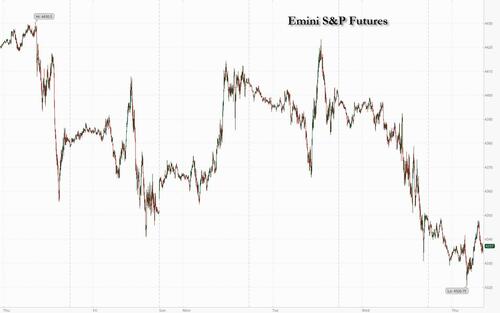

Futures dropped and global markets slumped again after treasury yields continued their relentless march higher (until something breaks), draining appetite for stocks as traders tracked earnings news and an intensifying diplomatic push to contain the Israel-Hamas war. Yields on 10-year US government bonds gained for a fourth day, pushing them just shy of 5% for the first time since 2007, while 30Y yields are well above 5% now. Many potential drivers for price action Thursday include weekly jobless claims data and a packed Fed speaker slate headed by Chair Powell at 12pm New York time...

... while the ridiculous explosion in US debt which has increased by over $600 billion in one month, or about $20 billion per day, is not helping.

As of 7:45am ET, US equity futures dropped 0.2% while Europe’s Stoxx 600 Index fell 0.8%. Markets are in wait and see mode until 12:00pm when Powell delivers remarks at the Economic Club of NY which will be very interesting given the recent run up in yields, the stronger data of late and the geopolitical events since we last heard from him.

In premarket trading, Tesla slid more than 7% in premarket trading after its third-quarter results missed already low expectations. On a brighter note, Netflix Inc. surged after posting the best quarter for subscriber growth in years. Here are some other notable premarket movers:

Oil stocks will be in focus Thursday as crude fell after a panicking Biden realized his best friends now that oil prices are soaring again, are banana republic dictators like Venezuela's Maduro, and the White House suspended sanctions on Venezuelan oil, gas and gold production. Occidental Petroleum Corp., Exxon Mobil Corp., Chevron Corp. and Schlumberger N.V. are lower by about 1% in premarket trading. Analysts estimate that Venezuela can produce about 200,000 more barrels a day, a roughly 25% jump in output.

In the Middle East, United Nations Secretary-General Antonio Guterres is due in Egypt, a day after US President Joe Biden’s visit to Israel, while UK Prime Minister Rishi Sunak has started a two-day trip to the region. Investor attention turns later to US data for fresh readings on the economy. Chair Jerome Powell rounds off another busy diary of speeches by Fed officials.

“US Treasuries have not been fulfilling their usual safe-haven role in recent days, with strong US data trumping worries about a deepening conflict in the Middle East,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “Instead, investors have been looking to gold and oil for a hedge against geopolitical risks.”

European equities fell for a third day as rising Treasury yields put pressure on risk assets across the world. The Stoxx 600 Fell 0.8% as real estate and automobile sectors led the drag, while technology and consumer products shares outperform. Here are the most notable European movers:

Earlier in the session, Asian stocks sank for a second day, driven by losses in Hong Kong, as concerns about China’s broader economy added to geopolitical tensions in the Middle East. The MSCI Asia Pacific Index declined as much as 1.6%, the most in about two weeks, led lower by Tencent and Samsung. Equities went south across the region. Nikkei, Kospi and Hang Seng indexes are all down about 2%. Singapore’s Straits Times Index fell to its lowest since March, while the benchmark in South Korea lost more than 1.5% as the central bank held interest rates steady and flagged upside risks to inflation. All other benchmarks in Asia were lower with those in Japan, Hong Kong and Australia down more than 1%.

In currencies, the Bloomberg Dollar Spot Index is up 0.2%. The pound fell as much as 0.4% against the dollar amid concern that the Bank of England may hold off from another rate hike due to concerns over weakness in the UK economy. Israel’s shekel declined for a ninth day, its worst streak since 2020. The Aussie underperforms after slower-than-expected job gains for September, falling 0.6% versus the greenback; the kiwi also lags.

In rates, treasuries were cheaper across the curve with losses led by long-end, extending disinversion of 2s10s beyond Wednesday’s high. Continued trend higher in Treasury yields sees 10-year approach 5%, peaking just below 4.98% in early London session. Many potential drivers for price action Thursday include weekly jobless claims data and a packed Fed speaker slate headed by Chair Powell at 12pm New York time. An auction 5-year TIPS closes an hour later. US yields cheaper by more than 6bp at long-end, widening 2s10s, 5s30s spreads by 3bp and 2bp; 10-year yields have eased from cheapest levels of the day to around 4.97% with bunds and gilts outperforming by 4.5bp and 1.5bp in the sector. Dollar IG issuance slate includes CAF 3Y; Goldman Sachs, MUFG, and Bank of New York raised almost $7b Wednesday, taking weekly total to $24b; this week’s seven offerings are all from the banking sector. $22b 5-year TIPS auction at 1pm is indicated around 2.53%, exceeding comparable results since 2008.

In commodities, oil prices slipped from a two-week high as the US eased crude sanctions against Venezuela, denting some of the price gains spurred by the conflict in the Middle East. Gold was steady after delivering gains of almost 7% on haven demand since the Oct. 7 attack by Hamas on Israel.

To the day ahead, the main highlight will be remarks by Fed Chair Powell on the economic outlook. Other Fed speakers include Vice Chair Jefferson, Vice Chair for Supervision Barr, along with Goolsbee, Bostic, Harker and Logan. Data releases include the US weekly initial jobless claims, existing home sales for September, and the Conference Board’s leading index for September. Finally, earnings releases include Union Pacific, AT&T and Blackstone.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were lower across the board amid spillover selling from global peers following the latest earnings releases and as geopolitical risks lingered, while further upside in yields also added to the headwinds. ASX 200 was pressured amid mixed jobs data and with underperformance in yield-sensitive sectors. Nikkei 225 suffered firm losses despite the mostly better-than-expected Japanese trade figures. Hang Seng and Shanghai Comp. conformed to the downbeat mood with the Hong Kong benchmark being the worst hit amid weakness in Chinese tech stocks and the property industry with the latter not helped by ongoing debt woes and after Chinese property prices remained at a contraction.

Top Asian News

European bourses are softer, Euro Stoxx 50 -0.2%, with broader macro driver somewhat light as earnings take centre stage. Sectors are largely dictated by earnings with Healthcare pressured post-Roche (-3.7%) with Nestle (-2.1%) also lower and impacting the SMI (-1.2%) while Autos stall after Renault (-6.3%). On the flip side, Tech is the standout outperformer given well received SAP (+4.8%) results. Stateside, futures are similarly in the red, ES -0.1%, ahead of highly anticipated commentary from Chair Powell and after mixed earnings from Netflix (+13.5%) and Tesla (-4.8%) Beijing weighs delaying approval of USD 69bln Broadcom (AVGO)-VMware (VMW) deal, FT reports.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Fed speakers

DB's Jim Reid concludes the overnight wrap

The market selloff gathered pace over the last 24 hours, as rising geopolitical risks and a fresh surge in long-term borrowing costs added to the downbeat mood. The main driver were investor fears about an escalation in the Middle East, which drove gold prices (+1.34%) to their highest since the end of July and meant the rebound in oil prices continued, with Brent Crude up a further +1.78% to $91.50/bbl. But the negative sentiment was clear throughout global markets, and the 10yr Treasury yield (+8.1bps) closed at a new post-GFC high of 4.91%, and this morning is up a further +4.7bps to 4.96%, which leaves it within touching distance of 5% for the first time since July 2007. Equities also struggled as well after defying geopolitical gravity in recent days, with the S&P 500 (-1.34%) losing sizeable ground, whilst futures are pointing to a further -0.18% decline for the index this morning following contrasting results for Netflix and Tesla after the bell yesterday. Later today, Fed Chair Powell's remarks at the Economic Club of NY will be very interesting given the recent run up in yields, the stronger data of late and the geopolitical events since we last heard from him.

In terms of the latest developments, yesterday continued to see both sides accuse the other of being behind the explosion at a Gaza hospital, which had already led to a significant risk-off move as the initial reports came through late Tuesday night European time. Oil prices took a further leg higher after Iran’s foreign minister called for an oil embargo against Israel, which saw Brent Crude hit its highs of the day at $93.00/bbl, before falling back in the European afternoon to close at $91.50 (+1.78%). For reference, Israel only plays a small role in the global oil market, but the comments added to fears of a broader escalation, and served as a reminder of the 1973 oil embargo (50 years ago this week) that sent several Western countries into recession and led to a sharp rise in inflation.

Whilst some haven assets benefited from the geopolitical risk premium, sovereign bonds continued to sell off sharply across the world. US Treasuries were at the forefront of that, with yields rising to new cycle highs across the curve. For instance, the 2yr yield was up +1.3bps to 5.22%, the highest since 2006, and the 30yr yield (+7.0bps) closed at 4.995%, the highest since 2007. Interestingly, we also saw inflation expectations reach their highest in months, with the 30yr breakeven (+2.3bps) closing at 2.50%, which is its highest level of 2023 so far. Longer-term yields did fall by nearly 5bps early in the US afternoon following a relatively successful 20yr Treasury auction, but inched higher again later in the session. This morning we’ve seen another rise in yields across the curve, with the 2yr up +2.0bps to 5.24%, and the 30yr up +4.0bps to 5.03% .

Over in Europe there was a very similar pattern, with yields on 10yr bunds (+4.3bps), OATs (+5.2bps) and BTPs (+9.5bps) all moving higher. That move meant that yields on I talian BTPs closed at 4.98%, their highest level since 2012, and those on French OATs were at 3.55%, their highest since 2011. Nevertheless, it was UK gilts (+14.6bps) which saw the biggest underperformance, as the latest UK CPI release surprised on the upside at +6.7% in September (vs. +6.6% expected). In turn, that led investors to ramp up their expectations of another hike from the Bank of England, with market pricing for another hike up from 55% the previous day to 75% by the close .

Amidst the rise in long-term borrowing costs, we also got fresh evidence that this increase has been filtering through to the real economy. That came from the Mortgage Bankers Association, with their weekly data showing that the rate on a 30yr fixed mortgage was now at 7.7% in the week ending October 13, the highest it’s been since 2000. In turn, that helped push the overall index of mortgage applications to its lowest level since 1995. In the meantime, investors have continued to price out the chance of rate cuts from the Fed any time soon, with futures for the December 2024 meeting putting the implied rate at a new cycle high this morning of 4.83% .

In part, that followed comments from Fed Governor Waller, who said that he believed “we can wait, watch and see how the economy evolves before making definitive moves” on rates. However, he also pointed out that “if the real economy continues showing underlying strength and inflation appears to stabilize or reaccelerate, more policy tightening is likely needed despite the recent run up in longer term rates”. So little urgency but a clear hawkish bias. Meanwhile, New York Fed President Williams said that “we need to keep this restrictive stance of policy in place for some time” but that he was “not yet convinced” that the neutral rate is higher.

All this proved a tough backdrop for equities, and the S&P 500 (-1.34%) posted a pronounced decline. After the close, we received contrasting Q3 results from Netflix and Tesla. Netflix shares gained as much as 13% in after-hours trading after delivering the strongest quarterly subscriber growth since 2020 and raising prices in some key markets. By contrast, Tesla fell in after-hours trading after missing both sales and earnings estimates. Beforehand, the FANG+ index of megacap tech stocks had underperformed (-2.32%), led by a -4.78% decline for Tesla. Another major underperformer within the S&P were airlines (-5.58%) after United Airlines (-9.67%) lowered its profit guidance due to the suspension of flights to Israel and higher fuel costs. Over in Europe, the STOXX 600 (-1.05%) and other major indices lost ground. However, one exception on both sides of the Atlantic were energy stocks (+0.25% in the STOXX 600 and +0.93% for the S&P 500), which were the biggest outperformers amidst the runup in oil prices.

Overnight in Asia, that risk-off tone has continued and all the major equity indices have seen strong losses. That includes the Hang Seng (-1.95%), the KOSPI (-1.84%), the Nikkei (-1.75%), the CSI 300 (-1.62%) and the Shanghai Comp (-1.21%). Separately, the Australian Dollar has weakened by -0.54% against the US Dollar overnight, following weaker-than-expected employment data, which showed employment up by +6.7k in September (vs. +20k expected).

In US politics, Republican Jim Jordan lost a second vote in his bid to become House Speaker, with the number of Republican representatives opposing his nomination rising from 20 in the first vote to 22. It isn’t clear what will happen from here, but the House is unable to pass any bills without a speaker, and it’s now less than a month until the next government shutdown deadline on 17 November, whilst President Biden said yesterday that he would be asking Congress for an “unprecedented support package for Israel’s defense .” Biden is due to give an Oval Office address tonight at 8pm ET.

Looking at yesterday’s other data, US housing starts recovered to an annualised rate of 1.358m in September (vs. 1.383m expected), moving up from their 3-year low in August. However, building permits fell back to an annualised rate of 1.473m (vs. 1.453m expected).

To the day ahead, and one of the main highlights will be remarks by Fed Chair Powell on the economic outlook. Other Fed speakers include Vice Chair Jefferson, Vice Chair for Supervision Barr, along with Goolsbee, Bostic, Harker and Logan. Data releases include the US weekly initial jobless claims, existing home sales for September, and the Conference Board’s leading index for September. Finally, earnings releases include Union Pacific, AT&T and Blackstone.