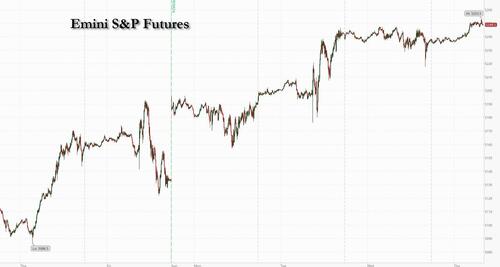

Another day, another all time high on deck. US equity futures are higher ahead of today’s PPI / Retail sales data, which we expect to be a big miss to expectations based on real-time card spending data. As of 8:00am, S&P futures were 0.3% higher trading around 5,250 while Nasdaq futures gained 0.4%, led by tech with the Mag7 stocks higher premarket (ex-NVDA, TSLA) as semis outperform pre-market. Europe trades mainly higher led by France while Asia is mixed on light overnight news. The yield curve is seeing some bear steepening with 10Y yield unchanged at 4.19%; keep an eye on the backend of the curve as we approach next week’s BOJ. The USD is stronger and commodities are mixed: energy is leading as WTI crude futures rise higher by almost 1% on the day after IEA projected a supply deficit for the rest of 2024. Today’s macro data focus includes Retail Sales (consensus +0.4%, last -0.4%), PPI (cons +0.2%, last +0.5% core PPI m/m) and Jobless Claims (exp. 218k, last 217k).

In premarket trading, Netflix and Meta Platforms rose with analysts flagging potential benefits to social-media and streaming companies from legislation targeting TikTok. Dollar General jumped after an upbeat forecast. Here are some other notable premarket movers:

While traders have been trimming bets on deep and imminent rate cuts, that hasn’t dampened enthusiasm for stocks, with the S&P 500 setting new records in its longest stretch since 2018 without a decline of at least 2%, according to Bloomberg data. Today's PPI data will be the final inflation report before next week’s Fed policy meeting. Officials are expected to hold interest rates steady for a fifth straight meeting, but the question is when they’ll start lowering borrowing costs.

“We’ve just upgraded our price target on the S&P 500, European stocks and Japanese equities because underlying data continues to be pretty resilient,” said Grace Peters, head of global investment strategy at JPMorgan Private Bank, who sees the US benchmark reaching 5,600 in a bull-case scenario. “The most realistic bull case is that corporate profits are stronger than expected.”

In politics, Donald Trump floated hedge fund titan John Paulson as possible Treasury secretary if he wins the November presidential election, and has held a series of meetings with other potential cabinet picks. Treasury Secretary Janet Yellen said it’s “unlikely” that market interest rates will return to levels that prevailed before the Covid-19 pandemic.

ECB Governing Council member Yannis Stournaras recommended two interest-rate cuts before the August summer break, and another two by the end of the year. Money markets maintained wagers on the scope for rate cuts this year, with the first quarter-point move seen by June, followed by two more and a 70% chance of a fourth. Bunds trimmed a small decline and the euro was steady.

Sentiment remained fragile in Chinese markets despite officials pledging central government funds to encourage consumers and businesses to replace old equipment and goods. Shares linked to Asian copper miners advanced after the metal jumped to an 11-month high on likely capacity cuts at Chinese smelters.

European stocks rose for a third day as Stoxx 600 touches a fresh record even as tech firms extend their decline for a second session. The mood points to a sector rotation in the background as retail, real estate and consumer products lead this month’s Stoxx 600 gains. Here are some of the biggest movers on Thursday:

Earlier in the session, Asian stocks edged lower, with the regional gauge on track for its first weekly drop in two months, weighed down by losses in Chinese technology shares and Australian banks. The MSCI Asia Pacific Index fell as much as 0.2% amid choppy trading. Financial names including Westpac Banking and ANZ were among the biggest drags on the index after Macquarie downgraded the Australian lenders. Copper miners were a bright spot in the region after the metal jumped to an 11-month high. BHP was the top positive contributor to the Asian gauge as Citigroup raised the stock to buy.

Equities in mainland China and Hong Kong ended lower, with the Hang Seng Tech Index falling more than 1% despite officials pledging central government funds to encourage consumers and businesses to replace old equipment and goods. Shares linked to Asian copper miners advanced after the metal jumped to an 11-month high on likely capacity cuts at Chinese smelters. The US House of Representatives passed a bill to ban TikTok in the country unless its Chinese owner sells the video-sharing app.

In FX, bloomberg dollar spot index gained 0.1% to erase Wednesday’s decline. The yen reversed an initial gain as Treasury yields turned higher and ahead of Rengo wage outcomes on Friday, which may affect the Bank of Japan’s policy decision. SEK and CHF are the weakest performers in G-10 FX, NZD and GBP outperform.

In rates, treasuries were narrowly mixed after yields edged to new weekly highs ahead of economic data slate including PPI and retail sales. US yields slightly richer from front-end out to belly of the curve and slightly cheaper across long-end, steepening 2s10s by almost 1bp on the day; 10-year yields around 4.19% with gilts outperforming by 1.2bp in the sector. Gilts outperform slightly, and core European rates drew support from comments by ECB’s Yannis Stournaras, who recommended two interest-rate cuts before the summer break in August. S&P 500 futures advance toward last week’s all-time high and WTI crude oil futures top $80/bbl; peripheral spreads tighten to Germany with 10y BTP/Bund narrowing 2.9bps to 119.8bps amid dovish remarks from ECB speakers. German, gilt and Treasury 10-year yields are steady as traders await US producer-price data, which comes after a sticky consumer reading earlier this week.

In commodities, crude oil added to the biggest gain in about five weeks after the International Energy Agency said global oil markets face a supply deficit throughout 2024 as OPEC+ looks set to continue output cuts. Iron ore extended its decline toward $100 a ton, with few signs of a turnaround in Chinese steel demand. Gold edged lower. Spot gold falls roughly $5 to trade near $2,170/oz.

Bitcoin took a breather after soaring to highs yesterday, and currently holds just shy of USD 73.5k.

The US economic data calendar includes February retail sales and PPI and weekly jobless claims (8:30am) and January business inventories (10am). No scheduled Fed speakers due before March 20 policy decision. From central banks, we’ll hear from ECB Vice President de Guindos, along with the ECB’s de Cos, Schnabel, Knot and Stournaras.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed after the indecisive performance stateside amid light catalysts and tech weakness, with participants lacking conviction ahead of next week's central bank bonanza. ASX 200 was subdued as losses in financials and tech overshadowed the gains in the commodity-related sectors. Nikkei 225 traded indecisively after a slew of BoJ-related source reports suggesting a policy shift next week. Hang Seng and Shanghai Comp. were somewhat varied with the Hong Kong benchmark pressured amid tech-related headwinds after the US House approved the bill which threatens to ban TikTok, while the mainland was indecisive with downside initially cushioned after China issued plans to promote trading in consumer goods and equipment upgrades.

Top Asian news

European bourses are mostly in the green, with sentiment lifted after dovish remarks from ECB's Stournaras. The SMI (-0.3%) underperforms, hampered by post-earnings weakness in Swiss Life (-5.7%). European sectors are mixed, with Basic Resources found at the foot of the pile, hampered by broader weakness in base metals, whilst Energy benefits from firmer crude prices. US equity futures (ES +0.2%, NQ +0.5%, RTY +0.2) are trading on a firmer footing, with slight outperformance in the NQ, attempting to pare back some of its losses from the prior session.

Top European news

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets struggled to keep up their momentum yesterday, with the S&P 500 (-0.19%) falling back from its all-time high, whilst yields on 10yr Treasuries (+3.9bps) moved up for a third day running. That came amidst growing concern about how stretched the rally was becoming, with the S&P 500 having risen by more than +25% in less than 100 trading days. Moreover, there’s still quite a bit of focus on inflation, and the US CPI release this week has led to some scepticism about whether the Fed will be able to cut rates by June after all.

That focus on inflation is likely to remain today, as we’ll get the US PPI release at 12:30 London time. That’s an important one, because several components from the PPI feed into the PCE measure of inflation, which is the one that the Fed officially targets. According to our US economists, one category to focus on will be portfolio management and investment advice, which tends to follow equity prices with a one-month lag, and added about 8bps to the core PCE print in January. So even though we won’t get the PCE inflation data until March 29th, the reading today will offer a better sense of what that’s likely to be.

Ahead of that release, there was a further selloff for sovereign bonds, which came as investors dialled back the chance of near-term rate cuts again. For instance, the chance of a rate cut by June was down to 73%, down from 78% the previous day. And for the year as a whole, the number of cuts priced by the December meeting came down by -4.9bps to 80bps, the lowest in a couple of weeks. In turn, that helped yields rise further, and the 2yr yield rose +4.8bps to 4.63%, whilst the 10yr Treasury yield was up +3.9bps to 4.19%. The sell-off in Treasuries came despite a strong 30yr auction, which saw $22bn of bonds issued 2bps below the pre-sale yield, with the highest bid-to-cover ratio since last June. And in overnight trading, the 10yr Treasury yield has risen by another +1.2bps, and is currently at 4.20%.

Over in Europe, there were also losses for sovereign bonds across most of the continent. That was led by gilts, where the 10yr yield rose +7.4bps after data showed UK GDP rose by +0.2% in January, up from a -0.1% contraction in December. Elsewhere, 10yr yields on bunds (+3.7bps) and OATs (+2.7bps) also moved higher. But I talian BTPs (-1.2bps) continued to outperform, and their spread over 10yr bund yields tightened to 123bps, the lowest since November 2021. Speaking of spreads, there was also a further tightening in credit spreads yesterday, with both European and US HY spreads down to their lowest since January 2022.

Elsewhere in Europe, one notable event in the central bank space was the outcome of the ECB’s operational framework review. In line with expectations, the ECB will take a hybrid approach to providing the liquidity needed to operate a floor-type system. Among the details, it will shrink the gap between the depo and the refi rate from 50bp to 15bp starting in September, while keeping banks’ required minimum reserves (which earn zero interest) at 1% of eligible deposits. The review has few immediate market implications, but will have long-term ramifications for the direction of ECB balance sheet policy and functioning of Euro Area money markets. See our economists' reaction note here for more.

For equities, there was a mixed performance yesterday, with the S&P 500 (-0.19%) moving off from its all-time high the previous day. However, that was driven by weakness among tech stocks, with the NASDAQ down -0.54%, whilst the Magnificent 7 fell -0.74%. The latter was led by a -4.54% decline for Tesla, which overtook Boeing as the weakest performer in the S&P 500 year-to-date with a -31.79% decline. Otherwise though, there was a better performance, with the equal-weighted S&P 500 marginally up by +0.01% to an all-time high, and the small-cap Russell 2000 rose +0.30%. Meanwhile in Europe there were further all-time highs, with new records for the STOXX 600 (+0.16%) and the CAC 40 (+0.62%).

Overnight in Asia we’ve also seen a divergent performance for equities. On the one hand, there’ve been gains for the Nikkei (+0.21%) and the KOSPI (+0.86%). But the CSI 300 (-0.10%), the Shanghai Comp (-0.09%) and the Hang Seng (-0.87%) have all lost ground. Elsewhere, US equity futures are indicating a positive start, with those on the S&P 500 up +0.12%.

Finally in the commodity space, Brent crude oil prices rose to their highest level since November, up +2.58% to $84.03/bbl, while WTI rose +2.78% to $79.72/bbl. The moves came amid Ukrainian drone strikes against Russian oil refineries and with data showing that US crude stockpiles declined for the first time in seven weeks. Higher oil prices have been filtering through to consumer prices since the start of the year, and the AAA’s measure of US daily gasoline prices has already risen from $3.110 per gallon at the end of 2023 to $3.396 per gallon yesterday.

To the day ahead now, and data releases include US PPI and retail sales for February, along with the weekly initial jobless claims. From central banks, we’ll hear from ECB Vice President de Guindos, along with the ECB’s de Cos, Schnabel, Knot and Stournaras.