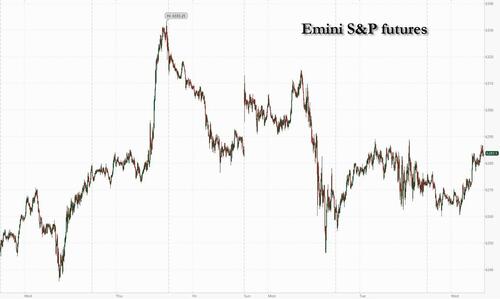

US equity futures inch higher as the market tries to regain some losses a day after President Donald Trump escalated his trade rhetoric and threatened more charges on copper and pharmaceuticals. Trump also foreshadowed an update to the trade status, saying he "will be releasing a minimum of 7 Countries having to do with trade" on Wednesday morning and with an additional number of countries to be released in the afternoon as we reach the 90-day deadline to Liberation Day. As of 8:00am, S&P and Nasdaq futures are 0.2% higher, with Mag7 names trading higher premarket while semis are mixed; banks and industrials are boosting cyclicals. Europe is also trending higher (+80bps) for a third day, while Asia finished mostly lower (HSI -1%, with HS Tech -1.7%). Goldman writes that heavy focus on recent momentum unwind (the Goldman High Beta Momentum Pair Basket -4.5% yesterday and now down 8.3% mtd). Recent catalysts for the Momo Reversal seem to be: the move in back-end Rates / positioning / ongoing re-shuffling to start the quarter / and the big reversal lower in Banks yesterday. Elsewhere, some minor underperformance in haven assets suggests investors are not too concerned by what Trump may reveal later today. Spot gold loses $10 or so. Treasuries are steady with bond yields flat to up 1bp as the USD is indicated higher. Commodities are also higher in both Ags/Energy as metals are generally weaker post-copper tariff announcement. Trump's 50% copper tariffs would be “extremely inflationary,” according to UBS O’Connor Global Multi-Strategy Alpha CIO Bernie Ahkong, while Goldman Sachs expects inbound-US flows of the metal to accelerate as the incentive to “front-run” the tariff implementation has increased. Today’s macro data focus is on Fed Minutes, mtge applications, and inventories.

In premarket trading, Microsoft gains 0.8% after Oppenheimer raised the recommendation on the software company to outperform, citing potential upside as AI revenue grows quickly and “investors embrace Microsoft as one of the long-term AI winners in software.” Other Mag7 names are all higher (Tesla +0.5%, Amazon +0.3%, Meta +0.3%, Nvidia +0.2%, Alphabet +0.3%, Apple unch).

In corporate news, there was another round of street actions moving stocks early (MSFT upgraded @ Oppenheimer / SMCI downgraded @ BofA / TMUS downgraded @ Keybanc). Elsewhere, Apple’s COO and company veteran Jeff Williams is stepping down this month before retiring later in the year. The firm is also said to be in talks to acquire the US rights to screen Formula 1 after the success of its hit movie, according to the FT. META is investing $3.5bn in a AI Glasses company; BABA is trading -2.5% after JD.com announced a new food delivery company; bloomberg is reporting that China wants to use 115,000 banned NVDA chips to fulfill its AI Ambitions; and SpaceX is said to be planning an offering valuing the company at $400bn (only 19 publicly traded companies in the S&P have a large mkt cap). Intel is selling 45 million shares of Mobileye, in a move seen likely to support Intel’s near-term liquidity and cash needs as it funds foundry ambitions, according to Bloomberg Intelligence.

Investors will seek clues for more insight on Fed’s policy path when the latest FOMC meeting minutes are released later today, amid increasing pressure on Powell from Trump. Kevin Hassett and Kevin Warsh are vying to be the next Fed chair, according to the WSJ.

Earlier this week, traders had largely brushed off a batch of letters in which Trump effectively delayed his tariff deadline while outlining new rates targeting over a dozen countries. Sentiment shifted on Tuesday, when he signaled fresh resolve to move forward with steep levies on foreign imports. He also signaled that updates to the trade status of at least seven nations would be released Wednesday morning, with more announcements later in the day.

“The market has already overreacted in the past on Trump’s trade announcements, so I think investors are being prudent and cautious,” said Stéphane Deo, senior portfolio manager at Eleva Capital in Paris. “That being said, tariffs will end up being much higher in the fall than they were at the beginning of the year, so that’s likely to fuel inflation.”

Investors will also parse minutes of the Federal Reserve’s June policy meeting later today for indications on whether officials are closer to lowering interest rates. Trump accused Fed Chair Jerome Powell of “whining like a baby about non-existent inflation” as he intensified his standoff over the pause in rate cuts. Swaps are almost fully pricing two quarter-point cuts until the end of the year, with a 65% chance of a first reduction in September.

Europe's Stoxx 600 is up 0.8% and set to rise for the third consecutive session, to the highest in almost a month, as investors look for signs of progress in trade negotiations with the US. Bank and energy names are leading gains while media shares provide a drag. Miners underperform after President Donald Trump indicated the US would implement a higher-than-expected 50% tariff on copper imports. Here are the biggest movers Wednesday:

Earlier in the session, Asian stocks fell as investor mood soured following US President Donald Trump’s latest vow to push forward with his aggressive tariff agenda. The MSCI Asia Pacific Index lost as much as 0.4%, with Alibaba, Tencent and Samsung Electronics among the biggest drags. Equities in Hong Kong were among the top losers in the region, partly weighed by declines in metals stocks. Copper names including Zijin Mining fell after Trump said he planned to implement a 50% tariff on imports of the commodity. Shares in Australia and New Zealand also fell after Trump’s tariff announcements from the White House. The Reserve Bank of New Zealand decided to leave interest rates unchanged, as expected. Malaysia’s stock benchmark index was down about 0.4% as the central bank cut its interest rate for the first time since 2020 amid trade tensions.

In FX, the dollar swung between gains and losses and stayed in tight ranges versus its major peers, while options pointed to demand for bullish exposure. The Canadian dollar underperforms slightly with a 0.2% fall.

In rates, treasuries drop, with US 10-year yields rising 2bps to 4.42% following a five-day run of losses which lifted the rate almost 20 basis points. The Treasury will sell $39 billion of 10-year notes later Wednesday followed by $22 billion of 30-year bonds Thursday. An offering of three-year securities on Tuesday was met with soft demand. Bunds edge higher with German 10-year borrowing costs down 1 bp at 2.68%. The Gilt curve flattens as short-end maturities underperform and lag gains at the longer-end.

“This week’s Treasury auctions are going to be important, at least in the short term, particularly where we are in terms of the tax cut extensions and the tariff negotiations,” said Justin Onuekwusi, chief investment officer at St James’s Place in London.

In commodities, oil prices advance, with WTI up 0.5% at $68.70 a barrel; spot gold falls $12 to around $3,290/oz. Bitcoin trades in a narrow range as we await further tariffs updates later in the session. At best, still just under 1k from the in-focus USD 110k mark.

Looking at today's calendar, the US economic data slate includes May wholesale inventories (10am) and minutes of the June FOMC meeting (2pm). Fed speaker slate is blank

Market Snapshot

Top Overnight news

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the similar performance stateside where tariff updates remained in focus after the US flagged more tariff letters and President Trump suggested a 50% tariff on copper. ASX 200 marginally retreated with most sectors in the red although price action was confined within tight parameters. Nikkei 225 swung between gains and losses amid global trade uncertainty, while there were balanced comments from BoJ's Koeda who stated it is inappropriate to say the specific timing of the next rate hike now due to high uncertainty but added the BoJ must debate how much it should eventually shrink its expanded balance sheet and balance of JGB holdings. Hang Seng and Shanghai Comp conformed to the mixed overall picture in the region as property names dragged the Hong Kong benchmark lower, while the mainland remained afloat as participants reflected on mixed inflation data from China.

Top Asian News

European bourses began the day with modest gains and have been grinding higher throughout the morning, Euro Stoxx 50 +1.1%; strength comes with the EU said to be nearing a deal with the US, with modest outperformance in the DAX 40 +1.2% amid associated auto strength. Amidst this, sectors began mixed but have been moving toward an overall positive bias. Banks lead with UniCredit (+3%) raising its stake in Commerzbank (+1%). Basic Resources weaker given pressure in non-US copper, hitting London-based minders, while Media lags after WPP's (-17%) profit warning.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Equity markets have been treading water over the last 24 hours, even with the latest tariff developments and some renewed jitters in global bond markets around fiscal sustainability. That meant yields rose in pretty much every major economy, with 10yr Treasury yields (+2.0bps) by no means the worst hit but still rising for a 5th consecutive session, before rising another +1.4bps this morning. Meanwhile, the S&P 500 (-0.07%) edged back for a second day as Trump said there’ll be no further tariff extensions beyond August 1st, with futures down another -0.12% overnight. And it was also a record day for US copper futures after Trump said copper would face 50% tariffs, with the biggest daily jump (+13.25%) in available data back to the late-1980s.

In terms of how the day unfolded, that bond selloff initially began in Japan, where there was a big spike in long-end bond yields that pushed the 30yr yield up +9.0bps, and back above 3%. That’s coming ahead of the upper house election there on July 20, where the major parties are advocating further spending or tax cuts, so that’s adding to concerns at a time when the Bank of Japan are already scaling back their bond purchases. And as we just managed to sneak into yesterday’s edition, the Reserve Bank of Australia voted to keep rates on hold, even though a cut was widely expected, so that helped to push yields higher in Australia too.

That momentum carried over into the European session, where yields moved up across the continent. UK gilts saw the biggest moves, with their 30yr yield (+6.3bps) back up to 5.45%, whilst the 10yr yield was up +4.7bps to 4.63%. So in both cases, that took yields above their close last Wednesday when Chancellor Reeves’ position looked under threat, and investors feared that the government might ease the fiscal rules. Coincidentally, the OBR fiscal watchdog published their “Fiscal risks and sustainability” report yesterday, which concluded that demographic pressures would help push debt-to-GDP above 270% of GDP by the early 2070s, at least on current policy. Admittedly, it’s a similar situation if you look at the CBO’s long-term reports for the US, but it demonstrates how this problem isn’t going away on the current trajectory.

These concerns were clear on both sides of the Atlantic, and 30yr Treasury yields earlier got close to 5% again, closing up +0.9bps at 4.92% after having reached 4.97% in early NY trading. Bear in mind we’ve got a 10yr Treasury auction today and a 30yr auction tomorrow, so those will be in the spotlight to see how much demand there is. Meanwhile in Europe, 10yr bund yields were up +4.4bps to 2.69%, whilst the 30yr yield (+5.4bps) hit 3.17%, which is just shy of its post-Euro crisis peak of 3.21% from late-2023. On the topic of German fiscal policy, DB are hosting a webinar today at 1pm London time on the latest developments and its impact. The details to register can be found here.

Otherwise, trade and tariffs were the main focus yesterday, and the big development was Trump saying that “No extensions will be granted” to the August 1 deadline on the reciprocal tariffs. That’s a shift in tone from Trump’s own comments on Monday evening, as Trump had said that the August 1 date was “not 100% firm”, and investors had been hopeful that ongoing negotiations and trade deals could avoid that. So it’s a clear hardening up of the rhetoric. During a cabinet meeting yesterday, the President took a hard line against the BRICS countries again, saying the group was “set up to hurt us…I can play that game too so anybody that’s in BRICS is getting a 10%” tariff addition. This comes even though he had previously noted that he was close to a deal with India. In addition, the President took a more hawkish tone, indicating that some countries would be seeing a 60% or 70% tariff rate and that sectoral tariffs are coming. While pharma, autos, and steel have been well flagged, the President proposed a 50% rate on copper products and said that some drug levies could reach as high as 200%, although the President stated that the pharma tariffs would only come after a “year or year and half”. Copper first month futures on the NY exchange hit an all-time high in response, as prices rose 13.25% (17% intraday), which was the largest daily move since on record going back to 1988.

Amidst those headlines, there was some more constructive news as we heard that the Japan-US talks were continuing, and Japan’s Ministry of Foreign Affairs said that economic revitalisation minister Ryosei Akazawa had a 30 minute phone call with Treasury Secretary Bessent. In the statement, it said that Japan would “continue to explore ways for a mutually beneficial agreement”, and it was later reported by Bloomberg that Bessent would be in Japan next week for the 2025 World Expo. President Trump indicated that at least seven tariff letters would be coming out this morning, Washington time, with more expected as the week goes on. Ultimately, the “reciprocal” tariffs rates have been extended to August 1st given Monday’s executive order, so investors will continue to weigh how likely the administration is to go through with the higher rates over the next three weeks.

That backdrop meant equities struggled, with the S&P 500 (-0.07%) losing further ground after its decline on Monday. However, the decline wasn’t particularly broad-based, and the equal-weighted S&P 500 was actually up +0.25% on the day. At the sub-sector level, Energy outperformed (+2.7%) on the back of higher oil prices (Brent crude up 0.82% yesterday), while Autos (1.2%), Semiconductors (+1.0%) and Pharma (+0.9%) all outperformed despite the specific sectoral tariff threats. There was also a decent divergence between the megacaps in the Magnificent 7 (-0.07%), and the small-caps in the Russell 2000 (+0.66%). Meanwhile in Europe, the mood was generally more positive, with the STOXX 600 (+0.41%) paring back its earlier losses after the news came through about the US-Japan call.

Overnight in Asia, most equity indices have managed to post an advance, with gains for the Nikkei (+0.18%), the KOSPI (+0.65%), the CSI 300 (+0.32%) and the Shanghai Comp (+0.29%). Indeed, the Shanghai Comp is currently on track to close at its highest level since early 2022. However, there’s been weakness elsewhere, and the Hang Seng is down -0.74%, whilst Australia’s S&P/ASX 200 is down -0.41% after the RBA’s unexpected decision to remain on hold yesterday. Indeed, Australian government bond yields have seen a further jump this morning, with the 10yr yield up another +9.0bps to 4.35%. The Reserve Bank of New Zealand have also kept rates on hold this morning at 3.25%, although that decision was widely expected.

Otherwise, the latest inflation data from China has been released overnight, which showed producer prices were down -3.6% year-on-year (vs. -3.2% expected). That’s a 33rd consecutive month of declining prices, and the biggest rate of decline in 23 months. However, consumer prices unexpectedly rose +0.1% (vs. -0.1% expected), marking the first inflationary reading since January.

There wasn’t much data yesterday, although the NFIB’s small business optimism index came out, which was exactly in line with consensus at 98.6. Otherwise, the New York Fed’s Survey of Consumer Expectations saw little change in inflation expectations. The 1yr measure was down to 3.0% in June, the lowest since January, but the 3yr measure was unchanged at 3.0%, and the 5yr was also unchanged at 2.6%.

To the day ahead now, and we’ll get the minutes from the FOMC’s June meeting, and hear from ECB Vice President de Guindos, and Bundesbank President Nagel. The Bank of England will also release their Financial Stability Report.