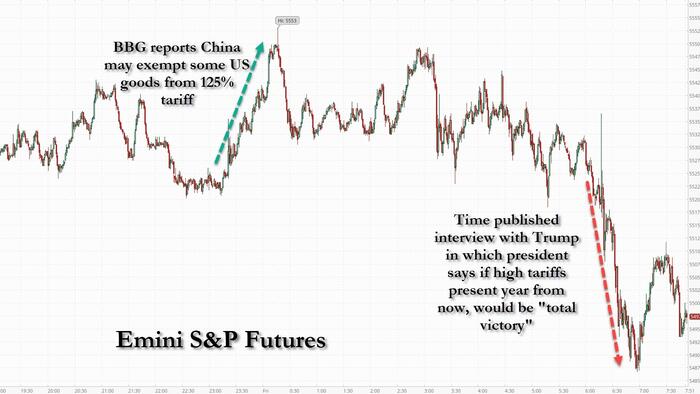

US equity futures are mixed after three days of gain, with tech leading, highlighted by GOOG (+5.6% amid strong earnings results last night), META (+3.5%), and TSLA (+1.6%). S&P futures first rose to session highs during the Asian session, when sentiment was first buoyed by dovish remarks from Fed officials Christopher Waller and Beth Hammack, which bolstered expectations for a potential interest-rate cut as soon as June; but the session highlight was a Bloomberg report that China was considering suspending its 125% tariff on some US imports including plane leases, indicating a shift in the game theoretical "game of chicken" balance and suggesting a deal may come sooner than expected as pain levels are rising for Beijing. Later, foreign ministry spokesman Guo Jiakun reiterated that China is not in talks with the US over tariffs, contradicting Trump and underscoring the complexities for investors tracking headlines out of Washington and Beijing. Futures then slumped to session lows just after 6am ET after Time published an interview with Trump (which took place on April 22) in which the president said China's President Xi has called him (something China denies), said he would not call XI himself, and when asked if high tariffs are still present a year from now, Trump said that would be a "total victory" adding that he expects trade deals in the next 3-4 weeks. In other words, if China may have been offering an olive branch before the interview, those hopes were dashed after its publication and S&P futures reflected that, sliding to session lows down about 0.4% after earlier they rose by the same amouint.

The dollar strengthened, while the yen and Swiss franc retreated as investor demand for non-US haven assets waned. Gold slid 1.5%. Treasuries extended their gains from Thursday; Bond yields dropped (2-, 5-, 10-yr yields are 0.8bp, -0.2bp, -1.6bp lower). Commodities were mixed with Base Metals higher and Precious Metals lower. The US session includes revised April University of Michigan sentiment gauges, and Fed’s external communications blackout ahead of the May FOMC meeting starts Saturday.

In premarket trading, Alphabet shares jumped as much as 5% after posting first-quarter revenue and profit that exceeded analysts’ expectations, buoyed by continued strength in its search advertising business. Alphabet was the top gainer in the Magnificent Seven stocks (Alphabet +4.9%, Meta +3.2%, Amazon +0.5%, Tesla +0.9%, Nvidia +0.4%, Microsoft -0.2%, Apple -0.8%; Alphabet rises 4.9%). Intel tumbled 7% as CEO Lip-Bu Tan gave investors a stark diagnosis of the chipmaker’s problems, along with the sense that it will take a while to fix them. Gilead drops 3.9% after the biopharmaceutical company posted 1Q revenue that fell short of estimates as sales of Trodelvy and Veklury disappointed. Here are some other notable premarket movers:

On the trade front, Bloomberg News reported that China is considering suspending its 125% tariff on some US imports. Later, Foreign Ministry spokesman Guo Jiakun reiterated that China isn’t in talks with the US over tariffs, contradicting President Donald Trump and underscoring the complexities for investors tracking headlines out of Washington and Beijing.

“We are currently in tariff purgatory,” said Joachim Klement, strategist at Panmure Liberum. “There is no fundamental change to the outlook, so markets latch on to noise and get constantly whipsawed by the ever-changing utterances of Donald Trump and his cabinet.”

Confirming that, in an interview Time published with Trump just after 6am ET, and which took place on April 22, Trump said China's President Xi has called him even though China has denied this; when asked if high tariffs are still present a

year from now, Trump said that would be a "total victory."

More recently, on Thursday, Trump said his administration was talking with China, even as Beijing denied the existence of negotiations and demanded the US revoke all unilateral tariffs. Meanwhile, the US and South Korea could reach an “agreement of understanding” on trade as soon as next week, said Treasury Secretary Scott Bessent.

Traders also took some early comfort from hopes that the Fed may reduce interest rates earlier than expected. Markets currently favor a quarter-point cut in June and a total of three such reductions by year-end. Fed Governor Christopher Waller said he’d support rate cuts in the event aggressive tariffs under President Trump’s trade policies hurt the jobs market, speaking on Bloomberg Television. Cleveland Fed President Beth Hammack told CNBC the central bank could move on rates as early as June if it has clear evidence of the economy’s direction.

While the dollar was on course for its first weekly gain in a month, Bank of America strategists said investors should sell into rallies in US stocks and the greenback, cautioning that the conditions for sustained gains are missing. The dollar is in the midst of a longer term depreciation while the shift away from US assets has further to go, according to the BofA team led by Michael Hartnett. The trend would continue until the Fed starts cutting rates, the US reaches a trade deal with China and consumer spending stays resilient. The depreciation of the dollar is the “cleanest investment theme to play,” according to Hartnett.

The Stoxx 600 rises 0.3%, on track for a fourth day of gains as worries about trade tensions between China and the US subsided, with most significant moves triggered by a continued deluge of earnings, including from Saab and Safran. Alten and Hemnet are among the biggest laggers. Here are the biggest movers Friday:

Asian equities also advanced after a Bloomberg report said Beijing is weighing a suspension of its 125% tariff on some US imports, though the Chinese Foreign Ministry spokesman Guo Jiakun later denied that they’re in talks with the US.

Earlier in the session, Asian stocks gained as signs of progress in trade negotiations boosted sentiment, with a major regional benchmark erasing all losses driven by Trump’s April 2 Liberation Day announcement of reciprocal tariffs. The MSCI Asia Pacific Index rose 0.9%, with TSMC and Tencent among the biggest contributors. Benchmarks in Taiwan, Hong Kong, Japan and South Korea all advanced. The key MSCI Asian index joins benchmarks in India, Korea, Australia and Indonesia in recouping losses from this month’s tariff selloff. The regional gauge is on track to cap its second-straight week of gains. Meanwhile, stocks and bonds tumbled in India, as traders braced for a potential worsening of the geopolitical situation with neighboring Pakistan. Indian shares were the worst performers in Asia on Friday, while the rupee and the nation’s bonds also slid, indicating growing angst among traders over any further ramping up of tensions between the two nuclear-armed nations. Markets are closed in Australia and New Zealand for holidays Friday. Key events to watch next week include rate decisions in Japan and Thailand as well as China PMI data.

In FX, the Bloomberg Dollar Spot Index rose as much as 0.4% and is set to notch its first weekly gain in a month. The greenback gained versus all G-10 currencies; The Japanese yen is among the weakest of the G-10 currencies, falling 0.5% against the greenback; USD/JPY rises 0.8% to 143.85.

In rates, Treasury futures rose to session highs in early US trading, with yields 1bp-4bp richer across a flatter curve, outperforming European bonds after stronger-than-expected UK retail sales data. The 10-year yield near 4.29% was ~3bp richer on the day, outperforming German counterpart by 5bp, UK by 2bp. Among US yield-curve spreads, 2s10s and 5s30s are 1bp-2bp flatter. Shorter-dated maturities also underperform in Germany where two-year borrowing costs rise 4 bps.

In commodities, WTI falls 0.5% to $62.50 a barrel. Bitcoin rises 2% to just shy of $95,000. Haven assets underpeform, with gold falling nearly $50 to below $3,300/oz.

Looking at today's calendar, the US session includes revised April University of Michigan sentiment gauges, and Fed’s external communications blackout ahead of the May FOMC meeting starts Saturday.

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly gained as the region took impetus from the rally on Wall St amid trade-related optimism after President Trump suggested that the US and China held talks despite a denial by the latter. However, conditions were somewhat quieter for most of the session with the absence of markets in Australia and New Zealand for a holiday, although there was a slight boost on reports that China is said to consider exempting some US goods from tariffs. Nikkei 225 rallied at the open but with further gains initially capped as participants digested firmer-than-expected Tokyo CPI before the China tariff story provided a late tailwind. Hang Seng and Shanghai Comp were somewhat varied as the Hong Kong benchmark rallied amid strength in property, tech and casino stocks, while the mainland lagged following the conflicting statements by the US and China on whether trade talks took place.

Top Asian News

European bourses (STOXX 600 +0.4%) opened entirely in the green with sentiment boosted by positive trade updates from China, and following a stellar Alphabet earnings report. However, around the time of the European cash open, sentiment waned a touch - but this ultimately proved fleeting. European sectors opened with a strong positive bias but is a little more mixed now. Travel & Leisure takes the top spot, with the sector propped up by post-earning strength in Accor (+4%) and Evoke (+1%). The former topped Q1 revenue expectations and highlighted that it saw “no cracks in demand” so far (re. hotels).

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Back from Luxembourg and last night stayed up late to watch the final episode of the latest series of "The White Lotus", one of the most famous dramas of the last few years. If you ever think your life is going through a tough patch please watch this program as many of these guys have some serious issues!!!

At times the series was so uncomfortable that it was a relief to get back to markets and to trade wars. However for now markets continue to recover with US assets in particular catching up on lost performance after the recent normalisation of policy from the US administration. My view is that the damage to US exceptionalism will be longer lasting but that it’s understandable that there’ll be a relief recovery after the US has come back from the brink policy wise. It’s also worth noting that before Liberation Day the Mag-7 were notably underperforming, especially since DeepSeek’s arrival onto the scene and a generally disappointing Q4 earnings season for the group. See my CoTD from yesterday here for more on this. How the Mag-7 perform from here will dictate a lot of the US exceptionalism trade.

We had the latest taste of this with Alphabet’s earnings yesterday evening. Google’s parent delivered a decent revenue and earnings beat, mostly driven by its search advertising business, and announced a 5% dividend increase. Its shares rose by close to 5% in post-market trading, following on a +2.37% gain in the regular session. S&P 500 (+0.51%) and NASDAQ 100 (+0.62%) futures are trading higher overnight helped by these results. Next stop for the Mag-7 will be the releases from Microsoft, Meta, Amazon and Apple on Wednesday and Thursday next week. So a big couple of days ahead next week. Interestingly the FT have just broken a story as we go to print saying that Apple plans to shift the assembly of all US-sold iPhones to India as soon as next year. This is a big move away from China and shows how the geopolitics are shifting. It's a big win for India.

As trade and geopolitics are reshaping, for now investors are becoming more relaxed about the near-term outlook with few signs of deteriorating data as yet and some dovish comments from Fed officials yesterday, which reassured investors that the Fed would still cut rates if the labour market deteriorated. So collectively, that helped the S&P 500 (+2.03%) to post a third consecutive gain for the first time since Liberation Day. And in another sign that market stress was easing, the VIX index (-1.98pts) fell to its lowest since the April 2 tariff announcements, closing at 26.47pts.

Those comments from Fed officials really helped to support the market yesterday, as they were notably more dovish than Chair Powell, who’d sounded a lot more concerned about inflation. For instance, Fed Governor Waller repeated his previous view that tariffs just represented a one-time price effect, and said that if he saw “a significant drop in the labor market, then the employment side of the mandate, I think, is important that we step in.” Earlier, we also heard from Cleveland Fed President Hammack, who said that if they had “clear and convincing data by June, then I think you’ll see the committee move if we know which way is the right way to move at that point in time”. So that was seen as opening the possibility of a rate cut sooner than expected, and futures moved to price in 85bps of cuts by the December meeting, up +6.0bps on the day. And in turn, Treasuries saw a strong rally, with the 10yr yield (-6.7bps) falling back to 4.32%, marking its third consecutive decline.

Aside from those remarks, the other good news yesterday was that the labour market appeared to remain in decent shape for the time being. For instance, the weekly initial jobless claims were at 222k over the week ending April 19, in line with expectations. Moreover, that was completely in line with where they’ve been over recent weeks, having oscillated between 216k-225k for the last 8 consecutive weeks now. So yet again, there was no obvious sign that layoffs were increasing, and we even saw continuing claims (for the week ending April 12) fall back to 1.841m (vs. 1.869m expected), which was their lowest since late-January.

All that helped to spur a strong market rally, with most US assets continuing to unwind their post-Liberation Day moves. For instance, the S&P 500 (+2.03%) posted a third consecutive gain, and it was actually the first time since February 2023 that the index has managed three consecutive gains of more than +1% a day. Tech stocks led the advance, with the Magnificent 7 (+2.94%) now up by +9.67% over the last three sessions.

When it came to the latest on tariffs, the most notable headline was Trump suggesting that his administration has been talking with China on trade. This came in contrast to comments from China officials earlier in the day, who said that there were no trade negotiations currently happening and that the US should revoke its unilateral tariffs if they wanted to start trade talks. Overnight Bloomberg are reporting that China is considering carving out exemptions to its tariffs on US goods given the stress it's causing in some areas. So whatever officials say there seems to be movement on both sides to pull back from the most extreme position of the last few weeks.

In terms of other trade talks, Treasury Secretary Bessent said that the US and South Korea could reach an “agreement of understanding” as soon as next week. This followed similar comments earlier in the week on progress in talks with India and added to the sense that the US is keen to announce some agreements soon, even if these represent only rough outlines of the eventual deals.

Back in Europe, markets also put in a decent performance for the most part, which was similarly supported by more robust data than expected. In particular, the Ifo’s business climate indicator from Germany unexpectedly rose to a 9-month high of 86.9 in April (vs. 85.2 expected). Fiscal expansion plans must be helping. Moreover, the expectations component only saw a modest pullback to 87.4 (vs. 85.0 expected), thus avoiding the sharp drop that was widely expected.

That backdrop helped to support European assets across the board, with the STOXX 600 (+0.36%) posting a modest gain by the close. It also meant that the index is now up just over 10% from its low on April 9, just before Trump announced the 90-day tariff extension. In the meantime, sovereign bonds also put in a strong performance, with yields on 10yr bunds (-5.0bps), OATs (-7.2bps) and BTPs (-8.4bps) all coming down. And that got further support from ECB officials, particularly as Olli Rehn said that they shouldn’t rule out a larger cut, and chief economist Philip Lane said “there’s no reason to say we’re always going to do the default 25”.

In Asia, Japanese markets are the best performers with the Nikkei (+1.83%) and the Topix (+1.37%) trading sharply higher after the Japanese government unveiled a package of emergency measures to counter the impact of tariffs. Elsewhere, the Hang Seng (+1.36%) and KOSPI (+1.02%) are performing well. Mainland Chinese stocks are a little more subdued with the CSI (+0.30%) and the Shanghai Composite (+0.15%) only a touch higher. Even with the Apple news mentioned above, Indian stocks (-0.90%) are lower as tensions are very elevated with Pakistan at the moment around Kashmir. Meanwhile, Australian markets are closed for a holiday.

Early morning data showed that Tokyo CPI grew more than expected, rising to a two-year high of +3.5% y/y in April (v/s +3.3% expected) amid a recovery in private spending. It followed a +2.9% increase the prior month. Core CPI rose +3.4% y/y in April (v/s +3.2% expected) after advancing +2.4% the previous month thus increasing speculation over more interest rate hikes by the BOJ.

To the day ahead now, and US data releases include the University of Michigan’s final consumer sentiment index for April. Elsewhere, we’ll get UK retail sales for March. Otherwise, central bank speakers include the BoE’s Greene.