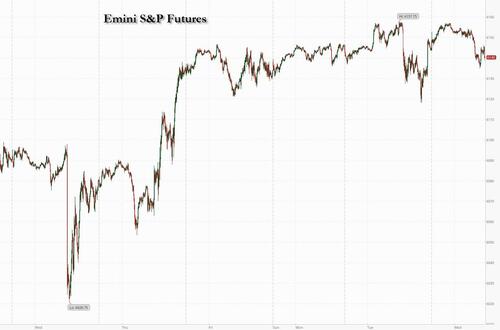

US equity futures are lower ahead of today's FOMC minutes, with global markets also sinking and bonds extended their slide after President Trump’s latest tariff threats stoked concern about a widening trade war; hawkish UK inflation prints which sent bond yields higher did not help. As of 8:00am S&P futures are -0.3% lower after the index topped its January record on Tuesday, while Nasdaq futures traded steady after Trump raised the specter of 25% tariffs on Autos and Pharma, both coming after April 1. The Trump Admin will also keep Biden-era rules on M&A. A slew of earnings reports also dented sentiment, with Arista Networks, Occidental Petroleum, Celanese and Bumble all dropping in premarket trading after results. Super Micro Computer rallied, however, after issuing an aggressive long-term revenue outlook. Pre-mkt, Mag7 names are mixed with Semis seeing some profit-taking. The yield curve is twisting steeper as the USD appreciates. Commodities are stronger despite the USD move; Brent trades above $76 while gold is at an all time high around $2940. Today’s macro data focus will be on Housing data and the Fed Minutes.

In premarket trading, Nvidia is leading gains among the Magnificent Seven (GOOGL +0.3%, AMZN -0.1%, AAPL -0.1%, MSFT -0.02%, META -0.09%, NVDA +0.4% and TSLA -0.1%). Bumble plunged 17% after the online dating company gave a first-quarter forecast that was weaker than expected on key metrics. Etsy tumbled 7% after reporting gross merchandise sales for the fourth quarter that missed the average analyst estimate. Here are some other notable premarket movers:

Traders’ attention will focus turn to the latest FOMC Minutes which could offer clues on the monetary policy outlook. While inflation has been slowing, many fear the effect of Trump’s tariff push on prices. Several officials, including Governor Christopher Waller and San Francisco Fed chief Mary Daly, have signaled rates will stay on hold until inflation slows significantly.

Separately, on Wednesday, the European Central Bank’s Isabel Schnabel said the bank will have to discuss pausing or ending its rate-cut campaign. Her comments pushed the euro 0.2% lower against the dollar, while bond yields rose across Europe, with 10-year German bund yields up about five basis points. Meanwhile, British 10-year gilt yields rose about six basis points after data showed inflation at a 10-month high.

Investors are also pricing increased government spending on defense should the war in Ukraine draw to an end. “When you think about the outcome of any peace treaty between Ukraine and Russia, that will involve a huge uplift in defense spending from European countries,” said Lilian Chovin, head of asset allocation at Coutts & Co.

Europe’s Stoxx 600 Index dropped 0.5% after another record close on Tuesday. Mining, travel, retail and construction stocks underperform. Sentiment was hurt after Trump warned he is weighing tariffs of around 25% on automobile, semiconductor and pharmaceutical imports. His comments added to the a fragile market picture as hopes for an end to the war in Ukraine were tempered by the exclusion of Ukrainian and European officials from US-Russia talks held on Tuesday. Major markets are all lower ex-Italy as bond yields increase following the UK inflation print. Aero/Def, Energy, Semis among the strongest baskets. Here are some of the biggest movers on Wednesday:

Some investors are also concerned about Germany’s national election on Sunday. While Friedrich Merz of the center-right opposition is expected to become chancellor, polls suggest the far-right Alternative for Germany will become the second-biggest party in parliament.

“I have been selling quite a lot over the last two days as Europe is now pricing the best possible scenario for the next catalysts, which is the Ukraine ceasefire and German elections,” said Alberto Tocchio, a portfolio manager at Kairos Partners. “The situation might get bumpy as both events are going to be more complicated than what the market thinks.”

In FX, the Bloomberg Dollar index rises 0.1%. The kiwi sits atop the G-10 FX leader board, rising 0.3% against the greenback after the RBNZ signaled it would slow the pace of interest-rate cuts after a third straight reduction of 50 bps. The yen rises 0.2%, taking USDJPY down to ~151.80 after BOJ Board Member Takata said it’s important for authorities to continue considering gradual hikes.

In rates, treasuries edged lower, pushing US 10-year yields up 2 basis points to 4.57%; long-end yields are less than 3bp cheaper on the day with 2s10s, 5s30s spreads wider by 2bp-3bp. Gilts led a selloff in European government bonds as traders trim their Bank of England interest-rate cut bets after UK inflation climbed to the highest since March 2024. UK 10-year yields rise 5 bps to 4.61%, although the pound still falls 0.1% to around $1.26. The German 10-year is ~5bp higher as expectations for ECB rate cuts decline; money markets see 72bps of easing by year-end vs about 76bps before Schnabel’s comments. Treasury coupon auctions resume with $16b 20-year sale at 1pm New York time and continue Thursday with $9b 30-year TIPS new issue. WI 20-year yield at around 4.835% is 6.5bp richer than January’s auction, which drew strong demand and stopped through by 1.1bp

In commodities, oil prices advance, with WTI rising 1% to $72.50 a barrel. European natural gas futures are flat having topped €50 a megawatt-hour at one stage. Spot gold rises $8 to around $2,944/oz.

The US event calendar includes January housing starts and building permits and February New York Fed services business activity (8:30am). Fed speaker slate includes Jefferson at 5pm; minutes of January FOMC meeting to be released at 2pm

Market Snapshot

Top Overnight News

Tariffs

A more detailed look at global markets courtesy of Newsuqawk

APAC stocks traded mixed following the somewhat choppy performance stateside as attention centred on US-Russia talks on Ukraine, while US President Trump reiterated threats of tariffs on autos, chips and pharmaceuticals. ASX 200 was dragged lower by underperformance in energy and the top-weighted financial sector after a double-digit percentage drop in Santos's underlying profit and Big 4 bank NAB also reported a decline in earnings. Nikkei 225 briefly tested the 39,000 level to the downside following disappointing machinery orders and export data. Hang Seng and Shanghai Comp were mixed with sentiment in Hong Kong subdued and the mainland kept afloat in a reversal of recent fortunes, while the US tariff threat lingered and Chinese House Prices continued to contract Y/Y albeit at a less severe pace.

Top Asian News

European bourses (STOXX 600 -0.4%) began the session on either side of the unchanged mark, continuing the indecisive mood seen in APAC trade overnight. As the morning progressed, stocks dipped lower, with a more pronounced sell-off seen in recent trade; indices generally at lows. The dip in sentiment does come amid commentary via Ukrainian President Zelensky who noted that the US demanding return of USD 500bln in minerals is "not a serious conversation". Seemingly pushing down optimism regarding a near-term Ukraine-Russia peace deal. European sectors are mixed vs initially opening with a slight negative bias; the breadth of the market is fairly narrow. Energy is towards the top of the pile, with upside facilitated by gains in BP, alongside broadly firmer oil prices; BP benefits on reports that it is mulling selling its lubricants unit, worth around USD 10bln. Basic Resources is the slight underperformer today, with the sectors hampered by losses in Glencore after its FY results disappointed (details in the FTSE 100 section below).

Top European News

FX

Fixed Income

Commodities

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets put in a strong performance yesterday, with both the S&P 500 (+0.24%) and the STOXX 600 (+0.32%) hitting all-time highs. For the S&P 500 that marked a second all-time high of the year. Remarkably, it had already registered 11 all-time highs by this time last year and 57 in 2024 as a whole. Talks over Ukraine were an important catalyst for yesterday’s advance, as hopes for an end to the conflict helped to power the European advance, where equities have seen a clear outperformance against their global counterparts so far this year. Indeed, the STOXX 600 hasn’t seen a weekly decline at all this year, with the index currently on track for a 9th consecutive weekly gain.

US equity futures are edging higher again overnight but Asian equities are more mixed after last night Trump signalled major tariffs on autos, chips and pharmaceuticals. When asked on auto tariffs, he said “I probably will tell you that on April 2, but it’ll be in the neighborhood of 25%”, adding similar comments on the other two sectors. In a report earlier this month (link here), Peter Sidorov highlighted how electronics, autos and pharma are three groups in which the US runs the largest trade deficit so it’s not a surprise to see these being targeted. It remains to be seen which of the floated tariffs will be implemented but there are now many tariff spinning plates in play, with reciprocal tariff investigations also due by early April, steel and aluminium tariffs due on March 12, and the one-month delay to tariffs on Canada and Mexico ending on March 4.

Turning to the latest on Ukraine, yesterday saw the US and Russia commence talks in Saudi Arabia, with US Secretary of State Marco Rubio speaking with Russian Foreign Minister Sergei Lavrov. In a readout from the US State Department, it said they agreed to appoint “high-level teams to begin working on a path to ending the conflict in Ukraine as soon as possible in a way that is enduring, sustainable, and acceptable to all sides.” However, there was no sign yet of a date for a meeting between Presidents Trump and Putin. In the meantime, we had a report from Fox News that the US and Russia were proposing a 3-stage peace plan, according to diplomatic sources close to the talks. That would involve a ceasefire, Ukrainian elections, and signing a final agreement, though Fox reporting later clarified that officials were only “floating” the elections idea at this stage. Trump also referred to the “long time” since Ukraine had an election in his comments later on.

There have been concerns that Europe and Ukraine are being left on the sidelines and yesterday Zelenskiy postponed his own visit to Saudi Arabia, saying “we want no one to decide anything behind our back”. That said, last night Rubio did have a call with major European foreign ministers to brief them on the meeting. And while the direction of travel may be very uncomfortable for Europe politically, markets have been more focused on the prospect of any agreement to end the war rather than the type of agreement. As such European risk assets continued to outperform. In fact, all of the major equity indices posted a fresh advance, which included new records for the STOXX 600 (+0.32%) and the DAX (+0.20%). There was also some positive news from the ZEW survey in Germany, as the expectations component rose to a 7-month high of 26.0 (vs. 20.0 expected). Perhaps the upcoming election is also bringing renewed hope. And even though tech stocks dragged on the main indices, other cyclicals helped to overpower that, with the STOXX Banks Index (+1.96%) up to a 13-year high as well. As a European banker that wasn't the worst news I've had this year.

Elsewhere in Europe, sovereign bonds stabilised after their Monday losses, with yields on 10yr bunds (+0.5bps), OATs (-0.7bps) and OATs (-0.1bps) seeing little movement in either direction. Nevertheless, the broader risk-on tone meant that sovereign bond spreads tightened further, with the Italian-German 10yr spread down to a 3-year low of 105bps. And it was the same story for credit as well, with both Euro IG and HY spreads closing at their tightest in over 3 years, around the time that energy prices began to spike higher and inflation rose meaningfully.

Over in the US, financial markets caught up with the rest of the world as they reopened after Monday’s holiday. The S&P 500 (+0.24%) was little changed for much of the day, but a late rally helped it reach a new all-time high, surpassing its previous record from January 23. The gains were fairly broad with more than 70% of the S&P 500 higher on the day and the Russell 2000 up +0.45%. But the advance was held back by the Magnificent 7 (-0.71%), with Meta (-2.76%) leading on the downside after a remarkable run on 20 consecutive gains that had seen its shares rise +20.5% in the past month. Meanwhile, Intel (+16.06%) was the second-best performer in the S&P 500 following weekend reporting by WSJ and Bloomberg that it could be broken up in a deal involving TSMC and Broadcom.

US Treasuries also struggled by comparison with their European counterparts, with the 10yr yield up +7.4bps on the day to 4.55%. That was in part a catch down to Monday's sell-off and also followed remarks from Fed officials on Monday, who reiterated the message that they were in no hurry to adjust policy. Yesterday’s sizable $30bn slate of IG corporate bond issuance may have also added upward pressure on yields. And in Canada, the 10yr yield surged by +8.4bps on the day, which came after their latest core CPI print surprised on the upside. For instance, both the core inflation measures preferred by the Bank of Canada moved up to +2.7% (+2.6% expected), which led investors to dial back the likelihood of another rate cut at their next meeting.

Here in the UK, gilts underperformed their European counterparts after the latest labour market data surprised on the upside. That included a rise in average weekly earnings to +6.0% (vs. +5.9% expected), whilst the unemployment rate remained at 4.4% (vs. 4.5% expected). So as with the Canadian inflation numbers, that also saw investors dial back the probability of a rate cut from the Bank of England at their next meeting. Yields on 10yr gilts themselves were up +3.0bps on the day, whilst the 2yr yield was up +3.7bs. Watch out for UK CPI just after we go to press.

Coming back to Asia, the Nikkei (-0.31%), the Hang Seng (-0.51%) and the S&P/ASX 200 (-0.73%) are all losing ground. The KOSPI (+1.72%) is the best performer rallying to a 5-month high buoyed by hopes of improving political conditions in the country. Additionally, mainland Chinese stocks are also advancing with the Shanghai Composite (+0.54%) moving higher after the central government vowed to support private industries.

In monetary policy action, the Reserve Bank of New Zealand (RBNZ) lowered the official cash rate by 50bps to 3.75% as expected in its policy meeting, marking its fourth straight cut, as easing inflation offers the central bank room to boost the economy. Additionally, the central bank indicated that it will likely follow with 25bps cut at its April and May policy meetings.

Early morning data showed that Japanese exports rose +7.2% y/y in January (vs +2.8% in December, +7.7% market consensus). Meanwhile, imports rose a bigger-than-expected +16.7% (vs +1.7% in December, +9.3% market consensus), thus leading to a trade deficit of -2.76 trillion yen in January (v/s -2.10 trillion yen expected) and compared with a revised surplus of +0.133 trillion yen in the previous month as worries continue to grow about looming tariffs from the Trump administration.

Looking at yesterday’s other data, the US Empire State manufacturing survey came in at 5.7 in February (vs. 0.0 expected). But there was more negative news from the NAHB’s housing market index, which fell to a five-month low of 42 in February (vs. 46 expected).

To the day ahead now, and data releases include the UK CPI for January, US housing starts and building permits for January. Otherwise from central banks, we’ll get the minutes of the FOMC’s January meeting, and also hear from Fed Vice Chair Jefferson.