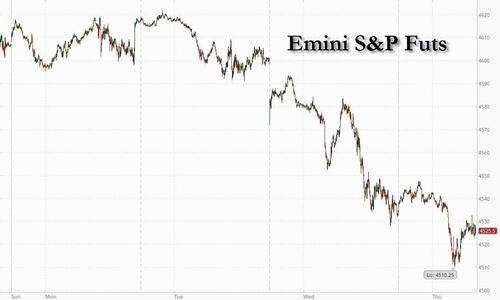

US equity futures are weaker for a second day amid a global stock sell-off sparked by a rout in US Treasuries which accelerated overnight when the BOJ "unexpectedly" stepped in with unlimited bond buying for a second time this week after the benchmark 10-year note yield touched a fresh nine-year high of 0.65%, confusing markets about what it wants to do: keep a cap on yields or strengthen the collapsing yen. European stocks fell 0.6% and Asian markets suffered their worst two-day drop since February as the S&P 500 was set to extend yesterday’s losses. As of 7:45am ET, S&P futures were down 0.3% while Nasdaq futures dropped 0.4% after several very disappointing earnings after the close yesterday. Tech gigacaps were mixed pre-mkt ahead of AAPL (-38bps) and AMZN (+34bps) earnings.

Global bond yields continue to surge higher with 10Y yields now +19.2bps this week. Bill Ackman added to the bearish mood by announcing he’s shorting 30-year Treasuries as a hedge on the impact of higher long-term rates on stocks. Commodities are mixed as the dollar strengthened for a fourth day; nat gas the upside standout with Ags and base metals giving up recent gains, which appear to be more geopolitically related moves. Today’s macro data focus includes ISM-Srvcs, Durable Goods/Cap Goods, Factory Orders, and Jobless Claims. The earnings highlight is after the close when AAPL and AMZN report and while they may not give a strong read-through on the broader economy, certainly every investor will be watching results.

It has been a busy session in premarket trading following an earnings deluge, with PayPal falling as much as 9% after the company’s transaction revenue fell short of estimates and as analysts cut their price targets on the stock, saying that the digital payments company’s transaction margins were disappointing and will weigh on sentiment. Qualcomm shares also fell around 8%, after the chipmaker gave a revenue outlook seen as weak by analysts, underlining headwinds in the handset market. Brokers said the struggling handset business will be slow to recover. Deutsche Bank cut the recommendation on the stock to hold from buy. Here are some other notable premarket movers:

All attention remains on the 10-year Treasury yield which increased five basis points to 4.13% this morning. The selling has come on the heels of news that the Treasury will issue $103 billion of securities next week, more than forecast. The decision by Fitch Ratings to strip the US of its AAA credit ranking also put a spotlight on the country’s booming fiscal deficits.

“The US downgrade doesn’t have any direct impact on markets, but what’s happened is there’s been a lot of concurrent news,” Fowler at UBS said. “Treasury supply is going to pick up. And the Bank of Japan’s policy change has also removed the floor on bonds and that’s led to rising yields.”

Long-term debt looks “overbought” from a supply and demand perspective and it’s hard to see how the market will cope with the increased issuance “without materially higher rates,” Ackman said in a tweet.

Warren Buffett, on the other hand, told CNBC the Fitch move doesn’t change what Berkshire Hathaway Inc. is doing at the moment. “Berkshire bought $10 billion in US Treasurys last Monday. We bought $10 billion in Treasurys this Monday. And the only question for next Monday is whether we will buy $10 billion in 3-month or 6-month” T-bills, CNBC cited Buffett as saying.

Elsewhere, the Bank of Japan came into the market for the second time this week to slow gains in benchmark sovereign bond yields, underscoring its determination to curb sharp moves in rates even as it makes room for them to rise. The yen strengthened against all its major peers, adding 0.3%.

In European equities, the Stoxx 600 Index headed for the steepest three-day retreat since March. Infineon Technologies AG plunged as much as 12% after disappointing forecasts from the German chipmaker. Deutsche Lufthansa AG dropped amid concerns over debt and higher costs. Here are the most notable European movers:

Earlier in the session, Asian equities fell, taking their two-day drop to the most since February, as investors sold tech and consumer discretionary shares on concerns over higher bond yields. The MSCI Asia Pacific Index extended losses by as much as 0.8% after a 2.1% drop on Wednesday. Alibaba, Sony Group and Samsung Electronics were among the biggest drags as 10-year Treasury yields climbed past 4.1%. Valuations for tech stocks are generally impacted by higher yields as elevated interest rates affect expectations for future earnings growth.

Fitch Ratings’ downgrade of US sovereign rating and increased Treasuries issuance sparked risk-off mood globally, with the recent rally in Asian stocks halting in August, which is seasonally a bad month for equities. The index has slumped as much as 2.7% so far this week amid bouts of profit-taking in North Asian markets as the AI rally peters out.

Benchmarks in Japan led declines in the region Thursday. All sectors were in the red. Australia's ASX 200 was dragged lower by losses in tech after the underperformance of their US counterparts, with sentiment not helped by softer monthly exports and a continued contraction in quarterly retail trade.

Investors are now looking ahead to US non-farm payroll data on Friday for cues on the Federal Reserve’s next policy move after ADP Research Institute data showed that US companies added more-than-expected jobs in July. “I think the selloff was waiting to happen,” said Aninda Mitra, head of Asia macro and investment strategy at BNY Mellon Investment Management. “Overconfidence about the inevitability of a US soft landing and dovish policy pricing, when in reality the regime of high inflation and high rates is very much entrenched.”

In FX, the Bloomberg dollar index gained for a fourth day, rising 0.2%; the pound fell 0.3% against the dollar after the BOE hiked rates by 25bps, disappointing markets which had priced in roughly 33% odds of another 50bps hike. JPY stood as the outperforming currency amid haven flows following overnight weakness sparked by another unscheduled BoJ JGB purchase operation. EUR is softer against the Dollar with the Single Currency digesting the Final PMIs for July while the Sterling gears up the Bank of England policy decision.

In rates, treasuries extend losses and the recent bear steepening move with long-end underperformance, leaving 30-year yields cheaper by around 6bps on the day. US yields cheaper by 2bp to 6bp across the curve with long-end led losses steepening 2s10s, 5s30s spreads by 3.5bp and 2.2bp on the day; 10-year yields around 4.13%, cheaper by 5bp on the session with gilts outperforming by 5bp in the sector. Gilts outperformed after the Bank of England raised rates 25bps, in line with estimates. The US session focuses on the flood of US economic data due, including initial jobless claims and ISM services. On the day UK 2-year yields richer by 7bp following Bank of England 25bp hike in a three-way vote split. The Dollar IG issuance slate empty so far; three deals priced $12.2b Wednesday, where issuers paid ~6bps in concessions on order books that were 4.4 times oversubscribed.

In commodities, iron ore slipped back below $100 a ton as investors questioned China’s resolve to revive growth with steel-intensive stimulus and the nation’s biggest group of mills called for curbs on trading. Futures in Singapore lost as much as 4.3%, to head for the sixth weekly drop in the past seven.

Looking ahead, US economic data slate includes July Challenger job cuts (7:30am), 2Q nonfarm productivity, unit labor costs, initial jobless claims (8:30am), S&P services PMI (9:45am), June factory orders, durable goods orders, July ISM services index (10am). We also have the UK July official reserves changes, Italian July services PMI, June retail sales, German June trade balance, the French budget balance for June and the Eurozone PPI result for June. In terms of central banks, we have the BoE decision, the Decision Maker Panel survey and we will also hear from the Fed’s Barkin. Finally, company earnings include Apple, Amazon, ConocoPhillips, Amgen, Booking Holdings, Stryker, Airbnb, Gilead Sciences, Cigna, Regeneron, Monster Beverage, EOG Resources, Block, Moderna, Cheniere, Warner Bros Discovery, Expedia and Draft Kings.

Market Snapshot

Top Overnight News from Bloomberg

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly followed suit to the weakness in global peers including on Wall St where stocks and bonds were pressured by the US rating downgrade, AMD earnings and hot ADP data, albeit with some of the losses were stemmed in Asia as participants digested Chinese Caixin Services and Composite PMI figures. ASX 200 was dragged lower by losses in tech after the underperformance of their US counterparts, with sentiment not helped by softer monthly exports and a continued contraction in quarterly retail trade. Nikkei 225 underperformed as yields edged higher and with newsflow dominated by earnings. Hang Seng and Shanghai Comp were choppy and briefly clawed back opening losses in the aftermath of somewhat mixed Chinese Caixin Services and Composite PMI data.

Top Asian News

European bourses and US futures continue to slump in an extension of Wednesday's price action as yields continue to rise; Euro Stoxx 50 -0.8% & ES -0.3% Sectors in Europe are lower across the board with marked underperformance in Tech as Infineon -7.7% slumps post-earnings given two-way commentary and below-forecast Q4 guidance. Autos also stalling on BMW while Travel & Leisure is affected by Lufthansa. Stateside, given the marked yield action the NQ -0.4% is the incremental underperformer with attention on data points before numerous blockbuster earnings, incl. Apple and Amazon after-hours.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

August is often a month where everyone thinks it will be quiet but also one that throws up a disproportionate amount of surprises in what are thin liquidity conditions. Clearly by the time the real dog days of the month are amongst us in a couple of weeks we may have forgotten about the Fitch US debt downgrade but its certainly given the start of the month a big dose of volatility with the S&P 500 (-1.38%) seeing its worst day since April. However the increased treasury issuance will live on so that's something we won't be able to forget in the weeks and months ahead. All this excitement has occurred ahead of a big day today including the BoE rate decision (we think 25bps over 50bps), US services ISM, jobless claims, unit labour costs and productivity, with Apple and Amazon then reporting after the bell.

The straw that probably broke the back for the Fitch downgrade was the surprise announcement on Monday of the Treasury’s near-term borrowing needs which were formalised yesterday in the refunding announcement. At the margin it seems slightly bigger than the very recently revised expectations but within the range of likely outcomes. Indeed rising borrowing needs are what Fitch cited as a key factor driving its decision to lower its rating for US sovereign debt. The increase in issuance announced yesterday is unlikely to be the last, as the Treasury concurrently announced that it expects “further gradual increases will likely be necessary in future quarters” into 2024. In the subsequent press conference, the Treasury also emphasised it was too early to speculate whether this would lead to future actions by Congress to reduce the deficit. Much too early for that discussion I would imagine but it’s a small shot across the bows nevertheless.

The culmination of this week’s news led to a decent steepening of the curve with 2yr and 10yr USTs -2.4bps and +5.6bps respectively with the latter up to 4.08% (peak at 4.12% for the day), their highest closing level since November last year. The 2s10s slope, while still deeply inverted at -80.5bp, rose to its highest level since early June. 30yr yields also continued to rise, gaining +8.3bps to 4.17%, also the highest since last November. This morning in Asia, US Treasuries are up another couple of basis points to 4.10% as I type.

A strong ADP (more later) contributed to an initial sell off at the front end (with 2yr trading +3.5bp higher at one point). But rates then rallied, especially at the short end, with Fed funds pricing for end-24 down -6.0bps on the day to 4.14%. So longer end yield moves were more of an issuance story than a response to the ADP given the Fed repricing. A reminder that DB thinks that US term premium should be going up for structural issues but the trade has certainly got a kicker from the BoJ last week and now the refunding announcement and Fitch this week.

In contrast, European bonds saw a bull steepening as the equity risk-off story and a flight to quality away from US debt was the dominant theme. 10yr German bund yields fell -2.4bps, with 2yr yields falling -6.0bps.

Equities were in the red across the board, with the S&P 500 slipping -1.38% in its largest down move since April, with only the consumer staples (+0.25%) and healthcare (+0.06%) sectors remaining in the green. 73% of the constituent members of the S&P 500 were negative on the day. Technology led the decline, with the NASDAQ falling -2.17%. The FANG+ index fell -3.45%, with all 10 constituents down. Accompanying the equity decline was a rise in implied volatility, with the VIX seeing its sharpest daily increase since the March banking stress, and up to its highest level since the end of May at 16.09. European equities also slipped with the STOXX 600 falling -1.35%. The retreat was even broader than in the US, with 88% of constituents down on the day.

The credit market was not left unscathed. US high-yield credit default swaps rose +11.3bps, with European Crossover rising +11.5bps. The indices for US and European investment grade credit default swaps also increased, +2.1bps and +2.5bps respectively.

In terms of data, we had the US July ADP report, which upwardly surprised at +324k (vs 190k expected), even if that marked a slowdown from +455k in June. Although typically not the most reliable monthly print, the annual wage growth component of the survey did prove consistent with the softening inflation narrative, falling from 6.4% to 6.2%. Overall, the market paid little attention to the report, with the US debt issuance surprise proving the lead story.

Turning to the UK, Prime Minister Rishi Sunak was reported stating that he felt inflation was not falling as fast as he would like. This came ahead of the BoE monetary policy decision later today. Our economists are expecting a 25bps hike to bring the policy rate to 5.25% and looking ahead, we see two further quarter point rate hikes, with the terminal rate at 5.75%. Read their preview here. 2yr gilt yields traded down -6.2bps yesterday ahead of the meeting, following the broader short-end rally in Europe. Money markets moved to price a 27% chance of a 50bp hike, down from 32% the day before. This had been at over 70% prior to the weaker UK inflation print on 19 July.

Risk-off sentiment has continued in Asia overnight. As I check my screens, the Nikkei (-1.42%) is sharply lower with the KOSPI (-0.64%), the Hang Seng (-0.15%), the Shanghai Composite (-0.18%) and the CSI (-0.02%) also edging lower. S&P 500 (+0.07%) and NASDAQ 100 (-0.03%) futures are fairly flat. 10yr JGB yields earlier rose +4bps to 0.66%, the highest since April 2014, but the second unscheduled bond buying program of the week has led to a 2bps rally from the yield highs.

Early morning data showed that China services activity expanded at a faster place in July as the Caixin services PMI edged up to 54.1 v/s (52.4 expected) from a level of 53.9, thus partly offsetting the drag from the weak manufacturing sector. Elsewhere, Australia’s services sector activity contracted in July as the Judo Bank services PMI fell to 47.9 (the lowest since December) from 50.3. Separately, the country’s trade surplus unexpectedly swelled to A$11.3 bn in June (v/s A$10.75 bn expected) compared to a downwardly revised surplus of A$10.5 bn in May.

In the geopolitics sphere, it was reported yesterday morning that Russia conducted a drone strike on the key Danube port in the Odesa region, Ukraine, hitting grain storage facilities. In response, the price of Chicago wheat futures jumped +4.87% above its previous day close before slipping to finish the day down -1.88%. Corn futures also spiked, before falling -1.76% on the day. US corn prices have in fact declined to their lowest since the end of 2020 amid a more encouraging weather outlook.

Looking ahead, we have the US July ISM services index, the Q2 unit labour costs, nonfarm productivity, June factory orders and initial jobless claims from the US. We also have the UK July official reserves changes, Italian July services PMI, June retail sales, German June trade balance, the French budget balance for June and the Eurozone PPI result for June. In terms of central banks, we have the BoE decision, the Decision Maker Panel survey and we will also hear from the Fed’s Barkin. Finally, company earnings include Apple, Amazon, ConocoPhillips, Amgen, Booking Holdings, Stryker, Airbnb, Gilead Sciences, Cigna, Regeneron, Monster Beverage, EOG Resources, Block, Moderna, Cheniere, Warner Bros Discovery, Expedia and Draft Kings.