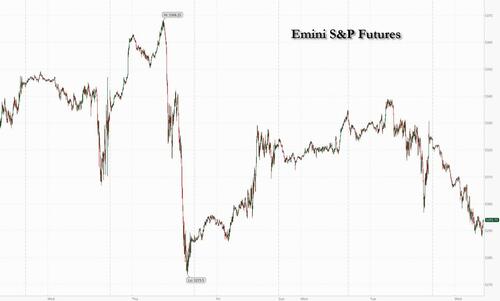

US futures are weaker with tech and small caps underperforming after the NDX made a new ATH yesterday on the back of the relentless Nvidia meltup. The weakness has been driven by surge in yields, a result of the latest batch of hawkish Fed remarks, two very weak bond auctions and stronger macro data (Consumer Sentiment; Housing Prices). Will we see more of the same today with the 7Y auction on deck? At 7:45am S&P futures are 0.6% lower while Nasdaq futures dipped 0.7% as Mag7 and Semi stocks (incl. NVDA) are all lower pre-mkt; Asian stocks fell, led by losses in Hong Kong, while Europe’s Stoxx 600 index also slipped 0.6%. Yields continued their rise, and after jumping 9 basis points on Tuesday, 10Y yields rose further to 4.57%, the highest level since May 3 when the huge payrolls miss sent yields sliding. The USD caught a bid, but commodities were a bright spot with both energy and base metals moving higher as another attack in the Red Sea added to heightened geopolitical tensions in the Middle East . It's a light calendar: the only US eco data is the May Richmond Fed index (10am) and Dallas Fed services activity (10:30am); we also get speeches from the Fed's Williams (1:45pm) and Bostic (7pm). Fed releases Beige book at 2pm

In premarket trading, Marathon Oil shares climbed 5.9% after reports that ConocoPhillips was set to acquire the E&P company, valuing the company at around $15 billion. Airline stocks on both sides of the Atlantic are under pressure after American Airlines cut its profit guidance heading into the crucial summer travel season, just one month after it published a very optimistic outlook which sent its stock price surging in a classical case of stock price manipulation.

And indeed, American Airlines shares plunged 8.3% after the airline slashed its second-quarter adjusted earnings per share outlook, taking the forecast below consensus expectations. The company also announced the departure of its chief commercial officer, Vasu Raja. Here are some other notable premarket movers:

Despite solid May performance - the S&P 500 is up 5.4% in the month as of Tuesday’s close, while Europe's Stoxx 600 is on track for a 2.2% gain in May - markets are feeling the ripples from a rough US session, after tepid demand for US note sales, resilient consumer confidence data and central bank talk fueled expectations interest rates will stay elevated. There’s an auction of seven-year Treasuries later Wednesday and an important US price growth print is in focus at the end of the week.

"The higher-for-longer bond yields risk is biting into equity valuations and short-term pressure seems to be a given,” said Leonardo Pellandini, an equity strategist at Bank Julius Baer. “Nevertheless, with inflation expectations moderating and interest-rate cuts coming soon, we think markets can continue to climb higher.”

And speaking of higher rices, Friday sees the release of the Fed’s preferred inflation gauge — the personal consumption expenditures index. Economists expect the PCE deflator to have risen in April at an annual pace of 2.7%, the same as in March.

“One potential banana skin is that major downside surprises in inflation could now bring in the view that the US economy could not be in as strong shape as previously expected — i.e. ‘bad news is bad news’,” Geoffrey Yu, strategist at Bank of New York Mellon.

European stocks also declined; the Stoxx 600 fell 0.3% with travel, financial service and consumer product shares leading declines. Major markets are all lower with France/Italy the biggest laggards. Oil and gas stocks outperformed after the price of crude hit a five-week high as another attack on a ship in the Red Sea added to heightened geopolitical tensions. Anglo American shares fell as much as 2.7% as BHP asked for more time to discuss its takeover plan and outlined a series of commitments; BHP shares meanwhile rise in London trading. Here are the biggest movers Wednesday:

Earlier, Asian stocks fell, led by losses in Hong Kong, as rising bond yields and more Fedspeak saw US rate-cut bets further recede. The MSCI Asia Pacific Index fell as much as 1.4%, on track for its biggest single-day plunge since April 19. Tencent, TSMC and Samsung were among the biggest drags Wednesday. Korean stocks slid after Samsung’s labor union said it plans to carry out its first strike ever, while Australia’s key benchmark tumbled after inflation came in faster than expected in April. The regional gauge is still on course for more than 2% gain this month.

In Fx, the Dollar Index rises 0.1% while the Swedish krona is the weakest of the G-10 currencies, falling 0.3% versus the greenback. The euro fell to a near two-year low versus the pound after data showed inflation in May slowed across Germany’s regions compared to a month ago

In rates, the US treasury curve continues to steepen with long-end yields higher by less than 2bp on the day and front-end little changed. After jumping nine basis points on Tuesday, 10-year Treasury yields inched higher to 4.56%. Bunds pared losses during London morning after German state CPI figures suggested the national print, due at 8am New York time, might come in below forecasts. German 10-year yields rise 3bps to 2.62%. Australian bonds are among the worst performers after CPI topped estimates earlier in the session. UK 10-year yields added five basis points while those on similar-maturity German debt pulled back from a six-month high after regional inflation prints came in lower than the monthly estimate for the national figure. The US auction cycle concludes with 7-year note sale, following weak reception for 2- and 5-year notes Tuesday, and first operation of new buyback program targets shortest-maturity coupons.

In commodities, brent crude advanced 0.8% to $84.93 per barrel as another attack in the Red Sea added to heightened geopolitical tensions in the Middle East ahead of an OPEC+ meeting on the weekend. West Texas Intermediate climbed above $80 a barrel. Spot gold falls roughly $19 to around $2,343/oz.

Bitcoin is softer and dips below $68k, whilse Ethereum holds just above $3.8k.

Looking at today's calendar, US economic data includes May Richmond Fed manufacturing index (10am) and Dallas Fed services activity (10:30am). Fed officials’ scheduled speeches include Williams (1:45pm) and Bostic (7pm). Fed releases Beige book at 2pm

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly lower after the indecisive performance stateside amid the rising yield environment. ASX 200 was dragged lower amid a jump in yields and after disappointing data including firmer-than-expected monthly CPI for April and a surprise contraction in Construction Work Done during Q1. Nikkei 225 failed to sustain an early momentum and a brief foray above 39,000 with headwinds from rising yields. Hang Seng and Shanghai Comp were mixed with notable losses in tech and consumer stocks front-running the declines in Hong Kong, while the mainland bucked the trend after more Chinese cities announced property support measures and the PBoC also conducted a relatively substantial liquidity injection heading into month-end.

Top Asian News

European bourses, Stoxx 600 (-0.4%) opened on a softer footing and continued to trundle lower as the session progressed, taking impetus from a subdued APAC session. European sectors are entirely the red, except Energy, which benefits from broader strength in the crude complex amid ongoing geopolitical uncertainty; strength which has dragged Travel & Leisure to the bottom of the pile. US Equity Futures (ES -0.6%, NQ -0.7%, RTY -0.7%) are entirely in the red, posting similar losses to that seen across European indices. As for stock specifics, American Airlines (-7.7% pre-market) sinks after it lowered its Q2 adj. EPS guidance.

Top European News

Central Banks

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

Markets struggled to gain much traction yesterday, with sovereign bonds selling off globally thanks to several hawkish headlines and weak demand at a Treasury auction. The initial catalyst for the selloff was the US Conference Board’s consumer confidence indicator, which unexpectedly rose to 102.0 in May (vs. 96.0 expected), marking the first increase in the measure since January. On the positive side, that helped to ease fears that the US economy might be starting to slow more meaningfully, particularly given the previous reading for April was at a 21-month low. But even though there was relief that consumer confidence had stopped falling, it also led investors to dial back their expectations for future rate cuts, with Treasury yields rising after the release.

That hawkish trend was cemented by comments from Minneapolis Fed President Kashkari, who’s one of the more hawkish members on the FOMC right now. He said that “I don’t think anybody has totally taken rate increases off the table”, suggesting he was at least open to the idea they could happen in the future. Moreover, he sounded relaxed about the Fed not needing to move too quickly to ease policy, saying that “We have time to assess how much downward pressure we are putting on demand”. So that adds to the theme from various speakers recently, suggesting the Fed will take their time as they seek to gain further confidence in the path of inflation. That was reflected in market pricing too, with the chance of a Fed rate cut by the September meeting falling from 58% on Monday to 50% by the close yesterday, and overnight it’s declined further to just 46%.

In light of that and the weak Treasury sales, sovereign bond yields moved noticeably higher across the board yesterday, with the 10yr Treasury yield (+8.5bps) back up to 4.55%, which is its highest closing level in over three weeks. The move was exacerbated after a $70bn auction of 5yr notes and a $69bn auction of 2yr notes came in softer, and it was also the biggest daily move higher for the 10yr yield since April 10 after the March CPI release. Moreover, that trend has continued overnight, with the 10yr yield up a further +1.2bps to 4.56%. Meanwhile in Europe the moves were slightly smaller in the same direction, with yields on 10yr bunds (+4.5bps), OATs (+5.4bps) and BTPs (+6.8bps) rising as well.

The bond moves got further support from the latest rise in oil prices, as Brent crude (+1.35%) moved higher for a third consecutive session to close at $84.22/bbl. Now admittedly that’s still some way beneath its levels in April, but it marks a bounceback since last Thursday when it closed at a 3-month low of $81.36/bbl, and it also added to fears about inflationary pressures. Indeed, yesterday saw the 5yr US inflation swap reach a 3-week high of 2.561%. Prices have continued to inch higher overnight as well, with Brent crude now up to $84.42/bbl, putting it on track for a 4th daily increase.

Inflation will remain in the spotlight today, as we’ve got the German CPI release for May coming out, ahead of the Euro Area-wide print on Friday. These will be in particular focus, as this is the last inflation print ahead of the ECB’s decision next week, at which they’re widely expected to cut rates. In terms of what to expect, our German economists at DB see HICP rising to +2.7% in May (link here), and for the Euro Area, our economists see HICP moving up to 2.55% (link here). So a bit of an uptick for both on the year-on-year measures. Yesterday also brought the ECB’s latest Consumer Expectations Survey for April, which showed 1yr and 3yr inflation expectations were both down a tenth compared to March, coming in at 2.9% and 2.4% respectively.

For equities, there was a steadier performance in the US, with the S&P 500 (+0.02%) recovering from a late decline to build on a run of 5 consecutive weekly gains. In fact, the index is moving into increasingly rare historical territory now, as the S&P 500 has currently experienced 23 positive weeks in the last 30, which is a joint record going back to 1989. If this week turns out positive again, that would make it 24/31 positive weeks, which would be a joint record back to 1963, so it’s not often we experience this. We explored this in Jim’s chart of the day yesterday (link here).

However, that steadiness in aggregate masked some considerable divergence at the sectoral level. For instance, tech stocks outperformed – specifically semiconductors (+4.1%) – and the Magnificent 7 surged by +1.30% to a new all-time high, whilst the NASDAQ (+0.59%) also hit a new record. However, several defensive sectors struggled in the S&P, including healthcare (-1.25%) and consumer staples (-0.85%). Meanwhile in Europe, equities put in a much weaker performance, although that was partly a reversal from their Monday gains when they’d been open (which the US was catching up to). Nevertheless, there were still sizeable losses across the continent that more than reversed Monday’s moves, with the STOXX 600 (-0.60%), the DAX (-0.52%) and the CAC 40 (-0.92%) all falling back.

Overnight in Asia, risk appetite has remained weak as yields continue to move higher across the world. Moreover, that theme has continued overnight following a stronger-than-expected Australian CPI print, which rose to +3.6% in April (vs. +3.4% expected). In turn, that’s seen the Australian 10yr yield up +15.0bps overnight, and a similar trend has been evident across the region. For instance in Japan, the 10yr yield is up another +4.9bps to 1.07%, which is its highest level since 2011.

Meanwhile for equities, there’s also been weakness across the region, with loses for the Hang Seng (-1.54%), the KOSPI (-1.32%) and the Nikkei (-0.48%). The main outperformance has come in mainland China, where the CSI 300 (+0.38%) and the Shanghai Comp (+0.33%) have both posted gains, whilst the onshore yuan has weakened to its lowest level since November against the US Dollar, at 7.25 per dollar.

To the day ahead now, and data releases include the German CPI release for May, the Euro Area M3 money supply for April, and in the US there’s the Richmond Fed’s manufacturing index for May. From central banks, we’ll hear from the ECB’s Villeroy and the Fed’s Williams and Bostic, whilst the Fed will also release their Beige Book. Finally, a general election is taking place in South Africa.