US equity futures and European bourses rebounded from yesterday's slump and are higher into CPI, which may provide clues on the Federal Reserve’s next steps, with slight outperformance from MegaCap Tech. As of 7:45am ET, both S&P and Nasdaq 100 futures were up 0.5%. The Stoxx 600 was up 0.4%, with travel and luxury companies among the biggest gainers on speculation that companies will benefit an increase in Chinese tourism spending after Beijing lifted travel curbs. The dollar dropped against all majors except the yen; bond yields are flat and oil slipped while metals and ags prices are higher. Today’s focus is on the CPI print at 8.30am; there are two Fed speakers this afternoon.

In premarket trading, Disney shares rose 1.6% in premarket trading after saying capital spending and outlays for movies and TV shows are coming in lower than projected; the stock earlier slumped after the company reported only the second ever drop in Disney+ streaming subs: it appears that Disney plans to make up in price what it loses in volume, always a winning strategy. Elsewhere, Capri soared as much as 34% after it was acquired by Tapestry, the parent company of Michael Kors and Versace among others, for $57. Here are some other notable premarket movers:

As previewed earlier, all eyes will be trained on today’s CPI which according to JPM's trading desk will be "more dovish than hawkish", and which is set to show a second consecutive reading on core inflation in line with the Federal Reserve’s target, but the first increase in annual CPI since June 2022. Bloomberg Economics expects CPI, excluding food and energy, to rise by 0.2% for the month, similar to June. “July’s CPI report will show a wave of disinflation hitting the US economy,’’ the team, led by Anna Wong, said. The report will be critical for investors trying to determine whether the Fed will stop raising interest rates.

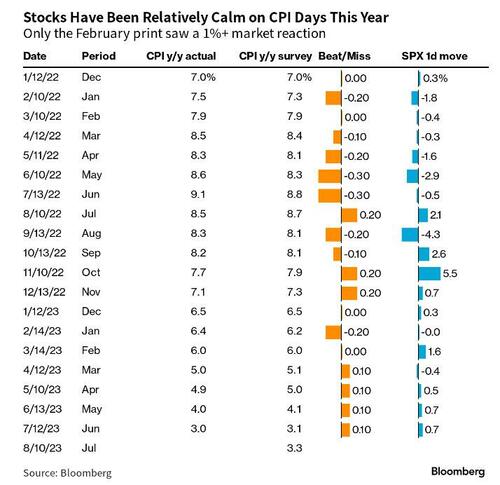

“A higher-than-expected number would produce some short-term equity and bond volatility,” said Andrew Bell, chief executive officer at Witan Investment Trust. “But I doubt it would change expectations for the peak in Fed rates as there is a weight of evidence pointing to the economy disinflating.” Indeed, historical data shows that CPI days have been largely a snoozer so far in 2023.

One potential pressure point could be commodities, which are rising after a year of falling. Oil traded near the highest level in almost nine months, with West Texas Intermediate futures above $84 a barrel after climbing 3% over the previous two sessions.

In Europe, the Stoxx 600 was up 0.4%, boosted by gains in luxury and travel stocks after China announced plans to relax travel curbs. LVMH and Hermes International added at least 2% after China’s Ministry of Culture and Tourism said it would lift a group travel ban to countries including the US, UK, Australia, South Korea and Japan. Buyers from China account for about 25% of European luxury-goods sales, including purchases made by tourists, according to latest estimates from Goldman Sachs Group Inc. Here are the most notable European movers:

Earlier in the session, Asian equities traded mixed as strength in energy and industrial shares help limit the impact of a selloff in the technology sector as investors exercised caution ahead of critical US inflation data. The MSCI Asia Pacific Index fell as much as 0.4% before paring the gain. Chipmakers and Chinese internet shares were among the biggest drags as higher US Treasury bond yields and skepticism over the AI-led rally prompted profit-taking. Gains in oil lifted commodities-related stocks. Investors in Asia have been cautious this week as rising yields and China’s economic woes sap risk appetite. The regional benchmark is down 3.6% so far in August after gaining nearly 8% in the previous two months. All eyes are on US monthly inflation data due later Thursday for clues on the Federal Reserve’s next policy move.

“The upcoming US CPI data could dictate the trend over coming weeks, largely seen as key in determining if a September rate hike is needed,” Jun Rong Yeap, market strategist at IG Asia wrote in a note. Meanwhile, China investors are “keeping a lookout for any worst-is-over” scenario, he added.

In FX, the Bloomberg Dollar Spot Index is down 0.2%, falling against all its G-10 rivals except the yen which is down 0.1%; the Swiss Franc led group-of-10 gains rising as much as 0.5%

In rates, Treasuries are slightly lower with the US 10-year yield unchanged at 4.01%. The treasuries curve is marginally steeper with short-end and belly slightly outperforming ahead of July CPI data and $23 billion bond auction. Treasuries price action is rangebound with core European rates underperforming, as July CPI readings are expected to support a pause to the Fed’s hiking cycle for September. The Treasury 2-year yields richer by around 1.5bp on the day with 2s10s and 5s30s spreads steeper by 1bp and 1.5bp vs Wednesday close; 10-year yields around 4% are near flat on the day, with bunds and gilts lagging by 3.5bp and 1.5bp in the sector. Treasury auction cycle concludes with $23b 30-year bond sale at 1pm New York time; demand was robust for 3- and 10-year auctions earlier this week. WI 30-year yield at ~4.165% is around 25.5bp cheaper than July’s stop-out, which tailed by 2bp, and higher than 30-year stops since 2011

In commodities, Crude futures are little changed with WTI trading near $84.40. European natural gas futures fall 5%. Spot gold adds 0.3%.

Looking at today's calendar, we have the all-important CPI print in the US. Aside from this, we will get the latest weekly claims data and monthly budget statement in US. With 90% of S&P 500 companies having now published their Q2 results, upcoming earnings releases are weighted towards Europe with today’s results including Novo Nordisk, Alibaba, Siemens, Deutsche Telekom, Allianz, Tokyo Electron, Orsted, RWE, Rheinmetall and HelloFresh.

Market Snapshot

Top Overnight News from Bloomberg

A more detailed look at global markets courtesy of Newsquawk

Top Asian News

European bourses are in the green, Euro Stoxx 50 +0.7%, as sentiment inches higher with macro drivers thin; FTSE 100 lags given a large amount of ex-dividend trade. Sectors are primarily bid with only Health Care in the red as Novo Nordisk trims recent gains post-earnings; Insurance outperforms following Allianz and Zurich Insurance with Luxury also bolstered as China continues to reopen. Stateside, futures are in the green as they take impetus from European action and attempt to recover some of the losses felt on Wednesday, ES +0.6%. Action has been relatively contained for US futures after they staged a recovery in APAC hours with drivers since light and the clock counting down to CPI, Fed speak and supply.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

While it would be hard to say this has been a bad August for markets so far, it seems to be hard to get through a day at the moment without a negative shock of some description. I'll need my holiday from tomorrow to have a lie down. Yesterday’s negativity was from a +27% spike in European natural gas prices (with a +40% intra-day high), the largest percentage increase since early March 2022, albeit still -87% below the peaks back in late August 2022. Oil also edged up above its April highs to the highest levels since last November.

These inflationary moves ironically come ahead of a big US CPI today which has of late been the print to give most encouragement to the soft landing argument. It’s likely too early for any recent commodity increases to show up in the data but we’ll all be watching oil, gas and food prices over the next few weeks and months. As it stands they should help to push up headline inflation shortly before the September FOMC which will be a bit uncomfortable even if core will be the main focus.

In terms of today, consensus expects a +0.2% monthly print for both headline and core inflation. Should this materialise, it would be the second consecutive MoM print close to the 2% annualised target, especially if the decimal roundings are favourable. Our US economists expect a marginally weaker headline reading (+0.17% vs. +0.18% prev.), with core inching up from its 28-month low seen in June (+0.21% vs. +0.16% prev). In terms of the drivers, they ironically see gas prices helping headline inflation lower with core goods also falling but services inflation remaining elevated. In annual terms, they see headline CPI in line with consensus at +3.3% (+3.0% prev.) and core inflation just about staying at +4.8% (consensus +4.7%). You can see our US economists’ full preview of the print here, as well as register for their post-CPI webinar at 9am EST today.

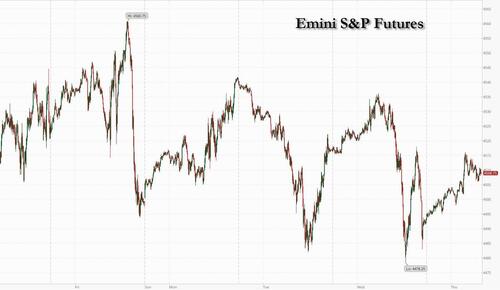

Ahead of today’s data, a risk-off tone dominated US equities, with the S&P 500 down -0.70% after selling off around -0.5% in the final half an hour of trading and closer to the earlier session lows. Banks (-1.57%) posted a second sizeable decline in a row, while tech also underperformed. The NASDAQ closed -1.17% lower with the FANG+ mega cap index down -2.11%, led by chip maker Nividia which saw a -4.72% fall. Energy stocks (+1.22%) rose alongside a strong day for oil prices. S&P and Nasdaq futures are back up +0.36% and +0.39% respectively overnight continuing the down/up nature of the month so far.

US rates saw some reversal of the twist steeping that had played out last week. The 10yr yield fell -1.3bps to 4.01% (+1.04 bps overnight), with the 30yr -3.7bp lower. Bonds were supported by a solid 10yr auction which saw $38bn of bonds sold at a 3.999% yield. On the other hand, the 2yr sold off +5.7bps, with 2s10s slope falling to -80.0bps. The short-end sell off saw Fed pricing for end-24 rise +7.2bps to 4.04%. However, terminal rate pricing for November was unchanged at 5.41%. Indeed, it is remarkable how stable near-term Fed expectations have been in recent weeks, with November pricing staying within a 7bps range since late June. Back in Europe, bunds saw a moderate sell off (2yr +4.4bps, 10yr +3.0bp).

In other European news, Italy’s windfall tax on banks continued to drive markets but this time the news we discussed yesterday morning around the Italian government clarifying that there would be a smaller impact than first thought led to a decent sized rally. Italian banks gained +3.65% on the back of the announced cap on the levy. This reversed slightly less than half of their Tuesday’s decline, with the overall Euro banks index (+1.42% after losing -3.54% the day before) also seeing a partial reversal. Meanwhile, we heard from Italy Prime Minister Meloni, who defended the tax claiming that rate hikes were mostly not being matched by increases in bank deposit rates, while also calling the efficacy of ECB rate hikes “questionable”.

The broader European indices reversed a fair amount of Tuesday’s decline. The DAX (+0.49%), CAC (+0.73%), FTSE MIB (+1.31%) and FTSE 100 (+0.80%) all posted solid gains, though this was in large part a catch up to the strong US close the previous day and the better Italian bank news.

As discussed at the top, there were a few stories of note in the commodities space. WTI crude oil (+1.78%) reached a 9-month high at $84.40/bl, though Brent (+1.60% to $87.55) stayed a touch below its YTD highs reached in January. There was no clear driver on the day, but with a preponderance of supply risks supporting a tight oil market narrative. Oil prices are on course to post a seventh consecutive week of gains, which for Brent would be its longest run since early 2022. In Europe, TTF natural gas prices spiked in Europe (+27.2%), as LNG supply risks reared their head with news of a possible strike that could affect LNG export facilities in Australia. Still, at EUR 39.50/MWh prices are at 13% of their peak last August (though around double their pre-Covid levels). And with EU gas storage 88% full, physical supply risks are low. Our economists note that the higher futures pricing for the upcoming winter, at around EUR 55/MWh, is broadly in line with their baseline and will include a degree of seasonal risk premium. So while gas price rises are a risk amid a tight global LNG market, it is the oil story that is more relevant in terms of the immediate impact on inflation. So a more pressing thing to watch for immediate Euro headline inflation.

Elsewhere, copper had seen a sizeable intra-day rebound after recent declines amid increased hopes for more stimulus in China, though it was up a more modest +0.45% at the close. When it comes to China’s outlook, our China economists published their latest chart book yesterday, in which they outline why they see a turning point for policy and growth, although the property sector remains a source of risks. See here for more. Indeed, China’s property woes have been in the headlines this week amid missed coupons by property developer Country Garden.

Asian equity markets are mostly trading lower this morning with Chinese equities leading losses across the region with the Hang Seng (-0.94%) emerging as the biggest underperformer followed by the CSI (-0.49%) and the Shanghai Composite (-0.26%) Additionally, the nation’s property issues continue to dent sentiment as Country Garden, one of the largest non-state-owned developers by sales missed interest payments on two bonds earlier this week, thus undermining confidence in the sector. Elsewhere, the KOSPI (-0.42%) is also losing ground while the Nikkei (+0.45%) managing to stay in the green.

Early morning data showed that Japan’s wholesale inflation (+3.6% y/y) slowed for a seventh consecutive month in July, down from June’s upwardly revised figure of +4.3% (v/s +3.5% expected)

Overnight, in the UK, the RICS house price balance survey for July saw a stronger-than-expected deterioration to -53% (-51% exp, -48% prev.), which marks a new post-GFC low as interest rates rise.

On the data front today, we have the all-important CPI print in the US. Aside from this, we will get the latest weekly claims data and monthly budget statement in US, while in Europe we have the final July CPI prints in France and Italy. With 90% of S&P 500 companies having now published their Q2 results, upcoming earnings releases are weighted towards Europe with today’s results including Novo Nordisk, Alibaba, Siemens, Deutsche Telekom, Allianz, Tokyo Electron, Orsted, RWE, Rheinmetall and HelloFresh.