S&P 500 futures rose 0.4% as Tesla shares rebounded 4% in premarket on signs that the spat between President Donald Trump and Elon Musk is cooling. Market gains had little conviction as traders brace for Friday’s main event: a pivotal payrolls report (full preview here) that’s likely to set the direction of travel for markets. Nasdaq futures also add 0.5% even as Broadcom shares fall 3% in premarket after giving a a lackluster revenue forecast for the current quarter. European stocks are little changed. Bond yields are 1-2bp lower; the USD is higher; the yen dropped after BBG reported that Bank of Japan officials are likely to discuss slowing their pullback from buying government bonds at a policy meeting later this month. Commodities are mostly higher: Gold climbs $6 to around $3,358/oz while silver tops $36/oz. WTI falls 0.6% to $63 a barrel. Bitcoin rises 3%. Macro headlines were largely muted overnight; All eyes on NFP today.

In premarket trading, Mag7 stocks are higher, led by Tesla, whose shares are set to rebound, rising 4.9% premarket, after plunging on Thursday as the feud between Elon Musk and President Donald Trump showed signs of de-escalation (Amazon +1%, Meta +0.8%, Apple +0.6%, Alphabet +0.6%, Nvidia +0.5%, Microsoft +0.4%).

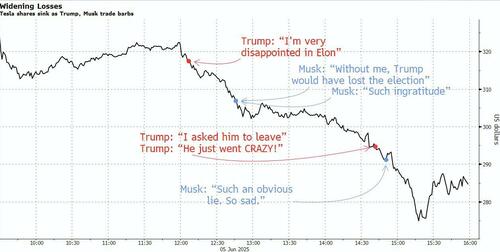

Markets are still reveberating from the spat between Trump and Musk in which Trump proposed cutting off the billionaire’s government contracts. Musk, who sparked the public feud by criticizing Trump’s signature tax bill, later signaled that he’s keen to dial down the hostility. White House aides have reportedly scheduled a call with the world’s richest person for Friday in an effort to cool things down. Their public back-and-forth triggered the most spectacular real-time destruction of wealth ever, with $34 billion erased from Musk’s net worth. Tesla shares are rebounding in premarket, after tanking 14% Thursday.

“Futures are edging higher, perhaps as Musk has started to suggest on X that he would be open to a cooling-off period in his war of words with the President,” said Jim Reid, global head of macro research and thematic strategy at Deutsche Bank AG.

Moves in other asset clases were more muted as traders awaited Friday’s nonfarm payrolls report for fresh insight on how the Trump administration’s trade war is affecting the economy. Turning to today's main event, economists see payrolls rising by 125,000 after job growth in March and April exceeded projections. The unemployment rate is seen holding at 4.2%. Weak payrolls data would be bad news for markets, with a big miss potentially sending stocks down 1.5%, according to Goldman Sachs traders (full preview here). A softening labor market would support expectations that the Federal Reserve will cut interest rates at least twice this year.

“Investors are getting used to all the noise and are looking at concrete matters like the jobs report or budget,” said Mabrouk Chetouane, head of global market strategy at Natixis Investment Managers. “There is a cooling trend in the labor market, which I expect will show this afternoon. That should further reinforce our call for two or three cuts from the Fed this year.”

Meanwhile, BofA’s Michael Hartnett is warning that global stocks are close to triggering sell signals as both fund inflows and market breadth are running too hot. The strategist said inflows to stocks and high-yield bonds have totaled 0.9% of AUM in the past four weeks. The sell signal will be set off if that exceeds 1%.

European equities are little changed as investors search for fresh catalysts on trade negotiations between the US and China and look ahead to a key US jobs report. The real estate and health care sectors outperform, while consumer shares are among the biggest laggards. Among individual movers, Adidas and Puma fall after Lululemon’s disappointing quarter fueled concerns over rising competition and tariffs. Here are the biggest European movers:

Earlier in the session, Asian stocks traded in a tight range as a much-anticipated call between Donald Trump and China’s Xi Jinping offered little details on how trade negotiations would progress. The MSCI Asia Pacific Index was little changed. Indian stocks rose after the central bank cut interest rates more than projected and unexpectedly reduced the cash reserve ratio for banks. Gauges in Hong Kong fell, while those in Japan rebounded. Markets in Indonesia, Philippines and South Korea were closed for holidays.

In rates, treasuries edge higher ahead of the jobs report, with US 10-year yields falling nearly 2 bps to 3.37%. Bunds outperform their US peers, pushing German 10-year borrowing costs down 5 bps to 2.54%.

In FX, the Bloomberg Dollar Spot Index rises 0.2%. The Japanese yen and Swedish krona are the weakest G-10 currencies, falling 0.4% each. The euro dips 0.3% with little reaction seen after euro-area GDP was revised up for the first quarter. ECB policymakers largely stuck to Thursday’s messaging after they cut rates by a quarter point. USDJPY rose 0.4% to 144.08 after BBG reported that Bank of Japan officials are likely to discuss slowing their pullback from buying government bonds at a policy meeting later this month.

In commodities, gold climbs $6 to around $3,360/oz while silver tops $36/oz. WTI falls 0.6% to $63 a barrel. Bitcoin rises 3%.

Looking at today's calendar, the payrolls numbers are due at 8:30 a.m., while consumer credit data is due later in the day. The Fed’s Bowman is scheduled to give a speech on supervision and regulation.

Market Snapshot

Top Overnight News

Tariffs/Trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the subdued handover from the US where a stunning online bust-up between US President Trump and Elon Musk overshadowed the recent call between President Trump and Chinese President Xi in which the leaders agreed to start a new round of talks ASAP. ASX 200 saw two-way, rangebound trade as outperformance in the energy and utilities sectors was counterbalanced by losses in gold miners and the top-weighted financial industry, while a lack of pertinent data releases also contributed to the uneventful picture. Nikkei 225 gained with the index supported by recent currency weakness although further upside was capped following disappointing Household Spending data which showed a steeper-than-feared M/M decline and a surprise Y/Y contraction. Hang Seng and Shanghai Comp were indecisive despite the recent phone call between US President Trump and Chinese President Xi which the White House had been touting throughout the week, while Xi reiterated calls for the US to handle the Taiwan issue with caution.

Top Asian News

European bourses - Flat/lower trade across Europe following the fallout of the dramatic Trump-Musk spat, but with traders setting their sights on the US jobs report due 13:30 BST/08:30 EDT. On the week, futures of the broad Stoxx 600 and Euro Stoxx 50 indices are currently poised for a second week of gains, though not by much at this stage, and will depend on how the aforementioned data comes in. European sectors - Sectors display a mixed picture with the breadth of the market also narrow, with no real bias. Top gainers at the time of writing include Health Care (+0.6%), Energy (+0.5%), and Retail (+0.3%); losers include Basic Resources (-0.9%), Industrial Goods and Services (-0.4%), and Media (-0.3%). European movers - HSBC (+0.3%) chairman Mark Tucker will step down on September 30th. Adidas (-1.3%), JD Sports (-0.5%), and Puma (-1.6%) are all slipping after US apparel maker Lululemon (LULU) saw its shares tumble by over 20% in extended trading. Airbus (-0.9%) confirmed that it delivered 51 jets in May (-4% Y/Y),

Top European News

FX

Treasuries

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

US Event Calendar

Central Banks

DB's Jim Reid concludes the overnight wrap

Markets had a volatile session yesterday, as they grappled with a barrage of news that each pushed in different directions. Those included positive US-China headlines amid a call between Trump and Xi, a hawkish ECB decision and more weak data from the US. But the most remarkable was an extraordinary war of words between Trump and Elon Musk that ultimately left risks assets losing ground. Tesla’s shares plunged by -14.26%, while the S&P 500 fell -0.53% despite earlier briefly moving into technical bull market territory as it climbed just over +20% since its recent low on April 8.

The dramatic feud between the US President and the world’s richest man emerged after Trump said during a meeting with Germany’s chancellor Merz that he was “disappointed” and “surprised” in Musk’s recent criticism of the Republicans’ budget bill, with Musk responding on X by suggesting that Trump would have lost the election without his support. The war of words then escalated on social media, with Trump posting that “The easiest way to save money in our Budget, Billions and Billions of Dollars, is to terminate Elon’s Governmental Subsidies and Contracts”, while Musk posted that Trump’s tariffs “will cause a recession in the second half of this year” and responded “yes” to a suggestion that Trump should be impeached.

Following the Trump-Musk spat, Tesla’s shares slumped -14.26%, which together with a -3.55% decline on Wednesday marked its worst two-day decline (-17.30%) since 2020. The feud also weighed on US risk assets more broadly, with the S&P 500 (-0.53%) seeing ten of its eleven sector groups move lower on the day. Meanwhile, the VIX volatility index rose +0.87pts to 18.48, having been earlier on course to fall to its lowest level since late March. The tech mood has stayed subdued overnight as Broadcom’s results delivered a lackluster revenue forecast. The chipmaker, which is now the 7th largest company in the S&P 500 and around $300bn of market cap ahead of Tesla, saw its shares slide by more than -4% after-hours. However S&P 500 (+0.25%) and NASDAQ 100 (+0.14%) futures are edging higher, perhaps as Musk has started to suggest on X that he would be open to a cooling-off period in his war of words with the President.

Earlier on in the session we had seen a clear risk-on move on both sides of the Atlantic as a surprise Trump-Xi call raised the prospect of fresh US-China talks, leading to growing optimism that trade tensions would ease. The news of a call by Chinese state media led to an immediate jump in US equity futures. Shortly after, the rally got a further boost after Trump posted that it was “a very good phone call” which “resulted in a very positive conclusion for both Countries.” In the post, it said that their respective teams would soon meet, and also that “There should no longer be any questions respecting the complexity of Rare Earth products.” So that helped to boost market optimism, particularly after Trump had posted the previous day that Xi was “VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!”.

The trade headlines outweighed an initial negative reaction to the latest weekly US jobless claims, which added to fears that the US labour market was finally deteriorating after Liberation Day. Initial jobless claims (one of the most timely indicators we get) moved up to 247k in the week ending May 31 (vs. 235k expected), reaching their highest level since October. Moreover, that followed the very soft ADP report the previous day, which had private payrolls up by just +37k in May. The one caveat to the claims data is that seasonals tend to boost the number a bit at this time of the year. However it’s not the only evidence of a slightly weakening labour market. So that’s really heightened the focus on today’s jobs report for May, as any softness there would really magnify those fears. In terms of what to expect, our US economists forecast nonfarm payrolls to come in at +125k, dipping down from the +177k in March, with the unemployment rate remaining at 4.2%.

Those competing factors drove a big turnaround for US Treasuries yesterday. They initially fell back, with the 10yr yield hitting an intraday low of 4.31% just after the claims data. But the hawkish ECB decision and the Trump-Xi call led to a significant turnaround, with the 10yr yield ultimately closing up +3.7bps at 4.39%. The moves were even larger at the front-end of the curve, with the 2yr yield up +5.4bps to 3.92% as investors dialled back the likelihood of Fed rate cuts.

Meanwhile in Europe, the ECB was the biggest market driver yesterday. They cut rates by 25bps as expected, taking the deposit rate down to 2%. But significantly, President Lagarde signalled that they had “nearly concluded” the easing cycle, suggesting that policy rates weren’t likely to go much lower from here. She also signalled little urgency to cut rates, saying that the current level left them “in a good position to navigate the uncertain conditions that will be coming up.” As such, the ECB appears to be saying that it may have now reached the appropriate level of rates, a stronger message than a soft signal of a pause our European economists had expected. That said, our economists see expected soft growth in H2 and more significant disinflation than projected by the ECB as still favouring some further easing. See their full reaction here.

Lagarde’s comments immediately drove a clear market reaction, with another 25bp ECB cut now being less than fully priced, the 2yr German yield surging +7.8bps on the day and the euro itself strengthening +0.25%. Several other details also fed into the hawkish narrative, with the policy statement saying that although trade uncertainty would be a short-term drag, “rising government investment in defence and infrastructure will increasingly support growth over the medium term.” Later in the day, Bloomberg also reported that ECB officials thought a pause at the next meeting in July was the most likely scenario, with mixed views on whether another rate cut was likely after that. By the close, yields on 10yr bunds (+5.2bps), OATs (+4.7bps) and BTPs (+3.5bps) had all moved higher. Otherwise, equities ended the day higher with the STOXX 600 up +0.16%, but that was mainly thanks to the Trump-Xi call, as the index had been in negative territory after the hawkish ECB news.

In Asia markets are relatively subdued this morning. The Nikkei (+0.24%) has risen a little on weak Japanese economic data that might delay further rate hikes by the BOJ (more below). Meanwhile, the CSI (-0.12%) and the Shanghai Composite (-0.06%) are struggling to gain traction while the Hang Seng (-0.21%) and the S&P/ASX 200 (-0.19%) are seeing minor losses.

Coming back to Japan household spending (-0.1% y/y) unexpectedly fell in April, attributed to consumers curbing spending due to rising prices. This contrasted sharply with market expectations of a +1.5% gain following the previous month's +2.1% increase.

Elsewhere yesterday, data showed the US trade deficit narrowed sharply to $61.6bn in April, reflecting the impact of the new tariffs. That was the smallest monthly deficit since September 2023, and a huge decline from the prior month's $138.3bn trade deficit. Given that lower imports mechanically add to GDP, this is expected to lead to a strong bounceback in GDP for Q2 after the Q1 contraction. Indeed, the Atlanta Fed’s latest GDPNow estimate is pointing to annualised growth of +3.8% in Q2.

To the day ahead now, and the main highlight will be the US jobs report for May. Over in Europe, there’s also Euro Area retail sales for April, and German and French industrial production for April. Otherwise, central bank speakers include ECB President Lagarde, and the ECB’s Holzmann, Simkus and Centeno.