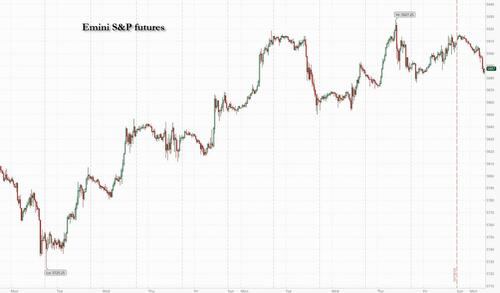

US stock futures drop to start the week, trading near session lows as investors looked to a busy week of company earnings for further signs on the strength of the economy. Oil climbed and gold touched another record on mounting tensions in the Middle East. As of 8:00am, S&P futures are down 0.3% after the index capped its longest run of weekly gains this year, while futures for the tech-heavy Nasdaq 100 fell 0.5% while Nasdaq futures slide 0.6%, with megacap tech stocks all mostly lower: TSLA -0.7%, AMZN -0.3%, AAPL -0.3% pre-market after last week's furious rally. 10-year Treasury yields rise five four basis points to 4.13% and the dollar edged higher. Commodities are higher led by oil and base metals after a bigger-than-expected China LPR rate cut announcement. Over the weekend, BA achieved a tentative settlement of the strike; BA is up +3.8% pre-market. This week, the key catalyst will be PMIs on Thursday. On earnings, more than a fifth of the S&P 500 is due to report this week with Tesla Inc., Boeing Co., General Motors Co. and Coca-Cola Co. in the lineup. Approximately 40% of Industrials (including GE, LMT, MMM, BA, UPS, HON, UNP) and 30% of Materials companies will report. In addition, VRT (Wed pre-mkt; focus on data center), IBM and TXN will provide further color on tech and semis. Also keep an eye on DHR (Tue pre-mkt; housing), KO (Wed pre-mkt; consumer trends), TSLA (Wed aft-mkt; first Mag 7 earnings).

In premarket trading, Boeing rose 3% after union workers struck out a tentative agreement with the planemaker that raises pay by 35% over four years. The workers are set to vote on Wednesday. Kenvue jumped 8% after the Wall Street Journal reported activist investor Starboard Value has built a stake in consumer-products company, seeking changes that would boost the Tylenol maker’s stock price. Here are some other notable movers:

US stocks are unlikely to sustain their above-average performance of the past decade as investors turn to other assets including bonds for better returns, Goldman Sachs strategists said. This year’s 23% bounce has been concentrated in a handful of the biggest technology stocks.

“Optimism about a soft-landing abounds, but that narrative is much more relevant for the US,” said Daniel Murray, chief executive officer of EFG Asset Management in Switzerland. “The European macro backdrop is much more vulnerable, and that is weighing on investor sentiment towards European stocks.”

Speaking of Europe, the Stoxx 600 index dropped 0.5% with gains in energy shares unable to offset losses elsewhere as another busy earnings week is gaining momentum. European companies have so far delivered fewer positive earnings surprises than usual, Barclays strategists said at the end of last week. JDE Peet’s shares jumped after an investor said it would acquire Mondelez’s stake in the coffee producer. SGS and Intertek are among the biggest laggards in the index after RBC downgraded both firms. DNB Bank ASA will acquire all the shares of rival Swedish firm Carnegie Holding AB for about 12 billion kronor ($1.1 billion) in what is the latest step of banking consolidation in the Nordic market. JAB agreed to buy Mondelez’s 86 million shares in JDE Peet’s for €25.10 per share, according to a statement. Here are some of the other notable European movers:

Earlier in the session, Asian stocks failed to hold on to their initial gains on Monday, dragged down by losses in Hong Kong-listed Chinese shares. The MSCI Asia Pacific Index fell as much as 0.6%, with financials and consumer discretionary sectors being the worst performers. Equities in India and most Southeast Asian markets also edged lower. While Chinese stocks onshore managed to eke out a small gain after banks cut their benchmark lending rates, the Hang Seng China Enterprises Index — a gauge of the nation’s shares listed in Hong Kong — slid almost 2%. The divergence in performance on Monday underscores a shift in investor preference in favor of Chinese equities traded on the mainland, which are seen benefiting more from Beijing’s policy support measures.

In FX, the Bloomberg Dollar Spot Index rose 0.2%. There was a spike of demand for the dollar last week which is likely to be linked to the US election, according strategists at JPMorgan. CFTC data showed non-commercial market players including hedge funds, asset managers and others cut aggregate bearish bets on the dollar to some $1.4 billion as of Oct. 15. That’s the least negative on the US currency since traders turned short in August, according to data compiled by Bloomberg.

In rates, treasuries trade lower into early US session, following losses in European rates as supply pressure weighs. The rebound in oil futures, up 2.2%, also adds to upside pressure on Treasury yields as investors monitor risk to supplies from Middle East warfare. 10-year Treasury yields are up 5 bps to 4.13%. Bunds are underperforming their US and UK peers, with German 10-year yields rising 5 bps to 2.23%.

In commodities, oil rebounded from last week's 8% rout; Brent crude traded above $74 per barrel, rising almost 2% on the session. In the Middle East, Israel is discussing its attack on Iran after a Hezbollah drone exploded near Prime Minister Benjamin Netanyahu’s private home at the weekend. Investors are also boosting gold holdings ahead of what’s expected to be a tight US presidential election. Spot gold has picked up where it left off on Friday, rising $15 to another record high.

Looking at today's calendar, the lone item of note is the September Leading index at 10am. Fed members scheduled to speak include Logan (8:55am), Kashkari (1pm), Schmid (5:05pm) and Daly (6:40pm).

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

Top Asian News

European bourses, Stoxx 600 (U/C) began the session with a slight negative bias, and generally opened just below the unchanged mark. Stocks attempted to tilt higher soon after the cash open, but have since dipped off best levels to display a generally negative picture in Europe. European sectors are mixed and with the breadth of the market fairly narrow. Energy takes the top spot, alongside Basic Resources. Insurance is found at the foot of the pile. US Equity Futures (ES U/C, NQ -0.2%, RTY +0.2%) are mixed, with very slight underperformance in the NQ. Catalysts today have been light and the docket ahead remains thin.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

It doesn't feel like its going to be the most exciting week ahead of us. Although with earnings season now in full throttle and with a seemingly extremely tight US election just two weeks tomorrow there is undoubtedly plenty to think about and react to.

Having said the election is tight, over the last two weeks the probability markets have been shifting back towards Trump. PredictIt has moved from a 45% probability of a Trump win on September 20th to 56% this morning. At the start of October a Republicans sweep was a 28% probability on Polymarket.com but that's now shifted to a 42% chance. A Democrats sweep has fallen from 21% to 14%. Outside of the tax and spending implications, Mr Trump last week said that "the most beautiful word in the dictionary is tariff". So that should have reminded markets that he is serious on this matter if he gets elected. In terms of fiscal, you'll remember from last week that our US economists believe that the deficit will be between around 7 to 9% from 2026-2028 whatever political configuration we have in the White House.

Staying on debt we do have the IMF and World Bank annual meetings in Washington from today and across the rest of the week. There is expected to be a focus on the unsustainability of global debt in these meetings but that is probably more of a medium-term concern rather than anything markets will latch on to this week. There are plenty of central bankers speaking at the various Washington events but in particular watch out for ECB President Lagarde and BoE's Governor Bailey (both tomorrow). Ahead of that, today sees quite a bit of Fedspeak. There is also the BRICS summit held in Kazan, Russia from tomorrow to Thursday hosted by Putin. China's President Xi and India's Prime Minister Modi are expected to attend.

In terms of data, the main highlight is probably the round of global flash PMIs (Thursday). Walking through the data day-by-day, the other highlights are German PPI, French retail sales and the US leading index today, the US Phili Fed tomorrow, US existing home sales, the Beige book, Eurozone consumer confidence and the Bank of Canada meeting on Wednesday, US initial jobless claims on Thursday, and US durable goods, Tokyo CPI, and the German Ifo on Friday. Recent strikes and storms will likely distort US claims and durable goods so it will be tough to get a clean data read at the moment. The Beige book may give us a bit more insight into current economic momentum.

In corporate earnings, the main highlights are SAP (today), Texas Instruments, GE, and GM (tomorrow), and Tesla, IBM, and Boeing (Wednesday). We list others in the day-by-day calendar at the end.

This morning, Asian equity markets are mostly trading higher. The Shanghai Composite (+0.82%), and the KOSPI (+0.67%) are leading the gains with the Nikkei (+0.33%) also higher. The Hang Seng is -0.55%, with US equity futures and US Treasuries pretty flat.

Focusing in on China, the PBOC has reduced the one-year loan prime rate (LPR) by 25 basis points to 3.10% from 3.35%, and the five-year LPR by the same margin to 3.6% from 3.85%. This is at the upper end of the 20-25bps of cuts expected with the consensus going for 20bps.

In the commodities market, gold continues its march higher (+0.33%) and to a fresh record high of $2,731 amid reports of Israel contemplating retaliation against Iran following Tehran’s recent missile attacks. Tensions have escalated further with news of a Hezbollah drone explosion near Prime Minister Benjamin Netanyahu’s residence on Saturday. The family weren't home at the time but questions are being asked about how the drone was able to penetrate the defence systems and also what the response will be. Against that backdrop, Brent crude prices have slightly rebounded, trading +0.45% higher at $73.39/bbl.

Looking back at last week now and markets continued to advance, as the combination of strong US data, solid earnings, and another ECB rate cut buoyed investors. In particular, the S&P 500 posted a 6th consecutive weekly advance for the first time in 2024, and the latest weekly gain means it’s still experiencing its strongest performance at this point in the year since 1997. In terms of the details, the S&P 500 was up +0.85% over the week (+0.40% Friday), whilst small-cap stocks did particularly well, with the Russell 2000 up +1.87% (-0.21% Friday). It was a similar story in other countries, with Europe’s STOXX 600 up +0.58% for the week (vs. +0.21% Friday). However, emerging market equities lost ground for a second week running, with the MSCI EM Index down -0.38%, despite a +1.76% rebound on Friday led by Chinese stocks.

That strength was evident across multiple asset classes. For instance, in credit there were several milestones, with US IG credit spreads falling to just 79bps on Thursday, which was their tightest level since 2005, before rising +2bps on Friday. Similarly, Euro IG credit spreads ended the week at just 105bps, their tightest since February 2022. That spread tightening also happened among sovereign bonds, with the gap between the 10yr Italian yield over bunds down -11.9bps last week to 118bps, which is their tightest level since November 2021.

Among sovereign bonds themselves, there was also a modest rally last week, with yields on 10yr Treasuries down -1.7bps (-0.8bps Friday) to 4.08%. And those on 10yr bunds came down by a larger -8.3bps (-2.6bps Friday) to 2.18% helped by the back-to-back cut by the ECB. Bonds were also helped by a noticeable decline in commodity prices, and Brent crude fell by -7.57% over the week to $73.06/bbl. But even as oil prices fell, gold prices climbed to another all-time high on Friday of $2,721/oz, having risen by +2.44% last week (+1.08% Friday).