delegation will visit the US Treasury on Thursday for staff-level technical discussions on trade and the economy. Sources suggested the TikTok issue will not be discussed and emphasised these talks are not the next round of trade negotiations but rather a technical meeting. KOSPI traded with mild losses amid a lack of progress in US-South Korea trade talks. Nifty 50 kicked off the session flat but remained above the 25,000 mark following its recent H-1B-related losses.

Top Asian News

European bourses (STOXX 600 -0.4%) opened lower across the board and have traded sideways throughout the morning. Nothing really driving sentiment this morning, but perhaps some continuation of the pressure seen on Wall St in the prior session. Most recently, the European Commission has opened a formal investigation into possible anticompetitive practices by SAP (-2.1%) - news which has put further pressure on the DAX 40 and Euro Stoxx 50, both at fresh session lows. European sectors opened with a strong negative bias, but are now a little more mixed. Basic Resources is found right at the top of the pile, driven by upside in underlying metals prices – namely copper. As a reminder, copper prices soared in the prior session after one of the world’s largest copper mines, Grasberg, halted operations and declared a force majeure; Rio Tinto (+2.7%), Anglo American (+2.2%). Retail is found in second place, boosted by considerable upside in Swedish-listed H&M (+8.7%); the Co. reported a beat on its Q3 Op. Profit metrics, whilst Sales were more-or-less in line. On trade, it said tariff costs are expected to have an increased impact on gross margin in Q4. Elsewhere, JD Sports (+2.7%) gains after the Co. announced a GBP 100mln share buyback. Construction & Materials is found right at the foot of the pile, joined closely by Healthcare; losses are broad-based, following reports that the US opened a probe into robotics, machinery and medical devices. Names that have been hit today include; Siemens Healthineers (-4.5%), Philips (-3%), Getinge (-4%) and others.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Our big Q3 market survey closes today. We're a little lighter than usual in terms of responses so all help filling it in will be gratefully appreciated. It should only take a few minutes and includes questions on Fed independence and bubble risk amongst other topics. Lots of fascinating answers so far.

Risk assets have struggled to find their footing over last 24 hours, with the S&P 500 (-0.36%) posting another modest decline after the AI-driven selloff on Tuesday. Overnight futures have recouped around half those losses, but it does seem that we've paused for breath in recent days. There hasn’t been a major catalyst driving this, but decent US housing data and stronger oil prices yesterday led to some doubts about the prospect of rapid rate cuts from the Fed. So that pushed Treasury yields higher across the curve, and there was a fresh yield curve steepening as Treasury Secretary Bessent called on the Fed to cut rates even more. Today's US jobless claims are one to watch as last week saw a big fall, reversing the prior week's spike higher. Since the FOMC and last week's fall in claims we've seen a 10-15bps rise in 10yr US yields back close to pre-payrolls levels. So that and tomorrow's core PCE will be important.

Back to yesterday and the noise around the Fed was there from the get-go, as Bessent said in a Fox Business interview that rates “need to come down”. Indeed, he said he was “a bit surprised that the chair hasn’t signaled that we have a destination before the end of the year of at least 100 to 150 basis points (lower).” So that’s a big contrast with the median dot from last week’s dot plot, which only pencilled in another 50bps of cuts by year-end. Bessent also offered a bit of commentary on the search for a new Fed Chair, saying that he was interviewing 11 candidates, and that there would be interviews happening next week. Meanwhile, existing Fed officials offered more measured signals. San Francisco Fed President Daly said further rate cuts were likely to be needed but stressed the need for careful decisions. And Chicago Fed President Goolsbee said in an interview that he was uncomfortable with “overly frontloading a lot of rate cuts” as inflation was “heading the wrong way” and the job market was still mostly steady.

Even as Bessent was calling for faster rate cuts, a couple of factors led markets to dial back their expectations for the months ahead. Notably, new home sales came in at an annualised pace of 800k in August (vs. 650k expected), marking the fastest they’d been since January 2022, back when rates were still at the zero lower bound. So that undercut the recent message of housing weakness that had driven some of the calls for rate cuts. Then in the background, Brent crude oil prices (+2.48%) closed at $69.31/bbl, their highest since August 1, which added to concerns about inflationary pressures, particularly with the tariffs as well.

That context meant that US Treasuries sold off across the curve. For instance, yields on 10yr Treasuries (+4.1bps) were up to 4.15%, with the 10yr real yield driving the bulk of that with a +3.5bps rise to 1.77%. At the front-end, the 2yr yield (+1.8bps) also rose as investors dialled back their rate cut expectations over the months ahead. Indeed, the amount of cuts priced by the June 2026 meeting was down -2.3bps on the day to 85bps. In Asia, Treasury yields are back down half to a basis point across the curve.

One factor pushing oil prices higher yesterday were Trump’s comments on Ukraine late on Tuesday night that we discussed yesterday, where he endorsed them being able to retake lost territory rather than come to a negotiated settlement, a shift in US policy towards the war. So that supported oil prices, as well as defence stocks, with Rheinmetall up +3.48% yesterday, making it the second-best performer in Germany’s DAX (+0.23%). Meanwhile, the Kremlin said later in the day that the process of normalising relations with the US is “much slower” than they would like, and that the idea that Ukraine could win back territories is “deeply mistaken.” And taken together, these developments were collectively seen as raising the risk of an escalation, hence the increase in oil prices and defence stocks.

For equities, stocks were down despite another barrage of tech-positive news, including upbeat quarterly forecasts from Micron (-2.82%), Alibaba’s (+8.19% on the ADR) announcement of increased AI spending, Oracle’s (-1.71%) issuing $18bn of debt, and reporting by Bloomberg that Intel (+6.41%) had approached Apple (-0.83%) about an investment into the chipmaker. So, while the Mag-7 (+0.24%) were propped up by a +3.98% rise in Tesla, the S&P 500 (-0.28%) and the Nasdaq (-0.33%) fell for a second day running. In Europe, the mood was also mixed, with a fall in the CAC 40 (-0.57%) pushing the STOXX 600 (-0.19%) lower, despite the FTSE 100 (+0.29%) and DAX (+0.23%) edging higher.

In Europe, the mood wasn’t helped by the latest Ifo reading from Germany, which unexpectedly fell back in September after 6 consecutive monthly gains. So, the headline indicator fell to 87.7 (vs. 89.4 expected), which was a reversal in the upward trend since the fiscal stimulus announcements earlier this year. So that was a contrast with the stronger PMI numbers from Germany on Tuesday. Sovereign bonds were fairly steady, with yields on 10yr bunds (-0.1bps) and OATs (+0.5bps) seeing little change.

In trade news, the US Department and Commerce published a document lowering the tariffs on auto imports from the EU to 15% retroactively as of August 1, as well as making effective exemptions on products such as aircraft and generic drugs. This cemented the terms of EU-US framework trade deal whose outline was agreed in late July.

In Asia, sentiment has turned a little higher with the CSI index (+0.94%) showing the most significant gains. The Hang Seng index (+0.43%) is also up, with the Shanghai Composite index (+0.16%) seeing smaller gains. Elsewhere, the Nikkei index (+0.22%) and the S&P/ASX 200 index (+0.11%) are also both edging higher but with the KOSPI (-0.14%) dipping slightly. S&P 500 (+0.15%) and Nasdaq (+0.13%) futures are slightly higher.

To the day ahead now, and data releases include US August durable goods orders, the advance goods trade balance, existing home sales, September’s Kansas City Fed manufacturing activity, and the weekly initial jobless claims. In Europe, we’ll have the Eurozone’s August M3 money supply. From central banks, we’ll hear from the Fed’s Goolsbee, Williams, Bowman, Barr, Logan and Daly, and also get the ECB’s economic bulletin.