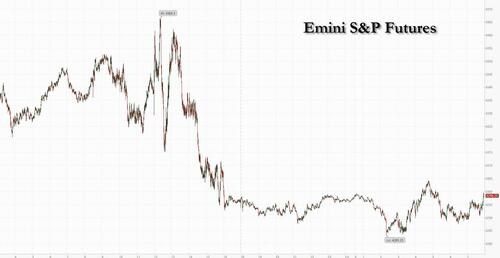

Global stock dipped and US equity futures traded lower as crude oil extended the weekly advance for a 4th day, rising above $90 on concerns Israel and Hamas war could widen into a regional conflict and as the DOE announced plans to refill the largely drained SPR with another $6 million barrels (good luck doing that with the proposed purchase price of "$79 or below"). As of 8:00am, S&P and Nasdaq 100 futures were down 0.3%; Europe's Stoxx 600 was down 0.7% to a seven month low and on course for a fourth day of declines. Meanwhile, Treasuries rose, led by gains in 10-year debt which briefly topped 5% yesterday for the first time since 2007, after Fed chair Jerome Powell suggested the US central bank is likely to hold interest rates steady at its next meeting. Asian equities also fell, on course for their worst week since August; China Evergrande Group is revising the terms of its proposed restructuring plan and Country Garden’s default on dollar bond interest payment still looms. A burst of buying among cryptocurrencies sent bitcoin above $30K, the highest since August.

In premarket trading, American Express gained in premarket trading after third-quarter revenue and profit soared to records. SolarEdge Technologies Inc. slumped 27% after cutting its sales forecast because of canceled orders. The declines spread across the sector, with German photovoltaic systems maker SMA Solar Technology AG down 16%. Stocks exposed to cryptocurrencies, including Cleanspark and Coinbase Global, rise, tracking the Bitcoin price as the digital asset inches closer toward the closely watched $30,000 level. Intuitive Surgical shares fall 7.8% in premarket trading after the maker of surgical tools reported third-quarter revenue that missed estimates. Analysts flagged the systems segment for the miss, noting that it had a higher mix of operating leases. Here are some other notable premarket movers:

A turbulent week in markets has seen Middle East events drive volatility in oil prices and push investors out of riskier assets into havens like gold. At the same time, 10-year Treasury yields have soared 30 points as traders position for higher-for-longer interest rates from the Federal Reserve to cool inflation. Chair Jerome Powell suggested Thursday the Fed is inclined to hold rates steady again at its next meeting, while it watches key growth data.

“This week we had several things weighing on sentiment: the war, poor corporate results, plus strong September US data supporting Powell’s comments yesterday,” said Liberum strategist Susana Cruz, referring to Federal Reserve Chair Jerome Powell. “If things stay like this with oil and gas, we might end up in a stagflation situation, making it less likely for a rebound in 2024.”

In terms of the latest geopolitical updates, the main rise in concerns came later in the US session after the Pentagon reported that a US military base in Southern Syria was targeted with a drone attack and a US Navy warship intercepted missiles near Yemen. Brent Crude prices had traded below $90 early in the day, but ended the day +0.96% higher at $92.38/bl. Overnight, oil prices are continuing to climb for the fourth consecutive day with Brent Crude up +0.93% trading above $93bbl as we go to press. Other markets also reacted to the geopolitical risks, with gold prices (+1.38%) hovering around a 21-week high and Israel’s TA-35 Index (-1.85%) seeing a noticeable underperformance .

“The risk premium in crude has shot up again,” said Vandana Hari, founder of consultancy Vanda Insights. “As long as the Israel-Hamas tensions run high, crude will remain susceptible to further spikes on signs of an escalation.”

European equities extended their drop to a seven-month low and on course for a fourth day of declines. The Stoxx Europe 600 fell 0.7% to the lowest since March 20. Miners lagged, along with travel and leisure stocks. L’Oreal SA pared losses as traders weighed disappointing North Asia sales against better than expected performance in North America and Europe. Here are the biggest movers on Friday:

Earlier in the session, Asian equities fell, on course for their worst week since August, as investors fretted over escalation in the Middle East crisis in addition to Federal Reserve policy and China’s uneven recovery. The MSCI Asia Pacific Index fell as much as 0.9% before paring its decline, with Samsung, Tencent and BHP Group among the biggest drags.

A record injection of extra cash by China may offer support after the nation’s stocks erased all gains seen during their massive reopening rally that took off late last year. The economy has been challenged this year by a lack of demand and a downturn in the property market. Still, Morgan Stanley advises against buying the dip in Chinese equities as market sentiment is likely to stay fragile while foreign fund outflow could persist near-term. Meanwhile, concerns around property sector lingered on with Country Garden Holdings missing a dollar bond interest payment, effectively triggering the largest property sector default since Evergrande.

In FX, the Bloomberg Dollar Spot Index steadied as investors weighed comments from Federal Reserve Chair Jerome Powell on the likelihood of rates being held steady.

In rates, treasuries rose across the curve as yields at multi-year highs drew buyer interest and as rising tensions in the Middle East push investors towards perceived safe haven assets. The curve bull-flattened, unwinding a portion of Thursday’s aggressive steepening that pushed 2s10s spread to least inverted level in more than a year. 10-year Treasury yields are around 4.94% after re-opening in Asia session at 4.992%, new multiyear high; bunds and gilts underperform by 4.5bp and 6bp in the sector. The US 2s10s spread sits around -21bp after topping at -16.9bp Thursday, least inverted level since September 2022. US yields richer by 1bp to 5bp across the curve with long-end-led gains flattening 2s10s, 5s30s spreads by 4..2bp and 0.3bp on the day;

In commodities, spot gold added 0.5% to around $1,984. Oil prices also gain, with Brent futures rising 1.2% to trade near $93.50.

Bitcoin convincingly broke above the $29k mark and has continued to climb to within relative proximity of the $30k handle, though the move has currently stalled/paused for breath around the $29.85k current session high. Action which takes BTC to a fresh WTD peak and to levels not seen since early August. Coinbase's legal officer Grewal said he is confident that the US SEC will approve a US Bitcoin ETF, via CNBC; adding, it is likely the approval will be "soon".

Looking to the day ahead now, and data releases include UK retail sales and German PPI for September. Central bank speakers include the Fed’s Harker and Mester. Lastly, earnings releases include American Express.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks mostly declined after the losses on Wall St where the curve steepened as markets digested various comments from Fed Chair Powell and with sentiment pressured by the escalating geopolitical situation. ASX 200 was dragged lower with broad weakness seen across all sectors aside from energy which is kept afloat by the geopolitical risk premium uplift in oil prices. Nikkei 225 retreated at the open but then gradually pared its losses amid reports of potential temporary income tax cuts and with participants also digesting the latest Japanese CPI data which printed mostly firmer than expected but softened from the previous month’s pace. Hang Seng and Shanghai Comp. were subdued albeit with the downside cushioned after the PBoC’s actions in which it unsurprisingly maintained its benchmark lending rates but boosted liquidity in the interbank market with its largest-ever open market operation net daily injection.

Top Asian News

European bourses are in the red, Euro Stoxx 50 -1.0%, in a continuation of APAC pressure with fresh catalysts comparably light and the region on track for a week of marked downside. Sectors feature pressure in Basic Resources closely followed by Travel/Leisure given IHG after earnings, while Healthcare is bucking the trend given its defensive status and after pronounced losses on Thursday following Roche. Stateside, futures reside in the red but are yet to deviate significantly from the unchanged mark, ES -0.3%, and holding just below the 4300 figure post-Powell and ahead of Fed's Harker & Mester alongside a handful of pre-market earnings.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Fed speakers

DB's Jim Reid concludes the overnight wrap

Not long after I send this I'm off to a Center Parcs for an activity weekend with the family. The kids are incredibly excited. My wife is pretty excited. I am considerably less so and will have to tolerate doing things such as climbing up high above the ground to the tree canopies on dodgy rope bridges with the risk of having to do a zip wire across a lake to get back down to earth.

Markets have been sliding down a zip wire of their own over the last 24 hours, as the confluence of uncertain forces currently impacting markets continued to linger. 10yr US yields closed around a basis point off 5%, a level we haven't breached since 2007 and were up +7.5bps on the day. The big story was a significant steepening encouraged by Fed Chair Powell’s remarks at the Economic Club of New York. 30yr US yields rose +11.5bps on the day (+12bps after Powell) and 2yr yields fell -6.3bps (-7bps after Powell), leading to the sharpest 2s30s steepening since the March banking stress. And the 2s10s slope rose +13.7ps to -17.2bps, its highest since September 2022 and a long way from the -46bps we were last Thursday. There has been a bit of a correction this morning in Asia as 2, 10 and 30yr US yields are down -1.2bps, -5.1bps and -4.8bps, respectively. So volatile markets.

In the speech on the economic outlook, Powell said that they were “proceeding carefully”, and explicitly nodded to the fact that financial conditions “have tightened significantly in recent months” which you could interpret as lessoning the need for the Fed to act. This led to an initial dovish rates reaction across the board, though there were also some more hawkish comments, including that “ Additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy .” Powell then added a notable comment during the Q&A, saying “I think the evidence is not that policy is too tight right now”.

Overall given the huge steepening, markets must have concluded that the hints that near-term rates didn't need to go up much more, but that policy wasn't overly tight, perhaps suggested a "reasonably high for longer" interpretation rather than a "lets make sure we crush inflation before we do anything else" one. Or maybe I'm clutching at straws as to explaining why curves steepened so much on one relatively "to form" speech.

The reaction at the front end was clear though and market pricing for the chance of a Fed hike this year fell back to 25%, from 40% the previous day. US equities seesawed as Powell spoke, with the S&P 500 trading nearly +0.5% up on the day around the end of this speech. But renewed geopolitical concerns contributed to a pronounced weakening during the rest of the session and left it closing down -0.85% on the day. The VIX volatility index rose +2.2pts to 21.4, its highest since March. The equity decline was broad-based with the NASDAQ down -0.96%. Tech megacaps saw a contrasting performance as Netflix, the 42nd biggest company in the S&P 500 was +16.05% and Tesla, the 7th biggest was -9.30% after Wednesday evenings' results. This morning, the S&P 500 (-0.16%) and NASDAQ 100 (-0.30%) futures continue to drift lower.

In terms of the geopolitical situation, the main rise in concerns came later in the US session amid news that a US military base in Southern Syria was targeted with a drone attack and a US Navy warship intercepted missiles near Yemen. Brent Crude prices had traded below $90 early in the day, but ended the day +0.96% higher at $92.38/bl. Overnight, oil prices are continuing to climb for the fourth consecutive day with Brent Crude up +0.93% trading above $93bbl as we go to press. Other markets also reacted to the geopolitical risks, with gold prices (+1.38%) hovering around a 21-week high and Israel’s TA-35 Index (-1.85%) seeing a noticeable underperformance .

The day's action followed a fairly divergent set of US data yesterday. On the plus side, the weekly initial jobless claims fell beneath 200k for the first time since January, coming in at 198k (vs. 210k expected). That’s not just a blip either, as it pushed the smoother 4-week moving average down to 205.75k, which is the lowest it's been since early February. But there were also several more negative reports. For instance, the continuing claims ticked up to 1.734m (vs. 1.706m expected), which is their highest since early July. Then we got more negative news from the housing market, as the number of existing home sales fell to a 13-year low in September, at an annualised rate of 3.96m (albeit a bit above the 3.89m expected). And lastly, the Conference Board’s Leading Index fell for an 18th consecutive month with a -0.7% decline (vs. -0.4% expected).

Ahead of Powell’s speech, European markets had lost a decent amount of ground yesterday, with the STOXX 600 (-1.19%) posting a third consecutive decline and falling to a 7-month low. That was echoed across the major indices, with losses for the FTSE 100 (-1.17%), the CAC 40 (-0.64%) and the DAX (-0.33%), whilst the Swiss Market Index (-2.13%) had its worst daily performance of 2023 so far. European sovereign bonds saw a mixed performance, with yields on 10yr bunds (+0.5bps) inching up but OATs (-0.6bps) and BTPs (-3.8bps) moving lower. Gilts underperformed, with the 10yr yield up +1.6bps and the 30yr yield (+3.5bps) closing at its highest level since 2002, at 5.07%.

Asian equity markets are extending losses this morning with the Nikkei (-0.52%), the Hang Seng (-0.34%), the CSI (-0.30%) and the Shanghai Composite (-0.27%) all lower.

Early morning data showed that Japan’s core inflation dropped below 3% for the first time in over a year on the back of easing gas and electricity prices. National core consumer prices grew +2.8% y/y in September (v/s +2.7% expected so a touch above) from +3.1% in August. At the same time, the national CPI rose +3.0% y/y in September as expected but down from +3.2%. Core ex-food and energy was a tenth higher than expected at 4.2%. Overall this data suggests the BoJ remains on course to tighten policy in the months ahead. See our Japan economists upgraded CPI forecasts after the number here.

In the US House of Representatives, there’s still no sign that any Speaker candidate can get a majority, with Republican Jim Jordan having fallen short in two votes thanks to opposition from fellow Republicans. Earlier yesterday, reporting from several outlets including the Washington Post suggested that Jordan would instead endorse a plan to temporarily empower Patrick McHenry until January 3. However, this plan appeared to be abandoned after a lengthy meeting of House Republicans. On the next steps ahead, Jordan would push for another vote (a third vote) on his candidacy to become speaker. McHenry is currently the Speaker pro tempore of the House, which is a member who acts in the Speaker’s absence when the office becomes vacant. But they don’t have the powers of a normal speaker, meaning the House is still unable to pass legislation, and there’s still an upcoming government shutdown deadline on November 17 if new funding isn’t passed.

To the day ahead now, and data releases include UK retail sales and German PPI for September. Central bank speakers include the Fed’s Harker and Mester. Lastly, earnings releases include American Express.