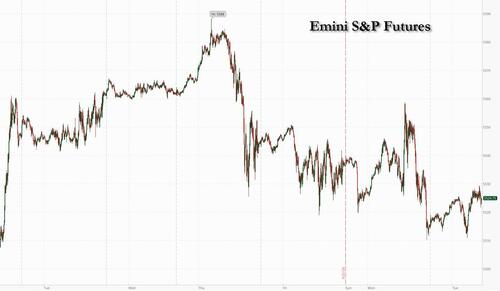

US index futures are higher, led by a rebound in the tech names in general and Nvidia in particular which rose as much as 3.5% in premarket trading after getting routed by a three-day, 13% selloff that wiped out $430 billion in market cap and saw it drop back into 3rd place behind Microsoft and Apple, after briefly becoming the world's most valuable company last week. As of 8:00am ET, S&P futures are up 0.1% while Nasdaq futures gain 0.4%. European stocks are in the red, led lower by industrial names, while Asian equities gained, snapping a three-day losing streak, as advances in value stocks helped offset weakness in the tech sector. Bond yields reversed a modest rebound and have extended their Monday drop with 10Y TSYs trading at session lows of 4.21%, down 2bps, while the USD is at session highs. Commodities are mostly lower, particularly base metals and Ags. Overnight, the news flow was relatively quiet as investors are mostly digesting the tech correction. Today, we will receive Conf. Board Consumer Confidence data at 10am. On earnings, FDX will report after market close.

In premarket-trading, the Mag 7/Semiconductor space rebounded from yesterday’s selloff: NVDA +3.1%, MU +1.5%, AVGO +1.1%, AAPL +38bp, GOOG/L +27bp, AMZN +11bp. Spirit Aero dropped 4% after Bloomberg News reported that Boeing switched its proposed funding from an all-cash offer to a deal funded mostly by stock. Here are some other notable premarket movers:

Tech shares have been the focus of US markets this week with traders rebalancing their portfolios as the quarter draws to a close. They’ve been taking profits from the AI-driven frenzy for tech stocks and switched into value shares and other laggards. The retreat in technology shares was “purely an investor/sentiment story,” Danske Bank analysts wrote in a note. “The fundamentals remain unchanged from a week ago.”

Meanwhile, there are signs that calm is returning to French markets, with yield spreads over Germany retreating from the highest level in over a decade. Jordan Bardella, the leader of the National Rally party which is leading the polls, sought to reassure investors on Monday with assurances that he will not upend the country’s finances if his party wins an absolute majority.

Later, the US Treasury kicks off this week’s trio of bond sales with an offering of $69 billion in two-year notes. Demand for the shorter, rates-sensitive debt is expected to be stronger than at last month’s offering, coming ahead of statistics on Friday that are forecast to show a slowdown in the Fed’s favored inflation gauge.

Stocks in Europe retreated 0.3% led by weakness in materials, utilities and communications sectors; markets were weighed by a drop of more than 10% for planemaker Airbus SE, which lowered its guidance amid persistent supply-chain issues. Germany’s Merck KGaA also tumbled, following a second surprise failure of a promising medicine. Here are the most notable European movers:

Earlier, Asian markets rebounded as advances in some value stocks helped offset weakness in the tech sector. The MSCI Asia Pacific Index rose as much as 1%, led by consumer discretionary and industrial shares. Japan and Australia were the biggest gainers in the region, while a gauge of Chinese stocks listed in Hong Kong climbed as traders moved away from semiconductors into other parts of the market. Chip-related shares extended their recent rout after Nvidia entered a technical correction amid a pause in the AI frenzy. Meanwhile, some of the biggest boosts to the Asian gauge Tuesday included auto, financial and miner stocks.

In FX, the Bloomberg Dollar Index gained 0.1%, reversing an earlier loss, with minimal moves across G-10 FX. USD/JPY was down 0.2% to 159.33 and AUD/USD little changed at 0.6659. GBP/USD rises 0.1% to 1.2695 with EUR/USD up 0.1% to 1.0740.

In rates, treasuries reverse earlier losses, with 2-year yields flat at 4.72% while 10-year yields dropped 2bps to 4.21% and 30-year yields were little changed at 4.365% as long-end outperformance deepens inversion of 2s10s spread past 50bp for first time since December. In core European rates, bunds and gilts outperform despite heavy auction slate that included Italy, UK and Germany selling a mix of linkers and bonds. French government bonds gain, outperforming their German peers and narrowing the 10-year yield spread by ~1bps to around 75.5bps. The US auction cycle begins with $69 billion 2-year note sale, followed by $70 billion 5-year and $44 billion 7-year Wednesday and Thursday. WI 2-year yield at around 4.680% is ~24bp richer than May’s, which tailed by 1bp.

In commodities, oil prices decline, with WTI falling 0.5% to near $81.30. Spot gold falls ~$2 to around $2,333. Bitcoin rises over 2%.

Looking at today's calendar, US economic data slate includes June Philadelphia Fed non-manufacturing activity and May Chicago Fed national activity index (8:30am), April S&P CoreLogic home prices (9am), June consumer confidence and Richmond Fed manufacturing index (10am) and June Dallas Fed services activity (10:30am). Fed officials scheduled to speak include Cook (12pm) and Bowman (2:10pm); speaking earlier Tuesday, Bowman reiterated her view that it’s too soon to cut interest rates

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive but with some of the gains capped following the mixed lead from Wall St where tech underperformed amid Nvidia's continued retreat from last week's record high into correction territory. ASX 200 outperformed with energy and real estate leading the advances amid broad optimism across sectors. Nikkei 225 shrugged off the initial indecision and gradually reverted to above the psychological 39,000 level. Hang Seng and Shanghai Comp. were mixed in which the Hong Kong benchmark advanced as strength in consumer and property stocks atoned for the slack seen in some tech names, while the mainland lagged despite the PBoC's liquidity boost with headwinds from US-China frictions as the Biden administration probes Chinese telcos. Furthermore, Premier Li flagged weak global economic momentum during his WEF address in Dalian.

Top Asian News

European bourses, Stoxx 600 (-0.3%) are almost entirely in the red, with sentiment hit following updates from Airbus (-9.8%) and Merck (-9.7%) (detailed in Notable European Headlines). European sectors are mixed; Industrials are the clear laggard after Airbus cut its 2024 delivery guidance, which has weighed on the entire sector. Tech is also towards the foot of the pile, with ASML (-2.2%) and ASM International (-2.1%) both suffering. US Equity Futures (ES +0.1%, NQ +0.3%, RTY +0.2%) are very modestly firmer, with mild outperformance in the NQ as Nvidia (+2.1% pre-market) finally edges higher after dropping around 11% over the past 5 days.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Fed Speakers

DB's Jim Reid concludes the overnight wrap

Nvidia has been driving markets again over the last 24 hours, as its share price came down another -6.68%, building on its -4.03% decline over the previous week and -16.1% from the intra-day high on Thursday. In turn, that held down US equity returns more broadly, as the losses for Nvidia pushed the NASDAQ (-1.09%) and the S&P 500 (-0.31%) into negative territory for the day. This decline came even as 70% of the S&P 500 constituents were higher yesterday, with the equal-weighted version of the index up +0.50%. Energy stocks (+2.73%) led on the upside, boosted by rising oil prices as Brent crude reached its highest level since April (+0.90% to $86.01/bbl).

The positive tone was more dominant in Europe, where markets continued to strengthen despite the political uncertainty as we head to the weekend French polls. For instance, the CAC 40 (+1.03%) closed at its highest level since the turmoil began, having advanced by +2.71% since its closing low on June 14. Banks were among the strongest performers, including BNP Paribas (+3.27%), Société Générale (+2.06%) and Crédit Agricole (+2.00%). And this strength was echoed among other indices across the continent, with the STOXX 600 (+0.73%), the DAX (+0.89%) and the FTSE MIB (+1.58%) all posting solid gains.

That European advance came despite another batch of weak data, as Germany’s Ifo survey for June came out. That saw the business climate indicator unexpectedly fall to 88.6 (vs. 89.6 expected), which is the second month in a row that it’s declined. Moreover, the e xpectations indicator fell back after a run of 4 consecutive monthly gains, with the measure falling to 89.0 (vs. 90.7 expected). And that follows some underwhelming flash PMI releases on Friday, where both the Euro Area and German numbers surprised on the downside.

When it comes to the politics, that will really ramp up this week, with financial markets keenly focused on the first round of the French election this Sunday. Ahead of that, an Ifop poll showed that Marine Le Pen’s National Rally was on 36%, ahead of the left-wing alliance on 29.5%, and President Macron’s centrist alliance on 20.5%. In seat terms, that would give the National Rally 220-260, short of the 289 required to win a majority in the National Assembly. The left-wing alliance would be on 185-215, and President Macron’s alliance would be on 70-100. A reminder of our joint econ/strategy webinar tomorrow at 3pm London time on the election and the market implications. Register here. Elsewhere, there are just 9 days to go until the UK’s election, and a Redfield and Wilton poll out yesterday had the opposition Labour Party in the lead on 42%, followed by Nigel Farage’s Reform UK on 19%, and the governing Conservatives on 18%.

Back to France, and the Franco-German 10yr spread tightened by -3.2bps to 77bps and away from Friday's close which was the highest spread since 2012. That came as Jordan Bardella of the National Rally said that he would seek to repair France’s “degraded public finances”, and would “bring the country back to reasonable budgets”. Other countries’ spreads also tightened, as the 10yr bund yield rose by +1.0bps, underperforming the rest of Europe.

Meanwhile in the US, a late rally saw the 10yr Treasury yield close -2.4bps lower on the day at 4.23% where it's stayed in Asia this morning. The rally was helped along by dovish-leaning comments from San Francisco Fed President Daly, who said that “ Future labor market slowing could translate into higher unemployment ”, adding “At this point, inflation is not the only risk we face”.

Asian equity markets are mostly trading higher this morning shrugging off the US tech weakness. The Nikkei (+0.51%), Hang Seng (+0.33%), KOSPI (+0.49%) and the S&P/ASX 200 (+0.94%) are all advancing. Elsewhere, Chinese stocks are extending recent losses with the CSI (-0.42%) and the Shanghai Composite (-0.38%) lower. S&P 500 (+0.08%) and NASDAQ 100 (+0.19%) futures are bouncing back slightly as I type.

Early morning data showed that Japan’s services producer price index climbed +2.5% y/y in May and less than the market expected gain of +3.0% as against a downwardly revised increase of +2.7% in April. The yen (+0.08%) has edged higher for a second day but at 159.51 against the dollar, it is still languishing near levels not seen since late April when the Japanese authorities intervened in the FX market. More broadly it remains very close to its 30 plus year lows.

To the day ahead now, and data releases from the US include the Conference Board’s consumer confidence measure for June, the Richmond Fed’s manufacturing index for June, and the FHFA house price index for April. We’ll also get Canada’s CPI for May. From central banks, we’ll hear from the ECB’s Stournaras, Makhlouf and Nagel, along with the Fed’s Bowman and Cook.