Global stocks rose, US index futures jumped and bitcoin erupted higher ahead of closely-watched earnings from tech gigacaps Microsoft and Alphabet later today (full preview here). As of 8:00am ET, S&P futures were up 0.6%, at session highs and set to snap a five-day losing streak with Nasdaq futures also higher by 0.6%. Treasuries stabilized, with the US 10-year yield dropping as low as 4.80% before reversing gains, amid growing speculation that the recent selloff was excessive. Treasury 10-year yields slipped as much as five basis points to a one-week low before paring the move. Europe’s Stoxx 600 index edged higher.

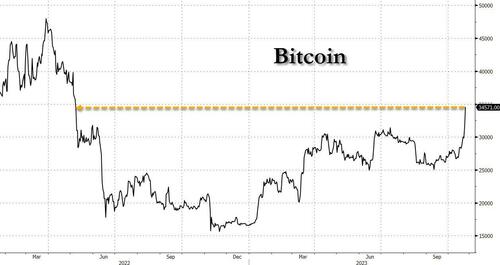

Bitcoin topped $35,000, rising to the highest level since May 2022, while the euro swung to a loss against the dollar as data showed the French and German economies struggling.

In premarket trading, shares in cryptocurrency-linked companies gained in US premarket trading, with Marathon Digital, Riot Platforms, Hut 8 Mining and Cleanspark all surging at least 12%. Nvidia and Arm Holdings rose, set to extend gains, after Bloomberg reported that Nvidia is using Arm technology to develop processors in personal computers. Intel shares were on track to fall for a third consecutive session. NVDA up 1.6%. ARM shares rise 2.6%. Spotify was down 2.5% even as third-quarter results and fourth-quarter guidance beat the average analyst estimate. Its forecast for monthly active users was also better than expected. Citi wrote that the stock’s negative reaction was surprising. Here are some other notable premarket movers:

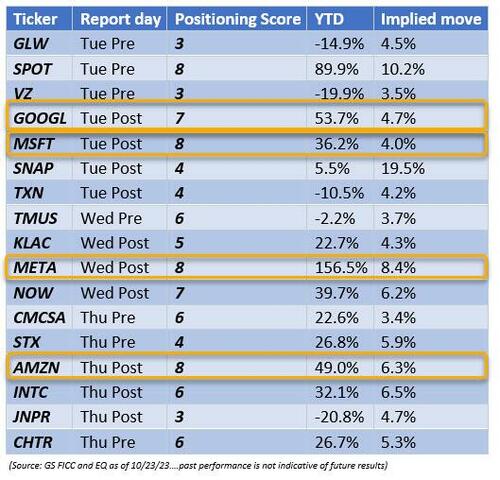

As noted earlier, all eyes now turn to the giga caps tech companies with MSFT and GOOGL reporting after the close today(full preview here). Mark Haefele, chief investment officer at UBS Global Wealth Management, said he expects a strong outcome from top technology and growth firms, despite the earnings season’s sluggish start so far.

Treasuries have stadied after some of the market’s most prominent bears warned of an economic slowdown, sparking bets the declines have overshot and that the Federal Reserve will need to lower interest rates. Wild swings in government debt are unsettling investors as a resilient economy makes it hard to work out when the Fed will halt rate hikes. Surging government issuance and geopolitical tensions are also clouding the outlook.

“I don’t think you should be pounding the table saying this is the absolute best time to buy,” said Patrick Armstrong, chief investment officer at Plurimi Wealth LLP. “But I would not be shorting."

Brent crude halted two days of losses, climbing above $90 per barrel. French President Emmanuel Macron called for an international coalition to fight Hamas and warned other Iranian-backed militant groups not to open new fronts in the war, as he met with Prime Minister Benjamin Netanyahu during a trip to Israel.

European stocks are also higher with the Stoxx 600 rising 0.2% as it looks to snap a 5-day losing streak; basic resources and utilities stocks as the biggest outpeformers, while banks and automobiles lead declines as Barclays shares slumped after a trading division miss and lower guidance. Here are some of the biggest European movers:

As Bloomberg's Jan-Patrick Barnert notes, European stock market declines the past few months have been broad-based across major benchmarks, but with the correction now at 10% or more in several regions, there could be a rebound coming, given oversold conditions and the Stoxx 600 at a major technical level. All that is needed would be convinced buyers.

However, that may be a tough call. Headline risks from geopolitics are far from over, plus there’s ongoing uncertainty regarding the European economic cycle — and more importantly tightening credit. There is some doubt if investors are already in the dip-buying mood. Instead, they may move hedging away from one-day event risk to adjusting positions that they can work with even among longer term unknows. This could finally spur some cautious dip-buying.

Earlier in the session, Asian stocks swung between gains and losses, as investors looked to corporate earnings and Treasury market moves for cues after the regional stock benchmark tumbled to an 11-month low on Monday. The MSCI Asia Pacific Index closed up 0.3%. In Asia, most Chinese stock gauges rose after the nation’s sovereign wealth fund bought exchange-traded funds to shore up prices. The rebound in Chinese equities “shows that while it may still be too early to call a bottom, the authorities are making it a rule to step on the brakes whenever there looks like there’s overwhelming downward momentum,” said Raymond Chen, fund manager at Zizhou Investment Asset Management.

The Hang Seng Index fell to its lowest level since last November as trading resumed after a holiday. Japanese stocks declined, with EV and tech supplier Nidec tumbling 10% after a quarterly earnings miss. Stocks climbed in Singapore and Indonesia. The volatile session follows a four-day slide in the key regional gauge, amid concerns over China’s economy as well as geopolitical risks in the Middle East and high US interest rates. Traders were closely monitoring moves in bond markets after some prominent investors said the historic rout in US Treasuries has gone too far. Treasury 10-year yields fell slightly in Asian trading.

In FX, the Bloomberg Dollar Spot Index is flat. The Aussie is the best performer among the G-10’s, rising 0.4% versus the greenback.

In rates US treasuries were mixed, reversing gains that initially pushed 10-year yields back below 4.80%, with the curve flatter as front-end trades cheaper on the day, unwinding a portion of Monday’s aggressive rally. Long-end Treasuries outperformed, with 30-year yields little changed; 10-year yields were around 4.865% and slightly cheaper on the day after breaching 4.80% in early London session, trailing bunds and gilts by 6bp and 4bp in the sector; long-end outperformance in Treasuries flattens the curve, tightening 2s10s, 5s30s spreads by 2.5bp and 3bps. In Europe, bunds outperform after October PMI figures for Germany and euro-area broadly miss median estimates. US auction cycle starts with 2-year note sale at 1pm New York time. The Treasury auction cycle includes $51b 2-year note, followed by 5- and 7-year notes Wednesday and Thursday. The WI 2-year yield at ~5.05% is 3.5bp richer than September’s auction, which stopped on the screws. The dollar IG issuance slate empty so far after just one deal was priced on Monday; around $20 billion in new bond sales are expected this week.

In commodities, oil prices advance, with WTI rising 0.4% to trade near $86. Spot gold falls 0.4%.

Bitcoin surges over 8%, fueled by expectations of fresh demand from exchange-traded funds.

Turning to the day ahead. In terms of data, we have the global flash PMIs for October in the US, UK, Japan, Germany, France, and the Eurozone. In the US, we also have the October Philadelphia Fed non-manufacturing activity (8:30am), S&P Global PMIs (9:45am) and Richmond Fed manufacturing index (10am). In the UK, we have the September jobless claims change results and the August unemployment rate, as well as the German November GfK consumer confidence, and the Euro Area Bank Lending Survey. Finally, we have earnings releases from both Microsoft and Alphabet, as well as Visa, Coca-Cola, Danaher, Texas Instruments, Verizon, General Electric, NextEra Energy, Fiserv, HCA Healthcare, General Motors, and Dow Inc.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following a similar lead from Wall Street with Mainland China leading the gains overnight. ASX 200 traded in the green with the upside led by Metals & Mining following the prior session’s gains in the complex, although gold names lag after the precious metal unwound some geopolitical risk premium after the weekend. Nikkei 225 gave up the 31k level in early trade as the prior day’s firming of the JPY weighed on the export-heavy index. Hang Seng and Shanghai Comp opened mixed with the former playing catch-up following its long weekend, whilst the latter gained as reports also suggested US and China held the first working group meeting.

Top Asian News

European bourses were initially pressured from soft PMIs and as EZ credit standards continued to tighten. Since then, the space has recovered back into the green as newsflow slows somewhat but has featured favourable updates that Israel is willing to delay its Gaza ground invasion by a few days, Euro Stoxx 50 +0.5%. Within Europe, sectors are being dictated by earnings with Basic Resources outperforming after favourable reports from sector heavyweights while Banking names lag post-Barclays. US futures have been directionally in-fitting but with magnitudes slightly more contained than those in Europe, ES +0.4% and above 4250; NQ +0.7% continues to outperform ahead of numerous mega-cap corporate updates incl. Microsoft & Alphabet. General Electric Co (GE) Q3 2023 (USD): Adj. EPS 0.82 (exp. 0.56), Adj. Revenue 16.50bln (exp. 15.7bln). Raises FY Adj. EPS view 2.55-2.65 (prev. 2.10-2.30; exp. 2.36), FY organic Revenue view "low teens" (prev. "low double digits"). +6.0% in pre-market trade.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Israel-Hamas

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Back from Center Parcs via our now seemingly annual trip to the drive through safari where amongst other things monkeys climb over our car looking for nuts and ripping off the rubber lining from our roof rack. The kids are off to football and swimming camp today while I go back to "trying to explain and predict wild bond market swings" camp in London.

Indeed, while it was very difficult to pinpoint the exact reasons curves steepened so much last week, even if you were sympathetic to the move, yesterday it was even harder to explain the intra-day Treasury price action asboth 10 and 30yr yields traded in a near 20bps range after the former crossed 5% for the first time since 2007 in the London morning before closing at 4.85%. Both Treasuries and the S&P 500 sold off notably at their respective opens, before reversing these losses even if the equity gains weren’t held taking the S&P (-0.17% at the close) to the lowest level since May and declining for five days in a row for the first time this year.

The main talking points of note were the further delays in Israel’s ground invasion of Gaza, market veteran Bill Ackman revealing he closed a publicly vocal short in US Treasuries that he announced in August, and PIMCO co-founder and fellow veteran Bill Gross writing that he was buying SOFR futures as he said recent data points to a significant slowdown. So, as we hit 5% the famous and not so famous buyers seemed to come out of the woodwork. Looking forward, watch out for Microsoft and Alphabet earnings after the bell today as these alone account for around 10% of the S&P 500. Earlier in the day the flash PMIs will be out with most attention on Europe and the manufacturing sector to see if there is any rebound.

So the main story over the last 24 hours has been US Treasuries. Having peaked at 5.02% just before London lunch, 10yr US yields closed -6.4bps lower on the day at 4.85%. 30yr yields fell -7.6bps to 4.9995%, having been +10.1bps higher at 5.17% earlier while 2yr yields rallied -8.4bps off the intra-day highs to close down -2.6bps at 5.07%. Resultingly, the 2s30s and 2s10s curves flattened -5.2bps and -4.0bps respectively after the huge steepening last week.

European yields were far less volatile but mapped the same course, as 10yr Bund yields declined -1.5bps, whilst 2yr yields gained +1.2bps. 10yr BTPs outperformed (-8.5bps) as S&P affirmed Italy ratings late on Friday. Today, we will have the release of the latest quarterly ECB bank lending survey, which will add further colour to the direction of future ECB policy. Recent quarterly reports have suggested very tight lending standards, but with the future expectations series looking more optimistic. We will see if that holds true. See our Europe economists’ recent note on the theme for more (link).

Over in equity markets, the S&P 500 index initially dropped -0.83% at the open but bounced after the US fixed income rally intensified. Indeed, the index broke below the 4,200 level in the first hour of intraday trading, a 50% retracement of its gains since the mid-March regional banking turmoil and its lowest level since June. Eventually the index closed at 4,217 or -0.17% lower on the day. The index was as much as +0.75% better by midday in NY but could not hold on to those gains through the afternoon.

Energy proved the weakest link on a sector-by-sector level, falling -1.62% off the back of retreating oil prices, followed by materials (-1.07%) and financials (-0.86%). Energy also seemed to sag as there was further M&A announced in the space, which weighed on the largest constituents. Chevron proposed a $53bn takeover of Hess Corp, which follows shortly after Exxon Mobil earlier this month acquired Pioneer Natural Resources. This comes despite the global push toward renewable energy as energy companies have largely deleveraged this cycle and as oil prices have continued to look buoyant.

Elsewhere, the FANG+ Index of megacap stocks wavered between gains and losses, dropping around -1.0% at the open before closing the day up +1.14%. Tesla successfully broke its three-day streak of consecutive losses, by finishing just better than unchanged (+0.04%) on the day. In line with the strong performance of the tech giants, the NASDAQ rose +0.27%. Over in European equities , the tough early session backdrop weighed on the STOXX 600’s performance before the later US rally. The index retreated -0.13%, driven by basic resources (-1.07%), telecoms (-0.95%) and energy (-0.78%).

Turning to recent developments in the Middle East, Israel has held off its anticipated ground invasion as efforts to free Hamas’ hostages continue, alongside reports Israel was reassessing the scope of its incursion. Although Israeli forces continued airstrikes and raids on Gaza on Monday, the delay of the broader invasion was read positively by the market. Accordingly, concerns about oil supply eased, and WTI crude subsequently slipped -2.97% to $86.11/bbl, and Brent by -2.53% to $89.83/bbl. The gold safe-haven play lost its sheen after spot prices fell by -0.43% to $1,973/ounce. The ratio of copper to gold, which is historically a good barometer of global growth, bounced off its lowest reading since November 2020 after having moved sharply lower since the start of the month.

Overnight in Asia, S&P and Nasdaq are up +0.25% and +0.34% respectively with other regional bourses off their session lows but bouncing back as the session nears the close. This still leaves the MSCI Asia benchmark gauge down -0.78% as I type, on track for its lowest level since last November. Kicking off the global flash PMIs, the preliminary October result for Japan recorded a decline from 52.1 to 49.9, putting it into contractionary territory. This was largely driven by a fall in the services sector, which fell from 53.8 last month, to 51.1. Off the back of this, the Nikkei 225 traded down -0.55%. Elsewhere in Asia, the Hang Seng has slipped -0.79%, and the Kospi -0.29%. Chinese equities have outperformed, with the Shanghai Comp in the green at +0.28%, whilst the CSI 300 is modestly down at -0.08%.

In Asian fixed income, the Bank of Japan announced another unscheduled bond purchasing operation to limit rising yields. This is the fifth such an operation since the central bank adjusted the yield curve control program back in July, as the global rout in sovereign debt puts upward pressure on yields. 10yr yields now trade at 0.86%, down from 0.88% in the previous session, but remain around decade highs. US Treasuries are surprisingly quiet after yesterday's rollercoaster with 10yr yields -0.8bps but with 2yrs +1.7bps higher.

In other news from yesterday, we had the release of the US Chicago Fed national activity index, which came in above expectations at 0.02 (vs -0.14 expected), up from -0.22, yet another indicator pointing to the better-than-expected strength of the US economy. Europe consumer confidence was largely unchanged in October, as the preliminary Eurozone consumer confidence survey for October came in above expectations at -17.9 (vs -18.2 expected), a modest fall from September’s result of -17.8.

Now turning to the day ahead. In terms of data, we have the global flash PMIs for October in the US, UK, Japan, Germany, France, and the Eurozone. In the US, we also have the October Richmond Fed manufacturing index, business conditions, and the Philadelphia Fed non-manufacturing activity. In the UK, we have the September jobless claims change results and the August unemployment rate, as well as the German November GfK consumer confidence, and the Euro Area Bank Lending Survey. Finally, we have earnings releases from both Microsoft and Alphabet, as well as Visa, Coca-Cola, Danaher, Texas Instruments, Verizon, General Electric, NextEra Energy, Fiserv, HCA Healthcare, General Motors, and Dow Inc.