Futures Rise On Hope For Trade War Relief, Europe Soars, Bunds Crash On "Whatever It Takes" Stimulus

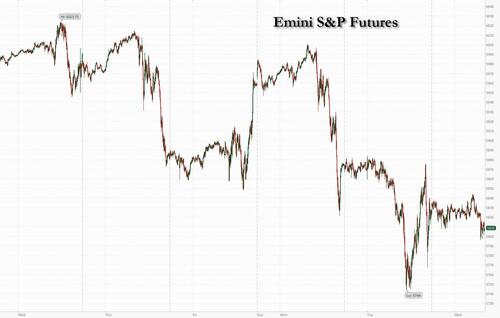

US equity futures are higher following comments from Commerce Secretary Howard Lutnick who seemed to suggest that a compromise on Canadia/Mexican tariffs could be announced today; and while Trump’s speech last night doubled-down on tariffs he but did not refute Lutnick’s comments; at the same time the US/Ukraine mineral deal also appears to be moving forward providing further de-escalatory relief for markets. As such, as of 8:00am, S&P 500 futures are up 0.3% while Nasdaq 100 contracts add 0.6% (both well off session highs) with all 7 of the Mag 7 higher and Semis are bid into MRVL earnings. Chinese stocks led a rally in Asia after Beijing set an ambitious economic growth target that boosted expectations of further stimulus.Finally, European stocks are surging (Dax +3%) after Germany unveiled plans to unlock hundreds of billions of euros for defense and infrastructure investments in a dramatic policy shift which has sent German bonds plunging by a near record 22bps. US Treasury yields are flat around 4.24% while the USD is weaker and commodities are mixed. Energy is lower, Ags higher, and precious over base. Today’s macro data focus is on ISM-Srvcs, Factory Orders, Mortgage Applications (up 20.4%), and ADP.

In premarket trading, Goldman and Citigroup rose more than 1%, while Tesla was poised to recover from a four-month low, and led gains among the Magnificent Seven stocks, putting the electric-vehicle maker’s stock on track to rebound after two sessions of losses (TSLA 1.6%, NVDA +1.5%, AMZN +0.8%, META +0.5%, GOOGL +0.6%, AAPL +0.3% and MSFT +0.3%). AeroVironment (AVAV US) shares are down 20% in premarket trading after the small unmanned aircraft maker slashed its FY forecasts. It also reported third-quarter results that missed expectations. Here are some other notable movers:

US stocks capped their worst two-day slump since December on Tuesday, before the comments from Lutnick, who told Fox Business that Trump may offer a path to alleviate some tariff pressure. Traders will be watching data due later today for a snapshot of the state of the economy.

“The market doesn’t like uncertainty and tariffs will most likely continue to be an overhang risk,” Nataliia Lipikhina, EMEA equity strategy head at JPMorgan Private Bank, said on Bloomberg TV. “But if we are looking at earnings growth in the US, we actually see double-digit growth in 2025 and 2026. We are buyers of the dip at this point.”

In an address to Congress, Trump acknowledged that there may be an “adjustment period” to tariffs as he defended his policies to remake the US economy. Ten-year Treasury yields traded steady at 4.24%, while the dollar sank 0.4%.

On the corporate front, Blackrock Inc., the world’s biggest asset manager, led a consortium that will buy a controlling stake in Panama ports and a larger unit that has operations across 23 countries. It’s one of the biggest acquisitions of the year that marks a win for Trump, who had raised concerns over control of key ports near the Panama Canal.

European stocks are sharply higher on German military spending/debt brake removal, unlocking hundreds of billion of euros in defense and infrastructure spending. Shares in the region have also received a boost on hopes that the Trump administration may walk back some tariff measures and also on the increasing probability of a US/Ukraine mineral deal which is boosting the odds of a ceasefire. Construction and industrial sectors are leading the gains. Stoxx 600 rises 1.7% to 560.62 with 473 members up, 121 down and 6 unchanged. The DAX is up over 3% and set for its best day in over two years, the euro rises 0.6% and now trades above $1.07 for the first time since November. Here are some of the biggest European movers on Wednesday:

Earlier in the session, Asian stocks rallied as China’s ambitious growth target raised prospects of more stimulus and the Trump administration indicated it may roll back some tariffs on its allies. The MSCI Asia Pacific Index rose as much as 1.1%, the most in three weeks, with Chinese technology stocks like Tencent and Meituan among the biggest boosts. Chinese stocks in Hong Kong rallied more than 3% after the National People’s Congress in Beijing set an economic growth target of about 5% for 2025, the third straight year it has maintained that goal. Stock benchmarks also rallied in Japan, Korea and Taiwan. Donald Trump’s administration showed willingness to walk back on the 25% tariff imposed on Canada and Mexico, two of its biggest trading partners. Hong Kong and China’s “major indexes do not look expensive, trading around historical means,” Citi strategists including Pierre Lau wrote in a note. “Valuations of China’s alternatives to the US’s magnificent-seven stocks look inexpensive, in our view,” he said. Elsewhere, India’s NSE Nifty 50 Index climbed, snapping a record-setting 10-day losing streak, while stocks fell in Australia.

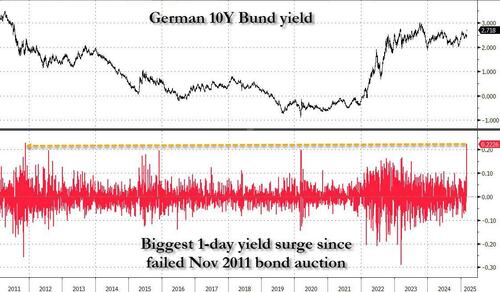

While German and European stocks are surging, German bunds lead a near-record plunge in European government bonds after Germany unveiled plans to unlock hundreds of billions of euros for defense and infrastructure investments in a dramatic policy shift. German 10-year yields soar more than 22 bps to 2.72%, the biggest one day move since the failed bund auction in Nov 2011.

“Huge quantities of debt in the coming years is going to be quite disruptive for European bond markets, particularly the long end of the curve,” said Peter Kinsella, global head of FX strategy at Union Bancaire Privee Ubp SA in London. “We’ve not seen this type of issuance pretty much since the early 1990s when Germany was paying for reunification.

In the US, treasuries are steady as US trading gets under way with the curve steeper, as front-end yields are more than 3bps richer on the day with long end little changed. Treasury yield shift leaves 2s10s, 5s30s spreads steeper by 3bp-4bp; US 10-year yield around 4.23% is ~2bp lower on the day while Germany’s is higher by 22bp, after German policy shift to a massive debt-financed defense spending plan. US session includes February ADP employment and ISM services gauge, and possibility of Mars Inc. corporate bond sale exceeding $25 billion.

In FX, the Bloomberg Dollar Spot Index fell 0.6%, hitting its lowest since Dec. 9, led by falls versus the euro; EUR/USD jumped 0.9% to 1.0722, a level last seen on Nov. 11 after Germany pledged to unlock hundreds of billions of euros for defense and infrastructure spending; the Swedish krona takes top spot among G-10 FX, rising 1% against the greenback.

“The US economy could slow down further and force the Fed to resume its easing cycle in the second half of the year,” said Valentin Marinov, head of global FX strategy at Credit Agricole CIB. “The Fed may also have to put an end to its quantitative tightening programme to accommodate US President Donald Trump’s fiscal spending plans. This could erode the USD exceptionalism.”

In commodities, WTI falls 1.5% to $67.20 a barrel. Bitcoin rises 3% and above $90,000.

The US economic data calendar includes mortgage applications which soared by 20.4%, after dropping 6.4% last week; February ADP employment change (8:15am), S&P Global US services PMI (9:45am), January factory orders and February ISM services index (10am). Fed releases Beige book at 2pm. Fed speaker slate empty for the session

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the whipsawing stateside on Trump's tariffs, subsequent retaliation and Commerce Secretary Lutnick's suggestion of a potential rollback, while the region also digested a slew of commentary from China’s Official Work Report and President Trump’s Address to the Joint Session of Congress. ASX 200 was dragged lower by underperformance in the consumer and energy sectors, while better-than-expected Australian GDP data failed to inspire a recovery. Nikkei 225 price action was initially choppy but gradually edged higher amid a weaker currency. Hang Seng and Shanghai Comp were positive after better-than-expected Chinese Caixin Services PMI data and with the attention on the NPC and the Official Work Report in which China maintained its annual growth target of around 5% and pledged measures including a boost in spending, while there was notable outperformance in Hong Kong where CK Hutchison surged by more than 20% after agreeing to sell its Panama Canal Ports stake to BlackRock.

Top Asian News

European bourses (STOXX 600 +1.5%) are entirely in the green, with sentiment boosted by several factors, which include; a) Lutnick suggesting Trump will scale back Canada/Mexico tariffs, b) Germany agreeing to debt brake reform, c) China’s Official Work Report which maintained its annual growth target and pledged measures including a boost in spending. Price action today has really only been one way, and that’s upward; as it stands, indices generally reside at session highs. European sectors hold a positive bias, with the key movers today attributed to the aforementioned German debt brake reform agreement. Construction & Materials tops the pile, joined closely by Industrial Goods and Services, Autos and then Tech; the latter two, buoyed by the risk-tone given the optimism surrounding a rolling back of US tariffs on Canada/Mexico.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

We've used the tagline that these are "days where decades are happening" in recent weeks and although that perhaps seems like an exaggeration, yesterday I truly believe it wasn't as last night Germany announced plans for one of the largest fiscal regime shifts in post-war history, perhaps with reunification 35 years ago being the only rival. Everything you thought you knew about Germany's economic prospects 3 months ago, or even 3 weeks ago, should be ripped up and you should start your analysis from fresh. This is game changing if it goes through.

As Merz himself said last night, "whatever it takes". More on this later but even before this it was a crazy day of volatility after the 25% Mexican and Canadian tariffs went through. The S&P 500 traded as low as -2.00% early in the session but was then +0.26% higher with 35 minutes of trading left before slumping again and closing -1.22% lower, wiping out its post election gains. Meanwhile the DAX (-3.54%) posted its worst day since 2022, having just experienced its strongest session since late-2022 (+2.64%) the previous day. DAX futures are back up +2.04% as I type this morning.

Meanwhile S&P 500 futures are trading +0.67% as I type, on the back Commerce Secretary Lutnick’s comments shortly after the US close yesterday that Trump might announce a pathway for some tariff relief on Mexico and Canada as soon as today. Lutnick said that with both Mexico and Canada “trying to show that they’ll do better”, Trump could decide to “meet in the middle some way and we’re going to probably announce that tomorrow “. That said, he appeared to rule out a full rollback or pause to the tariffs.

There was little softening in the tone on tariffs in Trump’s eagerly anticipated speech to Congress overnight. Trump said that "we need Mexico and Canada to do much more than they have done" on fentanyl, while also focusing on the April 2 date for reciprocal tariffs. When it comes to potential disruptions, Trump said “There’ll be a little disturbance, but we’re okay with that”. In other economic matters, Trump called for end to subsidies under the CHIPS Act, touted new energy and minerals projects and mentioned the goal of a balanced budget. But overall there were few striking announcements with Trump’s comments ranging from immigration to a new missile defence shield to suggesting that the US will get Greenland “one way or another”. On Ukraine, Trump acknowledged Zelenskiy’s comments earlier on Tuesday that Ukraine was ready to come to the negotiating table. However, Trump did not confirm if the minerals resource agreement would be revived, which reporting earlier in the day suggested he might do.

Turning back to the seismic fiscal news out of Germany last night. The leaders of the CSU/CSU and SPD announced an agreement to approve three material changes to the debt brake before the end of the outgoing parliament in which the centrist parties still hold a constitutional majority. Specifically , this includes a EUR 500bn SPV for infrastructure investment, an exemption from the debt brake for defense spending above 1% of GDP and a rise in the net borrowing cap for federal states from 0% to 0.35% of GDP. While recent reporting pointed to increased prospects of a change, the magnitude of the proposal, including the open-ended borrowing room for defence, is well beyond expectations. With party leaders explicitly referring to a "whatever it takes" moment and a determination to "rearm completely", our Germany economists think German defence spending could rise to at least 3% of GDP perhaps as early as next year. See their reaction here for more. One potential catch is that the Greens, whose support is needed for the constitutional majority, have not yet confirmed if they will support these changes. But our team strongly assumes that this will be the case, not least given the large infrastructure fund proposal.

Earlier in the day we also had an EU announcement on a new defence package ahead of the EU leaders summit tomorrow. The proposals would allow member states to significantly increase defence spending without triggering the EU’s deficit rules, and they also proposed a new instrument that would provide €150bn of loans for defence investment. While much less dramatic than the German news later in the day, this added to the sense of a developing paradigm shift in European defence. You can see our European economists’ take on the announcement here.

In terms of market implications, the German fiscal announcement has led our FX strategists to take an outright bullish view on the euro, targeting a 1.10 level against the dollar (link here), while our rates strategists see the much looser fiscal policy as favouring a short Bund view (link here) with a 10yr target of 3.0%. Meanwhile, our equity strategists (link here) see the events as confirming their case for an ongoing overweight of European equities, despite these having already posted the strongest outperformance versus the US at the start of a year since 2000. These moves have began to emerge in markets, with the euro ending yesterday’s session above 1.06 against the dollar for the first time since November, STOXX 50 futures trading +1.76% higher overnight and yields on bund futures around +10bps higher.

Moving on to review the different market moves yesterday that are now slightly out of date. Equities took a big hit as markets started to price in more aggressive tariff policies around the world. That included another slump for the S&P 500 (-1.22%), building on its -1.76% move the previous day. And in turn, the VIX index of volatility rose another +0.73pts to 23.51pts, its highest level of 2025 so far. The selloff was broad-based with the equal weighted S&P 500 (-1.63%) seeing its worst day of 2025 so far. Cyclical sectors underperformed, and banks took a particularly large hit, with the KBW Bank Index (-4.56%) posting its biggest daily decline since the regional bank turmoil of March 2023. The Magnificent-7 (-0.64%) and the small-cap Russell 2000 (-1.08%) saw more modest declines, though this still leaves the Mag-7 a full -15% beneath its post-election high.

Volatility was also visible in rate markets. A strong initial rally on the back of tariff news reversed over the course of the day, helped along by the German fiscal news and Lutnick’s comments. The amount of Fed rate cuts priced by year-end had spiked by more than 13bps to 85bps intra-day but reversed later on, with pricing down to 74bps as I type. Treasury yields saw a similar roundtrip , with 2yr yields down -11bps intra-day early in the US session but +4.1bps to 3.99% by the close, while 10yr yields closed +8.9bps higher at 4.245%. Earlier on in Europe, yields had been more steady, with those on 10yr bunds (+0.4bps) broadly flat, whilst those on 10yr OATs (+1.4bps) and BTPs (+2.4bps) moved higher.

European equities had seen a major slump yesterday, which saw the STOXX 600 (-2.14%) post its worst daily performance since early August. Most tariff-sensitive sectors saw a huge slump, with the STOXX Automobiles and Parts Index (-5.39%) suffering its worst daily performance since March 2022, just after Russia had launched their full-scale invasion of Ukraine. Obviously there are lots of moving part but German assets are likely to rebound strongly today.

Much of Asia is also bouncing with the Hang Seng (+1.72%) leading gains, rebounding strongly from the previous session losses after the National People’s Congress in Beijing set a 5% economic growth target for 2025, maintaining the target for a third consecutive year while laying out stimulus measures to boost its economy amid escalating trade tensions with the US (more below). Meanwhile, the KOSPI (+1.20%) is also strong but the Nikkei (+0.10%) and the Shanghai Composite (+0.10%) are only just higher. The S&P/ASX 200 (-0.69%) is bucking the regional positive trend despite economy picking up pace in the final three months of the year.

Coming back to China, Premier Li Qiang in a speech at the at the opening session of the National People’s Congress (NPC), acknowledged challenges posed by trade tensions as well as problems facing the Chinese economy. Meanwhile, the government report outlined plans to issue 1.3 trillion yuan ($179 billion) in ultra-long-term special treasury bonds in 2025 and another 500 billion yuan worth of special treasury bonds will be issued this year to support large state-owned commercial banks in replenishing capital. At the same time, Beijing raised its budget deficit target to 4% of GDP, from 3% last year, in line with our expectations. Additionally, Beijing revised down its annual consumer price inflation target to “around 2%” this year — the lowest in more than two decades — from 3% or higher in prior years.

Elsewhere, Australia’s GDP rose +0.6% q/q in the fourth quarter, in-line with market expectations while picking up from the +0.3% growth seen in the prior quarter, aided by robust public and private spending, along with a rebound in export demand. This strength in the Australian economy gives the RBA more headroom to keep rates high, given that inflation still remained sticky in the fourth quarter.

To the day ahead now, and data releases from the US include the ISM services index for February, the ADP’s report of private payrolls for February, and factory orders for January. Otherwise, we’ll get the final services and composite PMIs for February from around the world. From central banks, we’ll hear from BoE Governor Bailey, along with the BoE’s Pill, Greene and Taylor. And we’ll also get the latest Beige Book from the Federal Reserve.