Futures are higher on the first day of the month and ahead of what may be a very poor jobs report, with MegaCap tech leading. As of 8:00am ET, S&P futures were 0.4% with the benchmark on track for its worst weekly performance in more than a year amid unease over the outlook for artificial intelligence and cloud computing following results from Microsoft and Meta; Nasdaq futures gained 0.5%, as AMZN and INTC surged 5.8% and 5.7%, respectively, after strong earnings while AAPL is down -1% after its guidance disappointed; NVDA is rebounding and is up +2.0% this morning. Bond yields are flat, and the USD is fractionally higher. Commodities are mixed, with oil higher (WTI +2.9%) amid renewed tension in the Middle East, base metals lower, and precious metals modestly higher. The main event today is the jobs report, but we also get the Mfg ISM, US Mfg PMI, and Construction Spending.

In premarket trading, Amazon.com and Intel shares surged on optimistic earnings results, while Apple declined after reporting softer demand in China, a miss in wearables and services revenue and disappointed with its holiday quarter guidance. Oil majors Exxon Mobil and Chevron both rose after earnings beats. Boeing gained after the aircraft maker reached a tentative agreement to end a labor dispute. Here are all the notable movers this morning:

Today’s payrolls report (full preview here) could show job growth weakening, after the core PCE yesterday posted its biggest monthly gain since April. That muddied the water ahead of next week’s Fed policy meeting, with swaps pricing in 20 basis points of easing, down from 24 at the start of the week. Investors are also bracing for next week’s US election, with the VIX rising to levels last seen during the August market upheaval.

The “highly anticipated employment report, a busy week of earnings that includes a handful of the Magnificent Seven names, rising yields and, of course, next week’s U.S. election are all contributing to building angst in the market, not to mention the FOMC meeting,” said Adam Turnquist, chief technical strategist at LPL Financial. “We may need to wait until after Election Day for volatility to normalize as the VIX futures curve points to potential elevated near-term turbulence for stocks.”

In Europe, the Stoxx 600 index advanced 0.7%, snapping three straight days of declines after they posted the worst monthly drop in a year on Thursday; it remains on track for its biggest weekly drop in two months. Gains for energy stocks helped prop up the gauge, with Shell Plc, Total Energies SE and BP Plc adding more than 1%. Consumer products also gained, boosted by Reckitt after a baby formula trial win. Reckitt Benckiser soared 10% after a unit of the household goods company was cleared by a jury over claims it hid health risks of its premature-infant formula. Only the travel & leisure sector is declining. Here are some of the most notable movers:

Earlier in the session, Asian stocks declined, set to cap their fifth-straight week of losses, as a stream of earnings reports failed to lift sentiment ahead of next week’s US election and a key meeting of China’s legislative body. The MSCI Asia Pacific Index fell as much as 0.8% Friday, on course for its longest weekly losing streak in more than two years. Japanese stocks fell the most since Sept. 30, after the yen strengthened against the dollar following Bank of Japan Governor Kazuo Ueda’s comments; benchmarks in Australia and South Korea also slipped. Tech megacaps including TSMC and SoftBank were among the biggest drags on the regional gauge. Equity benchmarks rose in Hong Kong after a private survey showed China’s manufacturing activity unexpectedly picked up last month, a sign of stabilization on Beijing’s stimulus blitz. Traders are awaiting a session by the Standing Committee of National People’s Congress over Nov. 4-8, where further fiscal measures may be announced.

In FX, the Bloomberg Dollar Spot Index rises 0.2%. The yen weakens 0.5%, extending declines after the DPP chief said the BOJ shouldn’t raise interest rates before March. The Swiss franc drops 0.5% after CPI surprised to the downside.

In rates, US Treasuries were steady after minor gains Thursday. But October was the worst month for Treasuries in two years after the heavy selling of the past few weeks that reflected a rethink on US interest rates given signs of resilience in the economy. Front-end yields are higher by 1bp-2bp inside Thursday’s ranges, which included the highest 2- and 5-year yields since July-August. 10-year yields around 4.29% are only slightly cheaper on the day amid similarly muted price action in bunds and gilts; 5s30s spread near 30bp is ~1bp tighter on the day, 13bp on the week UK bonds fell, extending losses this week after the Labour government’s pivotal budget and plans for additional bond sales unleashed a wave of selling. UK 10-year yields rise 2 bps to 4.47%.

In commodities, brent crude futures rose 2% to $74.30 after a report that Iran could be preparing to attack Israel from Iraqi territory in the coming days. European stocks gain for the first time in four days, led by energy and personal care names. US equity futures also rise as Amazon and Intel shares rally in premarket post-earnings, offsetting a fall in shares of Apple. Spot gold is steady around $2,746/oz.

Market Snapshot

Top Overnight News

Earnings

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the tech-heavy losses stateside and heightened geopolitical concerns, while Chinese markets outperformed after further encouraging manufacturing PMI data. ASX 200 declined with nearly all industries subdued aside from the commodity-related sectors. Nikkei 225 slumped at the open after recent currency strength and the hawkish tone from BoJ Governor Ueda. Hang Seng and Shanghai Comp were underpinned after the Chinese Caixin Manufacturing PMI followed suit to yesterday's official release with a surprise return to expansion territory, while the attention was also on recent earnings reports.

Top Asian News

European bourses, Stoxx 600 (+0.6%) are entirely in the green, with sentiment lifted following strong results from Amazon/Intel which have ultimately been able to outmuscle pre-market losses in Apple. European sectors hold a positive bias. Optimised Personal Care tops the pile, lifted by Reckitt after it received a favourable litigation decision. Energy follows close behind, with oil prices firmer amid heightened geopolitical tensions – as such, Travel & Leisure lags. US equity futures (ES +0.1%, NQ +0.4%, RTY +0.1%) are modestly firmer, and with sentiment on a stronger footing after good results from Amazon and Intel; traders await US NFP/ISM Manufacturing later in the session.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

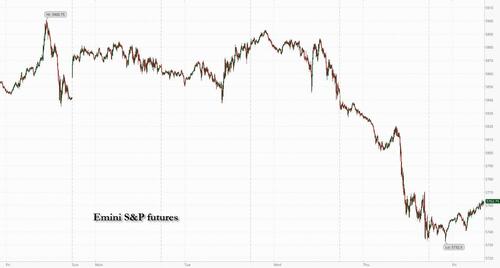

Markets finished October on a rough note yesterday, with the S&P 500 (-1.86%) posting its biggest decline in nearly two months, whilst UK assets lost significant ground thanks to investor concerns about Wednesday’s Budget. We’ll have more to say in our monthly performance review out shortly, but the declines mean that Bloomberg’s global bond aggregate has just experienced its worst month since September 2022, back when inflation was still raging and the Fed was hiking by 75bps each meeting. And for equities it’s been a lacklustre month as well, with the S&P 500 losing ground for the first time in six months.

In terms of the last 24 hours, there were several factors driving the losses, but an important one was disappointment at the big tech earnings after the previous day’s close. That meant the Magnificent 7 (-3.55%) slumped back, with Microsoft (-6.05%) experiencing its biggest daily decline in two years after they announced a weaker forecast for cloud revenue growth. But even though tech stocks led the declines in the S&P 500 (-1.86%), the losses were pretty broad, and the equal-weighted version of the index (-1.10%) also saw its weakest day since early September. Those moves were echoed in Europe too, where the STOXX 600 (-1.20%) fell to its lowest level since mid-August.

After the close, we did hear from Apple and Amazon who delivered a mixed set of results. Apple’s shares fell by close to 2% in post-market trading as it signalled slower sales growth “in the low-to-middle single digits” for the coming quarter, versus analysts’ projections for a 7% increase. By contrast, Amazon gained nearly 6% after delivering a strong profit beat. So with six of the Mag-7 reporting so far, we’ve seen an equal split of positive (Tesla, Alphabet and Amazon) and negative (Microsoft, Apple and Meta) reactions. That’s helped US equity futures to stabilise again this morning, with those on the S&P 500 pointing to a +0.24% gain.

The other big sell-off yesterday happened in the UK, as markets reacted negatively to the extra borrowing announced in the previous day’s budget. Specifically, the spread of 10yr gilt yields over bunds widened by +9.4bps to 206bps, which is their biggest gap since October 2022, back when Liz Truss was still Prime Minister. Moreover, in absolute terms, the 10yr gilt yield was up +9.5bps to 4.44%, which is its highest level since November 2023, and at the height of the sell-off they’d been up as much as +18bps intraday to 4.53%. So it was only thanks to the late recovery that things weren’t even worse. The effects were clear across other asset classes too, and sterling was the worst-performing G10 currency yesterday, weakening by -0.49% against the US Dollar to $1.2899. And with the extra borrowing announcements, investors also dialled back their expectations for rate cuts from the Bank of England, so by the close they were pricing in 80bps of rate cuts by the June 2025 meeting, down from 86bps on Wednesday.

Bonds also struggled in the rest of Europe, albeit to a much lesser extent than in the UK. This followed an upside surprise in the Euro Area inflation print, which raised doubts as to how quickly the ECB would be able to cut rates in the months ahead. It showed headline inflation was back at the ECB’s target of +2.0% in October (vs. +1.9% expected), while core CPI remained at +2.7% (vs. +2.6% expected). So it contributed to a sell-off in front-end yields as investors priced out the chance of rate cuts, with the 2yr German yield up +2.2bps. Further out the curve, yields were much steadier however, with those on 10yr bunds (-0.1bps) basically unchanged at 2.39%.

Over in the US, there’s still plenty of focus on Tuesday’s election, and yesterday saw markets react to the perception that a Republican sweep scenario was marginally less likely relative to the day before, with the prospects ticking down on prediction markets. At the margins, that was helpful for US Treasuries, given it would be more difficult to enact expansive fiscal plans under divided government, and the 10yr Treasury yield came down -1.6bps to 4.28%. Moreover, it was clear that several Trump trades were unwinding a bit, with Trump Media & Technology Group (-11.72%) falling for a second day, whilst Bitcoin fell -3.98%. Forecasting models remain very tight, with FiveThirtyEight’s model placing a 53% likelihood on a Trump victory.

Investor attention will remain on the US today given the US jobs report for October, which is the last one ahead of the Fed’s decision next week. As a reminder, the last jobs report was much stronger than expected, with nonfarm payrolls at +254k in September, alongside positive revisions to the previous couple of months. This time around though, our US economists are forecasting a weaker +100k print, which partly reflects a 44k drag from striking workers, as well as a negative impact from Hurricane Milton, which struck Florida during the October survey period. They also expect the unemployment rate to tick up a tenth to 4.2%. Click here for their full preview and how to register for their subsequent webinar.

Ahead of that, we did get some decent data on the US labour market yesterday, with the weekly initial jobless claims down to 216k in the week ending October 26 (vs. 230k expected), which is their lowest level since May. We also had the latest PCE inflation report for September, which the measure that the Fed officially target. That showed core PCE was up to a 5-month high of +0.25%, and the year-on-year rate remained at +2.7% (vs. +2.6% expected). But headline PCE was down to just +2.1% on a year-on-year basis, which is the lowest rate since February 2021. In the meantime, the Employment Cost Index for Q3 came in at +0.8% over the quarter, the weakest since Q2 2021.

In geopolitical news, oil prices rose after Axios reported that Israeli intelligence suggested Iran was planning a retaliatory strike against Israel using its proxies in Iraq. Brent crude rose +0.84% yesterday and is trading another +1.34% higher this morning at $74.14/bbl. Meanwhile, gold (-1.57%) saw its biggest retreat since July yesterday, slipping back from its record high on Wednesday.

Overnight in Asia, the sell-off has generally continued for risk assets, with the Nikkei (-2.43%) currently on course for its biggest decline in a month. Indices across other countries have also lost ground, with the KOSPI down -0.27%, and the S&P/ASX 200 down -0.51%. However, markets in mainland China and Hong Kong have outperformed, which comes as the Caixin China manufacturing PMI has moved back into expansionary territory in October with a 50.3 reading (vs. 49.7 expected). So against that backdrop, the Shanghai Comp (+0.33%), the CSI 300 (+0.65%) and the Hang Seng (+1.00%) have all posted solid gains this morning.

To the day ahead now, and US data releases include the October jobs report, along with the ISM manufacturing. Otherwise, earnings releases include Exxon Mobil and Chevron.