US equity futures are higher with small caps leading after the White House appeared to dial back speculation that Washington was on the verge of joining Israel’s strikes on Iran, while Reuters reported that Iran is ready to discuss limitations on its Uranium enrichment (if not going anywhere near close to what the US/Israel bid is for complete enrichment halt). As of 8:00am, S&P futures rose 0.2% and traded at session highs, while Nasdaq 100 futures gained 0.3% with Mag 7 stocks mixed and TSLA (+1.4%) outperforming. The big highlight today is a record (for June) $5.9 trillion option expiration which will see dealer gamma tumble and "unclench", allow the market to move much more freely. Bond yields are 2-3bp higher while the USD is lower even as the USDJPY approaches a 1 month high. Commodities are lower: oil drops on renewed hopes for Iran deescalation; aluminum and precious metals are also down. Headline focus continues to be on Middle-East tensions after Trump disclosed he will decide within two weeks whether to strike Iran. Elsewhere, Japan in focus with hotter inflation data overnight (driven by continued surge in rice prices) and reports of larger-than-expected planned cutback to superlong JGB issuance. WTI reached $77 briefly on Thursday before coming down to $73 this morning. It's a quiet end to the week: US economic data slate includes June Philadelphia Fed business outlook (8:30am) and May Leading Index (10am). No Fed speakers are scheduled.

In premarket trading, Magnificent Seven stocks rebound alongside index futures but are mixed with TSLA outperforming (Tesla +1.3%, Amazon -0.1%, Meta Platforms -0.1%, Apple -0.3%, Microsoft -0.3%, Alphabet -0.4%, Nvidia -0.5%).

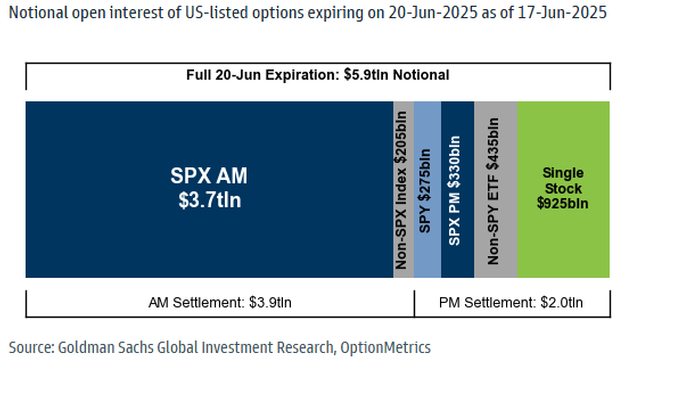

While markets remains focused on geopolitics, the big event for markets today is today's $5.9 trillion option expiration, including $4.0 trillion of SPX options and $925 billion notional of single stock options. This options expiration will be the largest June expiration on record...

Going back to geopolitics, sentiment was boosted after the White House said on Thursday that Trump would decide within two weeks whether to attack Iran, and there was still a “substantial chance” of a negotiated settlement. Israel, meanwhile, struck more of Iran’s nuclear sites and warned it could bring down Tehran’s leadership as both sides awaited the US president’s decision. Iran maintained Friday it won’t negotiate with the US while Israel’s assault continues. With the weekend in sight, traders appear to be staying on the sidelines, unsure about the trajectory of the conflict.

“One must of course be aware of the potential for significant gapping risk at the Sunday night open, depending on how geopolitical tensions evolve over the weekend,” said Michael Brown, senior research strategist at Pepperstone Group Ltd. “Some trimming of risk, and squaring of positions, seems likely as today goes on.”

Some extreme scenarios resulting from increased US involvement in the Israel-Iran war could push oil prices as high as $130 to $150 a barrel, particularly if Iran retaliates in a major way, said Jennifer McKeown, chief global economist at Capital Economics Ltd. Such a development would pause further policy easing by central banks, she said. Brent futures have been pricing in a geopolitical premium of about $8 a barrel since Israel and Iran began attacking each other last week, according to a survey of analysts and traders. US intervention in the conflict would bolster that further, but exactly how much would depend on the nature of the involvement, the nine respondents said.

“The recent air strikes pose risks to the new energy market landscape; however, further fallout for global energy prices seems, for now at least, limited,” said Kieran Calder, head of Asia equity research at Union Bancaire Privee in Singapore. “Markets tend not to price in geopolitical risks until there is a conflagration, and they are currently showing little sign of factoring in a worst-case outcome.”

Markets were rattled earlier in the week after the Fed downgraded its estimates for growth this year and projected higher inflation. “Even though central banks would like to think that would be a temporary impact, I think it would be a brave central bank that would cut interest rates,” McKeown said on Bloomberg TV.

European stocks also rose as the White House downplays the likelihood of imminent US military action against Iran. The Stoxx 600 snapped a three-day losing streak, up 0.5%. Travel, banks and tech outperform as almost all sectors climb, barring energy. Among individual movers in Europe, TUI AG gained the most in two months after Barclays Plc double-upgraded the stock, citing robust demand for packaged travel. Berkeley Group Holdings Plc slumped after the homebuilder announced management changes and cited persistent regulatory headwinds as it reported earnings. Here are some of the more notable European movers:

Earlier in the session, Asian equities advanced after news that President Donald Trump will decide within two weeks whether to strike Iran, allaying some concerns over immediate US involvement. The MSCI Asia Pacific Index gained 0.5%, with chip-related stocks SK Hynix and Advantest among the biggest boosts. South Korea’s Kospi closed above 3,000 points for the first time since December 2021, and a gauge of Chinese shares listed in Hong Kong rose 1.4%. Stocks fell in Japan and Australia. The MSCI Asian benchmark is still poised to end the week lower after a two-week streak of gains. Middle East tensions have put risk sentiment back in check as investors eye the potential impact on oil prices in particular.

The Bloomberg Dollar Spot Index fell 0.2%, extending its losses into a second day. The yield on benchmark 10-year Treasuries was little changed as cash market reopened following a holiday. USD/JPY rose 0.1% to 145.62; Japan’s key consumer inflation measure accelerated more than expected to 3.7% from a year earlier in May. GBP/USD up 0.2% to 1.3495; UK retail sales suffered the sharpest fall since 2023, a sign the economy could be struggling in the second quarter.

In rates, treasuries are steady as US markets reopen post-holiday. European yields erase earlier drop are are now little changed across the curve, while the euro and pound both gain. JGB futures turn lower and USDJPY trades near 145.50 after Japan proposes to cut the issuance of super-long bonds this year by more than earlier reported.

In commodities, Brent crude falls 2% to around $77.20, giving back gains from earlier in the week. Gold is down some $16 to around $3,354/oz. Bitcoin climbs.

Looking to the day ahead now, data releases include UK retail sales which had their sharpest fall since 2023 in May, slumping 2.7%, more than the estimated 0.5% decline, Euro Area money supply for May, preliminary consumer confidence for June, and the US Conference Board’s leading index for May. From central banks, we’ll hear from BoJ Governor Ueda, and the ECB will publish their Economic Bulletin.

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks initially saw directionless trade following a non-existent lead from Wall Street amid the Juneteenth market holiday. Nevertheless, geopolitics remained in the spotlight as US President Trump now has to decide whether or not to join Israel’s offensive against Iran’s nuclear facilities within the next two weeks, contingent on negotiations. Sentiment eventually turned mostly firmer with notable Israel-Iran newsflow on the lighter side. ASX 200 was subdued with miners dragging on the index whilst losses in financials also kept upside capped. Nikkei 225 was buoyed by recent JPY weakness but came off best levels in tandem with USD/JPY after Japanese Core CPI topped expectations, whilst stale BoJ minutes (from two meetings ago) were also released. Hang Seng and Shanghai Comp were initially choppy with the indices trimming modest earlier gains despite relatively quiet newsflow. The PBoC LPR setting was a non-event, with the central bank maintaining the 1-year and 5-year LPRs as expected.

Top Asian News

European bourses (STOXX 600 +0.4%) opened firmer, and are attempting to build on gains, benefiting from the positive mood surrounding geopolitical optimism. European sectors are almost entirely in the green, Energy is the sole loser, due to lower oil prices, which is to the benefit of travel and leisure, which gains. Banking stocks lead the charge, buoyed by fresh EU developments that see the European Investment Bank's annual lending ceiling raised to EUR 100bln.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East War

US Involvement

Strikes

Diplomacy

US Military and Deployment

Iranian Actions

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets are recovering a bit this morning after White House spokeswoman Leavitt last night said that Trump had dictated a message saying that "based on the fact that there's a substantial chance of negotiations that may or may not take place with Iran in the near future, I will make my decision whether or not to go within the next two weeks".

Prior to this, several sources had pointed to a US strike on Iran possibly happening as soon as this weekend which led to a risk-off mood yesterday in the quiet US-holiday influenced session.

So this should reduce the event risk ahead of the weekend and Brent futures, after closing the European session (+2.80%) and at the highest level since January at $78.85/bbl, are back down -2.44% to $76.93/bbl this morning. Even though US markets were closed yesterday, S&P 500 futures slid throughout the day and closed in Europe -0.93% lower with the Nasdaq equivalent -1.10%. This morning they have clawed back much of this lost ground to both be 'only' around -0.2% lower.

Even with the falls this morning, Brent crude has now risen +20.52% since the start of the month, which would make this the biggest monthly jump since November 2020, back when the vaccine announcements offered a path out of the pandemic. So this is still a substantial move.

That inflationary backdrop and earlier fears of a weekend US attack meant it was a tough environment for European markets yesterday, with equities and bonds both losing ground. So that meant the STOXX 600 (-0.83%) fell to a one-month low, with the more cyclical sectors leading the decline. Unsurprisingly, energy stocks were the main outperformer given the rise in oil prices, and the STOXX 600 Energy Index was up +0.79%. But otherwise there was a weak performance across the continent, with the DAX (-1.12%) and the CAC 40 (-1.34%) also losing ground. European equity futures are back up around +0.75% so far this morning.

Elsewhere in Europe, the main headlines yesterday came from several central bank decisions, including the Bank of England. They left their policy rate on hold at 4.25%, as widely expected, but the vote was 6-3 to hold, with the minority preferring a 25bp cut. Looking forward, they maintained their language about a “gradual and careful approach” to easing policy, and markets continue to price another cut at the August meeting as likely. So if realised, that would continue the pattern of quarterly rate cuts since the easing cycle began last summer. In his recap (link here), our UK economist also expects the next rate cut in August, and thinks that the disinflation path remains on track, despite the recent energy news.

In other central bank news, there was a surprise from the Norges Bank yesterday, who cut rates by 25bps, despite widespread expectations for a hold beforehand. Unlike a lot of other central banks, they hadn’t yet cut rates from their peak after the tightening cycle of 2021-23, so it was an important move, and the statement said they felt it was “appropriate to begin a cautious normalisation of the policy rate.” With the decision coming as a surprise, that led to a noticeable weakening in the Norwegian Krone, which fell around a percent against the US Dollar. Otherwise, the Swiss National Bank also cut rates by 25bps yesterday (the sixth consecutive move), but that was in line with expectations. They are now back at zero with the SNB seemingly more likely than not to move into negative territory in the autumn to try to stem the rise in the Swiss Franc and to try to prevent ultra-low inflation from being embedded. There was some relief they didn't do this yesterday though.

Those policy decisions didn’t have too much of an effect on European sovereign bonds, with investors more concerned about the prospect of higher inflation. So that pushed yields higher across the continent, including for 10yr bunds (+2.4bps), OATs (+5.9bps) and BTPs (+7.5bps). There was also a clear widening in sovereign bond spreads, consistent with the wider risk-off move, and the +5bps jump in the Italian spread over bunds was actually the biggest daily jump since early April.

Asian equity markets are mostly trading higher this morning after hopes that US involvement won't come as early as this weekend and that diplomacy still has a chance. Across the region, the KOSPI (+1.15%) is leading gains, climbing to its highest level since early 2022 while being closely followed by the Hang Seng (+1.13%). Elsewhere, the CSI (+0.24%) and the Shanghai Composite (+0.08%) were relatively unaffected by the PBOC’s decision to leave its benchmark loan prime rate unchanged. Meanwhile, the Nikkei (-0.02%) is struggling to gain traction lagging most of its Asian peers after slightly higher consumer inflation data increased expectations that the BOJ will hike interest rates further in the coming months.

Japan's inflation data included a headline figure of 3.5% YoY (3.6% in April), a core CPI excluding fresh food of 3.7% (3.5%), and a core-core CPI excluding fresh food and energy of 3.3% (3.0%). The YoY increases in both the core and core-core CPI exceeded consensus expectations by 0.1 percentage point. However, as our economist has pointed out, the actual YoY increases in the core and core-core CPI were 3.654% and 3.259%, respectively, so the reality is that they only slightly exceeded consensus. The seasonally adjusted MoM increases were 0.5% for the core CPI and 0.3% for the core-core CPI. Short-term inflation momentum does remains strong and you can review these numbers in more details here with our economists' view on how they influence BoJ policy. He remains on the hawkish side and expects a hike next month.

Meanwhile, the Chinese yuan (+0.09%) is gaining ground for the second straight day against the dollar, after the PBOC set fixing at the strongest level since March.

To the day ahead now, and data releases include UK retail sales for May, the Euro Area money supply for May, preliminary consumer confidence for June, and the US Conference Board’s leading index for May. From central banks, we’ll hear from BoJ Governor Ueda, and the ECB will publish their Economic Bulletin.