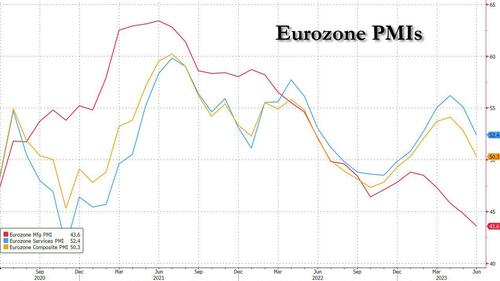

One week after S&P futures hit a 52-week high, sentiment has turned increasingly ugly and US equities are set to open lower for the 4th of the past 5 days, with global stocks also sliding, after the latest set of dismal European PMIs revealed that economic momentum in the euro area almost came to a halt in June, signaling an end to the revival the bloc demonstrated since its winter downturn (and good news for the ECB which has been desperate to spark a recession). As of 7:45am ET, emini S&P futures were down 0.5%, trading just over 4,400, almost 100 points below the YTD highs hit last Friday; Nasdaq futures were also down half a percent, as investors fled into the safety of bonds amid a return of fears that weak euro-area activity data together with aggressive central bank rate hikes will tip economies into recession. The Bloomberg dollar index traded near the day’s highs, pressuring all Group-of-10 currencies. Treasury yields fell across the board, following pullbacks in the UK and Europe. Gold advanced, Brent crude slid more than 1.5% and Bitcoin fell for the first time in five days. Today’s macro data focus is PMIs releases: the street expects another contractionary print from the US Mfg PMI at 48.5, while services are expected to dip to at 54.0 from 54.9

In premarket trading, defensive sectors such as health care gained offsetting broad weakness across giga-cap tech, led by TSLA: the world’s most valuable automaker has been downgraded by at least three brokerages this week, including Morgan Stanley, DZ Bank and Barclays. Here are some other notable premarket movers:

The second-quarter melt up is fraying fast under the threat of more rate hikes and fears that the full economic impact of aggressive rate increases has yet to be felt. Federal Reserve Chair Jerome Powell said the US may need one or two more rate increases in 2023.

“The market has not yet digested the lagged impact of tighter Fed policy,” said Emily Roland, the co-chief investment strategist of John Hancock Investment Management. “Based on what we’ve seen in terms of this really strong run-in markets, we would consider trimming risk.”

It wasn't just the US: global stocks also headed for their biggest weekly decline in more than three months. European shares suffered with the Stoxx 50 down 0.5% and set for a fifth consecutive fall. The downbeat tone was set by Siemens Energy's record 36% drop after a profit warning dragging on the broader market. Europe's composite PMI fell to a five-month low of 50.3, missing analyst estimates for a slight decline from May to 52.5. The Services PMI dropped to 50.3, just barely in expansion territory, while mfg tumbled to 43.6, the lowest in three years.

The PMI slump was led by France, which has been battered by strikes, though Germany’s struggling factories also played a role. Germany’s economic activity lost much more momentum than anticipated in June, driven by a slowdown in services and sustained weakness at the country’s factories; separate data for France showed its economy probably slumped in the three months through June. The euro fell sharply following the figures.

European bank shares fell Friday, underperforming broader European equities, as bond yields slid on concerns of a worsening economic outlook, following weak data in some of the largest regional markets. The Stoxx 600 Banks Index was 1.1% lower, double the drop of the Stoxx 600 Index. Losses were led by the most rate-sensitive lenders, including Commerzbank -3.9%, Bank of Ireland -3.3% and Santander -2.3%. Here are some of the other notable European movers:

Earlier in the session, Asian stocks failed to sustain an early positive bias and faltered following the mixed performance stateside where the S&P 500 and Nasdaq snapped their losing streaks although most sectors finished in the red after a busy day of central bank activity including several rate hikes.

In rates, treasuries rallied across the curve following wider gains in core European rates after German PMIs miss estimate, following earlier French services PMI miss, as traders repriced a peak ECB deposit rate back below 4%. Meanwhile in UK, traders price in the Bank of England to raise rates as high as 6.25%, most since 1998, as the gilt curve continues to aggressively flatten. US Treasury yields richer by 3bp to 5bp across the curve with belly-led gains tightening the 2s5s30s fly by 2.5bp on the day; US 10-year yields dropped 7bps to around 3.73%, with bunds and gilts outperforming by 6.5bp and 2.5bp in the sector. German two-year yields are down 11bps while the single currency has shed 1% against the greenback as traders pared back bets on the ECB’s terminal rate.

In FX, the Dollar spot Index rose, on course to snap its first weekly gain since May, after Powell re-emphasized the need for one or two more interest rate hikes in his second day of testimony to Congress prompting money markets to increase bets for further Fed tightening, and pricing in a 100% chance of a 25-basis-point hike by July; up from yesterday’s pricing of a 100% chance by September; global risk-off mood drove further upside. EURUSD slumps as much as 1% on weak manufacturing data, the pound was lower by 0.3% after UK PMI also disappointed, albeit to a lesser degree.

In commodities, crude futures declined with WTI falling 1.9% to trade near $68.20. Spot gold rises 0.3%. Bitcoin drops 0.5%.

Looking to the day ahead now, and the main highlight will be the flash PMIs for June from the US. Other data releases include UK retail sales for May. From central banks, we’ll hear from ECB President Lagarde, the ECB’s Vujcic, De Cos and Panetta, along with the Fed’s Bullard and Mester.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks failed to sustain an early positive bias and faltered following the mixed performance stateside where the S&P 500 and Nasdaq snapped their losing streaks although most sectors finished in the red after a busy day of central bank activity including several rate hikes. ASX 200 was lower with the declines led by underperformance in energy after the recent slump in oil prices, with the mood not helped by an inverted yield curve and after Australia’s flash manufacturing PMI remained in contraction territory. Nikkei 225 gave back its early gains and then some, as participants digested mixed inflation data from Japan which showed a slowdown in headline and core CPI although the latter and core-core readings were still firmer-than-expected, while Japan’s manufacturing PMI also slipped beneath the 50 benchmark level. Hang Seng was pressured on return from the Dragon Boat Festival with the index dragged lower by heavy losses in healthcare, tech and property amid headwinds from rising global yields and as Stock Connect trade remained shut due to the holiday in the mainland.

Top Asian News

European bourses trade on the backfoot with sentiment in the region subdued after the Flash PMIs sounded recessionary warnings. US equity futures are also lower on the session with the ES just about managing to maintain 4400 status - the macro narrative in the US hasn’t changed much this week. Equity sectors in Europe are mixed with energy names the clear laggard alongside softer energy prices and heavy losses in Siemens Energy (-32%) after the Co. withdrew guidance, while UK homebuilders have been pressured following a raft of broker downgrades at HSBC.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event calendar

DB's Jim Reid concludes the overnight wrap

Global markets have continued to struggle over the last 24 hours, with a fresh selloff for sovereign bonds and further equity declines across most regions. Several factors have been behind this, but the biggest was the dawning realisation for investors that central banks are set to keep hiking rates into the second half of the year, particularly after a surprise 50bps move from the Bank of England. At the same time, the latest data aggravated fears about a potential recession, which further dampened risk appetite. In fact, last week’s US initial jobless claims remained stuck at their highest level since October 2021, and the Kansas City Fed’s manufacturing index fell to levels that have only previously occurred in US recessions. So investors were left with plenty of bad news to digest, with little sign of any positive near-term catalysts.

Once again, the UK was at the centre of attention after the Bank of England hiked its policy rate by 50bps to 5%. That’s the highest Bank Rate since 2008, and it came as a decent surprise to investors who still viewed a 25bp hike as more likely, even after the upside inflation surprise the previous day. The decision was supported by a 7-2 majority of the MPC, and their statement acknowledged that recent data “indicates more persistence in the inflation process, against the backdrop of a tight labour market and continued resilience in demand.” In a separate letter to the Chancellor, Governor Bailey signalled the bank’s determination to clamp down on inflation, saying that “Bringing inflation down is our absolute priority.”

That larger-than-expected move meant investors are now pricing in a more aggressive path of rate hikes over the months ahead. For instance, overnight index swaps this morning now imply a 70% chance of another 50bp move at the next meeting in early August. Looking further out, they now see 123bps of further hikes by the peak, implying a 91% chance that Bank Rate will peak at 6.25%, which would be the highest since the 1990s. But despite the prospect of more hikes, gilts actually saw a strong outperformance following the decision, with 10yr yields down -3.8bps on the day, unlike the rises in bond yields seen elsewhere. The main reason was that the hike meant investors became more confident that inflation would be lower over the years ahead, so the -6.1bps decline in inflation breakevens outweighed the +2.3bps rise in real rates. In light of the meeting, our UK economist has also revised up his terminal rate projection to 5.75%. You can read his full recap here.

The Bank of England was far from the only central bank story yesterday, with several hawkish messages from around the world. One came from the Swiss National Bank, who delivered a 25bp hike as expected, but signalled that further hikes were likely. Then half an hour later the Norges Bank delivered a surprise 50bp hike of their own, rather than the 25bp move expected by the consensus.

Finally in the US, we heard from Fed Chair Powell again, who was testifying before the Senate Banking Committee. He reiterated the message that officials felt it was appropriate to take rates higher by year-end, noting that a “strong majority” of the FOMC saw two additional hikes. So Powell has been emphasising the Fed’s hawkish June dot plot more than he did at the post-FOMC press conference last week. On the topic of Fed hikes, yesterday our US economists and rates strategists published a report assessing how close the Fed is to a "sufficiently restrictive" stance. Considering different approaches, they find that a sufficiently restrictive level could plausibly be achieved with one or two more rate hikes. See here for more.

With all that in mind, investors began to price in the growing likelihood of rate hikes deeper into the second half of this year. For instance, when it came to the Fed and the ECB, market pricing for the rate at the December meeting hit its highest level since SVB’s collapse in early March. In turn that led to a sizeable bond selloff, with yields on 2yr Treasuries (+7.6bps) hitting a post-SVB high of their own at 4.791%, whilst those on 10yr Treasuries rose the same amount (+7.6bps) to 3.795%. It was much the same story in Europe, where yields on 10yr bunds (+5.9bps), OATs (+6.4bps) and BTPs (+8.0bps) moved higher as well. Much of that upward pressure came from real rates, and there was another milestone after the 2yr US real yield (+8.6bps) hit a post-GFC high of 2.75%.

Whilst bonds were taking a hit thanks to the various central bank moves, there wasn’t much respite from yesterday’s data releases either. The main one was the US weekly jobless claims, which came in at 264k (vs. 259k expected) over the week ending June 17. That’s in line with their revised level for the previous week, and keeps it at its highest level since October 2021. Furthermore, the 4-week moving average is at its highest since November 2021, so it’s clear this isn’t just a blip either. Later on, we then had the Kansas City Fed’s manufacturing index, which fell to -12 in June (vs. -5 expected). Since the series started in 2001, the lowest it’s been without a recession taking place is -11, so the fact it’s now beneath that is another concerning sign based on the historic patterns. On top of that, we also had the Conference Board’s leading economic index for May, which posted a 14th monthly decline in May with a -0.7% loss (vs. -0.8% expected). So it was difficult to find much upside in the various reports.

This backdrop meant it was a tough run for equities for much of the day, with Europe’s STOXX 600 (-0.51%) falling to a 3-week low, and the index falling for four days in a row for the first time since December 2022. A rally late in the US afternoon helped the S&P 500 post a gain (+0.37%), but this was a narrow one with 64% of companies in the index still losing ground on the day, meaning that the equal-weighted S&P 500 was down -0.42% in its 4th consecutive decline. Tech stocks were the big outperformer again, and the NASDAQ (+0.95%) and the FANG+ index (+1.46%) posted stronger advances. But small-cap stocks struggled, with the Russell 2000 (-0.80%) down for a 4th consecutive day.

Those equity losses have continued in Asia overnight, with the Nikkei (-1.78%), the Hang Seng (-1.94%), the CSI 300 (-1.53%), the Shanghai Comp (-1.31%) and the KOSPI (-0.94%) all seeing sharp losses. One factor not helping matters has been the latest CPI data from Japan, which has showed core inflation running faster-than-expected. For instance, “core-core” inflation accelerated to +4.3% (vs. +4.2% expected), marking its highest level since 1981. In the meantime, headline inflation did fall to +3.2% as expected, but that still marked its 14th month above 2%.

Another factor not helping matters has been the release of the flash PMIs for June overnight. We’ve only had Japan and Australia so far, but both showed the composite PMI slowing down relative to May, with Japan’s down to 52.3, and Australia at 50.5. We’ll get the numbers from Europe and the US as the day progresses, so one to keep an eye on for how the global economy has been faring this month. Looking forward, things don’t look too great for markets either, with futures on the S&P 500 down -0.46% this morning, and those on the DAX are down -0.71%. The risk-off tone has supported Treasuries however, with the 10yr yield coming down -1.9bps overnight.

Finally, concerns about demand saw commodities take a hit yesterday, with losses across the board. Brent crude (-3.86%) fell back to $74.14/bbl, marking its worst daily performance so far this month, whilst WTI was down -4.16% to $69.51/bbl. Both have experienced further losses this morning too, with Brent crude down another -1.11% to $73.31/bbl. Metals also struggled, with copper (-0.60%) falling back, and gold (-0.96%) closed at a 3-month low as real rates took another leg higher.

To the day ahead now, and the main highlight will be the flash PMIs for June from around the world. Other data releases include UK retail sales for May. From central banks, we’ll hear from ECB President Lagarde, the ECB’s Vujcic, De Cos and Panetta, along with the Fed’s Bullard and Mester.