US equity futures climbed rose for a fifth consecutive session - the longest winning streak since August - ahead of the September CPI report that’s expected to show further slowing in US inflation, which should cement the market's conviction that the Fed's hiking cycle is over. As of 8:00am, S&P 500 futures are up 0.4% and above Wednesday’s highs, following almost 1% gain for Estoxx 50, Nasdaq futures rose 0.3%. Treasuries were flat trading at 4.55%, while the dollar is slightly weaker ahead of key US consumer prices data. WTI crude futures are higher by 0.8%, paring Wednesday’s drop as commodities catch a bid with all 3 segments higher.

The latest FOMC minutes point to a paused Fed (according to JPM, confirmation is expected to come from Powell coming on Oct 19) with the debate now on how long to maintain at this level before cutting; Fedspeak puts R-star in the 2.5% - 3% range. China invites US SecDef to its Defense Forum; biggest olive branch of the year? Asian stocks gained after China’s state fund looks to increase its stake in the country’s biggest banks; will look to do more over next six months.

In premarket trading, Ford slipped in pre-market trading after union members went on strike at its largest plant, a highly profitable pickup factory in Kentucky. First Solar advanced after Barclays upgraded the stock to overweight. Birkenstock gained 0.7% after dropping from its initial public offering on Wednesday. Here are some other notable premarket movers:

The market's attention turns next to Thursday’s US consumer price data (full preview here) which economists are forecasting to show a further easing in inflation. CPI is forecast to have slowed to an annual rate of 3.6% in September from 3.7% the previous month, according to a Bloomberg survey. Data published Wednesday showed prices paid to producers rose by more than forecast in September, bolstered by higher energy costs.

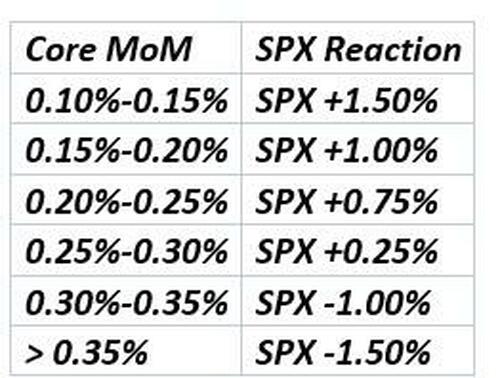

In its preview of the CPI print, Goldman writes that “Stocks have squeezed 4 trading sessions and counting since the guts of the NFP data last Friday were deemed goldilocks .. The tape remains resilient in the midst of the tragic geopolitical developments .. I think this rally continues today if CPI is 30bps (or softer).”

Here is Goldman's market reaction matrix:

Meanwhile Fed officials are taking a more patient approach now that rates are at or near their peak, Boston Fed President Susan Collins said Wednesday. Her Atlanta counterpart Raphael Bostic said the central bank doesn’t need to keep tightening unless inflation’s descent starts to stall.

“The less hawkish turn that we’ve seen from the Fed is in part to try and reduce the volatility that we’ve seen in rates markets and to try and bring expectations down to a more reasonable level,” Mehvish Ayub, senior investment strategist at State Street Global Advisors, said on Bloomberg Television.

European stocks are on track to rise for a third consecutive session The Stoxx 600 is up 0.7% to a three-week high. Energy shares led gains as oil rebounded after OPEC+ leaders Saudi Arabia and Russia reaffirmed their close cooperation to support the crude market. Mining and media stocks also outperformed while banks lagged, with Barclays Plc falling as much as 3.8% after Chief Executive C.S. Venkatakrishnan said stagnant deal activity, easing volatility and peaking interest rates are set to weigh on the sector’s earnings. Among individual movers, Publicis Groupe climbed as much as 5.1% to the highest level since April after the advertising agency upgraded its full-year organic growth target on the back of stronger-than-expected 3Q sales growth. Growth in the Epsilon unit — Publicis’s data management business — and a smaller tech industry exposure than peers helped the company outrun the broader slowdown in ad spending, analysts say. EasyJet Plc fell after the airline said it will order an additional 157 Airbus SE A320neo jets, with an option to add 100 more. Here are the most notable European movers:

Earlier in the session, Asian stocks were headed for a sixth straight day of gains, as a move by China’s sovereign wealth fund to buy bank shares lifted sentiment, while investors parsed the less hawkish commentary by the Federal Reserve. The MSCI Asia Pacific Index rose as much as 1.1% on Thursday, led by consumer discretionary and industrial shares. Equities in Japan and South Korea were among the best performers in the region.

In FX, the Bloomberg Dollar Spot Index is down 0.1% having earlier touched its lowest in almost two weeks; it is set for the longest run of losses in over three years after more Federal Reserve officials suggested that US interest rates may have peaked. The Swiss franc and Swedish krona are the best performers among the G-10’s; the kiwi is the laggard. The pound dipped, snapping a six-day rising streak, after figures showed the UK economy registered a modest rebound in August as the dominant services sector offset another weak month for manufacturers and construction firms.

The dollar has corrected lower as dovish Fedspeak drives a rebound in Treasuries, “but its too early to conclude this is the start of a USD downtrend,” said Carol Kong, a strategist at Commonwealth Bank of Australia in Sydney, adding that the US CPI reading “could again change the narrative and push the USD back up”

In rates, treasuries were little changed, as investors await a reading of US CPI later in the day to better gauge the outlook for inflation and rates. Yields are unchnaged on the day in front-end and belly of curve and marginally cheaper at long-end. All are within about 1bp of Wednesday’s closing levels with price action limited ahead of key inflation data. US 10-year yield little changed around 4.56% while bunds and gilts trail by 1bp and 1.5bp in the sector. Slight underperformance of long end moves 5s30s spread from daily low near 10bp to ~13bp, while 2s10s spread is minimally flatter on the day. Core European rates are slightly cheaper across the curve in early London session: gilts and bunds decline, with UK and German 10-year yields both gaining 2bps. Treasury auction cycle concludes with 30-year reopening at 1pm, follows 10-year auction Wednesday which tailed by 1.8bp. Fed Reserve Bank of Dallas President Lori Logan, Fed Bank of Atlanta President Raphael Bostic and Fed Bank of Boston President Susan Collins are due to speak later in the day.

In commodities, oil prices rose, with WTI gaining 1% to trade near $84.30. Spot gold adds 0.4%. Bitcoin was lacklustre following a recent retreat to beneath the USD 27,000 level.

To the day ahead now, and data releases include the US CPI release for September, the weekly initial jobless claims, and UK GDP for August. From central banks, we’ll hear from the Fed’s Logan, Bostic and Collins, the ECB’s Elderson, Villeroy, Holzmann, Knot, Vujcic, Vasle and Panetta, along with the BoE’s Pill. The ECB will also release the account of their September meeting.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks were firmer after the region took impetus from the intraday rebound on Wall St where dovish Fed rhetoric offset the hot PPI data, while stale FOMC Minutes provided no major fireworks. ASX 200 was led higher by early outperformance in its top-weighted financial industry although the gains in the index were limited as energy and the defensive sectors lagged. Nikkei 225 was boosted on a break above the 32,000 level following softer-than-expected PPI data and comments from BoJ Board Member Noguchi who continued to toe the dovish line. Hang Seng and Shanghai Comp. were underpinned in which the Hong Kong benchmark gapped above the 18,000 level and spearheaded the advances in the region, while Chinese banks were buoyed after China’s sovereign wealth fund raised its stake in the largest banks for the first time since 2015.

Top Asian News

European bourses are trading with modest gains in the wake of the late gains on Wall Street yesterday and the upbeat APAC session overnight. Sectors in Europe are mostly firmer with Basic Resources and Energy top of the leaderboard, whilst Banks lag to the downside. US futures are trading on the front foot, continuing the strength seen in yesterday’s session, with the hotter-than-expected PPI print unable to cap sentiment in the run-up to today's CPI.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

I'll be spending most of today telling my wife "you really, really don't look your age.. but how does it feel to be married to a younger man from a different half-century". Yes, she turns 50 today. I have exactly 8 months before the same fate awaits me so I won't be able to make too much fun of her. In terms of festivities, she's off to a spa day today and then we're out to dinner tonight as a family. Then tomorrow night we've booked a ridiculously expensive hotel in London for our first night away together from the kids since we've had them, with theatre and dinner thrown in. Then on Sunday she's seeing Madonna live at the o2 arena as she starts her world tour (Madonna not my wife). I'll be ducking out at that point and will be en route to New York for work. Next year we're having a joint 100th party at home which will be the hottest ticket in town (I live in a very small town).

The hottest ticket in town today will be ring side seats to the latest US CPI report. Our economists are looking for headline CPI at +0.26%, which will slightly outpace core, which they see at +0.24%. This would put the YoY at 3.5% and 4.0%, respectively, down 0.2pp and 0.4pp from last month. See their preview here along with a link to register for their webinar afterwards.

Ahead of this important print, markets this week have responded more to central bank speak than the tragic events in the Middle East, but the two combined have provided the perfect conditions for bonds to rally. With oil softening again yesterday (WTI down -2.88%), it's now only around one percent higher than before the weekend attacks on Israel.

10yr US bonds go into the big release some -31.5bps beneath their intraday peak last Friday immediately after the jobs report, with yesterday seeing a further -9.5bps move lower. We saw a sharp London morning rally on the back of Bloomberg headlines of missiles being fired from Lebanon towards Israel. Much of this rally then reversed, in part after a 10yr auction that saw softer demand from indirect bidders, but bonds rallied again later on after the release of the Fed September minutes. The big story was a significant flattening in the Treasury curve, with the 2yr yield up +1.3bps to 4.98%, whilst the 30yr yield came down -13.8bps to 4.69%, its largest daily decline since March at the height of the banking turmoil. Overall, there was lots of talk about steepeners being a crowded trade and helping to create the fairly sudden flattening of late. We have a 30yr auction today to test this recent long-end outperformance.

This out-performance got added support from Fed commentary. First, there were remarks from Fed Governor Waller, who said that that financial markets were “tightening up and they are going to do some of the work for us”. Then in the US afternoon we had the minutes from the Fed’s September meeting. These repeated some key messages from last month’s press conference, with all FOMC members agreeing that “policy should remain restrictive for some time” and that the Fed “can proceed carefully”. But there were also some dovish hints as “risks to the achievement of the committee’s goals had become more two-sided”. The minutes added focus to the details of today’s CPI print, noting that “significant progress in reducing inflation had yet to become apparent in the prices of core services excluding housing”.

The Fed commentary saw investors further discount the likelihood of a hike at the next meeting in November, with futures only giving it a 10% likelihood now, down from 14% the previous day and 31% last Friday after the strong payrolls. Those moves to price out further tightening came in spite of a strong US PPI inflation print for September yesterday. The monthly gain in headline PPI was at +0.5% (vs. +0.3% expected), whilst PPI excluding food and energy was up +0.3% (vs. +0.2% expected). In turn, that pushed the year-on-year measure for headline PPI up to +2.2%, which is a clear recovery from its low of +0.2% back in June.

Even with the latest fall in long-term borrowing costs, yesterday brought fresh evidence that the recent sharp increase was still filtering through. That came from the Mortgage Bankers Association, whose latest data showed the 30yr fixed mortgage rate was up to 7.67% in the week ending October 6, which is the highest it has been since 2000 .

Over in Europe, there was also a significant flattening in the yield curve, with yields on 10yr bunds (-5.7bps), OATs (-6.2bps) and BTPs (-6.2bps) all moving lower, even as the 2yr yields all rose. That came amidst several speakers from the ECB yesterday, including Dutch central bank governor Knot, who said that returning inflation to target in 2025 “would be an acceptable return for me”. Bundesbank President Nagel also said in a CNBC interview that “pausing could be an option” .

For equities, yesterday saw a moderate advance on both sides of the Atlantic, with gains for the S&P 500 (+0.43%) and Europe’s STOXX 600 (+0.15%). The S&P 500 had traded a few tenths lower in the middle part of the session but rallied in the last couple of hours, assisted by a renewed decline in yields. Tech stocks led the moves in the US, with the NASDAQ (+0.71%) and the FANG+ Index (+0.99%) seeing stronger advances, whilst energy stocks in the S&P 500 (-1.35%) underperformed amidst the decline in oil prices. Over in Europe there was a divergence by country, with Germany’s DAX (+0.24%) and Italy’s FTSE MIB (+0.36%) posting gains but France’s CAC 40 fell -0.44% as luxury giant LVMH fell -6.46% after reporting disappointing Q3 sales growth .

Turning back to oil prices, WTI crude was down -2.88% to $83.49/bl yesterday, and this morning it’s down a further -0.48% to $83.09/bbl. In addition to the fading of imminent concerns over supply risks from the Middle East, the reversal was helped by the latest monthly EIA report. This projects that US oil output will reach an all-time high of 13.16m barrels a day in Q4-23. Sticking to the topic, our commodities analyst Michael Hsueh updated his oil price projections in an oil market update yesterday.

Overnight in Asia, we’ve seen that broadly positive performance continue in markets, with gains for all the major equity indices. The Hang Seng (+1.89%) is leading the way, and was supported by the news that China’s sovereign wealth fund, had bought shares in some of the nation’s biggest banks. That said, the equity advances were spread across the region, with gains for the Nikkei (+1.66%0, the CSI 300 (+0.97%), the KOSPI (+0.94%) and the Shanghai Comp (+0.82%). US and European equity futures are also pointing higher, with those on the S&P 500 up +0.27% after 4 consecutive advances for the index already .

In US political news, late yesterday we heard that Rep. Steve Scalise was selected as the nominee for Speaker by a ballot of Republicans in the House of Representatives, defeating Trump-backed Rep. Jim Jordan. Scalise still faces a challenge to be elected Speaker as he can afford to lose support of at most four House Republicans to get the 217 votes needed. If Scalise is confirmed as Speaker, investors will be keen to see whether he can facilitate a spending deal ahead of the next government shutdown deadline on November 17th. In other news out of the US overnight, the UAW auto union’s strike expanded to Ford’s largest pickup plant in Kentucky. This arguably marks the largest escalation since the UAW strikes began in mid-September.

There wasn’t much other data yesterday, but we did get the ECB’s Consumer Expectations Survey for August. That showed expectations at the 1yr horizon up a tenth to 3.5%, and they were also up a tenth at the 3yr horizon to 2.5%. Overnight, however, Japan’s PPI inflation for September fell more than expected to +2.0% year-on-year (vs. +2.4% expected), which is its slowest pace in two-and-a-half years .

To the day ahead now, and data releases include the US CPI release for September, the weekly initial jobless claims, and UK GDP for August. From central banks, we’ll hear from the Fed’s Logan, Bostic and Collins, the ECB’s Elderson, Villeroy, Holzmann, Knot, Vujcic, Vasle and Panetta, along with the BoE’s Pill. The ECB will also release the account of their September meeting.