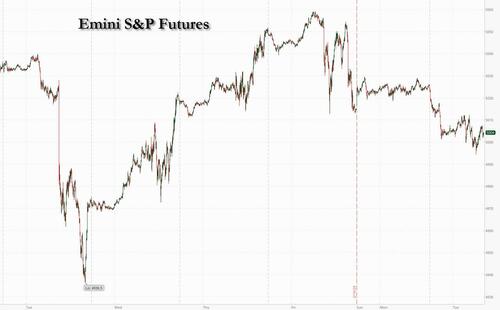

After a flat Monday when US cash market were closed for President's Day, equity futures are pointing to a lower open on Tuesday as the latest earnings reports and corporate news failed to shake concerns about higher-for-longer interest rates and the faltering Chinese economy, while markets braced for the main event: tomorrow's NVDA earnings after the close. As of 8:00am contracts on the S&P 500 fall 0.3% but rebounded from session lows and were trading just above 5,000; Nasdaq 100 futures lost 0.5%. European stocks were mixed while Asian stocks pulled back from their highest level since April 2022 amid a lack of positive momentum, with a reduction in China’s mortgage reference rate failing to lift sentiment. 10Y yields dropped 1 basis point from Friday's close (cash Treasuries were closed on Monday), while gold rose, the dollar dipped and bitcoin traded back over $52,000 erasing overnight losses. The only notable macro event today is the Leading Index (exp.-0.3, last -0.1).

In premarktet trading, AI bellwether Nvidia declined ahead of its widely anticipated earnings report due Wednesday. Credit card company Discover Financial surged after Capital One agreed to buy the credit card issuer; Capital One dropped. Here are some other notable premarket movers:

Among companies reporting earnings, Walmart rose a2% fter an beat, even though it delivered softer guidance. Medtronic Plc climbed after the medial device maker boosted sales. Home Depot Inc. declined after reporting a fifth consecutive drop in quarterly revenue.

Stocks closed lower last week, breaking a streak of 15 higher weeks in the past 16, as traders moved Fed rate-cut expectations out to June, from March, as a barrage of Fed officials warned against over-exuberant expectations of policy easing, and economic data continued to surprise to the upside. Former US Treasury Secretary Lawrence Summers said on Friday “there’s a meaningful chance” the next move is up.

Investors will thus be wary ahead of the Fed January meeting minutes to be released Wednesday, but most of the focus will be on Nvidia. The chip giant has surpassed the market value of Amazon.com Inc on the expectation it will be a big winner from artificial intelligence developments. The two companies together with Meta and Microsoft have collectively contributed almost 60% of the S&P 500’s year-to-date rally.

“Nvidia results on Wednesday could be a turning point for the markets,” Charles-Henry Monchau, chief investment officer for Banque Syz, said on Bloomberg Television. “The market relies on very few large-cap growth stocks and if they disappoint for any reason there is a risk of a pullback.”

European stocks look set to fall for the first time in four days albeit slightly, after a four-day rising streak that took it to within two points of its January 2022 record high on Monday. Mining shares are among the worst performers as iron ore prices fall to a three-month low: Miners Anglo American Plc and Rio Tinto Plc led basic-resources stocks lower after a slump in iron ore prices, with Bloomberg’s index of industrial metals down 0.7%. The chemicals sub-sector outperformed, with Air Liquide SA jumping more than 4% after the French gas producer beat analysts’ expectations for margin expansion. Barclays Plc soared as much as 6% after announcing plans for capital returns. Here are the biggest movers Tuesday:

Earlier in the session, Asian stocks pulled back from their highest level since April 2022 amid a lack of positive momentum, with a reduction in China’s mortgage reference rate failing to lift sentiment. The MSCI Asia Pacific Index dropped as much as 0.4%, with consumer discretionary and materials declining by the most. China’s benchmark CSI 300 slipped, suggesting investors remain skeptical that a record cut in the five-year loan prime rate will be sufficient to boost property demand.

In FX, the dollar slipped versus major peers amid a thin data calendar; the Bloomberg Dollar Spot Index erased a 0.1% advance to trade 0.1% lower on the day. The pound rises 0.1% as BOE Governor Bailey testifies to the Treasury Committee. “There doesn’t seem to be much appetite to embrace fresh USD longs here, but we think DXY can retain the bulk of its gains,” Richard Franulovich, FX strategist at Westpac Banking Corp., wrote in a note. The greenback might find support from Federal Reserve commentary, he added, “with officials likely to reinforce a patient and careful message, keeping first half Fed rate cut bets at bay.”

In rates, treasuries were mixed with the curve steeper as front-end yields drop around 2.5bps vs Friday close while long-end trades slightly cheaper on the day. Treasuries 2s10s, 5s30s spreads are steeper by ~2bp on the day with 10-year yield around 4.27%, down 1 bp vs Friday close. Core European rates outperform, led by front-end of UK curve after Bank of England Governor Andrew Bailey said inflation doesn’t need to fall to target before policymakers start lowering interest rates. UK yields richer by 4bp to 6bp across the curve with front-end and belly outperforming as more premium for BOE cuts is added following Bailey comments. Bunds also rose as ECB data showed euro-zone wage growth slowed at the end of 2023. According to Bloomberg calcs, credit issuance slate has begun to build, with syndicate desks anticipating a weekly total of about $45b, following $37b last week. Treasury auctions this week include $16b 20-year bond sale Wednesday.

Bitcoin holds just shy of USD 52k, whilst Ethereum (-1.9%) gives back some of the recent advances.

In commodities, oil prices declined, with Brent falling 0.7% to trade near $83. Spot gold rises 0.5%.

Looking to the day ahead now, and data releases include Canada’s CPI for January, and the February Philadelphia Fed non-manufacturing activity (8:30am) and the Conference Board’s January Leading index (10am). From central banks, we’ll hear from BoE Governor Bailey. Finally, earnings releases include Walmart and Home Depot.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with mild losses with price action contained following the US holiday lull. ASX 200 was dragged lower by miners after BHP reported flat underlying profits and cut its dividend by 20%. Nikkei 225 reversed its earlier advances as momentum stalled and the 1989 record high remained elusive. Hang Seng and Shanghai Comp. were lacklustre as tech weakness in Hong Kong clouded over the gains in the energy sector, while the mainland was rangebound as participants digested the announcement of the PBoC's latest benchmark rates in which the 1-year LPR was surprisingly maintained at 3.45% (exp. 5bps cut), but the 5-year LPR was cut by 25bps (exp. 10bps cut).PBOC LPR REVIEW: 1yr maintained but the 5yr cut, likely designed to support the property sector. Click here for more details.

Top Asian News

European bourses, Stoxx600 (-0.1%), began the session on a weaker footing and trade throughout the morning has been choppy/mixed. The CAC 40 (+0.2%) outperforms, lifted by post-earning strength in Air Liquide (+5.9%). European sectors hold a negative tilt; Chemicals outperform, with the sector lifted by Air Liquide. Basic Resources is hampered by poor BHP results, peers Anglo American and Rio Tinto lag. US Equity Futures (ES -0.3%, NQ -0.4%, RTY -0.9%) are trading modestly weaker, with clear underperformance in the RTY, as it continues the prior session’s weakness; focus ahead on key retail earnings including Walmart (WMT) In terms of stock specifics, Capital One (-4.5%) is to acquire Discover Financial Services (+14.6%) in an all-stock transaction valued at USD 35.3bln. Click here and here for the sessions European pre-market equity newsflow, including earnings from Air Liquide, Antofagasta, Barclays, IHG, Fresenius Medical Care and more.

Top European News

Earnings

FX

Fixed Income

Commodities

Geopolitics - Middle East

Geopolitics - Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Global markets have been subdued over the last 24 hours given the US holiday. In very quiet markets, the STOXX 600 (+0.16%) built on its run of four consecutive weekly gains to close at a fresh two-year high. And that strength was clear in other asset classes, since Euro IG and HY spreads both closed at their tightest level in over two years, whilst WTI oil futures closed at a 3-month high of $79.49/bbl.

However Asian equity markets are slipping this morning even after the PBOC cut the benchmark five-year loan prime rate (LPR), the peg for most mortgages, by 25bps to 3.95%, marking its first cut since June, and more than expected. Our Chinese economists have just published a piece here looking at the implications of the cut. They kept the one-year LPR, the peg for most household and corporate loans, unchanged at 3.45%.

Across the region, the KOSPI (-1.14%) is the biggest underperformer while the Nikkei (-0.28%), the Hang Seng (-0.27%), the CSI (-0.18%) and the S&P/ASX 200 (-0.17%) are also trading lower. S&P 500 (-0.29%) and NASDAQ 100 (-0.36%) futures are also down. US Treasuries have resumed trading following the holiday with yields on the 10yr up +1.8bps to 4.297% as we go to print.

Elsewhere, the minutes of the Reserve Bank of Australia’s recent meeting indicated that the central bank still remains inclined towards hiking interest rates further as it is not sufficiently confident that inflation is on track to return to its target range within the next couple of years.

On a similar theme, one interesting data point yesterday was the Swedish CPI print for January, which showed a larger-than-expected increase to +5.4% (vs. +5.0% expected). That led to growing doubts about how soon the Riksbank would be cutting rates, and added to fears that the global inflation path would still be bumpy this year, not least after the US CPI and PPI prints last week. Watch out for Canadian inflation today to see if there are any continued signs that inflation is edging up globally versus expectations. Swedish government bonds underperformed after the print, with the 10yr yield up +2.1bps. And there was a series of smaller rises across Europe, with 10yr bund yields (+0.9bps) closing at 2.41%, which is their highest level since November, whilst 10yr OATs (+0.8bps) and BTPs (+1.9bps) also saw a rise in yields. Meanwhile in the US, although Treasuries weren’t trading, it was clear from Fed funds futures that investors were also pricing out the chances of a near-term rate cut. Indeed, the chance of a cut at the March meeting was down to just 10.6%, the joint-lowest in over three months.

Nevertheless, that news on the rates side shouldn’t detract from a strong performance for risk assets, which saw the STOXX 600 (+0.16%) post a 4th consecutive daily advance. In fact, that leaves the index less than 0.5% away from its all-time high in January 2022, so it’s plausible we could get another record shortly. However, there was a divergent performance between sectors and regions, with Spain’s IBEX 35 (+0.59%) leading the advance, in contrast to Germany’s DAX (-0.15%) and France’s CAC 40 (unch). Looking ahead, the focus is likely to be on corporate earnings announcements today, with Walmart releasing at 12pm London time, before Nvidia then report tomorrow after the close. That Nvidia release will be critical, since the Magnificent 7 have continued to power this year’s equity gains so far, with a +10.65% YTD performanc e, and Nvidia has seen the strongest gain in the whole S&P 500 with a +46.63% rise

Over in the commodities space there was a very mixed performance yesterday. On the one hand, WTI oil prices (+0.38%) closed at a 3-month high of $79.49/bbl, so that’s one that’ll have a mechanical impact on inflation if it’s sustained, with US gasoline prices having already risen since the start of the year. By contrast however, European natural gas futures continued to decline, and yesterday saw a -4.50% decline to their lowest since June, at €23.70/MWh.

In the political sphere, we heard yesterday that European Commission President Ursula von der Leyen will be seeking a second five-year term in office, which comes ahead of the European Parliamentary elections in June. But unlike the US Presidency for example, where voters cast their ballot for a candidate, there’s no direct election for the Commission President. Instead, von der Leyen would need to be nominated as the lead candidate of her party, the centre-right European People’s Party, who are choosing their candidate next month. After the parliamentary election, the European Council (the group of EU leaders) then propose a candidate for Commission President to the Parliament, who is usually taken from the largest group in the Parliament. But even so, there’s no requirement for the leaders to select the lead candidate from the biggest grouping, as we saw last time when von der Leyen was selected over Manfred Weber, who was originally the lead EPP candidate. Once EU leaders have selected someone, the nominated candidate then requires an absolute majority of the European Parliament to get the job, and last time von der Leyen only won 383 votes, which was just above the 374 necessary. So if the political groupings are more fragmented after the election, then it could be even harder to achieve a majority this time round. Our economists have written about what a VdL 2.0 term might look like in their election monitor here.

To the day ahead now, and data releases include Canada’s CPI for January, and the US Conference Board’s leading index for January. From central banks, we’ll hear from BoE Governor Bailey. Finally, earnings releases include Walmart and Home Depot.