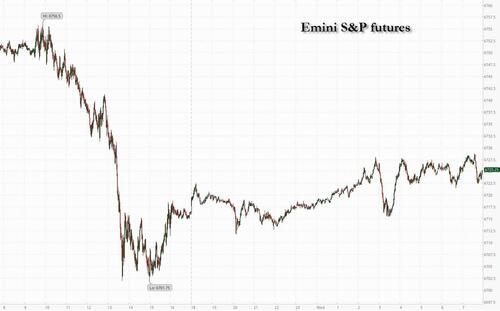

US futures are once again higher after taking a brief pause yesterday, led by Tech, with all of Mag7 higher pointing to a stronger open as Alibaba’s spending promise and Micron’s upbeat outlook lift sentiment on AI. Global stocks resumed their rally after a pledge by China's Alibaba for more spending (now the mere promise of more capex is sufficient to send your stock ripping) and Micron's upbeat forecast lifted sentiment on AI (even higher... if that's possible). As of 8:00am ET, S&P and Nasdaq futures rose 0.2% after big tech’s slide in the prior session broke a streak of records; Mag 7 are all green led by AMZN, +1.6% while TMT is boosted by Micron rising +1.5% after strong earnings underscored the boom’s ongoing momentum. Semis were bid after Alibaba jumped 9% in typhoon-hit Hong Kong on plans to boost AI spending beyond an initial $50 billion target. According to JPM, the AI-theme should perform well today (when does it not), including Critical Metals. Cyclicals are leading Defensives. The curve is steepening as 2Y yields are -2bps and the 10Y rises 3bps to 4.13% as the USD is bid up for first time this week. Trump said that Ukraine, with NATO help, has the tools to win back all of its Russian-occupied territory, included continued US weapons sales to NATO, and should shoot down Russian planes that enter its airspace. Gold held near all-time highs. Today’s macro data focus is on Home Sales, Building Permits and Mortgage Apps.

In premarket trading, Mag 7 stocks are all higher: Amazon (AMZN) gains 1.4% following an upgrade at Wells Fargo on greater conviction in the company’s Amazon Web Services division (Tesla +0.7%, Nvidia +0.6%, Meta +0.2%, Microsoft +0.2%, Alphabet +0.1%, Apple +0.07%).

In corporate news, OpenAI plans to invest roughly $400 billion it does not have to develop five new US data center sites in partnership with Oracle and SoftBank. Tether is in talks with investors to raise as much as $20 billion, a deal that could propel the crypto firm into the highest ranks of the world’s most valuable private companies. Apollo is rolling out three new private capital funds for wealthy individual investors in Europe.

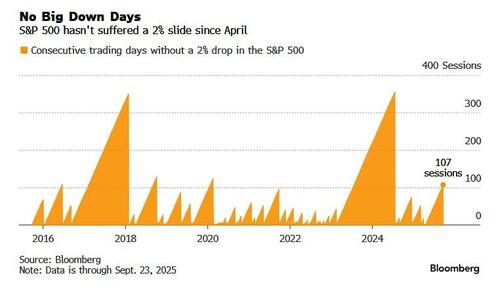

Turning back to the broader market, down days are few and far between at the moment, and the overall sentiment for stocks is becoming euphoric. JPMorgan’s head of market intelligence, Andrew Tyler, sums it up nicely: “several conversations yesterday focused on what could derail this bullish run. My favorite response was an asteroid hitting the earth.” Internal market metrics underscore just how bullish investors have become. Systematic strategies were already almost maxed-out. Now, discretionary investors are stretching to more bullish levels, with room to go further. Options volume is firmly skewed toward chasing the upside. Still, impending portfolio rebalancing may create a technical headwind as the month comes to an end.

In any case, the S&P 500 has gone 107 sessions without a drop of 2% or more, the longest streak in more than a year as hopes for rapid Fed easing have added to the buoyant mood.

Traders are paying little attention to a range of risks, with the threat emphasized Tuesday when Fed Chair Jerome Powell warned that policymakers still face a difficult path ahead. Bullishness over AI’s vast potential has fueled multiple all-time highs in stocks this year, offsetting all worries about rising geopolitical risks and trade tensions.

In the Middle East, Saudi Arabia’s move to ease foreign ownership rules added $123 billion to the country’s stock market. Banking stocks on the Tadawul All Share Index surged a record 9%.

Alibaba shares soared in Asia after CEO Eddie Wu revealed plans to ramp up AI spending above an original target of $50 billion-plus over three years. Micron, which has seen its shares almost double this year, gave an upbeat outlook driven by demand for AI equipment. Also top of mind for tech traders — California’s AG is looking at whether Trump’s $100,000 application fee for H-1B visas can be challenged by law.

"AI is back as the key driver for global markets. Investment continues apace and that’s keeping the AI theme relevant,” said Guy Miller, chief strategist at Zurich Insurance Co. “That leads to the question, is this getting to the last innings with overinvestment and misallocation of capital? From an investor perspective, all that actually tells you there’s a bit further to run.”

According to Bloomberg, the danger now is that officials scale back expectations for further cuts, leaving Wall Street disappointed. San Francisco Fed President Mary Daly speaks later Wednesday, in what is otherwise a light day for the events calendar.

"There’s going to be lots of chatter about the Fed and that’s going to dominate,” said Daniel Murray, deputy chief investment officer at EFG Asset Management. “I expect we’re going to drift for a couple of weeks. The next catalyst is going to be the third-quarter earnings season.”

European stocks slipped 0.3% diverging from gains in Asia and the US, as autos, consumer products and financials underperform. The region’s defense stocks rallied after US President Donald Trump’s latest criticism of Russia. Here are the biggest movers Wednesday:

Earlier in the session, Asian stocks advanced, as a boost from Alibaba’s AI spending plans countered a broader regional selloff in tech shares. The MSCI Asia Pacific Index gained 0.2%, with Alibaba the biggest boost while banks including Westpac Banking Corp. and Commonwealth Bank of Australia weighed on the gauge. Equity benchmarks rose in Japan and mainland China, and fell in South Korea, Taiwan and Australia. Meanwhile, the Hang Seng Tech Index surged more than 2% after Alibaba said it would beef up its AI budget and unveiled its new Qwen3-Max large language model. Shares of peers and China’s homegrown tech suppliers climbed, boosting key equity measures on the mainland as well as in Hong Kong. Australia’s main index declined nearly 1% after monthly consumer prices rose more than economists expected, weakening the case for a rate cut next week.

“Asian markets are treading cautiously today, caught between profit-taking and lack of new catalysts,” said Dilin Wu, a research strategist at Pepperstone Group. “After yesterday’s strong US tech rally, much of the initial enthusiasm has faded.”

In FX, the dollar climbs 0.3% after two days of declines. The Australian dollar is the only G-10 currency to outperform the greenback, while the yen is the weakest of the group. The euro slips after an unexpected drop in German business confidence.

In rates, front-end Treasuries outperform while 10Y yields rose 3bps to 4.13% as the curve steepened. Treasury auctions resume at 1pm New York with $70 billion 5-year note sale, follows a solid 2-year note auction Tuesday which stopped 0.1bp through the WI.

In commodities, oil extended its biggest gain in a week, as Trump ramped up his rhetoric against Russia and traders watched for supply disruptions from the OPEC+ member. Brent rose above $68 a barrel and WTI adds 0.4% to $63.64. Sot gold rises about $5 to $3,769 an ounce.

US economic data slate includes August new home sales/building permits (10am). Fed speaker slate includes Daly at 4:10pm, delivering keynote remarks on the outlook for the economy

Market Snapshot

Top Overnight News

Trade/Tarifffs

A more detailed wrap of overnight markets courtesy of Newsquawk

APAC stocks eventually traded mixed following a subdued open as the sentiment from Wall Street initially reverberated, but later improved after Chinese cash trade got underway, whilst Hong Kong remained open despite the Super Typhoon. ASX 200 declined as gold miners weighed following consecutive sessions of outperformance, while Tech mirrored Wall Street sectoral weakness. Nikkei 225 returned from holiday to trade softer in line with the regional tone, though losses were somewhat cushioned by the NVIDIA/OpenAI rally it missed yesterday and a weaker JPY intraday. KOSPI was pressured amid the broader global tech pullback and deteriorating South Korean consumer sentiment. Hang Seng and Shanghai Comp were choppy and eventually traded in the green, with the former also boosted by Alibaba, whose shares surged after releasing its largest LLM whilst announcing plans to ramp up spending on AI infrastructure to better compete with US rivals.

Top Asian News

European bourses (STOXX 600 -0.3%) began the session around the unchanged mark, but slipped into negative territory, soon after the cash open, but without a clear catalyst - perhaps some focus on the latest hawkish geopolitical rhetoric from Trump. More recently, the complex has picked up from worst levels to currently trade towards the mid-point of the day’s range. European sectors hold a negative bias, and with the breadth of the market fairly narrow today. Utilities is found towards the top of the pile, albeit only marginally so. Iberdrola (+0.8%) announced it will be investing USD 68bln to grow in the UK/US; the Co. also said it sees close to EUR 20bln in dividends between 2025 and 2028. Defence names today have been boosted today after President Trump said Ukraine can win all its land back from Russia.

Top European News

FX

Fixed Income

Commodities

Geopolitics: NATO

Geopolitics: Ukraine

Geopolitics: Middle East

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

Markets struggled to keep up with the recent momentum yesterday, with the S&P 500 (-0.55%) finally slipping back after a succession of record highs, with a couple of main drivers for this retreat. One was a reversal in tech as there were as many questions as answers over Nvidia's high profile $100bn tie-up with OpenAI from Monday. The other was a slightly more cautious tone on the labour market by Fed Chair Powell. Meanwhile, concerns also grew about a potential government shutdown next week. To be fair though, it wasn’t all bad news, as US Treasuries finally rallied after a run of 4 consecutive declines since the Fed meeting, and gold prices (+0.46%) hit a fresh record of $3,764/oz.

Powell’s prepared remarks on the economic outlook largely echoed his post-FOMC comments last week. The Chair said that “Two-sided risks” on inflation and the labour market “mean that there is no risk-free path” and avoided giving a firm rate cut signal for the upcoming meetings. However, in the Q&A he appeared to lean a little more into the dovish arguments, noting that “we do see meaningful weakness in the labor market“. While the comments had little impact on near-term Fed pricing, with 44bps of cuts being priced in by year-end (+0.6bps on the day), they reinforced a moderate rally in Treasuries. By the close, 2yr yields were -1.7bps lower at 3.59%, whilst the 10yr yield was down -4.1bps to 4.11%.

Earlier in the day, we’d already heard from several other Fed speakers, although the message was pretty divergent. For instance, Vice Chair for Supervision Bowman (voter) struck a dovish note, saying “it is time for the committee to act decisively and proactively to address decreasing labor market dynamism and emerging signs of fragility”. For context, Bowman has been widely reported as one of the candidates to become Fed Chair, and voted for a 25bp cut at the July meeting where they held rates steady, so has been one of the more dovish members recently. Otherwise, Chicago Fed President Goolsbee (voter) was more cautious, saying that “with inflation having been over the target for four-and-a-half years in a row, and rising, I think we need to be a little careful with getting overly, up-front aggressive.” And it was a similar message from Atlanta Fed President Bostic (non-voter), who said that “it’s incumbent upon us to continue to stay vigilant in the fight against inflation.”

Whilst Fed speakers provided the main headlines, an important developing story has been on the potential for a US government shutdown next week. For those who haven’t been following, government funding currently runs out on September 30, unless Congress vote to authorise more spending. And even though the Republicans have a majority in both chambers of Congress, they need 60 votes in the Senate to avoid a filibuster, when they only have 53 among themselves. Meanwhile, the Democrats are calling for an extension of healthcare subsidies, so there’s an impasse as it stands. There had been a meeting planned between President Trump and the House and Senate Democratic leaders, but Trump cancelled the meeting yesterday, posting that “I have decided that no meeting with their Congressional Leaders could possibly be productive.” So that cancellation has led to a fresh bout of concern that funding will run out at next week’s deadline, and we could see the first shutdown since the winter of 2018-19. Meanwhile, Trump’s main appearance yesterday was a combative speech at the UN, as he accused the organisation of offering only “empty words” and criticised other countries’ climate and immigration policies. Trump later seemed to give his clearest support to Ukraine yet suggesting that the country is in a position to win all its territory back. So that was a change in emphasis.

US equities fell back, with the S&P 500 (-0.55%) posting its worst day in three weeks, while the NASDAQ (-0.95%) and the Mag-7 (-1.55%) saw even larger declines. All of the Mag-7 moved lower, including a -3.04% slide for Amazon, but it was Nvidia’s -2.82% decline that was the main story. This reversed much of Monday’s +3.93% gain after it announced it would invest as much as $100bn into OpenAI. Investors have been left grappling with many questions around the deal. A more practical one is on the timing of the planned data center roll out and whether this can access sufficient power grid capacity. But the bigger concern from an AI bubble risk perspective was whether Nvidia was now relying on investments into customers to feed its revenue growth and whether we’re beginning to see some creative accounting reminiscent of 1990s telco deals.

Over in Europe, there was much more of a risk-on tone yesterday after the September flash PMIs painted a picture of ongoing resilience. Most notably, the Euro Area composite PMI moved up to a 16-month high of 51.2 (vs. 51.1 expected), which added to the optimism around European growth, particularly with the fiscal stimulus ahead. Nevertheless, there was a pretty divergent picture across different countries. Germany led the advance, with its composite PMI rising to 52.4 (vs. 50.7 expected), which was also a 16-month high. But France’s composite PMI fell back to a 5-month low of 48.4 (vs. 49.7 expected). By comparison, the US composite PMI saw a -1.0pt decline albeit to a still solid level of 53.6 (vs. 54.0 expected).

That positive backdrop helped to lift European equities, with the STOXX 600 (+0.28%) moving higher, alongside the DAX (+0.36%) and the CAC 40 (+0.54%). European bond yields also ended the session a bit higher, with yields on 10yr bunds (+0.1bps) and OATs (+0.4bps) inching up. Over in the UK however, there was a bit more weakness, with the FTSE 100 (-0.04%) losing ground after the country’s flash PMIs surprised on the downside. Indeed, the composite PMI fell to a 4-month low of 51.0 (vs. 53.0 expected), which also put downward pressure on gilt yields, with the 10yr yield down -3.3bps on the day.

Asian equity markets are mostly lower this morning outside of a bounce back for China risk. The KOSPI (-0.80%) is an underperformer, impacted by declines in regional technology stocks, while the S&P/ASX 200 (-1.07%) is seeing larger losses also after higher-than-anticipated CPI has dampened expectations for additional interest rate reductions from the RBA (details below).

The Nikkei is rallying back to flat as I type after a holiday yesterday. Conversely, Chinese stocks are defying the regional negative trend, with the Hang Seng (+0.91%), and the Shanghai Composite (+0.63%) seeing gains due to optimism surrounding potential stimulus measures from Beijing. Outside of Asia, US equity futures are fairly flat along with US Treasuries after their rally yesterday.

Returning to Australia, CPI increased by +3.0% year-on-year in August (compared to +2.9% expected; +2.8% in July), marking the highest reading in a year, primarily driven by housing costs. Although the RBA’s preferred trimmed mean measure, which excludes volatile items such as food and energy, decreased to +2.6% in August from 2.7% in the previous month, based on some of the components in the release our Q3 trimmed mean CPI forecast for Q3 is now at 0.8%qoq/2.7%yoy. The RBA’s forecast as outlined in the August SMP was for a 0.6%qoq/2.5%yoy print. As such DB has changed its call for November from a cut to a hold. We still expect cuts in February and May next year but a terminal rate that is now 25bps higher at 3.1%. See our report here.

Following the release of this data, the Australian dollar recovered from losses to trade +0.26% higher, settling at 0.6616 against the dollar, while yields on the policy-sensitive 3yr government bonds rose by +7.5bps to trade at 3.52%, as markets adjusted their expectations for the next rate cut.

In a separate report, Japan’s manufacturing activity contracted more than anticipated in September, with the S&P’s preliminary manufacturing PMI dropping to 48.4, down from 49.7 in the previous month, as overseas demand faced pressure from high US trade tariffs. Simultaneously, the S&P Global Flash Japan Services PMI increased to 53.0 in September, slightly slower than the 53.1 recorded in August, but still comfortably within growth territory. Staying with Japan, our economist has published a "what we need to know" about the LDP leadership battle.

To the day ahead now, and data releases include the Ifo’s business climate indicator from Germany for September, and US new home sales for August. Central bank speakers include San Francisco Fed President Daly, and the BoE’s Greene.