US equity futures gained for the second day ahead of a shortened trading session after the Thanksgiving holiday, with Treasuries also rising and the dollar slipping amid mounting (if naive) speculation that president-elect Donald Trump will temper his most extreme trade policies drove the dollar to its biggest weekly loss in three months. As of 8:00am ET, S&P 500 and Nasdaq 100 futures both rose 0.2%, pointing to modest gains in Friday’s post-holiday trading session on Wall Street. The 10-year Treasury yield fell four basis points to 4.22%, the lowest in more than a month, as cash trading resumed after the Thanksgiving holiday. The Bloomberg Dollar Spot Index fell 0.2%, ending an 8 week winning streak and heading for its biggest weekly loss in three months. Oil prices oil prices reverse an earlier loss and trade near session highs with WTI now at $69.20, while gold adds $25 to $2660. Bitcoin rises above $96,000. There is nothing on today's macro calendar.

In premarket trading, US semiconductor equipment makers climb after Bloomberg reported that additional US curbs on sales of chip technology to China may stop short of some stricter measures previously considered. Applied Materials shares rise 2.8% and Lam Research climb 3.3% in premarket trading. KLA is also gaining. Japanese and European chip-related stocks mostly gained on Thursday, when the US was closed. Some other notable movers:

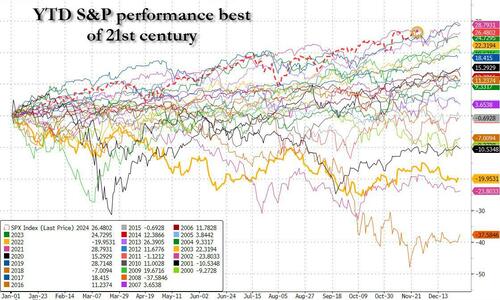

Trump’s pick for his Treasury secretary has fueled optimism that tariffs will be measured, boosting US stocks and bonds, and sapping dollar strength. The Bloomberg Dollar Spot Index extended a weekly decline to more than 1%, snapping eight weeks of gains. The S&P 500 has already risen 5% in November, on course for its best month since February, and its best year this century...

... as investors plowed $141 billion into US equities, the heaviest inflows for a four-week period on record, according to EPFR data. A handful of tech titans have led 26% year-to-date gains in US stocks on the prospect of Federal Reserve rate cuts while the American economy continues to chalk up growth.

“We were talking day in and day out about trade tensions in 2019. What happened? The Nasdaq was on a tear. What mattered was the Fed was making a U-turn, real rates went down, and that drove equities,” Max Kettner, multi-asset chief strategist at HSBC Holdings Plc, said in an interview with Bloomberg TV. “That’s very similar to now — this is still a cutting cycle. It’s a fantastic set-up.”

European stocks were little changed, although miners including Anglo American Plc outperformed, boosted by optimism that China will adopt further measures to stimulate its economy. The Stoxx 600 rose 0.1% as telecoms and utilities sectors were the biggest laggards. Miners outperform, gaining on the back of strong iron ore prices that received a boost from new China stimulus hopes. Here are the most notable movers:

Earlier in the session, Asian stocks also edged higher as gauges in China rallied on expectations of greater economic support at a key policy meeting in December. The MSCI Asia Pacific Index rose as much as 0.6%. Speculation that authorities will release further stimulus is growing ahead of the Central Economic Work Conference, where the nation’s top leaders will lay out economic priorities for the coming year. Indian stocks also rose. Elsewhere, Korea’s Kospi Index fell 2% after the central bank’s surprise interest-rate cut on Thursday spurred concerns about economic growth. Japanese benchmarks also dropped as the yen strengthened on stronger-than-expected inflation reading out of Tokyo.

“The market is evaluating the CPI data as making the possibility of a BOJ rate hike in December slightly higher than before,” pushing up the yen and weighing on export-oriented stocks, said Tomo Kinoshita, global market strategist at Invesco Asset Management.

In FX, the Bloomberg Dollar Spot Index fell 0.2%, heading for its biggest weekly loss in three months. The yen tops the G-10 FX leader board, rising 1% against the greenback and pulling USD/JPY down to around 150 after Tokyo inflation rose more than expected.

In rates, Treasury yields also declined at the start of a shortened US trading session that includes month-end index rebalancing at 1 p.m. New York time, estimated to extend its duration by 0.11 year. Yields are 3bp-6bp lower across the curve, 5- to 30-year at weekly lows, 10-year at 4.21%; 10- and 30-year fell below 200-day average levels for first time since late October. The US treasury market is headed for a monthly gain as benchmark yields have retreated from multimonth highs reached in the days following the US presidential election on Nov. 5; market-implied odds of a Federal Reserve interest-rate cut in December have rebounded to nearly 60%. As US markets reopen after Thursday’s holiday, yields also are lower in most euro-zone bond markets for second-straight day. German 10-year bonds hold higher after euro-area inflation rose in line with forecasts although shorter-dated maturities underperform. French bond spreads widen slightly after far-right leader Le Pen gave PM Barnier until Monday to accede to her budget demands before she decides whether to topple the government.

In commodities, oil prices reverse an earlier loss and trade near session highs with WTI now at $69.20, while gold adds $25 to $2660. Bitcoin rises above $96,000.

Friday’s early close times include Sifma’s recommendation of a 2 p.m. halt for trading of USD-denominated cash bonds, while Bloomberg index pricing is slated for 1 p.m. (vs 4 p.m. normally), aligning with early close for US stocks. Looking at today's calendar, there is are no US economic data or speeches by Fed officials are scheduled, and no new corporate bond offerings are expected

Market Snapshot

Top Overnight News

Thanksgiving News Recap

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed albeit with a slightly positive bias in the absence of a lead from Wall Street owing to the Thanksgiving Day holiday and as participants digested a slew of data releases into month-end. ASX 200 was lacklustre amid weakness in defensives, finance and tech with the latter not helped after the Australian Senate passed the social media ban for under-16s, while ANZ Bank also pushed back its forecast for the first RBA rate cut to May next year from February and only sees two 25bp cuts vs a prior view of three cuts. Nikkei 225 mildly declined with headwinds from recent currency strength after firmer-than-expected Tokyo inflation, while participants also digested the latest Industrial Production and Retail Sales figures which both fell short of estimates. Hang Seng and Shanghai Comp were underpinned despite the lack of obvious catalysts and shrugged off the PBoC's net daily liquidity drain, while participants await tomorrow's official PMI data in which the headline Manufacturing PMI is expected to show a further improvement.

Top Asian News

European bourses trade around the unchanged mark, Stoxx 600 U/C; specifics light aside from Flash EZ HICP. Sectors mostly in the red with Autos & Parts lagging to end a bruising week. Basic Resources bucks the trend given metals and Anglo American (+3.4%) amid speculation in the FT that BHP could come back with a fresh bid. Stateside, futures firmer ES +0.3% with the RTY +0.9% outperforming. Specifics light and the docket sparse on a limited post-Thanksgiving session, as such the macro narrative may not change significantly. MSFT -0.5% after the FTC launched an antitrust investigation while unconfirmed reports indicate MSTR +4.5% could join the Nasdaq 100.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Morning from Amsterdam and welcome to Black Friday, although I can't help think Black Friday starts in July these days! Whilst US markets were closed for the Thanksgiving holiday, there was still plenty happening over the last 24 hours, with European markets bouncing back after their recent slide. Several factors were supportive, including some lower-than-expected inflation numbers out of Germany, which led to growing confidence that the ECB would keep cutting rates. Moreover, there were also promising signs on the French budget situation, as the government sounded open to concessions in order to pass the bill, so that helped French assets to recover too. Overall, that meant it was a fairly positive day, with the STOXX 600 up +0.46%, whilst 10yr bund yields (-3.4bps) fell to an 8-week low.

In terms of the French situation, the day had started off pretty negatively, as yields on 10yr French debt briefly exceeded the 10yr Greek yield for the first time on record. But they then started to recover, as Finance minister Antoine Armand sounded open to concessions possibly in order to avoid the government being toppled. He said that “it’s better to work on a budget that is not exactly the same, otherwise we leap into the unknown.” Later in the day, Prime Minister Barnier then said that he wouldn’t raise taxes on electricity, which is something that Marine Le Pen’ had criticised. So that was seen as positive for the chances that the government would survive, and the Franco-German 10yr spread ended the day down -4.1bps at 82bps. Even so, Marine Le Pen’s National Rally have made further budget demands, so the situation is far from resolved just yet.

The bond rally then got further support from the latest German inflation data, which surprised on the downside of consensus. That showed HICP inflation remaining at +2.4% in November (vs. +2.6% expected), so that was seen as positive for the prospects of ECB rate cuts and investors dialled up the likelihood of a 50bp ECB rate in December, with the probability moving up from 15% on Wednesday to 18% by the close yesterday. Moreover, there were also comments from the ECB’s Villeroy that sounded open to a larger 50bp cut at the December meeting. He said that “Optionality should remain open on the size of the cut”, so clearly not ruling out a larger move. And in turn, that helped sovereign bond yields move lower across the continent, with those on 10yr bunds (-3.4bps) and BTPs (-6.3bps) both falling back.

This backdrop was also supportive for equities across Europe, with all the major indices moving higher on the day. By the close, the STOXX 600 was up +0.46%, with tech stocks leading the way. Germany’s DAX (+0.85%) was another outperformer, whilst other indices including France’s CAC 40 (+0.51%) and Italy’s FTSE MIB (+0.51%) posted a solid advance of their own. By contrast, the main underperformer was the UK’s FTSE 100 (+0.08%). Meanwhile in the US, markets were closed for the day, but equity futures were consistently positive throughout the European session as well.

Asian equity markets are seeing reasonable divergence with the KOSPI (-1.24%) the biggest underperformer led by declines in large-cap tech companies following yesterday’s surprise 25bps rate cut by the BOK as the economy stalled and inflation slowed more rapidly than policymakers predicted. Meanwhile, the Nikkei (-0.44%) is also trading lower after Yen strength on strong inflation data. Chinese stocks are outperforming with the CSI (+2.01%) leading gains followed by the Shanghai Composite (+1.59%) and the CSI (+1.29%) after China extended tariff waivers on some US goods, indicating that China likely isn't ready to escalate ahead of Trump. S&P 500 (+0.31%) and NASDAQ 100 (+0.54%) futures are higher and 10yr US yields are around -3bps lower after reopening post the holiday.

Early morning data showed that Tokyo inflation accelerated more than expected in November, rising +2.6% y/y (v/s +2.2% expected), picking up sharply from the +1.8% seen last month. At the same time, core CPI climbed +2.2% from a year earlier (+2.0% expected) in November, as against a +1.8% increase last month, largely on a winding down of energy subsidies. Core-core was in line at 1.9% which is the most important for the BoJ but the firmer slant to the overall data increases the chances of a hike in December.

Following the data release, the yen appreciated +1.05%, to trade at 149.97 against the dollar, hitting its strongest level in 5 weeks. Separate data showed Japanese retail sales rose +1.6% in October YoY, missing expectations for growth of +2.0%, up from an upwardly revised +0.7% gain in September.

Looking at yesterday’s other data, the European Commission’s economic sentiment indicator remained broadly stagnant at 95.8 in November (vs. 95.2 expected), remaining in a similar zone where it’s spent the entirety of 2024. We also had the Euro Area M3 money supply data for October, which showed a pickup to +3.4% year-on-year as expected, the highest since December 2022.

To the day ahead now, and data releases include the Euro Area flash CPI release for November, UK mortgage approvals for October, German unemployment for November and retail sales for October, and Canada’s Q3 GDP. From central banks, we’ll get the Bank of England’s Financial Stability Review, and also hear from ECB Vice President de Guindos and the ECB’s Nagel. Finally, a general election is being held in Ireland.