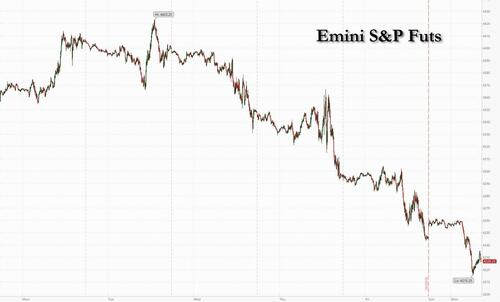

Global markets slumped and US equity futures started the new week deep in the red (if off the worst levels of the session) following losses on 5 of the past 7 weeks, after the 10-year Treasury yield finally topped 5%, fueling concern that soaring borrowing costs will erode economic growth. As of 8:00am ET, S&P futures were down 0.5% after sliding 0.7% earlier while Nasdaq 100 futures dropped 0.4%.

Europe’s Stoxx 600 index sank 0.7%, reaching the lowest intraday level since March. The catalyst for the selling was the 11bps surge in 10 year yields to 5.02%, the highest since 2007, before dipping modestly below 5.00%.

Copper, viewed as a benchmark for the global economy, tumbled to the lowest in nearly eleven months, offering fresh evidence that soaring borrowing costs and slower spending are beginning to bite in all corners of the industrial economy. WTI futures shed 0.7% as US and allies intensified efforts to stop the Israel-Hamas war from spreading. The USD is weaker pre-mkt, VIX higher, and commodities lower while the recent surge in bitcoin continued over the weekend, and pushed the crypto currency just shy of $31,000 before reversing.

Today the Fed enters its own blackout window after a flurry of Fedspeak the last 2 weeks, just as stocks exit their buyback blackout period. MegaCap Tech is the focus within earnings this week. Mega-energy M&A continues with CVX bidding for HES. Today's econ calendar is sparse: we get an update from the Chicago Fed ahead of tomorrow's flash PMIs.

In premarket trading, energy giant Chevron dropped 2% after it agreed to buy Hess Corp. for $53 billion, of $171 per share, a deal aimed at boosting production growth as the US oil industry bets on an enduring future for fossil fuels. Major technology and internet stocks such as Alphabet, Apple , Microsft and Nvidia, were among major technology and internet stocks that dropped, along with US equity futures as the 10-year Treasury yield crossed 5% for the first time in 16 years. Some other notable movers:

The speed and severity of the bond selloff is capturing Wall Street’s attention, just as earnings season gets underway. With US data continuing to show a strong economy and Federal Reserve speakers reinforcing the need to keep interest rates high until inflation abates, many investors are turning more bearish on risk assets.

“5% is purely a psychological level,” said Peter Chatwell, head of global macro strategies trading at Mizuho International. “All moves higher in yield pose the same difficulties for the markets — a higher ‘risk-free’ rate will encourage investors to reduce riskier asset holdings like equities, credit and emerging market assets, and allocate more into Treasuries.”

Inflation readings in Australia and Japan later this week as well as economic activity data in the US and Europe will offer more clues on the outlook for global interest rates. Fed Chairman Jerome Powell is due to give remarks and the European Central Bank will deliver a policy decision.

Europe's Stoxx 600 index sank 0.6%, reaching the lowest intraday level since March, with real estate and mining shares slumping the most, as US bond yields resumed their march toward 5%; autos and utilities also drop. Here are some of the most notable European movers:

Earlier in the session, Asian stocks extended losses from last week, as sentiment remained fragile amid concerns from the Middle East conflict to Federal Reserve policy and China’s economy. The MSCI Asia Pacific Index fell as much as 0.6%, heading for a fourth-straight day of declines, with TSMC, BHP Group and Samsung among the biggest drags. Monday’s drop comes after stocks capped their worst week since August on Friday. Risk sentiment is waning as investors contemplate the possibility of a wider conflict in the Middle East that could spur global oil prices higher and further add to concerns over inflation and high interest rates. This week, traders will be parsing for clues on the outlook for global interest rates with inflation readings in Australia and Japan.

In Argentina, investors were bracing for a selloff after Economy Minister Sergio Massa did better than forecast in Sunday’s presidential vote, dashing hopes for an outright win by a more market-friendly candidate. The country’s dollar bonds — already trading below 30 cents on the dollar — extended their losses on Monday, with five of them including the 2029 note figuring among the worst performers in emerging markets.

In FX, the Bloomberg Dollar Spot Index steady at 1273.23 after losing 0.2% in the past two days. Investors are waiting for the release of US data including the manufacturing PMI due Tuesday, third-quarter GDP Thursday and the Federal Reserve’s favored inflation gauge on Friday. USD/JPY briefly rose above 150 in early Asian trading before slipping back below. The euro is the best performer among the G-10’s, rising 0.2% versus the greenback.

“Data this week should confirm that the US economy continues to run hot and that the Fed has more work to do to cool it off,” Win Thin, global head of currency strategy at Brown Brothers Harriman & Co., wrote in a research note. “The dollar should play catchup and strengthen along with the higher yields”

In rates, the 10-year Treasury yield topped 5% for the first time since 2007 - rising 9bps to 5.01%, before retreating modestly. Treasuries were cheaper by 4bp-8bp across the curve, holding a bear-steepening move that saw 10-year yields breach 5% for the first time since 2007. Treasuries follow similar bear-steepening moves across core European rates amid an absence of escalation in Middle East tensions. US 10-year yields hover near 5% into early US session after topping close to 5.02%, underperforming bunds and gilts by 2bp and 3bp in the sector; long-end-led losses steepen 2s10s curve by ~4bp, 5s30s by ~1bp. 2s10s spread reached -11bp, least inverted since July 2022. The Dollar IG issuance slate is rather spares and includes BGK 5Y; around $20 billion in new bond sales are expected this week; among six biggest Wall Street banks, Bank of America, Citigroup and Morgan Stanley have yet to announce offerings. The Treasury auction cycle begins Tuesday with $51b 2-year note sale, followed by 5- and 7-year auctions Wednesday and Thursday.

In commodities, oil prices were lower but off their worst levels with WTI falling 0.2% to trade near $87.90. Fears softened over the weekend that the conflict in the Middle East would escalate as Israel held off on its ground offensive into Gaza amid efforts to secure the release of more hostages. Gold prices pared an earlier drop to trade little changed.

The US economic data slate is quiet to start the week and only includes the September Chicago Fed national activity index at 8:30am. Ahead this week are the October preliminary S&P Global PMIs, first estimate of 3Q GDP, and September personal income/spending.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with losses across the board following the downside seen on Wall Street on Friday, with participants citing mixed earnings and geopolitical angst. ASX 200 fell at the open with the losses led by the Metals and mining sector as the sector caught up to the price action across base metals. Nikkei 225 was also weaker with the downside led by the Energy and Material names, while the index managed to stay afloat above 31k. Hang Seng was closed due to a public holiday while Shanghai Comp conformed to regional losses. In Taiwan, Apple-supplier Foxconn tumbled over 3% after Global Times sources suggested Chinese mainland tax and natural resource authorities have conducted inspections on key enterprises of Foxconn.

Top Asian News

European bourses are in the red, Euro Stoxx 50 -0.7%, despite fleeting gains at the cash open with the negative APAC handover and broader market sentiment, geopolitical concerns and ongoing yield upside weighing on the space. Sectors are almost all in the red with Basic Resources lagging on the risk tone and benchmark pricing while Real Estate suffers from marked yield upside despite favourable broker action in the sector. Stateside, futures are in the red, ES -0.7%, throughout much of the European morning the magnitude of losses had been more limited than those seen in Europe. However, as yields continue to rise and the US 10yr eclipse 5.0% performance has deteriorated to be in-line with Europe ahead of a particularly quiet US schedule today before a very busy week. Chevron (CVX) is to purchase Hess (HES) in a deal valued at USD 53bln or USD 171 per share. In pre-market trade, Hess (HES) +1.6% with Chevron (CVX) -2.9%.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Israel-Hamas

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Morning from the middle of a forest somewhere deep in a Center Parcs resort. Hopefully I won’t see another zip wire, quad bike or a tornado water slide until the next time I’m dragged here.

With the Fed on their media blackout ahead of next week's FOMC, things will be slightly quieter this week in terms of scheduled macro events after a hectic round of Fed speak last week. Those Fed speakers, including and especially Powell on Thursday, have been having a big impact on rates and the curve even if they haven't said much that adds to the debate as to whether the Fed is done and if so, how long they'll stay at these levels. US 2s10s and 2s30s both steepened more than 30bps last week (the most since post-SVB) even though 2yr yields were up +1.8bps. Although we are fully bought in to the steepener trade I’m struggling to explain why it moved so much last week. Perhaps the long end continues to be hit by supply, US fiscal fears (maybe including extra funding for Israel), and concerns over where the oil price might go whereas the front end is receiving the (relative) flight to quality trade that few want to put on at the long-end. Perhaps the recent back-end moves and the Middle-East tensions are also making the market more comfortable that central banks won’t move again at the front-end even as oil goes higher.

I continue to be concerned as to how markets will cope with such high yields at the back end of markets, especially those in the US. We spent 10-15 years with yields and rates low/zero/negative across the DM world, helped by QE as this was seen as the only way we could finance the enormous global debt load. If this synopsis is correct, then surely one of the biggest 2-3 year yield sell-offs in history risks causing a lot of pain beyond any seen so far. If yields stay elevated, the only way I think I’ll be wrong is if we actually didn’t need those levels of rates and yields in the 2010s, or if central banks and governments have taken on enough of the risk just in time to avoid pain from higher yields. That argument is harder to buy in to with QT and strong government supply combining at the moment. On the risk of accidents it was interesting that the US Regional Bank index fell -3.53% on Friday and is down around -20% since the local peak in August and is less than 10% away from the crisis lows in Q2 .

It isn't the busiest week for data but there are a few important signposts which we'll go through below but such is the way of the world it wouldn't be a surprise if the big-tech results have as much impact as the data. We have Microsoft and Alphabet tomorrow as well as Meta on Wednesday and Amazon on Thursday, which together make up over $6tn in market cap, and nearly 17% of the S&P 500. Note that the 7th largest in the index Tesla fell -15.58% last week which was a bit of a blow for the mega caps but AI related stocks like Microsoft may fair better.

The data highlight might be the latest US core PCE reading as part of Friday’s consumer income and spending data. In terms of macro events the ECB meeting on Thursday might be a little more dull than it has been for the last 15 months but there could be discussion as to how they will further reduce their balance sheet going forward (see our economists’ preview here). T omorrow sees the latest quarterly ECB bank lending survey where the recent reports have suggested very tight lending standards but with expectations that this should loosen in the subsequent quarter. This optimism has reduced the concerns over current conditions so we will see if that improvement has materialised and whether it’s expected to continue.

The global flash PMIs tomorrow will also be important, especially to see if manufacturing and Germany can pick up from what are very low levels historically.

Investors will also keep an eye on the preliminary Q3 GDP report in the US where our economists expect a 5.2% annualised number (vs. 2.1% in Q2) in what was a quarter that surprised almost everyone with its strength.

Elsewhere in the US we have durable goods orders (DB forecast -0.5% MoM vs +0.1% in August) and advance goods trade balance on Thursday, new home sales on Wednesday, and the final UoM consumer confidence numbers on Friday with the final inflation expectations reading. The Bank of Canada will also decide on rates on Wednesday with markets only pricing in around a 10% probability of a hike .

There will be more indicators of economic sentiment on the continent next week. This includes consumer confidence for the Eurozone today as well as a gauge for Germany (tomorrow) and France (Friday). Germany will also be in focus when it comes to business sentiment, with the Ifo survey due on Wednesday. In the UK, the focus will be on labour market data tomorrow with unemployment rate already 0.8pp above the lows, the most in the DM world. Moving on to Asia, key data releases in Japan include the Tokyo CPI on Friday and the services PPI on Thursday. This follows news from the Nikkei last night that the BoJ are looking at another tweak to its YCC policy. Our economist continues to believe they'll make changes at their meeting next week.

In terms of earnings, in addition to the US tech earnings mentioned at the top, we have a busy week with the key highlights mentioned in the day-by-day calendar at the end which also includes all the main data and other events.

Asian equity markets have started the week on a negative footing, mirroring Friday’s losses on Wall Street as reservation around risk-taking persists along with dollar strength. As I check my screens, the S&P/ASX 200 (-0.90%) is leading losses across the region closely followed by the Nikkei (-0.81%), the Shanghai Composite (-0.81%) and the CSI (-0.79%). Otherwise, the KOSPI (-0.46%) is also edging lower this morning while markets in Hong Kong are closed for a holiday.

In overnight trading, US stock futures are seeing a rebound with those on the S&P 500 (+0.21%) and NASDAQ 100 (+0.22%) moving higher ahead of the release of big tech earnings this week. Meanwhile, yields on the 10yrs USTs (+6.83bps) have again moved higher standing at 4.98%, within a whisker of 5% as we go to press. 2s10s curve is seeing further steepening in Asia session reaching -14.9bps, marking its highest level since July 2022.

We’re keeping an eye on Argentina which went to the polls over the weekend. With almost all the vote counted Sergio Massa, the Economy Minister, is in front on 37% while the libertarian economist Javier Milei coming in second with 30%. The two will now go to a run-off in November.

Now looking back on last week, the situation in the Middle East remained highly uncertain but playing out in an environment where investors are reluctant to buy duration as their safe haven play. Such a view may have been a big contributor to the large steepening seen as the front end held in much better.

Although US 10yr Treasury yields fell -7.5bps on Friday, 10yr yields rose +30.3bps to 4.92% on the week, in its largest up move since April 2022. The 30yr rose +32.2 bps. Both saw their highest weekly close since 2007. By contrast, the 2yr yield was near flat on the week (+1.8bps to 5.08%) after rallying -8.6bps on Friday. This contrast marked the sharpest weekly curve steepening since just after the collapse of SVB in March. The 2s30s slope returned to a zero level for the first time since last summer (it was -73bps a month earlier, on the day of the September FOMC). European bonds saw a more moderate sell off on the week, with 10yr bund yields up +15.3bps (and -4.1bps on Friday) with 2yr yields down -1.7bps (-8.1bps on Friday) .

US equity volatility jumped last week, as the VIX index rose +2.4 points to its highest level since March (and +0.3 points on Friday). Overall, equities closed the week down, with the S&P 500 down -2.39% (and -1.26% on Friday) to its lowest level since early June. Tech was not spared from the selloff, as the NASDAQ slipped -3.16% week-on-week (and -1.26% on Friday). Over in Europe, the STOXX 600 fell -3.44% last week, down to its lowest level since the first trading day of the year (and -1.36% on Friday).

The FANG+ index of megacap stocks also struggled last week after it fell -5.03% (and -1.93% on Friday), with Tesla down -15.58% in its worst week since last December (and -3.69% on Friday). Tesla’s retreat came on the back of Wednesday’s earnings and new restrictions by China on Friday on the export of natural graphite exports, critical for EV batteries, in reaction to new US limits on Nvidia’s AI chip exports. Read more on this development and impacts in Marion Laboure and Cassidy Ainsworth-Grace’s latest reports on graphite (here) and semiconductors (here)***

Finally, we turn to commodities. As Middle East tensions weigh on oil markets, Brent crude secured its second consecutive week of gains after gaining +1.40% to $92.16/bbl, although it retreated slightly on Friday (-0.24%). WTI crude followed suit, rising +1.21% week-on-week (-0.69% on Friday). Gold posted its strongest week of the year so far, climbing +2.51% to eye the $2,000 mark at $1,981/ounce (and +0.99% on Friday).