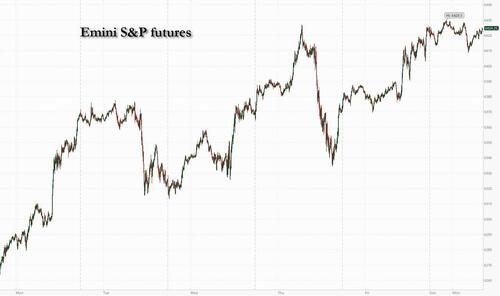

US equity futures are up small with Russell/small caps outperforming, and yields dip at the start of a data-heavy week that will be pivotal for the Fed's rate cuts later this year. As of 8:00am ET, S&P 500 contracts rose 0.2% after the index ended Friday just shy of a record high; Nasdaq futures were flat. In premarket trading, AMD fell 2.3% and NVDA was 1% lower after the chipmakers agreed to remit to the US government 15% of their revenue from AI chip sales to China in exchange for export licenses. Bond yields are lower as the curve flattens and the USD rises. Cmdtys are lower with Energy/Metals weaker but Ags stronger. Meanwhile, Trump asked China to increase soybeans purchases 4x ahead of tomorrow's trade deadline although Lutnick last week said another extension is likely. Geopolitics is also in focus with a larger impact on EMEA and the Trump/Putin summit this Friday. Bitcoin rises back to $122K and Ethereum surge to $4350 overnight, hitting the highest since 2021. There are no major macro data prints today but market will focus on CPI on Tuesday.

In premarket trading, Mag7 stocks are mixed: Tesla +1.2%, Microsoft +0.3%, Amazon +0.2%, Apple -0.5%, Meta +0.06%, Alphabet -0.2%, Nvidia -0.6%. Here are some other notable premarket movers:

After last week’s Big Tech rally took the Nasdaq 100 to fresh highs, prospects for further gains rest with an inflation reading that may help persuade the Fed to cut interest rates and hopes for US-Russia talks over the war in Ukraine. Tomorrow's release of July inflation data will give traders a chance to assess the impact of tariffs on consumer prices amid growing signs of a cooling labor market. Swaps are currently pricing in an 80% probability of a quarter-point rate cut in September, with core inflation expected to have risen 0.3% in July from June. “That is a number that can probably be seen as acceptable for the Federal Reserve to proceed with a September cut,” noted ING Groep NV currency strategists.

Ironically, this means the Fed will cut when a record number of investors think US stocks are too expensive, according to the latest Bank of America Fund Managers survey. About 91% of participants indicated that American stocks are overvalued, the highest-ever proportion in data going back to 2001. While investor allocation to global equities climbed to the highest since February, a net 16% were still underweight the US, the poll showed.

Among other economic data in the coming week, a Fed report is likely to show stagnant factory output as manufacturers contend with evolving tariff policy. Friday’s July retail figures are expected to show a solid gain as incentives helped fuel vehicle purchases and Amazon’s Prime Day sale drew in online shoppers.

European stocks surrendered early gains as traders dialed back optimism that a meeting between US President Trump and Russian President Putin raises the likelihood of ending the war in Ukraine. The Stoxx 600 is flat as gains in health care and telecommunication shares are offset by losses in industrial and travel. Wind power firm Orsted A/S fell as much as 29% in Denmark on the back of a $9.4 billion rights issue announcement. Here are the biggest movers Monday:

Earlier in the session, Asian equities edged higher amid expectations geopolitical tensions may relax, ahead of a meeting between US and Russian leaders. Shares gained in China. The MSCI AC Asia Pacific Excluding Japan Index rose as much as 0.4%, with SK Hynix and Alibaba among the top contributors. Lithium stocks jumped after a suspension at Contemporary Amperex Technology Co.’s mine eased oversupply concerns. Key gauges advanced in Indonesia and mainland China. Markets were closed in Japan and Thailand for a holiday. Some chip stocks in the region declined after Nvidia and AMD agreed to pay 15% of their revenues from China to the US government as part of a deal with the Trump administration to secure export licenses. Analysts said the move is mostly priced in.

“Asian markets are set to remain on high alert ahead of an eventful — and potentially historic — week that could force investors to reassess risk exposure,” said Hebe Chen, an analyst at Vantage Markets in Sydney. Additionally, any breakthrough in US–China tariff truce “would likely fuel further gains in Asian equities and commodities, while a breakdown could unleash a wave of disappointment and sharp risk-off flows across the region,” Chen said.

In FX, the Bloomberg Dollar Spot Index is flat. The Norwegian krone outperforms its G-10 peers, rising 0.4% against the greenback after CPI topped estimates.

In rates, the yield on 10-year Treasuries slipped two basis points to 4.27%, supported by wider gains in gilts which fell 4bps stoked by UK wage-growth data, and edging toward a three-month low of 4.18% touched last week. The dollar was little changed. US yields are 1bp-2bp richer across tenors with curve spreads little changed; 10-year is near 4.265%, trailing UK’s by 1.5bp while Germany’s lags by ~2bp. Monday’s US session has no calendar events, but weekly slate includes July CPI and PPI reports that could influence pricing for Federal Reserve interest-rate cuts later this year.

In commodities, gold futures in New York declined as traders awaited clarification from the White House over its tariff policy. Lithium prices and stocks spiked after battery giant Contemporary Amperex Technology (CATL) halted operations at a major mine in China. Brent crude futures fall 0.1% to $66.50 a barrel. Spot gold falls $40. Bitcoin rises 2.5% toward a record.

Meanwhile, Bitcoin approached an all-time high, supported by strong demand from institutional investors and corporate buyers, which are helping to lift the entire cryptocurrency market.

Looking ahead, there is no US economic data or Fed speakers are scheduled for Monday. Ahead this week are CPI, PPI, retail sales, Empire manufacturing, industrial production and University of Michigan sentiment, and appearances by Fed’s Barkin, Schmid, Goolsbee and Bostic

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly in the green but with gains limited and price action contained in the absence of notable catalysts from over the weekend and with Japanese markets closed for a holiday. ASX 200 notched a fresh intraday record high with lithium miners boosted after CATL temporarily suspended operations at the Jianxiawo lithium mine in China. Hang Seng and Shanghai Comp kept afloat following reports that the US licenced NVIDIA to export chips to China, with the Co. and AMD to pay 15% of China chip revenue to the US government, although gains were capped as participants continued to await an extension to the US-China tariff truce deadline which expires on Tuesday, while inflation data from China was mixed as CPI topped estimates to print flat Y/Y but coincided with a deeper-than-expected deflation in factory gate prices.

Top Asian News

European bourses began the session on the front foot, attempting to add to a two-day win streak, though early morning gains pared amid pressure in the risk tone alongside the opening of the US Premarket: NVIDIA (-1.4%), AMD (-2.7%), after reports that they will pay 15% of China chip revenues to the US government, according to FT. European sectors opened almost entirely in the green, though in line with the broader risk tone, have since turned more negative. Healthcare outperforms after Novartis (+2.2%) said both Ianalumab Phase III clinical trials met primary endpoints. Utilities lags, dragged down by Orsted (-27%) after a DKK 60bln rights issue.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

As we move into mid-August, markets are bracing for a surprisingly busy week, with several key events and data releases likely to shape sentiment. The most closely watched will be tomorrow’s US CPI report, which could prove to be one of the larger events of the summer for markets.

Also on the radar is Friday’s high-stakes meeting between Donald Trump and Vladimir Putin in Alaska as the US has pushed for a ceasefire in Ukraine. Last Friday Trump said a deal would involve “some swapping of territories” with reports suggesting that it would see Ukraine ceding Russia the parts of Donbas that it still controls. Ukraine’s President Zelenskiy was quick to reject the idea and European leaders have called for any peace talks with Russia to include Kyiv. Bloomberg reported yesterday that European leaders are seeking to speak with Trump before his meeting with Putin.

Elsewhere, tomorrow marks the deadline for the pause in levies between the US and China, and markets will be watching closely to see whether the truce is extended. There are also expectations that the long awaited pharmaceutical and semiconductor sector tariffs will be announced by the US.

Beyond geopolitics, the economic calendar is busy even beyond the CPI release. In the US, we’ll also get PPI data on Thursday, retail sales figures that may show a boost from Amazon’s extended four-day Prime Day event (up from two days previously), and industrial production numbers on Friday. Internationally, Japan’s PPI is due Wednesday, while China’s monthly data dump arrives Friday. Tomorrow also brings Germany’s ZEW survey and UK labour market statistics, followed by Q2 GDP releases for the UK on Wednesday and Japan on Friday.

Central banks will also be in focus. Australia announces its rate decision tomorrow, with Deutsche Bank expecting a cut, while Norway follows on Thursday, after CPI releases today from both Denmark and Norway.

Turning to tomorrow’s US CPI, Deutsche Bank economists expect a 2.4% decline in seasonally adjusted gas prices to weigh on the headline figure, forecasting a +0.24% monthly increase versus +0.29% previously. In contrast, core CPI is expected to rise +0.32%, up from +0.23%. This would push year-over-year growth rates for headline and core CPI up by a tenth to 2.8% and 3.0%, respectively, with a risk that core rounds up to 3.1%.

Shorter-term trends for core inflation are expected to be mixed. The three-month annualised rate is projected to rise three-tenths to 2.7%, while the six-month rate is seen falling by the same amount to 2.4%. Our Economists also anticipate a notable increase in core goods categories (+0.42% vs. +0.20%), which are already showing signs of tariff-related price pressures. This impact is expected to extend to vehicle prices as well. It’s worth recalling that last month’s headline CPI appeared soft, but rates still sold off as the underlying details revealed growing evidence of tariff-driven inflation.

Thursday’s PPI report is expected to show a +0.2% increase for both headline and core, with attention focused on categories feeding into core PCE. Deutsche Bank is currently tracking a +0.31% increase for July’s core PCE, which would lift the year-over-year rate to 2.9%, with rounding risks toward 3.0%.

Fed commentary will also be in the spotlight. Richmond Fed President Thomas Barkin (non-voter) speaks tomorrow following the CPI release. On Wednesday, Chicago’s Austan Goolsbee (voter) and Atlanta’s Raphael Bostic (non-voter) will share their views. Bostic recently reiterated his expectation for one rate cut this year, despite increased risks to the labour market outlook following the July employment report. Markets are likely to pay closer attention to Goolsbee, given his voting status at the upcoming September 17 FOMC meeting and his previous concerns about the inflationary impact of tariffs.

Rounding out the week, corporate earnings in the US will feature Cisco, Applied Materials, Deere and CoreWeave. In China, investors will be watching results from Tencent, JD.com and Lenovo.

Asian markets are slightly higher this morning, with the Hang Seng (+0.19%), Shanghai Comp (+0.51%), and S&P/ASX 200 (+0.32%) all in positive territory. S&P 500 (+0.14%) and Nasdaq (+0.13%) futures are also edging higher. In an unusual move, Nvidia and AMD have agreed to pay the US 15% of its revenues from AI chip sales to China.

Elsewhere, the KOSPI is flat and Japan is closed for a holiday. Over the weekend, China released their latest inflation data, with yoy CPI at 0.0% (vs. -0.1% expected) and yoy PPI at -3.6% (vs. -3.3% expected).

Recapping last week now and Equities continued their upward momentum, with the S&P 500 climbing +2.43% overall and gaining +0.78% on Friday alone, ending the week just a whisker—less than 0.01%—from its all-time high. Technology stocks led the charge, as the Nasdaq advanced +3.87% (+0.98% on Friday), while the Magnificent 7 surged +5.42% over the week (+1.54% on Friday). In Europe, the Stoxx 600 posted its strongest weekly performance since early May, rising +2.11% (+0.19% on Friday). The DAX gained +3.15% despite a slight pullback on Friday (-0.12%), and the FTSE MIB rallied +4.21% (+0.56% Friday), buoyed by optimism surrounding potential talks between the US and Russia over Ukraine.

These gains came in spite of fresh US tariffs that took effect on August 7. President Trump announced that imported semiconductors could face tariffs of up to 100%, though exemptions would apply to companies pledging to manufacture domestically. Pharmaceutical tariffs are also set to be phased in gradually, reaching as high as 250% over the next 18 months. Further details on these measures are expected in the coming week. In a surprise move on Friday, Trump also declared that gold bars would be subject to tariffs of up to 39%, a development that helped December gold futures rise +2.69% over the week (+1.09% on Friday). Earlier in the week, he also announced a doubling of tariffs on India to 50% in response to its purchases of Russian oil. However, Brent crude prices fell -4.42% on the week to two-month lows, as the implementation of these tariffs was delayed by 21 days and amid anticipation of the upcoming Trump-Putin meeting.

On the data front, the US July ISM services index disappointed, coming in at 50.1 versus expectations of 51.5. The employment component contracted further, while the prices paid index rose to its highest level since October 2022, fuelling concerns that tariffs may be nudging the US economy toward a stagflationary path. Meanwhile, Trump nominated Stephen Miran, Chairman of the Council of Economic Advisers, to temporarily fill Governor Kugler’s seat on the Federal Reserve Board.

In fixed income, 10-year Treasury yields rose +6.6bps over the week (+3.3bps on Friday) to 4.28%, pressured by soft demand across the week’s 3-year, 10-year, and 30-year auctions. In Europe, economic data was more encouraging, with the euro area’s July composite PMI rising to 50.9 from 50.6 in June. This prompted markets to scale back expectations for ECB rate cuts, with just 13bps of easing now priced in by year-end, down -2.4bps on the week. German 10-year bund yields rose +1.1bps over the week, including a +5.9bps jump on Friday.

Finally, the Bank of England delivered a 25bp rate cut to 4.00%, but the decision was far from straightforward. The initial vote split was an unprecedented 4-4-1, with four members favouring no change. A second vote was required to reach a 5-4 majority—something never seen before in the Bank’s history. Market pricing for the BoE’s policy rate at the end of 2025 rose +11.7bps over the week, with 17bps of easing now expected by December. The FTSE 100 underperformed its European peers, rising just +0.30% on the week. Our UK economist, Sanjay Raja, now anticipates one further rate cut from the BoE this year