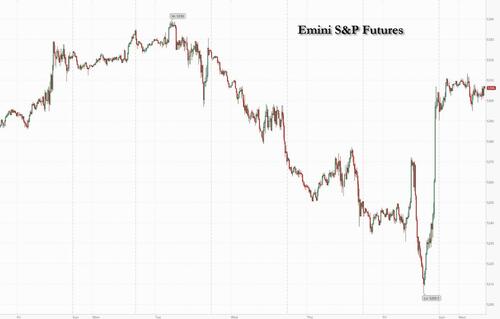

After closing the month of May on the front-foot when a last minute rebalancing spike in the S&P reversed two days of losses, US stock futures are ticking higher to start the month of June following the lead of broad gains across European equity markets and a jump in Asia. As Bloomberg notes, "a degree of extra optimism about the prospect for interest-rate cuts by the Fed following last week’s PCE data, along with better manufacturing figures from China, filtered through markets."

As of 7:50am, S&P futures traded 0.2% higher with both Tech and Small-Caps outperforming as bond yields start the day lower amid bull flattening, while Nasdaq futures gained 0.4% signaling a recovery after last week’s 1.4% selloff which was driven by investors pulling out of expensive tech leaders, as NVDA jumped 3% after CEO Jensen Huang announced at the Computex conference that the group plans to update its AI accelerators every year, underlining its bullish outlook on the demand for chips and announced a Blackwell Ultra chip for 2025, along with a next-generation platform in development called Rubin for 2026. 10Y Treasury yields dropped 4bps to 4.46% after closing at 4.50% on Friday; the Bloomberg dollar index jumped while oil was volatile after the OPEC+ group announced an extension of output cuts while setting out a plan to gradually restore some production as early as October. Commodities ex-energy are weaker with natgas the standout +5%. Today’s macro data focus is on ISM-Mfg, vehicle sales, and construction spending. This is an important macro data week with the narrative gradually moving to lower growth; NFP may help frame the Fed’s reaction function.

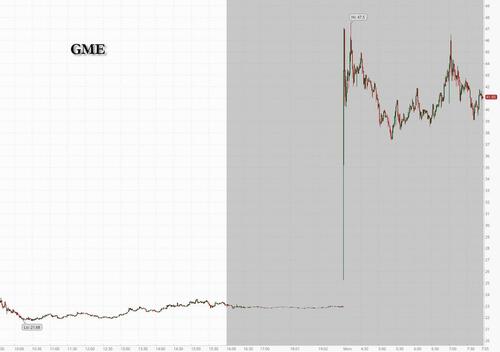

Pre-market, NVDA is +3% and AMD up 1.6% helping both Mag7 and Semis, after the CEOs of the chipmakers made artificial intelligence announcements in Taiwan. More notable, GME is +75% and AMC +25% after the Reddit account that drove the mania in 2021 posted what appeared to be a $116 million position in GameStop. A screenshot by Keith Gill known as Roaring Kitty, which also included 120,000 call options, couldn’t be verified. Still, that didn’t prevent GameStop shares from more than doubling in premarket trading, or as JPM put it, "It appears the optimism in the last hour of Friday’s trading has resumed."

Here are some other notable premarket movers:

Elections dominated the newsflow on Monday with results from Mexico and India swaying local markets. India’s Sensex jumped more than 3% and the rupee strengthened the most in a year on speculation a decisive victory would allow Modi to push through policies to spur growth. In Mexico, the peso tumbled after Claudia Sheinbaum became the country’s first female leader in a landslide victory.

After the S&P 500 posted gains in six of the past seven months, there’s a split among some of the top Wall Street strategists over whether the rally can continue. Investors betting on more US gains over the coming months will be disappointed, according to strategists at JPMorgan. On the opposing end, Morgan Stanley’s Michael Wilson says his bull case is in play for now.

“We see the market upside capped during summer due to the inconsistency between the consensus call for disinflation, and at the same time, the belief in no landing and in earnings acceleration,” a JPMorgan team of strategists led by Mislav Matejka wrote in a note to clients.

Elsewhere, online fashion retailer Shein is set to file for an initial public offering in London as soon as this week that could value the company at about £50 billion ($64 billion), according to a person familiar with the matter. Shein’s offering could become one of the UK’s biggest ever IPOs, clawing back a chunk of the market value London has lost from companies shifting their primary listings to New York.

European stocks also gained, led by construction and material names, after a broadly positive Asian session. Estoxx 50 higher by 0.7% in early London session with construction and retail shares leading gains, while health care and mining stocks are the biggest laggards. Here are the biggest movers Monday:

Earlier in the session, technology stocks led a rally in Asia on Monday, as renewed rate-cut hopes and Nvidia’s new chip plans fueled risk-on sentiment. The MSCI Asia Pacific Index climbed 1.7%, with TSMC and Tencent among stocks giving the biggest boost to the benchmark. Onshore Chinese equities traded higher after two days of losses. Concerns over the economy’s strength linger even as a private survey showed China’s manufacturing activity expanded at the fastest pace in almost two years in May. Risk sentiment returned to Asia as moderating inflation in the US revived bets that the Federal Reserve will cut interest rates. The region also got an added boost from India, where stocks surged to an all-time-high as exit polls predicted a sweeping victory for Prime Minister Narendra Modi in the general election.

Equity markets displayed some anxiety recently around the impending political uncertainty and “with this clear verdict, markets will heave a sigh of relief,” Motilal Oswal strategists led by Gautam Duggad wrote in a note. The anticipated win by Modi’s party “provides stability and continuity in policy making with a single-party majority government,” which is expected to continue pushing its economic agenda, they said.

In FX, the Bloomberg Dollar Spot Index rises 0.2%. The pound is the weakest of the G-10 currencies, falling 0.3% against the greenback. The Mexican Peso falls 1.5% after preliminary election results spooked investors.

In rates, treasuries gained across the curve led by long-end, following similar gains in gilts and bunds over early London session. 10Y Treasury yields richer by up to 4bp across long-end of the curve with 2s10s, 5s30s spreads flatter by 2bp and 1bp on the day; 10-year yields around 4.465%, richer by 4bp on the day with bunds and gilts outperforming by 1bp each in the sector. Bunds and gilts also gain. With no coupon supply scheduled for this week and Fed officials in self-imposed quiet period, economic data culminating with Friday’s May jobs report are focal points. Meanwhile, ECB is viewed as almost certain to lower interest rates by 25 basis points at its next meeting on Thursday.

In commodities, oil prices advance after OPEC+ set out a timetable for gradually unwinding some of its oil production cuts. WTI rises 0.2% to trade near $77.20 a barrel. Spot gold is little changed around 2,325/oz.

In crypto, bitcoin saw modest gains overnight but remains within recent ranges of around $68,000.

Looking at today's calendar, US economic data includes May S&P Global US manufacturing PMI (9:45am), April construction spending and May ISM manufacturing (10am); this week also includes JOLTS, factory orders, ADP employment change, services PMIs and May jobs report. Fed officials are expected to refrain from commenting until after their June 12 policy announcement.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks opened higher and then extended on gains as the region reacted to the softer-than-expected US Core PCE data on Friday alongside the prospect of a potential Israel-Hamas deal brokered by the US. The broader chip sector in the region was supported by NVIDIA CEO Huang stating the Co. is to upgrade its AI accelerators every year, later followed by an update from AMD at the Computex event in Taipei. ASX 200 saw its upside led by a broader strength across energy and financials, whilst Australia's Final Manufacturing PMI saw a modest revision higher from the prelim. Nikkei 225 briefly rose back above 39,000 with the upside also led by energy and financials, whilst capex data showed company profits surprisingly accelerated in Q1. India's Nifty 50 opened sharply higher by almost 3.5% at a record high after exit polls pointed to a landslide win by PM Modi. Hang Seng and Shanghai Comp were mixed as the former soared at the open with heavyweight stocks Alibaba and Tencent among the top gainers, whilst the latter initially bucked the regional trend and lagged despite any major headlines aside from China stating it will not join the Swiss peace conference on Ukraine, although losses were briefly trimmed after the Chinese Final Manufacturing PMI was revised higher than expected.

Top Asian News

European bourses, Stoxx 600 (+0.5%) are entirely in the green, continuing the price action seen in APAC trade overnight. Indices came under some slight selling pressure in the early portion of the morning, and has been choppy within today's range. European sectors hold a strong positive tilt; Construction & Materials takes the top spot, joined closely by Retail, which is lifted by significant strength in JD Sports (+7.5%). Healthcare is the clear laggard, dragged down by GSK (-9.4%) on Zantac-related lawsuits. US Equity Futures (ES +0.2%, NQ +0.2%, RTY +0.9%) are modestly firmer, though with price action fairly contained thus far. In terms of pre-market movers, AMD (+1.3%) gains after unveiling a new MI325X accelerator chip, whilst Nvidia (+2.2%) benefits after its CEO said the Co. is to upgrade its AI accelerators every year. GameStop (+66.4%) surges pre-market after Roaring Kitty reveals a USD 116mln position in the Co.

Top European News

FX

Fixed Income

Commodities

OPEC+

Bank commentary on OPEC+

Geopolitics: Middle East

RUSSIA-UKRAINE

CHINA-TAIWAN

OTHERS

US Event Calendar

DB's Jim Reid concludes the overnight wrap

It's a busy morning for the EMR with DB Research launching our latest World Outlook and with the start of the month bringing us our usual performance review which Henry has just published. With regards to the World Outlook "Optimism with uncertainties ahead", the tone is optimistic across economies and asset markets. Like most others we thought the US would experience a recession last year and when it didn't happen, we upgraded our US growth numbers considerably in January to the top end of street forecasts for the next couple of years. Nearly 6 months on and our US forecasts remain similar, but we've upgraded Euro Area GDP for 2024 by half a percent to 0.9% for 2024. The big uncertainty is the US election with plenty of risks to the growth, inflation, and Fed outlook from the results. In China, our economists upgraded 2024 growth to 5.2% in April which remains unchanged while in Japan growth should stay above trend for the next couple of years which helps us be more hawkish on the BoJ than the market. India continues to be the standout with a minimum of 6-6.5% real GDP growth and 10-11% nominal growth over the next several years. The report also includes all our strategist latest forecasts for YE 24 and into 2025. See the piece here.

Since it’s the start of the month, we’ve also just released our monthly performance review for May and YTD. Most assets rebounded after a weak April with the S&P 500 and STOXX 600 reaching new records during the month. A late surge in the last 20 minutes of month-end trading on Friday helped the S&P 500 regain some poise after a more challenging last week of the month. See the performance review here.

Moving forward, it's another payrolls week with DB (+200k) and consensus (+190k) expecting job gains to pick up from last month's +175k number with unemployment widely expected to stay at 3.9%. Our economists think the risks are biased to it rounding down a tenth rather than up. The JOLTS data tomorrow is many people's preferred employment measure but it's always a month lagged to payrolls which reduces the impact. The employment components of May's ISM indices (today for manufacturing and Wednesday for services) will also help fine tune expectations for payrolls. At the index level, our US economists see the manufacturing gauge moving from 49.2 to 49.4 in May and the services one expanding to 50.4 from 49.4 in April. See the week ahead at the end for the rest of the US data releases.

In Europe, all eyes will be on the ECB decision on Thursday, where our European economists expect a 25bps cut with markets pricing in a 96% probability. Their preview is here with all eyes on how they signal the path after this meeting. The Bank of Canada meet beforehand on Wednesday with expectations that they stay on hold for now. In terms of European data, various final PMIs are out this week alongside Germany factory orders (Thursday), industrial production (Friday), and the trade balance (Friday). Elsewhere, there will be the French trade balance data (Friday) and industrial production (Wednesday), Swiss CPI (tomorrow), as well as retail sales for the Eurozone and Italy (Thursday).

Elsewhere we have the presidential elections result in Mexico after yesterday’s election with Sheinbaum set for a landslide victory according to exit polls (BBG) just released. Staying with elections we have the important European Parliamentary elections between June 6-9 (see our econ preview here) and the results of India's general elections will be counted tomorrow. Exit polls show a resounding win with a predicted seat range of 350-400 for Narendra Modi’s BJP-led NDA coalition which would likely be seen as supportive for the current policy regime after Indian assets had underperformed over the last month. They need 272 for a majority and more than 352 to better the 2019 outcome. See DB's exit poll reaction piece here. As I type Indian equities have opened around +2.75% higher.

It will be interesting to see the reaction in French bond markets this morning after S&P downgraded from AA to AA- on Friday night due to the Government’s failure to restrain the deficit post Covid. This also may impact the European Parliamentary elections as National Rally’s Le Pen has already seized on it over weekend campaigning.

Asian equity markets are mostly rallying as we start a new month helped by the upbeat manufacturing PMI data coming from the region’s top economies. The Hang Seng (+2.18%), KOSPI (+2.01%) and Nikkei (+0.94%) are all higher but with mainland Chinese stocks lagging with the CSI (-0.15%) and the Shanghai Composite (-0.51%) edging lower. S&P 500 (+0.22%) and NASDAQ 100 (+0.27%) futures are higher and yields on 10yr USTs are -1.5bps lower at 4.48% as I type.

Coming back to the region’s PMI data, China's Caixin S&P manufacturing PMI rose from 51.4 in April to 51.7 in May (51.6 expected), recording the fastest pace since June 2022. Meanwhile, South Korea's PMI also rose to 51.6 in May, its highest reading since May 2022 and entering expansionary territory after staying below 50 for the past two months.

Yesterday OPEC+ announced that it would be extending production cuts into 2025 and laid out plans for phasing out voluntary cuts towards the end of the year. Oil is broadly unchanged this morning.

Looking back on last week now and it was another a big week for inflation data, with the US April PCE data on Friday the star of the show. Headline PCE came in line with expectations at +0.3% month-on-month, and +2.7% year-on-year. Similarly, core PCE posted at +0.2% month-on-month, and +2.8%, as expected. On the other hand, real personal spending unexpectedly contracted, falling -0.1% (vs +0.1% expected), down from +0.5% in March, potentially indicating a flagging US consumer.

Despite the weak personal spending data, the PCE inflation numbers helped raise the amount of rate cuts expected this year, with an additional +2.9bps of cuts expected by year-end on the week (and +1.8bps Friday). The prospect of more rate cuts lent support to US fixed income, as 2yr yields fell -7.3bps last week (and -5.2bps on Friday). 10yr yields likewise slipped on Friday, down -4.8bps, but failed to fully erase earlier losses (+3.4bps last week).

Over in Europe, the inflation story was a touch more concerning. The May flash HICP came in above expectations at +2.6% year-on-year (vs +2.5% expected). The core number also surprised to the upside at +2.9% (vs +2.7% expected). In response, markets casted some doubt on how aggressively the ECB will cut over the next months. As such, the amount of rate cuts priced in by overnight index swaps by December fell -7.3bps on Friday, leaving the expected rate -3.3bps lower in weekly terms. This saw yields on 10yr bunds rise +1.2 bps on Friday, adding to the selloff earlier in the week that followed on from a hotter than expected German inflation print last Wednesday, which sent yields up +8.1bps on the week.

US Equities staged a very late month-end comeback on Friday after trading lower much of the day as the personal spending data hinted at a weakening US consumer. In the final hour of trading the S&P 500 rallied nearly a full percentage point to finish +0.80 higher on the day. This made up for some of the week’s earlier losses, leaving the index down -0.51% in weekly terms. The NASDAQ saw a similar rebound, having been down -1.75% near the European close before rallying to finish just below unchanged (-0.01%) on the day and -1.10% on the week. Indeed, tech was dragged down by weakness in the cloud software sector, with the likes of Salesforce slipping -15.78% following a weak earnings report. The Russell 2000 index of small cap stocks fared somewhat better than both the S&P 500 and the NASDAQ, outperforming on Friday (+0.66%), and gaining marginally (+0.02%) last week. In Europe, the STOXX 600 fell -0.46% but retraced some losses on Friday after rising +0.32%.