US equity futures fell following hawkish comments from FOMC non-voter Jim Bullard and another double digit CPI print out of the UK; China was weak with property names dropping -2% led by Hong Kong developers which dropped after city leader John Lee dismissed calls by the industry to scrap property cooling measures. Sentiment was also dented by news Tesla cut prices again - just hours before it reports Q1 earnings -which is likely to not be well received by auto sector. Netflix tumbled as much as 12% on Tuesday before recouping almost all losses after a miss on subscribers but after boosting cash flow. Regional banks within a hair of new lows but WAL numbers overnight should give some support to the sector.

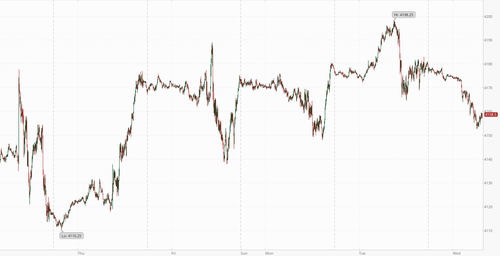

Contracts on the S&P 500 fell 0.5% at 7:15 a.m. ET Nasdaq 100 futures slipped 0.8% as the yield on the 10-year Treasury rose to nearly 3.62%, mirroring larger moves in UK gilts following the abovementioned CPI print. The Bloomberg Dollar Spot Index traded near the day’s highs, pressuring most Group-of-10 currencies. Oil, gold and Bitcoin all fall in tandem.

In premarket trading, Tesla dropped 2% after further cutting prices on some models in what is an increasingly bitter price war to capture EV market share ahead of first-quarter results due later Wednesday. Netflix dipped after the video-streaming firm added fewer subscribers than anticipated in the first quarter. Here are some other notable premarket movers:

With tax receipts filtering in expect to see a broad based liquidity drain over the next few weeks. CTA positioning is approaching fully long, macro buying has persisted for 6 weeks (nets have crept higher ) and the Goldman trading desk has already seen quite substantial vol control demand with vix back to a 16 handle.

Investors are monitoring earnings to assess how companies have grappled with headwinds including slowing demand and higher interest rates. At the same time, they’re looking for clues if and when the Federal Reserve will end its tightening policy amid fears of a recession and more bank failures.

“Central banks, for now, will keep hiking until they see more evidence of lower inflation down the road,” Barclays Plc strategist Emmanuel Cau said on Bloomberg Television. “Inflation is still high and to some extent growth is resilient at the same time, so I think the resolve of central banks to hike and to see more evidence of inflation coming down is still here.” Separately, Cau said in a note that there’s scope for first-quarter earnings to beat estimates given that growth momentum has rebounded in China, and held up better than expected in the US and Europe.

Globally, volatility has remained at low levels leading many bearish strategists to warn of complacency. Bank of Atlanta President Raphael Bostic said he favors raising rates one more time and then holding them above 5% for some time to curb inflation, while his St. Louis counterpart James Bullard said he prefers getting rates into a 5.5% to 5.75% range. Global markets appear to be overbought and “people should not be too complacent” about the reduced volatility, JPMorgan Asset Management’s Head of Investment Specialists for Asia excluding Japan Jonathan Liang said in a Bloomberg Television interview. He added that a US recession has not yet been priced in.

DAX and CAC lose 0.1%, while UK stocks underperformed their regional peers following another month of hotter than expected double-digit CPI, pushing the FTSE 100 down 0.3%. Here are the biggest European movers:

Earlier in the session, Asian stocks fell as Chinese shares struggled to find footing after mixed economic data released Tuesday, while investors parsed the latest comments from Federal Reserve officials on interest-rate hikes. The MSCI Asia Pacific Index dropped as much as 0.9%, led by consumer discretionary and technology shares. Hong Kong and Chinese benchmarks led losses around the region, while South Korea edged closer to a bull market. Australia also advanced. The latest set of Chinese economic data showed an uneven recovery picture, while hopes for further stimulus have been dampened. That has kept a lid on investor enthusiasm as it signals China’s recovery will likely be gradual, even though the worst may be over after its reopening from Covid Zero.

Japanese stocks declined, halting an eight-day rally, as investors remained concerned about the risk of higher US interest rates and Chinese equities were hit by shareholders’ plans to trim their stakes. The Topix was virtually unchanged at 2,040.38 as of the market close in Tokyo, while the Nikkei 225 declined 0.2% to 28,606.76. Out of 2,158 stocks in the index, 753 rose and 1,251 fell, while 154 were unchanged. “With the stock indexes at a high level, profit-taking selling is prevailing,” said Hideyuki Suzuki, a general manager at SBI Securities.

Australian stocks edged higher, with the S&P/ASX 200 index rising just 0.1% to close at 7,365.50, buoyed by miners as most sectors dropped. Asian shares fell with US stock futures as traders weighed earnings from Wall Street and as Chinese equities were hit by shareholders’ plans to trim their stakes.

In FX, the Bloomberg Dollar Spot Index is up 0.3% having risen versus the rest of its G-10 rivals amid some modest risk-off. US and German short-end yields have followed their UK counterparts higher, rising by 7bps and 5bps respectively.

“The picture being painted by the data released so far this week will likely be raising concerns inside the BOE,” said Stuart Cole, chief macro economist at Equiti Capital in London. “This likely means a continuation of its hiking cycle, a lengthening that will come at a time when peers such as the Federal Reserve will likely have paused with their own cycle of interest-rate rises.”

In rates, treasuries fell, lifting the 10-year yield 6bps higher to 3.63%, the highest since March 22, as BOE and Fed rate hike bets mount following higher-than-forecast UK inflation figures. US yields cheaper by 2bp-7bp across the curve at highest levels this month, with front-end-led losses flattening 2s10s, 5s30s spreads by ~2bp and ~3bp on the day. Money markets price 23bps of Fed hikes next month and 31bps by June; 46bps of easing is priced by year-end. Gilts are sharply lower and the pound has outperformed as traders ramp up bets on additional rate hikes from the Bank of England after UK inflation surprised to the upside. UK two-year yields have jumped 14bps to a six-week high of 3.83% while the pound gains 0.2% versus the greenback. BOE rate hike wagers surge even more, pricing a 5.03% peak rate by November — the highest since October — compared to 4.86% on Monday. Treasury auctions resume with $12b 20-year bond reopening at 1pm; $21b 5-year TIPS new-issue is ahead Thursday

In commodities, crude futures decline with WTI falling 1.9% to trade near $79.30. Spot gold is down 1.4% around $1,978.

Bitcoin has come under marked pressure this morning, with BTC dropping from USD 30k to a test of USD 29k in minutes. At the time, there was no clear fundamental catalyst with the likes of Coindesk subsequently suggesting it may have been spurred by long-liquidations. US House Financial Services Committee will hold a hearing on stablecoin regulation on Wednesday, according to Cointelegraph.

To the day ahead now, and data releases include the UK CPI reading for March. From central banks, the Fed will be releasing their Beige Book, and we’ll hear from the Fed’s Goolsbee, the ECB’s Lane, Knot, de Cos, and Schnabel, as well as the BoE’s Mann. Finally, earnings releases include Tesla, Morgan Stanley and IBM.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were lacklustre in the absence of any major positive macro drivers and following the flat handover from Wall St where risk sentiment was clouded amid mixed data releases and earnings results. ASX 200 was kept afloat amid outperformance in the mining and materials sectors although gains were limited by weakness in energy and consumer stocks, as well as uninspiring data with Westpac Leading Index flat. Nikkei 225 declined after the latest Reuters Tankan survey for April showed Japanese manufacturers remained glum with the Large Manufacturing Index stuck in negative territory. Hang Seng and Shanghai Comp were subdued with underperformance in Hong Kong amid losses in autos, property and tech, while the mainland was also cautious ahead of US Treasury Secretary Yellen’s major speech on Thursday regarding US-China Economic ties where she will outline US economic priorities on China.

Top Asian News

European bourses are in the red, Euro Stoxx 50 -0.4%, after the index's largest weighted component ASML drops post-earnings despite beating estimates as it highlights caution among customers. Elsewhere, the macro backdrop has been influenced by hotter-than-expected UK CPI data with a hawkish move seen in Europe/UK at the time, FTSE 100 -0.4%. Given the above, sectors have a negative skew with Real Estate lagging as yields increase while Tech names slip given ASML, at the other end of the spectrum Food, Beverage and Tobacco outperforms after Heineken's update. Stateside, futures are in the red with the Nasdaq lagging as yields increase while banking names are deriving support from WAL's after-hours update. Netflix Inc (NFLX): Top- and bottom-lines were broadly in line with expectations, although net subscriber additions were short in the quarter, and guidance for the next quarter was soft relative to analyst expectations; some analysts suggested that the soft subscriber guidance was a result of pushing back the launch of its paid-sharing service into Q2. Western Alliance Bancorp (WAL): The regional bank reported that deposits stabilised in Q1, and profits topped expectations.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US event calendar

Central Banks

DB's Jim Reid concludes the overnight wrap

I’m in the US showing off my panda eye ski tan for the rest of the week. Before I left I had the weirdest, nostalgic dollop of deja-vu. Unbeknown to me my wife had bought our five-year-old twins their first Panini football card album. To say they were immediately obsessed was an understatement. It brought back memories of me desperate to swap my excess cards for one Ian Rush sticker over 40 years ago. From my brief interactions before I left it seems they'll do anything for a pack of new cards now to expand their set. So we have a list of chores that completing will gain a set. I've written to Panini to see if they'll do an Investment Bank edition. Imagine the excitement of getting the full house of DB Research professionals' stickers in your book before one of our rivals!

The market has been collecting a few duller days of late but it probably wouldn’t want to swap for those seen a month or so ago. The last 24 hours fitted into that narrative with most major assets closing either side of unchanged. We did get several earnings releases to chew over, but they were pretty mixed overall and didn’t point to an obvious conclusion for investors, and it was much the same from yesterday’s limited round of data. So with all said and done, the S&P 500 ultimately ended the day just +0.08% higher, remaining in its narrow band over April that’s left it within a range of little more than 1% either side of its level at the start of the month.

With little volatility to speak of, that’s enabled a continued easing in financial conditions, with Bloomberg’s index hitting a post-SVB high yesterday. In fact, it’s now unwound around 90% of the tightening related to last month’s market turmoil, so it’s increasingly feeling like a bad dream with little lasting impact on market based financial conditions. We’ll see from the SLOOS report in a couple of weeks whether there has been scars from bank-based financial conditions. For now the looser market-based financial conditions have helped cement investors’ conviction that the Fed are set to deliver another hike in just two weeks’ from now, which was supported by the latest round of FOMC speakers. For instance, St Louis Fed President Bullard struck a bullish tone on the economy, saying that “Wall Street’s very engaged in the idea there’s going to be a recession in six months or something, but that isn’t really the way you would read an expansion like this.” Later on, Atlanta Fed President Bostic then said that his baseline was for one further hike and then a pause that left them there for “quite some time”. But even as officials offered more signals about another rate hike, 10yr Treasuries reversed a touch to end the day -2.5bps lower at 3.576%. Fed futures ticked slightly lower with the probability of a rate hike next month dropping 2 percentage points to 85.8% but this comes after increasing 64pp since the Monday after SVB failed.

When it came to equities, there was a reasonable amount of dispersion given the subdued movements for the broader indices. In fact, there was exactly 50% of constituents higher and lower on the day, with cyclicals outperforming defensives as industrials (+0.46%) and energy (+0.45%) stocks outpaced healthcare (-0.66%), communications (-0.65%) and utilities (-0.51%). In terms of the various earnings reports, the main highlights included Goldman Sachs (-1.70%), whose share price fell back after their FICC sales and trading revenue came in beneath expectations thanks to a -17% decline. Elsewhere, Bank of America’s (+0.63%) trading revenue beat expectations and overall revenue was up 9%. And away from the financials, Johnson & Johnson (-2.81%) was another that struggled, even as they raised their earnings forecast for this year. After the close, NFLX (initially down -12.5% before recovering to unchanged in after-market trading) missed on new subscriber growth (+1.75mn vs +2.41mn estimated) and lowered sales and profit guidance further than analysts expected. United Airlines was up +1.30% in after-market trading after reporting increased international travel that will see stronger 2Q results than analysts expected after posting a first-quarter adjusted loss of $0.63 EPS.

Over in Europe, the performance was a bit stronger yesterday, although in part that reflected a catchup to the US rally after Europe went home the previous day. That enabled the STOXX 600 (+0.38%) to hit a 14-month high, and the Euro STOXX 50 (+0.60%) is now just shy of its closing peak from November 2021, which if surpassed would leave the index at its highest level since late 2007. For bonds there was also a bit more of a risk-on tone, and yields on 10yr bunds ended the day up +0.4bps. That followed comments from ECB chief economist Lane that “I think the baseline is that we should indeed increase interest rates in May”.

Whilst most sovereign bonds in Europe were fairly steady yesterday, back in the UK, gilts were an underperformer thanks to data that showed stronger-than-expected wage growth, and the 10yr yield climbed +5.6bps on the day. The release showed that growth in average total pay was up +5.9% (vs. +5.1% expected) over the three months to February compared to the previous year. And with upward revisions to the previous month as well, the data added to fears that inflation would prove more persistent than expected, and that the Bank of England would need to hike rates yet further. Indeed, the chances of another 25bp rate hike at the May meeting moved up to 90.1% according to overnight index swaps, the highest level since SVB’s collapse. On that front, the next crucial component will be the CPI release this morning, which should be coming out around the time this email hits your inboxes.

Asian equity markets are mostly trading lower this morning following the lacklustre performance on Wall Street overnight. As I type, the Hang Seng (-0.60%) is leading losses across the region, pulled down by technology and real estate stocks, while the CSI (-0.50%), the Shanghai Composite (-0.21%) and the Nikkei (-0.24%) are also in the red amid the prospect of interest rate hikes from the Fed. Otherwise, the KOSPI (+0.23%) is bucking the regional market trend in early trading, albeit only just.

Outside of Asia, US stock futures are retreating with those on the S&P 500 (-0.12%) and NASDAQ 100 (-0.16%) inching downward following the latest round of earnings.

Running through yesterday’s other data, the German ZEW survey’s expectations component fell back for a second month running in April, with a decline to 4.1 (vs. 15.6 expected). In Canada, CPI inflation declined as expected in March, falling back to 4.3%. And finally in the US, housing starts decelerated in March, falling to an annualised rate of 1.42m (vs. 1.40m expected), with building permits also falling back to 1.413m (vs. 1.45m expected).

To the day ahead now, and data releases include the UK CPI reading for March. From central banks, the Fed will be releasing their Beige Book, and we’ll hear from the Fed’s Goolsbee, the ECB’s Lane, Knot, de Cos, and Schnabel, as well as the BoE’s Mann. Finally, earnings releases include Tesla, Morgan Stanley and IBM.