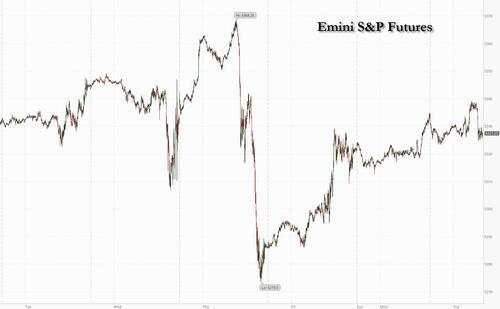

Stocks traded in a narrow range as markets reopened in the US and Europe with investors putting (a stronger than expected) Q1 earnings season in the history books, and looking to Friday's core PCE print prints and central bank speakers for hints on the timing of interest-rate cuts. As of 7:45am, S&P futures climbed 0.1%, while Nasdaq futs gained 0.2% helped by premarket gains for Apple which added 2.4% after China shipments rebounded over 50%. Europe’s Stoxx 600 dipped 0.2%, trimming its gain in May to 3.2%. The Bloomberg dollar index dropped while treasuries erased small gains, with 10Y yields trading at 4.46% before a slate of short-term auctions including offers of 2Y and 5Y notes on Tuesday. Brent crude rose as tensions in the Middle East ratcheted higher. On the calendar, today we get the release of house price and confidence data, before we get reports on GDP on Thursday. The centerpiece then comes on Friday, with the publication of the PCE price index, the Fed’s favorite inflation gauge. Economists expect that to show the smallest advance so far this year for the measure.

In premarket trading, the most notable movers was Apple whose shares gained 2.2% after new figures showed an iPhone sales rebound in China last month, with shipments increasing 52% amid discounts from retail partners.

As traders return from the long weekend they’re alert for problems connected with the switch to “T+1” rule — whereby US equities will settle in one day rather than two. There are worries about potential teething issues, including that international investors may struggle to source dollars on time, global funds will move at different speeds to their assets, and everyone will have less time to fix errors.

Meanwhile, strong earnings from tech megacaps like Nvidia helped stocks erase April’s slump, even as US data and cautious fedspeak cooled market bets on the scope for policy easing this year. And in a busy week for data, traders are concentrating on the PCE deflator, the Fed’s preferred gauge of inflation, on Friday.

“We are very much on the inflation data watch for now,” said Marija Veitmane, senior multi-asset strategist at State Street Global Markets. “Stocks and risk will continue to be supported, but I don’t see change of leadership nor a broadening of the performance. Large-cap growth stocks will be leading.”

European stocks are lower; the Stoxx 600 is down 0.2% with underperforming sectors including healthcare and industrials. European miners may be active on Tuesday as copper, along with other base metals, gained ground after China stepped up efforts to rescue its property market and a weakening US dollar boosted the demand outlook. Consumer inflation expectations in the euro zone ticked lower in April, ECB data showed, as policymakers next meet on rates on June 6. On Monday, France’s Francois Villeroy de Galhau said the ECB shouldn’t exclude cutting rates in both June and July, though hawkish policymakers including Executive Board member Isabel Schnabel recently came out in opposition to back-to-back moves.

Earlier, Asian stocks rose in thin trading, driven by advances in Hong Kong, ahead of global inflation prints set to offer monetary policy clues. The MSCI Asia Pacific Index rose as much as 0.3%, overcoming a shaky start. Gains were also notable in Indonesia and Taiwan, while Japanese benchmarks dipped. Volumes on many key gauges were 15-20% below 30-day averages after US and UK markets were closed on Monday.

“For all intents and purposes, we haven’t started the week — things will pick up tonight when the US opens,” said Kyle Rodda, a senior market analyst at Capital.Com. “I suspect the next few days, all else being equal, will be driven by end-of-month flows and then that crucial PCE Index release."

In FX, the Bloomberg Dollar Spot index traded lower versus most of its Group-of-10 peers amid month-end flows as markets in the UK and the US reopen after holidays. The Index slipped as much as 0.2% before paring most losses. The Swedish krona tops the G-10 FX pile, rising 0.4% versus the greenback.

In rates, treasuries were mixed with front-end outperforming, following wider gains across the gilt curve after remarks by BOE’s Broadbent, who said disinflation is “getting there,” according to the Times. US 2-year yields are richer by around 2bp on the day while yields are marginally cheaper further out the curve, steepening 2s10s spread by 1.8bp vs Friday’s close. 10-year is little changed at 4.465%, trailing gilts by 2.5bp in the sector; gilts outperform after a survey said UK shop inflation was now back to ‘normal’ levels. UK 10-year yields fall 3bps to 4.23%. The US session also features two auctions, 2-year notes at 11:30am New York time and 5-year notes at 1pm; the WI on the 2-year yield is around 4.903% ahead of $69b sale, about 0.5bp cheaper than last month’s result; $70b 5-year note sale follows

In commodities, oil prices advance, with WTI rising 1.5% to trade around $78.90 as tensions in the Middle East ratcheted higher following the death of an Egyptian soldier during a clash with Israeli troops. Spot gold falls 0.3%.

Bitcoin fell as traders monitored transfers by wallets belonging to the failed Mt. Gox exchange, whose administrators have been stepping up efforts to return a $9 billion hoard of the largest digital asset to creditors.

Looking at today's calendar, US economic data includes 1Q house price index, March FHFA house price index and S&P CoreLogic home prices (9am), May consumer confidence (10am) and Dallas Fed manufacturing activity (10:30am); Fed officials’ scheduled speeches include Kashkari (9:55am), Cook and Daly (1:05pm).

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed with price action mostly rangebound in the absence of a lead from Wall St and as geopolitical uncertainty lingered following an Israeli strike on Rafah which killed dozens of Palestinians on Sunday. ASX 200 swung between gains and losses albeit in a thin range with sentiment not helped by soft retail sales. Nikkei 225 retreated after stalling beneath the 39,000 level as participants also digested the firm Services PPI data which accelerated by its fastest pace since 2015. Hang Seng and Shanghai Comp were somewhat varied as Hong Kong outperformed with Alibaba Health Information Technology front-running the gains post-earnings, while there was also notable strength in China's major oil companies after the recent upside in underlying commodity prices. Conversely, the mainland lacks conviction with only brief support seen in property stocks following Shanghai's latest measures to spur the flagging sector.

Top Asian News

European bourses, Stoxx 600 (U/C) are mixed and trade modestly on either side of the unchanged mark, continuing the tentative price action seen in APAC trade overnight. European sectors are mixed; Real Estate takes the top spot, benefitting from the relatively lower yield environment, whilst Travel & Leisure is weighed on by broader strength in crude prices. US Equity Futures (ES +0.3%, NQ +0.5%, RTY +0.5%) are indicative of a firmer open, after US markets were shut on Monday on account of Memorial Day. Apple (+1.6% pre-market) gains following reports that China iPhone shipments rose 52% in April.

Top European News

Central Banks

FX

Fixed Income

Commodities

Geopolitics - Middle East

Geopolitics - Other

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

Good evening from a wet New York where I’ve just landed. So an early edition for you today and hopefully I'll be asleep for part 2 of my Sunday night sleep by the time you read this. Given it was a holiday in both the US and the UK yesterday we’ll still preview the week ahead this morning and briefly review last week even if the rest of the world was trading yesterday.

In fact in the absence of the US and the UK the week has started off positively as the ECB speakers yesterday leaned dovishly with French Governing Council member de Galhau suggesting they shouldn’t rule out back to back June/July cuts. Chief Economist Lane was also slightly dovish in an interview with the FT although didn’t provide any additional hopes to the July cut narrative. Finland's Olli Rehn also supported a cut next week in comments yesterday. Overall European bonds yields rallied 3-6bps across the curve and the number of basis points of cuts priced in for December 2024 increased from 58bps (a low for the year) on Friday to 61bps. A slightly softer than expected German IFO probably helped as well. European equities were up nearly half a percent to start the week.

Asian equity markets rallied 0.5% to 1.5% yesterday but are a little more subdued in early trading this morning with most either side of the flatline with the exception of the Hang Seng which is +0.8% in very early trading. S&P 500 (+0.12%) and NASDAQ 100 (+0.21%) futures are slightly higher after yesterday’s holiday.

Early morning data showed that Japan’s services PPI advanced +2.8% y/y in April (v/s +2.3% expected), recording its fastest rise in nine years and higher than the revised +2.4% gain in March. Elsewhere, retail sales in Australia rebounded +0.1% m/m in April but less than Bloomberg’s forecast for a +0.2% advance. This followed a -0.4% fall last month and a YoY rate just over 1% that has only really been lower during Covid in recent times. So a very soft consumption story in Australia at the moment.

In the energy space, Brent crude (+0.04%) prices have steadied this morning after rebounding more than +1.0% yesterday from more than three-month lows ahead of the online OPEC+ meeting on June 2.

Before that, all roads this week point towards the April US core PCE print on Friday which in MoM terms is expected to edge down from +0.32% to +0.26%. You don't need me to tell you how well scrutinised this data will be and how important it is to the Fed. As part of the same release, personal income (+0.4% forecast vs. +0.5% previously) and consumption (+0.2% vs. +0.8%) will likely come in a little softer. Back to inflation, and the preliminary May CPIs are out in Germany tomorrow, and in France, Italy and the Eurozone on Friday. Our European economists see this coming in at + 2.55% (+2.4% in April) for headline and +2.84% (+2.66% April) for core inflation. See their full preview here. At the start of 2024, euro area inflation avoided the sizeable upside surprises we saw in the US, but the last print in April did see core inflation slightly stronger than expected. I t would be a tall order for the data to derail the strongly signaled ECB cut next week but it could have important implications for the ECB’s signal beyond this. We will also have the latest inflation expectations from the ECB consumer expectations survey for April today. Our economists’ own dbDIG survey (see here) suggests that median medium-term expectations are likely to stay stable at 2.5%. Finally on inflation, Tokyo CPI is also out on Friday.

Elsewhere, in the US we have consumer confidence today, the Fed Beige Book tomorrow, the second reading of GDP and the Trade Balance on Thursday with the Chicago PMI alongside the personal spending and income report (alongside core PCE) on Friday. In China, May's PMIs on Friday will be the highlight. You can see the full day-by-day week ahead at the end including all the main central bank speakers highlighted too.

In what is a busy busy year for elections, this week we have the South African election tomorrow (DB primer here), the last leg of the Indian elections on Saturday and the Mexican equivalent on Sunday. Note it's also less than two weeks until the European Parliamentary elections. DB has a great primer here.

It might seem like ancient history by now, but when it came to last week, markets lost some momentum after strong data cast doubt on the chance of rate cuts. In particular, the flash PMIs for May came in stronger-than-expected on both sides of the Atlantic, with the US composite PMI up to a two-year high, whilst the Euro Area number hit a one-year high. Moreover, that positive data was cemented by a fall in the US initial jobless claims, along with an upward revision in the University of Michigan’s final consumer sentiment index. That strength has been evident in other indicators, and the Atlanta Fed’s GDPNow Index is pointing to US Q2 growth at an annualised +3.5% pace.

Much as the positive data was welcome, it also led to a fresh reassessment about how rapidly central banks would be able to cut rates. For instance, the amount of cuts priced in by the Fed’s December meeting came down by -10.7bps over the week to 33bps. And for the ECB, it fell by -8.3bps to 58bps, which was the fewest so far this year. This trend was further exacerbated by the minutes from the latest Fed meeting, which leant in a hawkish direction. In fact, it said that “ Various participants mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate.” So that helped to crystallise concerns about more restrictive monetary policy.

This backdrop meant that sovereign bonds struggled globally. Yields on 2yr Treasuries (+12.2bps) saw their largest rise in 6 weeks (+1.1bps Friday) while 10yr yields were up +4.4bps over the week (-1.2bps Friday) to 4.47%. Similarly in Europe, yields on 10yr bunds were up +6.8bps (-1.2bps Friday), and in the UK there was an even larger selloff after the April inflation print surprised on the upside. That meant yields on 10yr gilts were up +13.4bps for the week (+0.2bps Friday) and the 2yr yield was up by +18.7bps (-0.4bps Friday). Finally in Japan, there was a significant milestone as yields on 10yr JGBs surpassed the 1% mark in trading for the first time since 2012. By the end of the week, they’d risen by +5.6bps (+0.3bps Friday). Obviously European bonds have started the week on a firmer footing which perhaps reflects the uncertainty with the back and forth on rate expectations at the moment. Albeit it's a low volatility back and forth.

The prospect of higher rates for longer (last week at least) caused a mixed week for risk assets. The S&P 500 was essentially flat on the week (+0.03%), though a +0.70% recovery on Friday helped it just post a 5th consecutive weekly gain. There were contrasting moves within this, with a strong earnings report from Nvidia helping the Magnificent 7 (+2.91%, and +1.63% in Friday) and the NASDAQ (+1.41%, and +1.10% on Friday) up to new record highs by the close on Friday. However, most sectors outside of tech lost ground, with the Dow Jones index down -2.33% on the week (+0.01% on Friday). Meanwhile in Europe, the STOXX 600 fell -0.45% last week (-0.19% Friday).