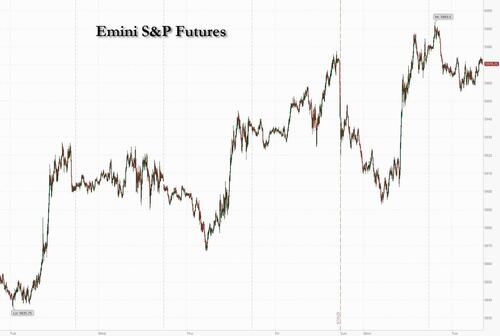

US equity futures are weaker with Tech underperforming, threatening a six-day winning streak that propelled the S&P 500 to the brink of a bull market. Then again, Monday started off even worse and then we saw the biggest burst of retail buying on record resulting in one of the biggest intraday reversals in recent history (according to JPM, more here), so brace for more unexpected moves. As of 8:00am ET, S&P futures are down 0.2%, while Nasdaq 100 futs drop 0.3% with Mag7 stocks mixed amid weakness in semis into today’s Google I/O developer conference; healthcare is leading Defensives over Cyclicals. The yield curve is twisting steeper with the 10Y yield flat and USD weakening. Commodities are mixed with crude down, natgas up, base metals down, precious up, and Ags generally higher. Macro data is light, with just the Philly non-mfg PMI on deck ahead of Thursday’s Flash PMIs & Claims prints, but we have another round of Fed speakers where the message continues to be patience.

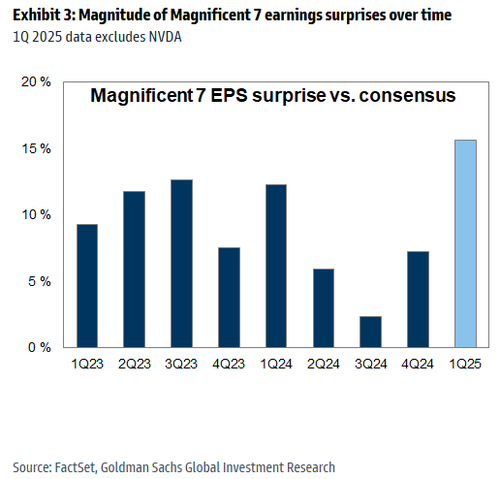

In premarket trading, Mag 7 stocks were mixed (Tesla +1.4%, Alphabet +0.5%, Nvidia -0.2%, Microsoft -0.1%, Apple -0.3%, Amazon -0.2%, Meta Platforms -0.3%). Home Depot gained 2.2% after maintaining its guidance for the fiscal year as US sales ticked up, a sign that consumer spending has held up despite economic turbulence. Vipshop’s US-listed shares (VIPS) decline 8% after the China-based online marketplace reported its first-quarter results and gave an outlook. here are some other notable premarket movers:

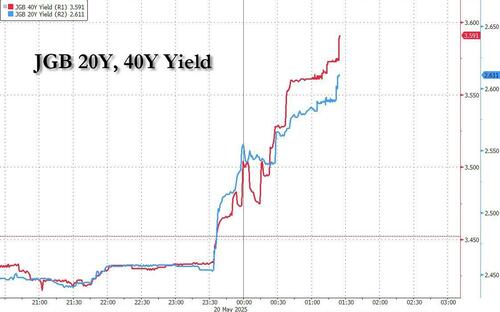

Ironically, as everyone was expecting a Monday metldown in US treasuries - and got just the opposite - the big move was in Japan, where bonds cratered and long-end yields soared to a record high after a near-failed government bond auction saw the weakest bid-to-cover demand since 2012 and the biggest tail since 1987, pointing screaming to increasing concerns about investor support as the Bank of Japan dials back its huge debt holdings.

As markets continue to meltup, investors are looking for clarity on market direction, with strategists in a Bloomberg poll now far more optimistic about European stocks than the US market. Jamie Dimon, meanwhile, has been warning about risks from inflation and credit spreads to geopolitics. “The market came down 10%, it’s back up 10%; I think that’s an extraordinary amount of complacency.”

Meanwhile, the threat of US tariffs showed up in Chinese shipments of smartphones, which fell 72% in April, according to China’s customs data.

Tech has been the main driver of the recent market bounce and will remain in focus into next week’s key earnings release from Nvidia. Google is holding its I/O developer conference, with the keynote speech at 4:30 pm ET. Broader deployment of AI mode on Google search will be a big focus, Bloomberg Intelligence said.

A slate of Fed speakers will be closely watched today for clues on the outlook for the US economy and any commentary on the Moody’s downgrade. Two Fed officials suggested on Monday that policymakers may not be ready to lower rates before September as they confront a murky economic outlook.

In Europe, the Stoxx 600 climbs 0.4%, on pace for a fourth session of gains, led by utilities, telecoms and health care. Germany’s DAX topped 24,000 for the first time. Among individual stocks, Orange advances after Bloomberg reported that Patrick Drahi is weighing a SFR sale. Wall Street strategists are betting European stocks will enjoy their best performance relative to the US in at least two decades as the region’s economic outlook improves. While US stocks have rallied in recent weeks, two Federal Officials warned on Monday that they would adopt a wait-and-see approach before lowering interest rates. Here are the most notable European movers:

Asian stocks gained for the first time in four sessions, with Hong Kong-listed shares leading the advance thanks to a slew of positive corporate developments. The MSCI Asia Pacific Index rose as much as 0.6%, the most in nearly a week, with Alibaba and Sony among key gainers. Xiaomi shares jumped after the CEO said the company is starting mass production of a new chip, while Chinese healthcare stocks surged after biotech company 3SBio entered into a pact with Pfizer. Shares in India slipped. Momentum is returning to Asian stocks with tensions easing on the trade front while global growth seems intact. Chinese battery giant CATL gained in its debut in Hong Kong after wrapping up the world’s largest initial public offering this year, showing the appetite for such themes in the region.

The RBA delivered a 25bp cut at their May meeting, as widely expected, but with clear dovish elements to the meeting as a whole. The statement was materially more positive on the progress made on the inflation mandate, with inflation expected to remain around the RBA’s 2-3% target band, and with a removal of the previous language on being determined to “sustainably return inflation to target”. The updated macro projections were also materially softer, in-line with our economists’ expectations, with lower profiles for growth and inflation, and a higher path for the unemployment rate. Perhaps the most notable dovish news though was Governor Bullock noting that the Board discussed a 50bp cut at today’s meeting, suggesting a clearer break from their previously more cautious thinking. Goldman economists revised their RBA call to include an additional cut at the November meeting, in addition to the cuts they continue to expect at the July and August meetings.

In Fx, the Bloomberg Dollar Spot Index slips 0.1%. The Aussie lags G-10 peers, down 0.6% versus the greenback after RBA Governor Michele Bullock said the board considered a 50bps rate cut before opting for 25. The Dollar continues to underperform, but within tight ranges this morning. EUR (+10bps) price action remains constructive after the trading desk’s flow bias being skewed towards selling yesterday. Our Spot Traders (KBS) note that there was a lack of interest from HFs to chase yesterday - partly an element of some still tending to prior wounds but we seem to have hit the limit of false starts without a clear identifiable catalyst that HFs are willing to chase. USDJPY is trading -25bps lower after a choppy price action overnight. Despite continued spot moves lower in USDJPY and increased speculation that there may be some kind of “currency deal” as part of trade negotiations, our traders noted that downside USDJPY gamma has repriced lower (1m ATM -0.25v vs the roll) with the market struggling to digest front end vol supply the last 48hrs. USDCNH is trading +10bps higher after jumping on headlines that cut benchmark lending rates for the first time since October. The outlier overnight was AUD (-70bps), amid the dovish 25bps cut from the RBA.

In rates, treasuries are mixed as US session gets under way with the yield curve steeper. Front-end yields are 1bp-2bp lower on the day while 30-year is higher by around 3bp near 4.93%. Treasury curve pivots around little-changed 7-year sector, with 10-year near 4.46%, trailing bunds and gilts in the sector by 1.8bp and 2.5bp. Bunds and gilts outperform following softer-than-expected German PPI data and pricing of a £4 billion 2056 syndicated gilt issue. Gilts lead a rally in European bonds, with UK 10-year yields down 3bps to 4.63%. Traders shrugged off BOE Chief Economist Huw Pill’s warning that interest rates may be coming down too quickly. US economic data calendar includes only a regional indicator, however several Fed speakers are slated. Treasury auctions ahead this week include $16 billion 20-year new issue Wednesday and $18 billion 10-year TIPS reopening Thursday

In commodities, Oil pares earlier gains seen after Iran’s Supreme Leader Khamenei voiced skepticism over talks with the US. WTI drops 0.2% to near $62.50. Spot gold rises $8 to around $3,238/oz.

The US economic data calendar includes May Philadelphia Fed non-manufacturing activity (8:30am). Fed speaker slate includes Bostic, Barkin (9am), Collins (9:30am), Musalem (1pm), Kugler (5pm), Hammack and Daly (7pm)

Market Snapshot

Top Overnight News

Tariffs/Trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were marginally higher as the region took impetus from the rebound stateside where the major indices gradually recouped the losses triggered by the US rating downgrade, and both the S&P 500 and the Dow notched six-day win streaks. ASX 200 was led by outperformance in tech and financials, while the attention was on the RBA which delivered a widely expected rate cut. Nikkei 225 rallied at the open in tandem with a surge in USD/JPY but then gave back the majority of the spoils amid currency fluctuations and with little in the way of fresh catalysts for Japan. Hang Seng and Shanghai Comp were kept afloat after China's largest banks cut deposit rates and slashed the benchmark Loan Prime Rates by 10bps as guided by PBoC Governor Pan, while sentiment was also underpinned by a jump in CATL shares on its Hong Kong debut.

Top Asian News

RBA

European bourses (STOXX 600 +0.3%) opened modestly firmer across the board and have traded within a tight range thus far, given the lack of pertinent updates. European sectors are mixed, and aside from the top performer, the breadth of the market is fairly narrow. Utilities takes the top spot, with sentiment in wind names boosted after the Trump administration lifted a stop-work on Equinor’s (+1.3%) New York offshore wind farm project; the name is higher by around 1.5% - peers such as Orsted (+14%) have also been edging higher.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Russia-Ukraine

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

Yesterday felt like we were somewhere along the line of a "death by a thousand cuts" with regards to the US fiscal situation. Hard to know where in that thousand we are but probably much nearer a thousand than at zero even as yesterday saw an initial sell off reverse as the session went on. At the end of the day the loss of the final US triple-A rating late on Friday night doesn't change anything much immediately but it keeps the drip, drip, drip of poor fiscal news building up against the debt sustainability dam in the background. Anyway, that's enough of the metaphors.

In yesterday's CoTD (link here) I highlighted that Moody's base case is now for US deficits to hit nearly 9% by 2035 and asked in a flash poll whether this would happen, or how it would be avoided or dealt with if it did. I'll keep the poll open for a couple of hours before publishing the results in my CoTD this London lunchtime. See it here. It should only take less than 5 seconds and all views very welcome.

We saw a large round trip in Treasuries around the news, with the 30yr yield briefly reaching its highest intraday level since 2023, at 5.035%, before paring back that move to close at 4.90%, -4.1bps lower on the day and virtually in line with where we were immediately before the news late on Friday. That recovery started shortly after the US open and continued as the session went on. It perhaps indicates the slow moving trend of overseas investors selling Treasuries but domestic investors increasing their holdings.

Earlier on, the cross-asset moves had seen a minor rerun of what happened after Liberation Day as US assets lost ground across the board. The S&P 500 recovered from -1.05% at the lows to end +0.09% higher. The US asset that struggled the most was the dollar, with the index (-0.72%) seeing only a modest recovery from its -1.02% intra-day low. That dollar decline repeated the early April parallels of capital flight scenarios often seen in emerging markets, where the currency struggles even though rates are going up.

This is coming at a delicate time, because the US administration are seeking to pass an extension to the 2017 Trump tax cuts, which are currently due to expire at the end of 2025. My CoTD showed that the CBO believe that the US federal debt held by the public will surge to 220% by 2055 if the tax cuts are extended, with the deficit reaching 12% of GDP. Again feel free to vote in the CoTD flash poll if you want to express a view as to whether something happens way before we get to these type of levels or whether we will take it in our strides like every other debt / deficit landmark in recent years.

In terms of that bond move in more detail, the selloff was initially very aggressive, with the 30yr yield reaching 5.035% and on track for its highest close since 2023 and actually higher for only six business days since 2007. However, that was then pared back, and it actually ended the day -4.1bps lower at 4.90%. Similarly, the 10yr yield hit an intraday high of 4.56%, but eventually closed -3.0bps lower at 4.45%. So the initial fears of the day ultimately didn’t materialise as US buyers stepped in, and at the front end, the 2yr yield fell -2.4bps to 3.98%. Overnight, yields are moving less than a basis point across the curve.

Similarly to the rates move, the S&P 500 rallied from more than -1% down at the open to +0.09% by the close, marking its sixth consecutive gain. Defensive sectors including healthcare (+0.96%) and consumer staples (+0.42%) posted the strongest advances. By contrast, tech stocks didn't fully recover, with the Magnificent 7 down -0.25% after its best weekly performance in over two years. The small cap Russell 2000 (-0.42%) also lost ground. And reflecting the pick up in volatility, the VIX index rose (+0.90pts) rose from Friday’s seven-week low to 18.14pts.

Whilst the US fiscal news dominated attention, in the geopolitical space we had President Trump holding a call with President Putin, but this delivered little new on resolving the war in Ukraine. Trump posted following the call that Ukraine and Russia would “immediately start negotiations”. However, Trump’s comments did not repeat earlier threats of new sanctions against Russia or put immediate pressure on Moscow to deliver a ceasefire and his post suggested that the US might now take more of a backseat in the talks. Meanwhile, Putin was rather vague on the upcoming talks, again referring to the “need to eliminate the root causes of this crisis.”

Otherwise yesterday, several Fed officials signalled they weren’t in a hurry to cut rates. For instance, Vice Chair Jefferson said “I believe that it is appropriate that we wait and see how the policies evolve over time and their impact”. Similarly, Atlanta Fed President Bostic said “I think we’ll have to wait three to six months to start to see where this settles out” and reiterated his expectation of only one more rate cut this year. Meanwhile, New York Fed President Williams said “It’s not going to be that in June we’re going to understand what’s happening here, or in July”. And Minneapolis Fed President Kashkari noted “It’s really just wait and see until we get more information.” So it was little surprise that investors continue to see a near-term rate cut as unlikely, with only a 35% chance of a cut priced by the July meeting.

Earlier in Europe, markets had put in a much steadier performance, with the STOXX 600 (+0.13%) just about posting a small gain. That was echoed on the rates side too, where yields on 10yr bunds (-0.2bps), OATs (-0.4bps) and BTPs (+0.1bps) all saw little change. In the meantime, the UK and the EU also reached an agreement that deepened ties between the two after Brexit. Among others, the UK agreed an extension of EU fishing rights, in return for the removal of most border checks on farm exports. That came alongside a defence and security agreement, along with a potential youth mobility scheme, although the latter will be subject to further discussion. Our UK economists looked at the deal yesterday (link here), and their estimates show the long-run benefits to be around 0.5% of GDP by 2040.

For those of us in the UK fed up by not being able to use e-gates in the EU the deal only refers to the "potential use of eGates where appropriate". I've been in so many long queues in the last couple of years when eGates have been empty.

In Asia risk sentiment has been helped after China’s central bank announced cuts to key lending rates for the first time since October reinforcing expectations of looser monetary policy to support the country’s economy (more below). Across the region, the Hang Seng (+1.29%) is leading gains while the CSI (+0.62%) and the Shanghai Composite (+0.38%) are also edging higher. Elsewhere, the Nikkei (+0.26%), the S&P/ASX 200 (+0.54%) are gaining but with the KOSPI (+0.05%) slipping back towards flat. S&P 500 (-0.29%) and NASDAQ 100 (-0.43%) futures are giving back some of yesterday's recovery from the lows.

Coming back to China, the PBOC cut the 1-year loan prime rate (LPR), the reference rate for pricing all new loans and outstanding floating rate loans, to 3.0% from 3.1% and the 5-year LPR to 3.5% from 3.6%. Meanwhile the RBA have just cut rates 25bps (as expected) as I finish this off with the presser ongoing. So far it leans dovishly.

To the day ahead now, and data releases include Canada’s CPI and German PPI for April, along with the European Commission’s preliminary consumer confidence indicator for May for the Euro Area. From central banks, we’ll hear from the Fed’s Bostic, Barkin, Collins, Musalem, Kugler, Hammack and Daly, the ECB’s Wunsch, Knot and Cipollone, and the BoE’s Pill. Finally, earnings releases include Home Depot.