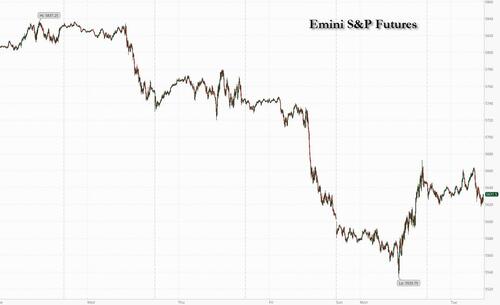

US equity futures fell abruptly just around 6am ET, reversing earlier gains and unable to benefit from the positive risk tone in European trade, hinting at another very volatile session on Wall Street, as tomorrow's tariffs "liberation day" loomed over markets. Gold extended its winning streak, rising to another record high. As of 8:00am ET, S&P futures were down 0.5%, reversing an earlier gain of 0.2%, after the Washington Post reported a White House proposal to impose tariffs of around 20% on most imports. Nasdaq futures slid 0.6% as Tesla rose modestly but other Mag 7 stocks were in the red. European and Asian markets both rose. Bond yields slid 4bps, pushing the 10Y yield to 4.16% while the USD traded higher on the back of Euro weakness. Commodities are mostly flat this morning with base metals declining (copper -0.9%). Overnight, headlines were largely light, with geopolitical tension and trade policy remaining uncertain. Trump seems to dial back his criticism on Putin, per BBG article (here). We will get the Final March ISM-Mfg this morning: consensus expects the Index to print 49.5 survey vs. 50.3 prior; we also get the latest JOLTS report.

In US premarket trading, Tesla rose while fellow Magnificent Seven stocks edge lower (Tesla +3.1%, Nvidia +0.6%, Alphabet +0.5%, Meta +0.2%, Amazon +0.3%, Microsoft +0.2%, Apple -1%). Johnson & Johnson slid 3.5% in premarket trading after a judge rejected its third attempt to use bankruptcy of one of its units to end baby powder cancer claims. Delta Airlines Inc. and Southwest Airlines Co. fell after Jefferies analysts cut their ratings on concern about consumer spending. Here are some other notable premarket movers:

President Donald Trump will announce his reciprocal tariff plan at 3 p.m. on Wednesday at an event in the White House Rose Garden, but the extent of his levies remain unclear. There’s also confusion around whether the US president will take a lenient or harder tack, making investors wary of risky stock bets.

“Investors are grappling with what could be announced this week,” said Laura Cooper, global investment strategist at Nuveen. “The range of outcomes is so wide that traders are struggling with how to price in that potential outcome.”

Futures were hit shortly after 6am after the WaPo reported that White House aides have drafted a proposal to impose tariffs of around 20% on most imports to the United States. In a hitpiece that appears intended to spark panic and restart the selloff, the authors write that "if implemented, the plan is likely to send shock waves through the stock market and global economy. Assuming that permanent tariffs took effect in the current quarter and triggered robust retaliation by U.S. trading partners, the economy would almost immediately tumble into a recession that would last for more than a year, sending the jobless rate above 7 percent, according to Mark Zandi, chief economist for Moody’s, who described the results as a worst-case scenario."

Trump has touted his April 2 announcement as a “Liberation Day,” heralding the start of a more protectionist policy meant as retribution against trading partners he has long accused of “ripping off” the US. He has already placed levies on Canada, Mexico and China — the US’s three largest trading partners — as well as automobiles, steel and aluminum. Import taxes on copper could come within several weeks. He has also threatened duties on pharmaceutical, semiconductor and lumber imports.

Many fear Trump’s announcement will mark the start of lengthy and fractious negotiations with trade partners, pressuring the economy and keeping market volatility elevated. On Tuesday, European Commission President Ursula von der Leyen said the bloc is prepared to retaliate if reciprocal tariffs are imposed.

“We could get another period of potential negotiations which is just going to prolong this uncertainty and underpin further choppy price action,” Nuveen’s Cooper said.

As tariffs loom, US carmakers are lobbying the administration to exclude certain low-cost car components, Bloomberg reported. The EU said it will use a broad range of options to retaliate. An analysis by Bloomberg Economics found that a maximalist approach could add up to 28 percentage points to the average US tariff rate — resulting in a hit of 4% to US GDP.

Strategists at Citigroup said that a surge in short flows pushed net positioning for the Nasdaq back to neutral ahead of tariff announcements. Barclays strategists, meanwhile, said that hedge funds and CTAs turned short US equities and long Treasuries last month, likely improving the risk-reward outlook into April 2.

Chip stocks could be in focus after Commerce chief Lutnick signaled he could withhold promised Chips Act grants as he pushes companies in line for subsidies to expand their US projects.

Europe's Stoxx 600 rose 1.2% and is on course to snap a four-day losing streak as concerns regarding imminent US trade tariffs appear to have subsided. All 20 sectors are in the green, with auto, industrial and technology names leading gains. Goldman Sachs strategists cited a weaker growth outlook as a reason to cut their forecast for Europe’s Stoxx 600, following a similar move from the US team. The team led by Sharon Bell trimmed the 12-month target on the index to 570 points from 580. Here are the biggest movers Tuesday:

Earlier in the session, Asian equities also rose, poised to snap a three-day selloff as traders reassessed positions ahead of the planned imposition of more US tariffs. The MSCI Asia Pacific Index advanced as much as 1.1%, led by gains in Taiwan, South Korea and Hong Kong. TSMC, Tencent and Samsung Electronics were among the biggest boosts. Traders remained on edge, however, with 30-day volatility on the gauge trading around the highest level since October. Most key Asian benchmarks were in the green on Tuesday. India was an exception, with tech heavyweights sliding on concern that slower growth in the US may hurt spending by their clients. Markets in Indonesia, Malaysia and the Philippines were shut for holidays.

The rebound doesn’t signal “much about the overall market’s direction in next 6 to 12 months,” said Homin Lee, senior macro strategist at Lombard Odier Singapore. “It will still be important to get the details of Trump’s announcements tomorrow given the significant - and potentially market-negative - complexities implied in the tariff framework Trump appears to be considering.”

In FX, the Bloomberg Dollar Spot Index is little changed. The Aussie dollar pared gains seen after the RBA stood pat on rates with a slight hawkish tinge to the statement. The Swedish krona takes top spot with a 0.5% gain.

In rates, treasuries continue to benefit from haven demand, with futures reaching session highs after the Washington Post reported a White House proposal to impose tariffs of around 20% on most imports. Additional support comes from steeper gains for bunds after euro-area inflation eased further toward the European Central Bank’s 2% target, and declines for S&P 500 futures. US yields are 2bp-4bp richer across maturities with gains led by intermediates, flattening 2s10s spread by around 2bp; 10-year is on session lows around 4.165% with bunds and gilts outperforming by 3bp and 2.5bp in the sector. European government bonds are broadly higher with UK and German 10-year borrowing costs falling 6 bps each. Traders have added to their ECB and BOE interest-rate cut bets, although there was little reaction to euro-area CPI data - the headline matched forecasts while the core rate slowed slightly more than expected. US session includes March US manufacturing PMIs from S&P Global and ISM.

In commodities, spot gold adds $10 to $3,133 having notched another record high earlier near $3,150. WTI is steady near $71.50 a barrel. Bitcoin rises over 2% to above $84,000.

Today's US economic calendar includes March final S&P Global US manufacturing PMI (9:45am), February construction spending, JOLTS job openings and March ISM manufacturing (10am) and Dallas Fed services activity (10:30am). ed speaker slate includes Richmond Fed’s Barkin discussing monetary policy and the economic outlook (9am).

Market Snapshot

Top Overnight News

Tariffs/Trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher as markets recovered from the recent sell-off and with sentiment helped by data releases although gains were capped as tariff uncertainty persists heading into April 2nd 'Liberation Day' reciprocal tariffs. ASX 200 advanced with broad gains seen across sectors, while there was a muted reaction to the RBA rate decision in which the central bank maintained the Cash Rate at 4.10% as unanimously forecast and provided little clues for future policy. Nikkei 225 rallied at the open after data showed a decline in the Unemployment Rate and a mostly better-than-expected Tankan survey although the index then pulled back and gradually reversed the gains after failing to sustain a brief reclaim of the 36,000 level. Hang Seng and Shanghai Comp were underpinned after stronger-than-expected Chinese Caixin Manufacturing PMI data.

Top Asian News

European bourses (STOXX 600 +0.9%) are entirely in the green, as the region recovers from the prior day’s hefty losses. Indices have gradually climbed higher as the morning progressed. European sectors hold a strong positive bias, but with no clear outperformer and with gains fairly broad based given the risk tone. Healthcare leads the pack today, lifted by strength in AstraZeneca (+1.5%) after it reported positive trial results for its cholesterol drug, which has boosted hopes of another blockbuster drug. Consumer Products is a little higher today, with clothing brands benefiting in tandem with post-earning strength in PVH (+15.8% pre-market) which beat Q4 analyst expectations.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: China

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Happy April Fools' Day. I could make up a wild story here but it might be boring relative to realities these days. Having said that, 15 years ago today I went on a first date with my wife. I think she now thinks that there has been a decade and a half long April Fools' joke at her expense. So thoughts are with her this morning.

For US markets Q1 seemed like a bad joke as the rest of the world left it behind in equity terms. Henry will soon be releasing our regular performance review, running through how different assets fared over the quarter just gone. It’s fair to say it was a historic period for markets, as the combination of US tariffs, the European fiscal shift, and DeepSeek’s AI model led to a huge reappraisal about the near-term outlook. Indeed, the S&P 500 has just posted its worst month in two years. However, European equities did very well by comparison, with the DAX up +11.32% YTD thanks to the fiscal impulse. And given the general risk-off tone and stagflationary fears, gold put in its best quarterly performance since 1986. See the full review in your inboxes shortly.

Some of those Q1 trends did reverse yesterday amid a jittery quarter-end session as investors await the US reciprocal tariffs announcement tomorrow. The S&P 500 recovered from -1.65% down shortly after the open, when it was briefly back in correction territory, to close +0.55% higher, while the STOXX 600 (-1.51%) fell to a two-month low. On the US side there must have been some quarter end flows that made a difference, especially as US equity futures are back down nearly half a percent this morning.

The losses for the STOXX 600 means that it has now unwound over half of its YTD gains, having risen +5.18% since the start of the year, though it is still way ahead of the S&P 500’s -4.59% decline. And even as US equities outperformed, the gains for the S&P were led by defensive sectors with consumer staples (+1.63%) leading the way. By contrast, the Magnificent 7 (-0.41%) moved lower, while the VIX (+0.62pts) rose for a fourth consecutive session, reaching a two-week high of 22.28. And over in Japan, yesterday saw the Nikkei fall -4.05%, marking its biggest daily decline since September. This morning it's given up most of its attempts to rally back and is only just above flat.

In terms of the upcoming tariff announcement, we still don’t know which countries they’ll be imposed on and what rate. It's fair to say that the administration might not have the final plan ready as yet. Yesterday, White House Press Secretary Leavitt said a planned Rose Garden announcement would feature “country-based” tariffs, with further sectoral duties to come later, while last night Treasury Secretary Bessent said on Fox News that Trump will announce the reciprocal tariffs at 3pm EST on Wednesday. Bessent also said that he was working with Republicans in Congress to deliver Trump’s fiscal campaign promises, including “No tax on tips, no tax on Social Security, no tax on overtime”.

A big concern for investors is that the US tariffs will be met by retaliatory moves, which in turn could lead to a further round of escalation as the US seek to respond. So that’s meant inflation expectations have continued to rise, with the 1yr US inflation swap (+13.3bps) yesterday hitting another two-year high of 3.25%. Other traditional inflation hedges have done well on the back of that, with gold prices (+1.24%) moving up to another record high of $3,124/oz. And matters weren’t helped yesterday by a fresh rise in oil prices, with Brent crude (+1.51%) moving up to a one-month high of $74.74/bbl. So collectively, that’s served to exacerbate existing concerns about inflationary pressures.

Those losses cascaded across global markets, and mounting fears of a US downturn led to a fresh decline in Treasury yields. For instance, the 2yr yield (-2.8bps) fell back to 3.89%, whilst the 10yr yield (-4.3bps) fell to 4.21% with a further -1.15bps fall in Asia so far. That came as investors dialled up the likelihood of Fed rate cuts over the rest of the year, with the amount priced in by the December meeting up +2.7bps on the day to 76bps. Those declines in yields would have been even greater were it not for the move up in inflation expectations, as the 2yr real yield (-4.5bps) hit a two-and-a-half year low of 0.60%.

Over in Europe, sovereign bonds had initially rallied as well, but those moves were pared back after Bloomberg reported that ECB officials were questioning whether they should cut rates again at the next meeting. They’ve already delivered 150bps of easing since last June, but inflation is still lingering slightly above target, and the article said that policymakers were thinking about a pause given the uncertainty over tariffs and higher military spending. There was no sourcing in the article so its not clear it was anything other than observing the facts as they stand. Regardless of this, yields on 10yr bunds (+1.0bps), OATs (+2.1bps) and BTPs (+1.9bps) had all moved slightly higher. An April cut by the ECB was 73% priced by the close, having been at nearly 90% early in the session but falling as low as 65% after the Bloomberg story broke.

Earlier in the day, we also had the latest inflation data from Germany, where the EU-harmonised print surprised on the downside at +2.3% (vs. +2.4% expected). That followed last week’s releases showing downside surprises in France and Spain, so those collectively pointed on the downside. However, the Italian reading yesterday was stronger than expected, moving up to +2.1% (vs. +1.8% expected), so that pointed in the other direction. We’ll get the Euro Area-wide numbers today, so that’ll be an important input for the ECB’s next decision in just over two weeks’ time.

Staying on Europe, there was significant political news out of France, as the National Rally’s Marine Le Pen was given a five-year election ban after being convicted of embezzling EU funds. That means she wouldn’t be able to run in the next presidential election in 2027, but Le Pen’s lawyer said that she’ll appeal the verdict. Later in the evening, Le Pen criticised the ruling as a “political decision”, saying she would fight for the right to run for President.

Asian equities are recovering this morning after Wall Street’s overnight gains but performance is mixed. Across the region, the KOSPI (+1.89%) is leading gains with the Hang Seng (+1.06%) also trading notably higher. Elsewhere, the Nikkei's (+0.20%) recovery is disappointing after yesterdays -4.05% rout where it hit a six-month low. The S&P/ASX 200 (+0.92%) is also trading higher after the RBA decided to leave rates unchanged while Chinese equities are edging higher with the CSI (+0.29%) and the Shanghai Composite (+0.59%) both trading in the green as China’s factory activity beat forecasts (more below). S&P 500 (-0.40%) and NASDAQ 100 (-0.45%) futures are moving back lower.

As was widely expected, the RBA left the Official Cash Rate (OCR) unchanged at 4.1% at the conclusion of the April monetary policy meeting this morning. In an accompanying statement the central bank sounded cautious about the outlook and reiterated that returning inflation sustainably to target remains the highest priority, thus failing to give clarity on when the next rate cut might arrive. Attention now turns to the next two-day meeting on 19-20 May, where markets expect a second cut after February’s 25bps cut, which was the first reduction since late 2020.

Coming back to China, manufacturing activity grew more than expected to a four-month high as the Caixin manufacturing PMI hit 51.2 in March (v/s 50.6 expected) due to a sustained rise in new orders. It follows the prior month’s reading of 50.8. The Caixin data comes after the official PMI over the weekend, which showed the manufacturing sector grew a bit more than expected in March.

To the day ahead now, and US data releases include the ISM manufacturing for March, and the JOLTS report for February. Elsewhere, we’ll get the global manufacturing PMIs for April, the Euro Area flash CPI print for March, and the Euro Area unemployment rate for February. Central bank speakers include ECB President Lagarde, and the ECB’s Vujcic, Cipollone and Lane, along with the Fed’s Barkin and the BoE’s Greene. And in the political sphere, there are two special elections taking place for the US House of Representatives in Florida.