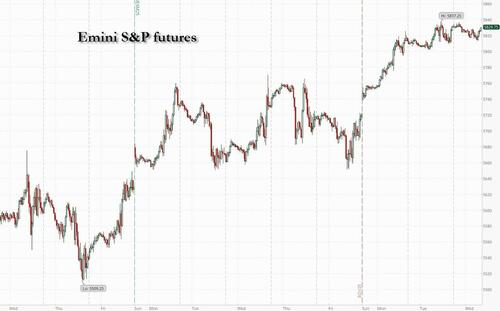

US equity futures are flat, reversing earlier losses while global markets were mixed (Europe down, Asia up) as investors awaited more clarity on US tariff plans and the economic outlook before Donald Trump’s April 2 "Liberation Day" deadline to impose a fresh reciprocal tariffs. As of 8:00am ET, S&P futures were up 0.1% following modest gains on the indexes on Tuesday, while Nasdaq futures were flat as Tesla and Nvidia shares edged lower, pressuring the Mag 7. Europe’s Stoxx 600 index dropped 0.5%. Bond yields are 1-3bp higher and USD is higher. Commodities are mostly higher led by oil and base metals. Copper futures in New York surged to a record high (up 1% now after easing off records) as traders priced in the possibility of hefty import tariffs that may come within several weeks. Headlines were mostly quiet since market close yesterday. Today's economic calendar includes Feb durable goods orders at 8:30am; Fed speaker slate includes Kashkari (10am) and Musalem (1:10pm).

In premarket trading, video game retailer GameStop jumped 14% after the struggling video-game retailer that became a favorite of retail traders during the meme stock frenzy said its board approved a plan to add Bitcoin as a treasury reserve asset. Tesla and Nvidia lead losses among the Magnificent Seven stock (Alphabet -0.4%, Amazon +0.2%, Apple +0.1%, Microsoft -0.1%, Meta +0.1%, Nvidia -1.4% and Tesla -1.2%). Dollar Tree (DLTR) rises 2% as the company will sell its Family Dollar chain for about $1 billion to Brigade Capital Management and Macellum Capital Management a decade after buying the business. Here are some other notable movers:

The tariffs issue remains front and center for investors, who took comfort earlier this month from the Trump adminstration’s signal that the coming wave of levies may be less expansive and more targeted than originally feared. However, the president has since sown confusion by saying he didn’t want too many tariff exceptions, but he would “probably be more lenient than reciprocal.” All that has left investors struggling to work out how to position ahead of the April 2 deadline that Trump has dubbed “Liberation Day.”

“Uncertainty on the tariff front remains ridiculously high, leaving it incredibly tough for businesses or consumers to plan more than about a day into the future, and still making it nigh-on impossible for market participants to price risk,” said Michael Brown, a strategist at Pepperstone Group Ltd.

European stocks retreated on lingering jitters about US tariffs. UK mid-caps rise on an unexpected cooldown in inflation before a key budget statement from the government later in the day. The Stoxx 600 fell 0.6% to 549.21 with 366 members down, 223 up and 11 unchanged. In Britain, the FTSE 250 gauge of mid-sized stocks advanced about 0.5%, as data showing an unexpected inflation slowdown strengthened the case for the Bank of England to cut interest rates. Here are some of the biggest movers on Wednesday:

Earlier in the session, Asian equities rose, heading for their first advance in four days, helped by gains in Chinese technology heavyweights and a rally in Indonesia’s market. The MSCI Asia Pacific Index climbed as much as 0.5%. Nintendo Co. was among the biggest contributors after Goldman Sachs reinstated coverage of the Japanese games maker with a buy rating. Samsung Electronics, Alibaba and Tencent were among other major stocks buoying the regional benchmark. The Jakarta Composite Index jumped 4%, the most in the region, after several state-owned banks increased their dividend payouts. Stocks in Australia closed higher after the government unveiled tax cuts and other sweeteners in a pre-election budget. Chinese equities listed in Hong Kong also gained. Morgan Stanley strategists raised their targets for the nation’s equities for the second time in a little more than a month, citing upside for valuations amid an improving outlook for earnings. A gauge of Chinese tech shares in Hong Kong rebounded after falling to the brink of a technical correction in the previous session.

In FX, the dollar is little changed, supported on the view that the US would limit exceptions to the next tranche of tariffs expected next week. The Bloomberg Dollar Spot Index rose 0.1% before paring gains during the European session; it is on track to gain for the five of the last six days.

In rates, treasuries edged lower as investors await speeches by Federal Reserve officials later in the day for more steer into the US interest rate outlook. Treasury yields are 1bp-3bp cheaper across a slightly steeper curve, with 5s30s spread around 1bp wider on the day; 10-year, 3bp higher near 4.35%, trails bunds and gilts in the sector by 2bp and 5bp.

Gilts outperform, led by front-end tenors as swaps price in additional easing by Bank of England after UK February CPI data rose less than estimated. UK 2-year yields are more than 5bp lower on the day after the inflation data, steepening the gilts curve. Treasury auction cycle continues with $70 billion 5-year note sale at 1pm New York time, following good demand for 2-year notes on Tuesday. It concludes with $44 billion 7-year note auction Thursday

In commodities, copper futures in New York surged to a record high as traders priced in the possibility of hefty import tariffs that may come within several weeks. WTI oil edged higher after an industry report signaled a large decline in US crude stockpiles, while the market weighed the prospect of a Russia-Ukraine ceasefire in the Black Sea. Gold extended gains, rising 0.6% to $3,027.

Looking to the day ahead now, data releases include the preliminary durable goods orders for February. Meanwhile from central banks, we’ll hear from the Fed’s Kashkari and Musalem, along with the ECB’s Villeroy and Cipollone.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with a mostly positive bias after the somewhat mixed performance stateside where the focus centred on tariffs, data and geopolitics including reports that Ukraine and Russia agreed with the US on a maritime ceasefire. ASX 200 was led higher by gains in the mining, resources and financial sectors in the aftermath of the recent budget announcement, while participants also digested softer-than-expected monthly inflation from Australia. Nikkei 225 reclaimed the 38,000 level with upside supported by a weaker currency and after slightly softer Services PPI data. Hang Seng and Shanghai Comp eked slight gains but with upside capped amid ongoing tariff uncertainty with a Chinese delegation to meet with the US Commerce Secretary and the USTR today to negotiate over tariffs in which they will also discuss fentanyl and trade barriers among other issues, while a PBoC adviser warned at the Boao Forum that changes in the global environment will be challenging for China and China must boost domestic demand, especially consumption.

Top Asian News

Despite a steady and firmer open European bourses now find themselves mostly in the red, Stoxx 600 -0.6%. Selling pressure picked up after the cash open with no obvious catalyst for the price action at the time. Sectors began mixed but now have a negative bias with Health Care, Chemicals and Autos bottom of the pile; the latter seemingly hit on remarks from Trump about Europeans "freeloading", reports of copper tariffs and pressure in Porsche SE on an Volkswagen impairment.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

US Event Calendar

Central Banks

DB's Jim Reid concludes the overnight wrap

Markets put in a decent performance yesterday, with the S&P 500 (+0.16%) posting a third consecutive advance for the first time since early February. The moves came despite several obstacles, including an unexpectedly large drop in the US Conference Board’s consumer confidence indicator. But ultimately investors shrugged that off, as there were still no signs that this recent survey weakness was being reflected in the hard data. Moreover, the rally got further support thanks to hopes that next week’s reciprocal tariffs wouldn’t be as bad as previously feared. So that helped to lift sentiment around the US outlook, with signs of market stress continuing to ease after the S&P 500’s correction. Indeed, the VIX index of volatility fell to its lowest level in over a month yesterday, at 17.15pts.

That story had looked quite different around the US open, when the Conference Board’s indicator was released. It showed an unexpectedly large drop in consumer confidence to 92.9 in March (vs. 94.0 expected), leaving it at its lowest level since January 2021, back when the economy was still emerging from the pandemic. Moreover, the expectations measure fell to a 12-year low of just 65.2. So that took it beneath its 2022-lows, when the Fed were still hiking rates aggressively and CPI inflation was running above 8%. But despite the negative headlines, investors were reassured by the fact that the labour market measures were still holding up. For instance, the differential between those saying jobs were plentiful versus hard to get actually moved up slightly in March, to a net +17.9%. On top of that, investors also recognised that we still hadn’t seen this deterioration echoed in the hard data yet. So they’re still waiting for more evidence before they’re willing to price a more significant economic downturn.

That more positive tone led to a fresh pickup for US equities, with the Magnificent 7 (+1.23%) leading the way once again. That group are now up +6.21% over the last three sessions, making it their best 3-day performance since the news of Trump’s election victory in early November. However, the broader equity performance was more subdued, and even though the S&P 500 advanced (+0.16%), the equal-weighted version of the index was down -0.27% and the small cap Russell 2000 (-0.66%) lost ground after its Monday surge.

Equities also got support from a fresh drop in Treasury yields, with the 10yr yield coming off a one-month high of 4.37% intraday, before closing down -2.3bps at 4.31%. Near term market expectations for the Fed were little changed, but a modest decline in 2026 pricing helped 2yr yields post a similar -2.0bps decline to 4.02%. Otherwise, we didn’t hear from many Fed speakers, but Governor Kugler sounded a patient note, saying that “FOMC policy is well positioned”, and that they could keep policy on hold “at the current rate for some time”. Meanwhile, Chicago Fed President Goolsbee said in an FT interview that the Fed wasn’t on the “golden path” of 2023-24, and that “there’s a lot of dust in the air”.

Nevertheless, he still said he thought borrowing costs would be “a fair bit lower” in 12-18 months time. Overnight, 10yr Treasury yields have reversed course again, moving up +2.1bps to 4.33%.

Over in Europe, there was an even stronger risk-on tone yesterday, with the STOXX 600 (+0.67%) recovering after three consecutive declines. That got a boost from the Ifo’s latest business climate indicator in Germany, which moved up to an 8-month high of 86.7 in March, in line with expectations. However, sovereign bonds sold off, in contrast to their US counterparts, after some hawkish comments from several ECB officials. They cast doubt on the prospect of another rate cut at the April meeting, with Croatia’s Vujcic saying that he saw the next meeting “as a completely open question.” Separately, Slovakia’s Kazimir said that he was “open to discussing either further interest-rate cuts or holding steady”, while France’s Villeroy noted that “the easing cycle is neither finished nor automatic”. So all that contributed to a rise in yields, with those on 10yr bunds (+2.7bps), OATs (+2.3bps) and BTPs (+2.1bps) all moving higher.

Elsewhere, there was a clear market reaction after the US said yesterday that Russia and Ukraine had agreed to a ceasefire in the Black Sea, as well as on the previously signalled 30-day halt to strikes against energy infrastructure. President Zelenskiy said Ukraine would implement this partial ceasefire immediately. Oil prices fell back in response, as the news eased fears about supply disruptions, with Brent trading crude falling by about 1% following the headlines to trade -0.7% lower intra-day. However, it rose back to close +0.03% on the day at $73.02/bbl, perhaps reflecting some inconsistency in the signals from the different sides. Notably, the Kremlin said the maritime ceasefire was conditional on the lifting of sanctions against Russian banks and companies involved in agricultural trade, a detail that was absent from the US statement. Still, there was a positive reaction among Ukraine’s dollar bonds, with the 10yr yield down -22.5bps on the day. And given the Black Sea’s importance for grain shipments, wheat (-0.82%) and corn (-1.29%) futures also fell back.

Overnight in Asia, markets have continued their strong performance, with decent gains for the Nikkei (+1.13%) and the KOSPI (+1.14%). Meanwhile in Australia, the S&P/ASX 200 (+0.71%) is also higher, which comes after the February CPI print was a bit softer than expected, falling to +2.4% (vs. +2.5% expected). However, there’s been a weaker performance in mainland China, where the CSI 300 (-0.19%) has lost ground this morning, and the Shanghai Comp (+0.06%) has only seen a modest increase. Looking forward, European equity futures are broadly positive, with those on the DAX up +0.22%, but US futures are very slightly lower, with those on the S&P 500 down -0.01%.

In terms of today, one of the main highlights will be the UK Government’s Spring Statement. That includes a new set of forecasts from the Office for Budget Responsibility, who are the UK’s independent fiscal watchdog, and they judge if the government are on track to meet their fiscal rules. However, because the economy has been weaker than the OBR set out last autumn, and gilt yields have also moved higher, our UK economist thinks that will remove the fiscal headroom set out at the time of the budget. In his preview for today’s event (link here), he expects fiscal consolidation near £14.5bn, comprising of welfare savings, departmental efficiency savings, and NHS reforms. And from a market perspective, he says the focus is likely to be on the size and composition of the 2025/26 gilt remit, how much fiscal headroom the government now has, and the credibility of any medium-term fiscal consolidation.

To the day ahead now, and here in the UK, Chancellor Rachel Reeves will deliver the spring statement, and there’s the CPI report for February as well. In the US, data releases include the preliminary durable goods orders for February. Meanwhile from central banks, we’ll hear from the Fed’s Kashkari and Musalem, along with the ECB’s Villeroy and Cipollone.