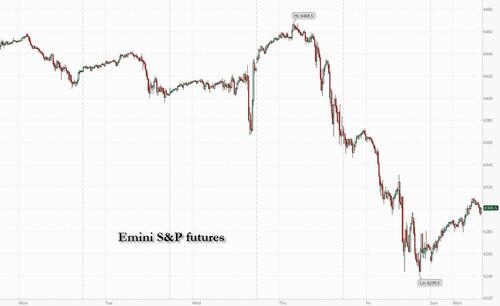

Futures are higher as markets rebound from last week’s sell-off amid increased expectations the Fed will ride to the rescue with rate cuts following Friday’s dismal US jobs data. As of 7:45am ET, S&P 500 and Nasdaq futures climbed 0.7% after the index had its biggest decline since May on Friday. Pre-market, Mag7 and Semis are outperforming with Cyclicals over Defensives. Bond yields are 2-3bp higher as the USD falls again. Commodities are weaker with Energy underperforming as OPEC+ approves another supply hike. This is a catalyst-light week with tomorrow’s ISM the most important and heightened focus on weekly claims with the Fed spotlighting the unemployment rate.

In premarket trading, all Magnificent Seven stocks are higher alongside index futures (Amazon +1.8% after a Friday selloff, Nvidia +1.2%, Meta Platforms +1.1%, Tesla +1%, Alphabet +0.8%, Microsoft +0.8%, Apple +0.8%). here are the other notable premarket movers:

Friday’s tumble on Wall Street, which was sparked by rising US unemployment and slower job creation, boosted bets for a Fed rate cut to prop up the market economy. Traders rushed into Treasuries despite worries about the inflationary effect of Trump’s tariffs, which have kept policy makers in hawkish mode.

“We’re buyers of pullbacks and bullish the next 12 months,” Morgan Stanley equity strategists led by Michael Wilson wrote in a note. “We think the Fed will eventually transition to cuts. Friday may be all we get to the downside for now; that is, until the next payroll number or other weaker, lagging growth data is potentially revealed.”

Overnight-indexed swaps signaled more than 80% odds of a reduction next month while fully pricing in one more cut by year-end. Some market-watchers are even anticipating the Fed may cut rates by 50 basis points, twice the regular amount. That may be too optimistic, given the outlook for inflation and growth, according to Pictet Wealth Management.

Separately, Trump said he will announce a new Fed governor and jobs data statistician in the coming days, two appointments that could shape his economic agenda. The Fed announced Friday that Adriana Kugler will step down from her position as a governor, giving Trump an opportunity to install a policymaker who aligns with his demands for lower interest rates. Also on Friday, Trump fired chief labor statistician Erika McEntarfer hours after labor market data showed weak jobs growth based in part on steep downward revisions for May and June.

Meanwhile, the US Trade Representative Jamieson Greer sounded a cautiously optimistic note on discussions with China on rare earth flows, following trade talks that further steadied ties between the economies. “Things have changed dramatically in the trade environment globally, not only the US,” veteran investor Mark Mobius said in a Bloomberg TV interview. “People are looking at this much more realistically. There’s going to be a lot of thinking about how to make things fairer for all countries involved.”

Europe’s Stoxx 600 index rose about 0.6%. Banks led the advance after UK lenders won a major reprieve in a pivotal UK car finance case, with Lloyds Banking Group Plc surging more than 7%. As noted above, the Swiss stocks benchmark, meanwhile, fell as the market reopened after a holiday, on worries about the impact from US President Donald Trump’s punitive 39% export tariff and a push for drugmakers to lower prices. Here are the biggest movers Monday:

Swiss stocks slumped as the market reopened after a holiday, on worries about the impact from US President Donald Trump’s punitive 39% export tariff and a push for drugmakers to lower prices.

Earlier in the session, Asian equities traded in a narrow range, with Japanese stocks leading declines while South Korean shares rose after growing optimism a controversial tax plan may be revised. The MSCI Asia Pacific Index gained slightly, erasing an earlier loss of as much as 0.5%. Advances in Tencent and Nintendo helped boost the regional benchmark. MUFG was among the biggest drags along with other Japanese large caps including Recruit and Hitachi.

Key equity indexes fell more than 1% in Tokyo while the yen climbed, as Friday’s weak US payrolls data raised expectations for Federal Reserve interest-rate cuts. Korean benchmarks rebounded as a petition to withdraw planned corporate and capital-gains tax hikes drew strong support. The regional MSCI Asia gauge was set to snap a six-day decline, as investors digested a slew of new US tariffs. Shares rose in Hong Kong as investors looked beyond the Politburo meeting, seeking fresh catalysts amid ongoing tariff negotiations between US and China. Mainland investors also poured a record amount of money into exchange-traded funds that track the market in the Asian financial hub.

In FX, the dollar was steady after a gauge of the greenback’s strength plunged 0.9% on Friday. The Swiss franc underperforms, falling 0.5% against the greenback having only derived brief support from a larger-than-expected rise in CPI.

In rates, treasuries pared last week’s gains as traders braced for a hefty slate of bond sales this week. Yields on the 10-year notes climbed 1 basis point to 4.23% after dropping 16 basis points Friday. Gilts dip but German government bonds are steady. Treasury new-issue auctions this week begin Tuesday with $58 billion 3-year notes, followed by $42 billion 10-year notes and $25 billion 30-year bonds Wednesday and Thursday

In commodities, WTI crude futures slide 1.3% to near $66.50 a barrel after OPEC+’s latest supply increase. Spot gold is steady near $3,360/oz.

Today's economic data slate includes June factory orders at 10am. Fed speaker slate empty for the session. Ahead this week are appearances by Cook, Daly, Bostic, Musalem and Bowman.

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following a quiet weekend of newsflow and last Friday's disappointing Non-Farm Payrolls data. ASX 200 was subdued amid underperformance in the top-weighted financials sector and with weakness also seen in energy, Industrials and tech, although losses were stemmed by resilience in defensives and miners. Nikkei 225 underperformed after recent currency strength and briefly dipped back beneath the 40k level. Hang Seng and Shanghai Comp were kept afloat amid earnings and corporate updates, while the PBoC announced last week that it is to expand the issuance scale of sci-tech bonds and promote cross-border financing facilitation, as well as strengthen the implementation and supervision of interest rate policies.

Top Asian News

European equities (STOXX 600 +0.6%) began the week in the green (ex. SMI), and have continued to climb higher as the session progressed. The SMI (-0.6%) underperforms as it reacts to the US unexpectedly raising tariffs on Swiss goods to 39% (from 31%); as a reminder, Switzerland was on holiday last Friday. European sectors began mixed, though as the session has progressed, the picture looks more positive. Banks reside at the top and Healthcare at the bottom; the latter is hampered by heavyweight Novartis (-0.5%), given the broader pressure across Swiss stocks. Stateside, equity futures (ES +0.7%, NQ +0.8%, RTY +0.9%) have been firming throughout the morning with some modest outperformance in the RTY after closing with significant losses on Friday. Tesla (TSLA) sold 67,886 China-made vehicles in July (vs. 71,599 in June), according to China's CPCA.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Russia-Ukraine

US Event Calendar

DB's Jim Reid concludes the overnight wrap

The Extel survey opens in 11 months, if you value our…. … ok..... Too soon. Sorry. Hope you all had a nice weekend. Since we last spoke on Friday, I’ve played 5 rounds of golf as my family were on a “no Dads allowed” camping long weekend in Devon with a number of other families. My back and knees now hurt a lot but my handicap is back down to the lowest it’s ever been at 1.7, 40 years after starting the game. So there’s still life in a body that needs twos knee replacements and back fusion surgery.

Markets may need a little physio this week to get through all the things being thrown at it. August has opened with extraordinary developments, despite only one full trading day having passed. The resignation of Fed Governor Kugler on Friday has created an opportunity for President Trump to appoint a new board member. This individual could potentially be groomed as a successor to Chair Powell or, at the very least, represent another dovish voter. While last week’s FOMC vote was 9-2 against a rate cut, it’s worth noting that the two dissenters—Waller and Bowman—were both appointed during Trump’s first term. The significant revisions in Friday’s payroll release have also increased the likelihood that other members may reconsider their hawkish positions. The probability of a rate cut in September surged to 87% on Friday, up from around 40% before the payroll data was released, and market pricing for cuts by year-end rose from 18 basis points to 41bps.

Our economists point out that although the usual nomination and confirmation process for a Fed Governor can take months, Section 10.5 of the Federal Reserve Act allows the President to temporarily fill vacancies during Senate recesses. Such appointments would last until the next session of the Senate. With the Senate scheduled to be in recess from 4 August to 1 September, Trump could theoretically appoint a new Governor through January 2027 without going through the traditional confirmation process. However, the Senate may hold pro forma sessions during this period to block such appointments, leaving some uncertainty about how unilateral Trump’s actions could be and how long the process might take. Nonetheless, it seems likely that a dovish figure will eventually fill the vacant seat.

Adding to the upheaval, Trump dismissed Bureau of Labour Statistics head McEntarfer, accusing her of political bias following the dramatic -258,000 revisions to the previous two months’ payroll figures—the largest on record outside the pandemic. The revisions were partly attributed to a declining initial response rate to the survey, which has made early releases increasingly provisional and less reliable. On Friday, yields fell sharply, with 2-year Treasuries dropping by 27.5 basis points and 10-year Treasuries by 15.8 basis points - the largest one day fall in US 10yr yields since August 2 last year when the unemployment rate ticked up to 4.3% and triggered the Sahm rule. However, the replacement of both a Fed Governor and the BLS chief could ultimately impact the ease of funding the US twin deficits. This may hinder long-end rallies unless there is a significant economic slowdown. For now, though, seasonal trends in August remain supportive so it’s not recommended to lean too much against it for now. See our piece on this here from last week. Yesterday Trump said he will announce both new appointments in the coming few days. So certainly one to watch.

Looking ahead, the new 7 August trade deadline looms, with several new deals expected to take effect. This date also marks the implementation of recent trade agreements. The week also features key economic indicators from the US and Europe, trade data from China, and wage figures from Japan. A notable event will be the Bank of England’s decision on Thursday. Typically, the week following payrolls is quieter for US data, but given Friday’s shock revisions, commentary from Fed officials may prove more influential than the data itself. On Wednesday, Governor Cook and Boston’s Collins, a voting member, will participate in a panel discussion alongside a Board Member from the Central Bank of Chile. San Francisco’s Daly, a non-voter, will speak at an economic summit. On Thursday, Atlanta’s Bostic, also a non-voter, will discuss monetary policy, and on Friday, St. Louis’s Musalem, a voter, will take part in a fireside chat.

Bostic, speaking after Friday’s jobs report, expressed concern about the slowdown evident in the employment data. However, he stated that he would not have changed last week’s decision to hold rates steady and is not yet prepared to revise his projections for near-term rate cuts.

Among the US data releases that matter, Tuesday’s ISM report (forecast at 51.2 versus 50.8 previously), particularly its employment component, and Thursday’s initial jobless claims (225,000 versus 218,000) will be closely watched in light of the payroll revisions. Tuesday also brings the international trade balance (-$75 billion versus -$71.5 billion), which will include country and product-level details. These will allow for a recalculation of the average tariff rate. Our economists estimate that, as of 7 August, when country-specific rates take effect, the average tariff rate will be 19.6% on a static basis using 2024 trade weights. However, this is likely an upper bound, and after adjusting for overestimation, the more realistic average is closer to 15%. See their piece here for more on this.

Thursday’s US data also includes productivity (expected at +2.5% versus -1.5%) and unit labour costs (+1.0% versus +6.6%). In Europe, the highlight will be the Bank of England’s rate decision. Our UK chief economist expects the central bank to cut the Bank Rate to 4%, marking the fifth quarter-point reduction in the current cycle. See his preview here. Additional European data will come from trade and industrial production figures across key Eurozone economies, with Germany’s factory orders due on Wednesday. CPI prints are expected in Switzerland today and in Sweden on Thursday.

In Asia, the focus will be on China’s trade balance, due Thursday, and Japan’s wage data on Wednesday. Our economists anticipate Chinese exports to slow to 5% year-on-year in July, down from 5.8% in June. The Bank of Japan will release its summary of opinions from the July meeting on Friday and the minutes from the June meeting tomorrow.

On the earnings front, the US season has passed its peak, but notable reports are expected from Eli Lilly, Palantir, and AMD. Other S&P 500 names reporting include McDonald’s, Walt Disney, and Uber. In Europe, attention will be on Novo Nordisk, Siemens, and Rheinmetall. Novo’s report on Wednesday will be particularly interesting following last week’s profit warning. In Japan, Toyota and Sony are set to report. Saudi Aramco, the world’s largest energy company by market capitalisation, will release its results tomorrow.

Asian markets are mixed this morning but DM futures are higher after the difficult Friday session. The Nikkei (-1.49%) and the S&P/ASX200 (-0.11%) are lower but the Hang Seng (+0.50%) has rebounded after its worst seven-day losing streak since July 2021. In Korea, the Kospi (+1.04%) is managing to outperform as a petition to withdraw the proposed capital gains tax hike received more than 50,000 signatures, enough to trigger a standing committee review. The CSI 300 (+0.05%) and Shanghai Composite (+0.25%) are trading higher. On the rates side, JGBs are following Friday’s global yield rally with the 10-year yield -5bps this morning. 30-year JGBs are unchanged though, after gaining +9.1bps since last Tuesday. Equity futures are higher this morning with the S&P 500 up +0.38% and the Nasdaq up +0.44%, with European futures also higher by +0.52%.

Oil prices are relatively flat after news that OPEC+ endorsed an additional 547,000 barrels per day production increase from September. A decent boost but broadly in line with expectations.

Recapping last week now, and the lead-up to the 1 August tariff deadline saw a flurry of announcements involving major US trading partners. The EU agreed to a 15% tariff on most goods and pledged $750 billion in energy imports and $600 billion in US investments. South Korea committed to a $350 billion investment fund for the US, including $150 billion for shipbuilding. Other countries faced steeper tariffs: India at 25%, Switzerland at 39%, Taiwan at 20%, and Canada’s tariffs rising from 25% to 35%. Mexico received a 90-day extension, maintaining its 25% tariff rate in the meantime.

Friday’s payroll shock sent 2-year Treasuries down 27.5 basis points (24.2bps on the week) and 10-year Treasuries down 15.8bps (17.2bps weekly). In Europe, Q2 flash GDP showed a slight improvement, with eurozone growth at +0.1% quarter-on-quarter versus 0.0% expected. German Bunds fell 3.9bps (-1.6bps Friday), French OATs dropped 3.8bps (-0.2bps Friday), and Italian BTPs declined 4.0bps (though rose 0.4bps Friday).

Equities saw notable divergence at the micro level in the heart of results season. Novo Nordisk, which began the week as Europe’s second most valuable company, plunged 30% intraday on Tuesday and ended the week down 31.7%, now ranking seventh. Semiconductor stocks were also weak, with the Philadelphia Semiconductor Index down 2.09% (-1.43% Friday). On the positive side, Microsoft rose 2.02% (though fell 1.76% Friday) and Meta gained 5.24% (down 3.18% Friday). Apple and Amazon underperformed, falling 5.38% and 7.21% respectively on the week. Overall, markets ended the week lower, particularly on Friday, with the S&P 500 down 2.36% (-1.60% Friday) and the Nasdaq down 2.17% (-2.24% Friday). In Europe, the Stoxx 600 declined 2.57% (-1.89% Friday), while Japanese equities followed suit, with the Nikkei falling 1.58% (-0.66% Friday).

The dollar was one of the week’s winners, with the dollar index climbing +1.52% (though down 0.84% Friday), marking its longest winning streak since February. The euro weakened by 1.32% over the week but rebounded 1.51% on Friday following the US developments.