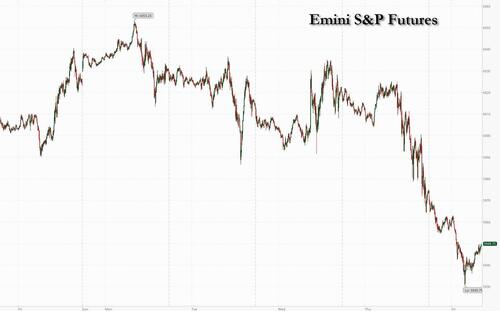

US equity futures drop, and global stocks slide after Fed chair Jerome Powell signaled the Federal Reserve was in no rush to cut interest rates, and unease built over the composition of Donald Trump’s cabinet. As of 8:00am ET, S&P futures were down 0.5%, off session lows; and pointing to a second day of declines; Nasdaq 100 futures were down 0.9% with Mag 7 mostly lower: AAPL, MSFT and META are all 1.0% lower. Drugmakers Moderna, Novavax and BioNTech all slid in New York premarket trading after Trump picked vaccine-skeptic RFK Jr, as his Health secretary. Domino’s Pizza Inc. was among the prominent gainers, after Buffett took a small stake in the restaurant chain. Europe’s Stoxx 600 index slipped 0.3%, on track for its fourth weekly drop, with pharma sector among the biggest laggards, while the MSCI Asia Pacific Index climbed as much as 0.7%, snapping a five-day loss. Bond yields are modestly lower, and the USD retreated, trimming its weekly gain, as some market participants took profit before key data later on Friday and ahead of speeches from Federal Reserve policymakers despite Powell's clearly hawkish comments. Commodities are mixed, with oil flat, reversing an earlier loss of -1.4%; base metals are lower, while precious metals rise.

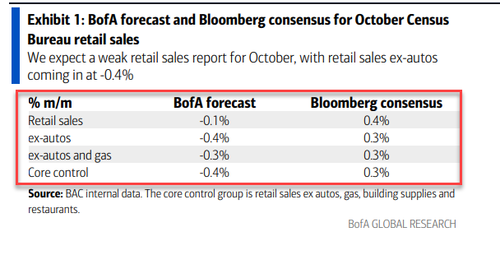

Today, we will receive a slew of growth data: more clarity on the Fed’s path may emerge Friday, with retail sales data due and a host of Fed officials set to speak. Bank of America real-time credit and debit card data suggest a big miss in today's retail sales print. We also get the October Industrial Production data.

In pre-market trading, Moderna and other vaccine makers fell in premarket trading after President-elect Donald Trump said he was tapping vaccine skeptic Robert F. Kennedy Jr. to lead the Department of Health and Human Services. Moderna -2%, Novavax (NVAX) -1%. Domino’s Pizza rose 6% after Berkshire Hathaway bought stock in the pizza chain as Chairman Warren Buffett cut back on some long-held investments. Here are some other notable movers:

The S&P has now given up about a third of the trough-to-peak gains notched after the US presidential election, as some of the optimism over corporate growth under Trump fades. There’s also realization that interest rates will fall less quickly than anticipated, with recent data showing still-elevated inflation pressures and Powell confirming the Fed may take its time easing policy.

“Equity markets seem to be adjusting to the new rate cut trajectory but it doesn’t seem to be a game changer,” said Mathieu Racheter, head of equity strategy at Julius Baer Group Ltd. “Some controversial cabinet announcements obviously do not help the market.”

Powell’s remarks have pushed odds on a December rate cut to less than 60% from roughly 80% a day earlier. Yields on two-year Treasuries steadied after jumping in the previous session in response. The higher-for-longer rates view is supportive for the dollar, however. The greenback stayed below two-year highs hit on Thursday, but is set for its seventh straight weekly gain. More clarity on the Fed’s path could emerge later Friday, as the US releases retail sales data and a host of Fed officials are set to speak.

In Europe the Stoxx 600 index slipped 0.3%, on track for its fourth weekly drop, with pharma sector among the biggest laggards, after Trump named RFK Jr to the top health-policy role. Vaccine makers Sanofi, GSK Plc and AstraZeneca Plc fell after the news. Generali and Aegon are both among the biggest gainers, both on their respective solid earnings. Here are the biggest movers Friday:

Earlier, in Asia the MSCI Asia Pacific Index climbed as much as 0.7%, snapping a five-day loss. Samsung Electronics provided the biggest boost as the South Korean chipmaker rose the most in four years. Mizuho Financial Group and Toyota Motor were among the other notable contributors to the advance. China’s CSI 300 Index dropped despite signs of resilience in the nation’s economy as concerns over a deepening rift with the US outweighed signs of economic stabilization. “Concerns over the Trump administration continue to suppress market risk appetite,” said Ken Chen, an analyst at KGI Securities, referring to Chinese equities. “In addition, some investors interpreted authorities’ appeal to build a slow bull market as an intention to cool down the rally, so they chose to take profit when they can.”

The dollar retreated, trimming its weekly gain, as some market participants took profit before key data later on Friday and ahead of speeches from Federal Reserve policymakers. The market pivoted from Trump trades to the Fed’s cautious tone on interest-rate cuts. Traders pared back December Fed rate-cut odds after Chair Powell’s remarks on economic resilience, stabilizing Treasury yields after Thursday’s swings. The yen outperformed G-10 FX near 155.20/USD on intervention speculation.

In rates, treasuries are mixed with front-end outperforming, recouping some of the losses from late Thursday after comments by Powell curbed wagers on a December rate cut. The yield curve is steeper, likewise reversing part of the flattening reaction to Powell. Front-end yields are richer by more than 3bp with 30-year slightly cheaper on the day; 2s10s and 5s30s curves are nearly 3bp steeper near session wides, erasing about half of Thursday’s flattening. Two-year USTs outperform comparable bunds and gilts, with US yields down 2bps to 4.32%; the US 10-year is little changed around 4.43%, Germany’s also little changed while UK 10-year yield is ~1bp lower on the day. Friday’s US session includes four Fed speakers and retail sales data.

In commodities, oil and gold headed for a weekly drop, weighed down by the stronger dollar. WTI crude drops 1.1% to $67.94, gold steadies at $2,566/oz.

Another of the so-called Trump trades, Bitcoin, also gave up some gains. It hit a record $93,000 level earlier this week on hopes of crypto-friendly policies from the new US administration, but has since dipped back to $87,000. “Much of the good news is already priced into Bitcoin. What the market needs now are concrete political steps from the Trump administration,” said Jochen Stanzl, Chief Market Analyst at CMC Markets. “Otherwise, as with many US equities, a cooling-off is overdue for this ‘Trump trade’ as well.”

Looking at today's US economic data calendar we get November Empire manufacturing, October retail sales and import/export price indexes (8:30am New York time), October industrial production (9:15am) and September business inventories (10am). Fed speaker slate includes Goolsbee (8:30am, 2:05pm), Collins (9am, 10:30am), Williams (1:15pm) and Barkin (3pm)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with a predominantly positive bias albeit with gains capped following the uninspiring handover from Wall Street and as participants digested recent earnings releases and mixed Chinese activity data. ASX 200 was led by outperformance in Utilities and with gains in nearly all sectors aside from Healthcare amid headwinds for the latter following pressure in the industry stateside after US President-elect Trump picked vaccine sceptic RFK Jr as HHS Secretary. Nikkei 225 rallied on the back of recent currency weakness and with outperformance seen in some financial names after Japanese megabanks' earnings results, while GDP data was mostly either inline or better than expected. Hang Seng and Shanghai Comp ultimately gained but saw mixed price action throughout the day after various data releases in which Industrial Production disappointed but Retail Sales topped forecasts, while Chinese Home Prices showed a steeper Y/Y drop although the M/M decline moderated. Participants also digested tech earnings and the PBoC's largest daily liquidity injection via reverse repos in over four years which is meant to counteract factors including maturing MLF loans and tax payments.

Top Asian news

European bourses began the session on a mostly lower footing, in a continuation of the losses seen on Wall St. in the prior session; a paring of the strength seen in Europe on Thursday may also be at play. Since the cash open, sentiment gradually improved, but indices now display a mixed picture in Europe. European sectors are mixed vs initially opening with a strong negative bias. Energy is towards the top of the pile, with Banks and Insurance following just behind. Healthcare is by far the clear underperformer, with several heavyweights within the sector seeing notable downside after US President-elect Trump picked vaccine sceptic RFK Jr as HHS Secretary. US equity futures are entirely in the red, with slight underperformance in the tech-heavy NQ, in a continuation of the negative price action seen in the prior session; which was ultimately sparked by a hawkish-leaning Powell. US finalises USD 6.6bln chips subsidy award for TSMC, according to the US Commerce Department.

Top European news

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Bank speakers

DB's Jim Reid concludes the overnight wrap

Risk assets struggled for momentum yesterday, with the S&P 500 (-0.60%) losing ground as investors reflected on some sticky inflation data and increasingly elevated valuations. The initial catalyst for that was the US PPI inflation for October, where the core PPI reading was stronger than expected, which added to fears that inflation could become stuck above the Fed’s target. Then later in the session, that narrative was reinforced by some hawkish comments from Fed Chair Powell, which added fresh doubts about the likelihood of a December rate cut. By the close, that meant futures had dialled back the probability of a December cut to 62%, down from more than 82% the previous day. Moreover, those moves have seen further momentum overnight, with the probability of a December cut down to 59% this morning, whilst the 10yr Treasury yield is currently at a 4-month high of 4.46%, and S&P 500 futures (-0.32%) are pointing to further losses.

In terms of Powell’s remarks, he explicitly said that the economy “is not sending any signals that we need to be in a hurry to lower rates”, and that its strength “gives us the ability to approach our decisions carefully”. Indeed, yesterday we found out that the weekly initial jobless claims fell to their lowest level since May, at 217k. So there was plenty of support for that message of economic strength, and it was a much more hawkish message from Powell relative his Jackson Hole speech in August, where he said that the “time has come for policy to adjust”. He also noted that yesterday’s PPI data was stronger than the Fed had pencilled in, seeing the data as consistent with a +2.8% yoy core PCE print.

Whilst the PPI data wasn’t that alarming by the standards of the high inflation of 2022-23, the problem was it showed inflation remaining stubbornly above levels consistent with the Fed’s target. For instance, the core PPI reading was at +0.3% (vs. +0.2% expected), which pushed up the year-on-year measure to +3.1% (vs. +3.0% expected). Moreover, that comes on the back of core CPI staying at +0.3% for a third month running, so the concern is that inflation is getting stuck at those levels. Now it’s worth noting that the Fed officially target the PCE measure of inflation, rather than the CPI or PPI measures, and we don’t get the PCE numbers until the end of the month. But we know several categories from the PPI release feed into the PCE, and those were on the stronger side, with sizeable increases in airfares and portfolio management prices. So one to look out for when the October PCE is released on November 27.

Against that backdrop, there were growing signs that investors were becoming more concerned about inflation. For instance, the US 2yr inflation swap up +0.7bps on the day to 2.63%, which is its highest in almost six months. In turn, that led to a notable rise in front-end Treasury yields, with the 2yr yield (+5.9bps) closing at 4.35%, its highest since July, having been near flat on the day before Powell’s comments. However, yields declined at the long end, with 10yr and 30yr yields -1.5bps and -4.9bps lower, respectively. So in some ways it was a mirror image of the curve steepening seen the previous day. One theme that persisted was dollar strength however, and the dollar index (+0.18%) posted a fifth consecutive advance to reach a one-year high.

For US equities, Powell’s comments reinforced what had already been a more challenging day, with the S&P 500 (-0.60%) seeing its largest decline so far this month. The NASDAQ (-0.64%) and the Magnificent 7 (-1.30%) saw sizeable declines, with Rivian (-14.30%) and Tesla (-5.77%) among the worst performers after Reuters reported that president-elect Trump plans to eliminate the consumer tax credit for electric vehicles. The small-cap Russell 2000 (-1.37%) lost ground for a third consecutive day, which marked its worst 3-day run since early August. By contrast in Europe, equities saw a strong rebound from the last couple of days, with the STOXX 600 up +1.08%, alongside gains for the DAX (+1.37%), the CAC 40 (+1.32%) and the FTSE MIB (+1.93%).

On the rates side in Europe, sovereign bond yields saw consistent declines, with those on 10yr bunds (-4.6bps), OATs (-5.6bps) and BTPs (-8.6bps) all moving lower. That also followed the release of the accounts from the ECB’s October meeting, where they delivered another 25bp rate cut. It said that if the slowdown in various indicators were just temporary, then an October rate cut would be like bringing forward a December cut, and so “there was little risk associated with cutting, especially given that interest rates would remain in restrictive territory”.

Overnight in Asia, we’ve had a mixed set of data out of China this morning. On the positive side, retail sales came in stronger than expected, with a +4.8% year-on-year reading in October (vs. +3.8% expected). However, industrial production was a bit weaker than expected at +5.3% year-on-year (v.s +5.6% expected). So Chinese equities have been steady against that backdrop, with the CSI 300 (-0.03%) and the Shanghai Comp (+0.02%) hovering either side of unchanged.

Elsewhere in Asia, we also had Japan’s Q3 GDP data overnight, which was a bit faster than expected with an annualised quarterly gain of +0.9% (vs. +0.7% expected). That’s helped support the Nikkei (+0.87%) to a stronger gain this morning, although it wasn’t all good news in the release, as Q2 growth was revised down to an annualised pace of +2.2% (vs. +2.9% previously). In turn, the Japanese Yen is losing ground for a 5th consecutive day against the US dollar, and this morning is trading at 156.45, which is its weakest level since July.

To the day ahead now, and data releases include US retail sales, industrial production and capacity utilization for October, along with UK GDP for Q3. Central bank speakers include the Fed’s Collins and Williams, and the ECB’s Lane and Cipollone. Lastly, the European Commission will release their latest economic forecasts.