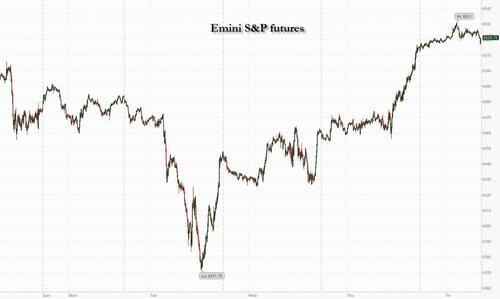

US equity futures are higher into NFP, rising after strong results from Broadmcom and on optimism that Friday’s jobs report will set the stage for the Fed to resume cutting interest rates this month. At 8:00am, futures for the S&P 500 ticked 0.1% higher - reaching a new record high - but eased off the best levels of the session. Nasdaq contracts advanced 0.5%. In premarket trading, Broadcom rallied more than 9% following its pact with OpenAI to create an artificial-intelligence chip. Tesla rose 2% after the board proposed a potentially $1 trillion pay package for Elon Musk. US Treasuries were little changed, with the two-year yield near the lowest in almost a year. The dollar headed for its weakest showing this week. Commodities are mixed: oil and base metals are lower, while gold and ags are mostly higher.

In premarket trading, Mag 7 stocks are mixed (Tesla +2%, Meta Platforms +0.3%, Microsoft +0.2%, Apple -0.1%, Amazon -0.3%, Alphabet -0.1%, Nvidia -0.8%) as Broadcom (AVGO) soars 11% after the chipmaker is said to be helping OpenAI design and produce an artificial intelligence accelerator from 2026. It also said that its artificial intelligence outlook will improve “significantly” in fiscal 2026.

Investors are riding high ahead of today’s nonfarm payrolls report, with hopes it will strike the balance of a softer labor market that clears the way for policy easing without undercutting confidence in the economy. A bigger surprise in either direction could unsettle markets.

August payrolls are projected to rise by roughly 75,000, extending a four-month streak of job growth below 100,000. The unemployment rate is seen climbing to 4.3%, the highest since 2021 (our full preview is here). JPMorgan Market Intel estimates a better than 90% chance that the S&P 500 will advance following the payrolls report. Although the data is unlikely to sway the September decision, a weaker-than-expected print could amplify calls for a 50 basis-point cut, the team led by Andrew Tyler noted earlier this week. While softer numbers may briefly stoke recession fears, the bank notes that the real risk lies in a substantially stronger-than-expected report.

“Today’s release is unlikely to show the kind of pronounced weakness that would force the Fed to accelerate its easing plans,” wrote Max McKechnie, global market strategist at JPMorgan Asset Management. “Instead, investors should focus on the unemployment rate and wage growth for a clearer sense of the Fed’s next steps.”

The run-up to today’s payrolls report has brought a raft of data signaling a slowdown in the labor market. Fed Chair Jerome Powell cautiously opened the door to a first rate cut for 2025 in his Jackson Hole speech, citing risks to the jobs backdrop even as inflation concerns persist.

Some investors are approaching the release cautiously after recent revisions showed significantly weaker growth than previously reported. The downward adjustments, published with the July report, also led US President Donald Trump to dismiss the head of the Bureau of Labor Statistics, raising concerns about the integrity of data going forward. Stretched valuations also argue for restraint.

“We’re at a pivotal moment not only on growth and the labor market but also on inflation,” said Patrick Brenner, chief investment officer of multi-asset at Schroders Plc. “The market is priced for perfection and so we’re taking a wait-and-see approach by taking profits on our equity position.”

European stocks rise for a third straight session as investors await key US payrolls data later in the day. The Stoxx 600 rose 0.3% to 551.97 with the FTSE 100 outperforming European peers. The CAC 40 lagged, flat on the day. Miners, industrials and tech led sector moves. Dutch chip equipment maker ASML gains after an upgrade at UBS. Here are some of the biggest movers on Friday:

Earlier in the session, Asian stocks rose, on track for a weekly advance, supported by a rebound in Chinese equities as well as bullish sentiment around a US-Japan trade deal. The MSCI Asia Pacific Index gained as much as 1.2% in Friday’s session, set to finish higher on the week. China’s benchmark CSI 300 Index rose more than 2% after a three-day selloff. Stocks in Hong Kong, Japan, South Korea and Taiwan also advanced. Chinese stocks are bouncing back as investors mull the week’s events, including President Xi Jinping’s strengthening ties with India and North Korea as well as market policy proposals. Regulators are considering measures to curb the speed of the rally in its stock market, which may introduce more stable structural growth. Elsewhere in the region, Thailand got a new prime minister, with parliament electing Anutin Charnvirakul on Friday. Thailand’s stock index gained to its highest since mid-August. Shares in India traded lower, dragged by information technology firms.

In FX, the Bloomberg Dollar Spot Index edged down 0.3%, trimming its weekly gain. Markets have almost fully priced a Fed rate cut in September, with a follow-up reduction cemented by year-end, according to swaps data compiled by Bloomberg

In rates, Treasuries are steady with yields close to Thursday’s closing levels as investors wait for the August payrolls data and the potential impact on expectations for the September FOMC decision. Treasury yields marginally richer on the day, underpinned by gilts, where a broader bull-flattening move has been seen over the early London session. US 10-year yields trade around 4.15%, with gilts outperforming by 1bp in the sector and bunds trading broadly in line. Ahead of the jobs report, Fed-dated OIS is pricing in around 23bp of easing for the September policy meeting. For nonfarm payrolls change, which was 73k in July, the Bloomberg survey median estimate is 75k, matching the crowd-sourced whisper number. French and UK bonds advanced, while bunds were little changed.

In commodities, WTI held near $63.44 and gold added about $3 to $3,548/oz. Bitcoin gained another 2%.

Today's US economic data slate includes only the August jobs report at 8:30am. The Fed speaker slate is empty for the session, and external communications blackout ahead of Sept. 17 rate decision begins Saturday

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly took their cues from the gains on Wall Street where participants digested soft labour metrics and dovish Fed speak ahead of today's NFP report. ASX 200 was led higher by outperformance in real estate, tech and consumer discretionary, although gains were capped with the commodity-related sectors, consumer staples and utilities at the other end of the spectrum. Nikkei 225 rallied at the open and briefly returned to above the 43,000 level after US President Trump signed an Executive Order to officially implement the US-Japan trade deal in which the US will apply a baseline 15% tariff on nearly all Japanese imports, although some of the gains were pared amid a firmer yen and an acceleration in Labour Cash Earnings. Hang Seng and Shanghai Comp conformed to the constructive mood following recent tech-related support pledges by Beijing and with DeepSeek targeting an AI agent release by year-end, while reports also noted the PBoC may inject reasonably ample liquidity this month and that cities in China are said to examine new tactics to buy unsold homes.

Top Asian News

European bourses (STOXX 600 +0.3%) opened modestly firmer across the board but dipped slightly off best levels in early-morning trade. Currently, still displaying a positive picture in Europe, but are off best levels. European sectors hold a positive bias, and with the breadth of the market to the downside fairly narrow. Basic Resources takes the top spot, buoyed by strength in underlying metals prices. Tech follows closely behind, with the sector boosted by a trifecta of factors; 1) strong Broadcom results, 2) broker upgrade for STMicroelectronics, 3) broker upgrade for ASML. On the latter, ASML was upgraded to Buy from Neutral at UBS and got a 13% boost to its PT. Analysts cite recent underperformance, and note that the "overhang" from China is well understood by investors.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Today see's the first of the three massive days for markets in the next nine business days. US Payrolls today, US CPI next Thursday and then the FOMC decision the following Wednesday. Ahead of today's start to this run, markets have put in a strong performance over the past 24 hours, after soft data meant investors became increasingly convinced that the Fed would cut rates this month. Those prints pointed to growing weakness in the US labour market, which is top of mind given that last month’s jobs report was unexpectedly bad. So bonds saw a broad rally on both sides of the Atlantic, and the 2yr Treasury yield (-2.9bps) even closed at an 11-month low of 3.59%. In turn, the prospect of imminent rate cuts lifted equities, with the S&P 500 (+0.83%) closing at a new record high.

In terms of that jobs report, our US economists expect nonfarm payrolls to come in at +100k in August, picking up from the +73k reading back in July, with the unemployment rate staying at 4.2%. However the revisions will be of massive importance after last month saw the biggest downward revisions in over 5 years to the prior two months. As you will no doubt remember this contributed to BLS chief Erika McEntaref losing her job hours after the release. The presumptive nominee E.J. Antoni hasn't yet been confirmed by the Senate with hearings expected this month. After last month's report, the entire picture of labour market resilience after Liberation Day was suddenly undercut, and the current data shows payrolls up by just +19k in May and +14k in June. So as it stands, both the 3-month and 6-month average of payrolls are at their weakest levels of this economic cycle, at +35k and +81k respectively. However such numbers might still reflect a tight labour market as our economists believe that due to the crackdown on immigration and the increase in deportations, the breakeven level of payrolls that keeps the unemployment rate steady could now be as low as 50k per month.

Ahead of the big print, labour market jitters got more traction yesterday, as the ADP’s report of private payrolls was a bit weaker than expected in August, at +54k (vs. +68k expected). Then 15 minutes later, we found out that the weekly initial jobless claims hit a 10-week high of 237k in the week ending August 30 (vs. 230k expected). To be fair, there was a bounceback in the ISM services index, which rose to a 6-month high of 52.0 (vs. 51.0 expected). But even there, the employment component was still in contractionary territory at 46.5. So when it came to the labour market, it was hard to generate much of a positive narrative from yesterday’s releases.

All that helped to fuel the bond rally, with investors dialling up their expectations for Fed rate cuts over the months ahead. For instance, the amount of cuts priced by the June 2026 meeting rose +3.8bps by the close to 113bps. And in turn, that helped to push Treasury yields lower across the curve, with the 2yr yield (-2.9bps) at an 11-month low of 3.59%, whilst the 10yr yield (-5.6bps) hit a 5-month low of 4.16%. Over the last couple of days, the market has been less worried about inflation but the prices paid component of the ISM services remained at a very high 69.2 yesterday even if it was three tenths less than expected and seven tenths below last month. See my CoTD from yesterday here for why that's still a potential worrying sign for future CPI even if the prices paid number is more volatile.

Those inflationary concerns were echoed by Cleveland Fed President Hammack, one of the hawks on the FOMC, who said that “inflation is still too high, and we’re trending in the wrong direction” and reiterated that she did not see the case for a September rate cut. By contrast, NY Fed President Williams said that concerns on the labour market have ticked up relative to ones on inflation and that it will "become appropriate" to cut interest rates "over time", though he did not comment on exact timing.

Yesterday also saw the Senate confirmation hearing for Stephen Miran to join the Fed’s Board of Governors, which is an important one given investor concerns about the Fed’s independence. In his testimony, Miran said that “If I’m confirmed to this role, I will act independently, as the Federal Reserve always does”. Miran was also questioned on his intention to take a leave of absence from, but keep his current CEA Chair role as he fills the rest of the Governor term expiring in January, though he said would resign from his CEA post if nominated for a longer term role at the Fed. Separately, we heard that the US Justice Department opened a criminal investigation into whether Fed Governor Lisa Cook committed mortgage fraud. That comes as we await to hear whether Cook will succeed in getting a temporary court order blocking her dismissal.

Thrown altogether, this provided a strong backdrop for equities, as investors became increasingly confident that the Fed would cut rates in a couple of weeks’ time. So that helped drive both the S&P 500 (+0.83%) and the Magnificent 7 (+1.31%) to new all-time highs. All of the Mag-7 were higher on the day, led by Amazon which jumped +4.29% after Business Insider reported that it is testing a new AI-powered workspace software. Overnight the FT reports that Open AI are teaming up with Broadcom to produce a new AI chip to rival Nvidia. So it'll be interesting to see if that creates any competition to Nvidia over the medium term. Broadcom itself issued a rosy revenue outlook overnight and was up +4.6% in extended trading. Nasdaq futures are up +0.35% overnight with the S&P equivalent up around half that.

Switching continents, and attention is increasingly turning back to France, as the confidence vote is being held on Monday in the National Assembly. We should hear the results after 5pm local time. The announcement of the vote several days ago led to considerable market concerns, as investors feared a prolonged bout of instability that would make fiscal tightening even more difficult. But since then, French assets have stabilised over recent days, as a defeat is now widely expected given the positions of the various parties, meaning that the prospect of a defeat in itself isn’t driving market moves anymore. Indeed, French OATs outperformed yesterday, with their 10yr yield down -5.0bps to 3.49%, which was bigger than the decline for bunds (-2.1bps) and BTPs (-4.4bps). So that brought down the 10yr Franco-German spread to 77bps, which is its lowest in the last week and a half. The STOXX 600 rose +0.61%.

In Asia, Chinese equities have recovered some of yesterday's losses which came from fears of a regulatory clampdown, with the CSI (+0.92%), the Hang Seng (+0.62%), and the Shanghai Comp (+0.35%) all higher. Elsewhere, the Nikkei (+0.64%) is also trading higher following President Trump's signing of an executive order that enacts the trade agreement with Japan, under which the US will impose a maximum 15% tariff on most of its products. Elsewhere, the S&P/ASX 200 (+0.41%) is building on its previous session gains with the KOSPI (+0.08%) struggling for momentum after seeing decent gains in the previous three sessions.

Coming back to Japan, nominal wages increased by +4.1% year-on-year (compared to +3.0% anticipated), representing the fastest growth in seven months during July, and an acceleration from a revised +3.1% rise in June. Real wages unexpectedly increased for the first time this year, rising by +0.5% year-on-year in July (against an expected -0.6%), contrasting with a revised -0.8% decline the previous month, thereby strengthening the case for the BOJ to consider a rate hike in the forthcoming months. Additionally, household spending rose by +1.4% year-on-year in July (versus +2.3% expected), compared to a +1.3% increase the prior month.

Looking ahead, the main highlight today will be the US jobs report for August. Meanwhile in Europe, data releases include German factory orders and UK retail sales for July.