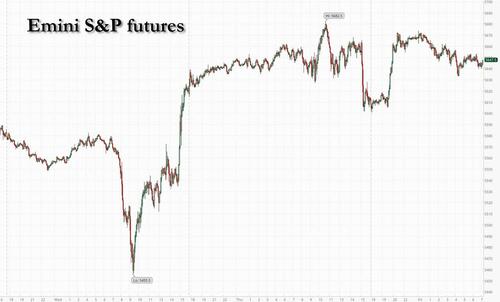

US equity futures gained ahead of the April Payolls report, but were well of their highs, after China said it is assessing the possibility of trade talks with the US, the first sign that negotiations could begin between the two sides since Donald Trump hiked tariffs last month. As of 8:10am ET, S&P futures are up 0.4% while Nasdaq 100 contracts add 0.2%, limited by weakness in the tech sector as Apple and Amazon.com shares fall in premarket after their respective updates appeared to underwhelm investors. If the S&P 500 closes in the green on Friday, it would mark a ninth day of gains, the longest winning streak for the US benchmark since November 2004. Asian markets were also broadly higher and Europe's Estoxx 50 advances 1.5% in early London session, with risk sentiment stoked after China hinted at the possibility of trade talks. Bond yields are unchanged, reversing an earlier drop, oil and USD are both lower, while gold rebounds +0.7% from recent losses. Today, all eyes on NFP at 8.30am ET to assess market sentiment; Consensus expects a 138k print vs. 228k prior and the Unemployment Rate to hold at 4.2% (more in the full preview here).

In premarket trading, Apple falls 3% after the iPhone maker reported China sales that were disappointing, and warned about the impact of tariffs. Amazon.com slips 0.5% after the e-commerce and cloud-computing company gave a weaker-than-expected outlook for operating income as tariff uncertainties weigh. Here are the other Mag7s: Alphabet +0.8%, Meta +1%, Nvidia +1.1%, Microsoft +0.3%, Tesla +0.4%. US-listed Chinese stocks rise as Beijing says its assessing the possibility of trade talks with America (Alibaba (BABA) +3%, Baidu (BIDU) +2%, NetEase (NTES) +1.3%). Airbnb (ABNB) fell 5% after issuing a weak outlook for the second quarter, citing economic uncertainties for softer travel demand in the US. Here are some other notable premarket movers:

Optimism is steadily fueling an equity comeback. If the S&P 500 closes in the green on Friday, it would mark the longest winning streak for the US benchmark since November 2004. Indeed, investors are now betting on a more market-friendly stance from President Donald Trump in the coming months, and fears about a US recession could diminish further if Friday’s key jobs report shows resilience, according to Bank of America Corp.’s Michael Hartnett.

“It seems we may have reached peak policy uncertainty,” said Kevin Thozet, a member of the investment committee at Carmignac in Paris. “There are talks ongoing, and Trump seems to have watered down some of his policies. If you add in that the earnings season has been fairly positive, the overall backdrop isn’t that bad.”

Even so, bets are rising the Federal Reserve will be forced to accelerate interest rate cuts to head off an economic slowdown. Money markets are pricing in almost four quarter-point rate cuts in 2025, one more than was anticipated before Trump’s tariff announcement on April 2.

Meanwhile, economists expect the jobs report to show only 138,000 new positions added in April after the data blew away expectations in March. The surveys behind the report were conducted the second week of April, when Trump put some levies on hold and sharply raised those on China goods (full preview here).

European stocks followed their Asian counterparts higher The Stoxx 600 is up 0.8%, led by gains in mining, technology and construction names. Utilities underperform. Here are some of the biggest movers on Friday:

Earlier, Asian stocks surged to their highest level more than five weeks in broader regional rally after China said it was mulling trade talks with the US. The MSCI Asia Pacific Index rose as much as 1.8% to the highest since March 25, with TSMC, Alibaba and Tencent among the biggest boosts. The key regional gauge is on track for a third-straight week of gains in the rebound from Donald Trump’s tariff offensive. Taiwan’s benchmark advanced more than 2% Friday, leading gains around the region as many markets reopened after holidays. Hong Kong’s Hang Seng Index climbed more than 1% after China’s Commerce Ministry said it was assessing the possibility of trade talks with the Washington, the first sign since Trump hiked tariffs last month that negotiations could begin. Mainland markets remain shut. Australia and Singapore are gearing up for federal elections to be held on Saturday, with cost-of-living issues top of mind for voters in both nations. Australian stocks rose for a seventh straight day ahead of the vote, while shares were higher in Singapore on Friday.

In FX, the Bloomberg Dollar Spot Index falls 0.4%. The Aussie dollar and Swedish krona are leading gains against the greenback. EUR/USD rose 0.3% to 1.1329; GBP/USD rose 0.1% to 1.3229

In rates, treasuries are flat ahead of the US jobs report, as 10-year yields reverse a 2 bpsdrop to trade flat at 4.22%. Gilts outperform, with UK 10-year yields falling 7 bps to 4.41%. Bunds fall, with little reaction shown to euro-area CPI which rose slightly more than expected in April.

In commodities, oil prices decline as traders weigh the possibility of US-China trade talks and a fresh sanctions threat against Iranian flows against a potential supply hike from OPEC+. WTI falls 0.8% to $58.80 a barrel. Spot gold rises $22 to around $3,260/oz. Bitcoin edges up 0.3% toward $97,000.

Looking at today's calendar, the highlight is April jobs report (8:30am), and March factory orders and durable goods orders (10am)

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly higher as many regional participants returned from the Labor Day holiday and with some hopes for US-China trade talks. ASX 200 gained with the advances led by outperformance in the energy sector following the upside in oil prices and with a continuation of the status quo seen as the outcome in tomorrow's federal election with Australian PM Albanese highly favoured to win a second term. Nikkei 225 rallied at the open but is off intraday highs after stalling near the 37,000 level and following a surprise increase in Japan's unemployment rate. Hang Seng outperformed on return from the holiday closure and despite the continued absence of mainland participants, while there were reports that China is currently evaluating possible US trade talks and noted that the US has repeatedly expressed its willingness to negotiate with China on the tariff issue, although it urged the US to demonstrate sincerity for trade talks and correct its unilateral tariff measures.

Top Asian news

European bourses (STOXX 600 +1%) are entirely in the green as the region returns from holiday; sentiment today has been boosted following a strong session on Wall Street in the prior session, and mostly positive APAC trade overnight. Price action has been relatively rangebound and near recent highs, with traders ultimately cautious ahead of the day's key US NFP report. European sectors hold a strong positive bias; Tech tops the pile, followed closely by Industrials (lifted by post-earning strength in Airbus) whilst Utilities is found at the foot of the pile. A number of banks reported today; Standard Chartered (+1%, strong Q1 results), ING (+4.5%, reported record deposit growth and launched EUR 2bln share buyback), Danske Bank (+4%, strong results across the board and guidance range topped expectations), NatWest (+1.9%, Q1 headline figures beat expectations and suggested 2025 income to be at top-end of guidance range).

Top European news

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

US Event Calendar

DB's Jim Reid concludes the overnight wrap

I briefly went back inside my old school (Hampton) last night for the first time in 33 years to help record a fund raising video. So I’m feeling a little nostalgic and old this morning. However, it could also be the incredible heatwave we’re having for the time of year playing tricks on me.

In markets as most of Europe was enjoying the one of the hotter May Day holidays on record, the S&P 500 (+0.63%) closed within 1.18% of its April 2nd close, just minutes before the Liberation Day press conference after the bell that day. This now also brings its gains over the last 8 sessions to a huge +8.65%. Indeed, that marks the fastest 8-session gain since November 2020, back when markets were surging after the announcement of the Pfizer vaccine that offered a path out of the pandemic. Meanwhile, other tariff-related moves also unwound, with the dollar index (+0.78%) hitting a 3-week high (albeit -3.43% below April 2nd close), whilst US HY spreads tightened -16bps. There continued to be mounting optimism around the trade war, following on from US trade representative Greer’s comments that deals were moving closer.

This optimism has continued overnight after China's Ministry of Commerce said that it's evaluating trade talks with the US. The ministry said this comes as "the US has recently sent messages to China through revenant parties" and urged Washington to shows "sincerity" towards China. Against that background Asian equities are higher on the news (more below), with S&P 500 (+0.77%) and NASDAQ 100 (+0.50%) futures also moving higher even after unwhelming results from Apple and Amazon last night.

Amazon’s Q1 performance was actually a touch above expectations, but the company gave weaker-than-expected guidance for the current quarter on the back of tariffs, projecting an operating profit of $13bn to $17.5bn (vs. $17.8bn expected). Amazon’s shares fell -3.2% in extended trading, mostly reversing a +3.13% gain during yesterday’s regular session. Apple delivered a modest headline beat across revenue ($95.4bn vs $94.6bn expected) and earnings, but weaker revenue in China ($16bn vs $16.83bn) was seen as a concerning sign of the potential trade war challenges. Apple stock slid by -3.8% after-hours (+0.39% yesterday). Both companies may be helped by the renewed trade optimism overnight. For more on tech’s recent performance, see our team’s April tech performance review here.

Looking back at yesterday, the tech earnings the night before played a big role in the market rally, with the Magnificent 7 surging +2.79%, alongside a +1.52% move for the NASDAQ. Microsoft gained +7.63% and Meta +4.23% after their results. Nvidia posted a +2.47% advance, also helped by a Bloomberg report that the US is considering easing restrictions on Nvidia chip sales to the UAE.

Earlier yesterday the risk-on tone had received additional support from the latest batch of US data, which wasn’t as bad as feared. In particular, the ISM manufacturing print only fell to 48.7 (vs. 47.9 expected), which wasn’t too much of a dip from the 49.0 reading in March, and still above its levels from May-November last year. Admittedly, the weekly initial jobless claims did tick up to 241k (vs. 223k expected), but that could be explained by a surge in New York, which probably reflected difficulties in the seasonal adjustment around the Easter holidays, so it wasn’t seen as a sign of a rapidly deteriorating labour market.

Staying on the data, the next watchpoint will be the US April jobs report out today, which is the first to cover the period since Liberation Day, and one of the first hard data points we’ll have. As a reminder, our US economists expect headline nonfarm payrolls to grow by +125K (vs +228K previously), with private payrolls at +125k (vs. +209k previously). So they see a reversion after a strong March, particularly within the leisure/hospitality and retail sectors but note the late Easter has the potential to distort the data and seasonal adjustments. They also expect unemployment to remain unchanged at +4.2%. You can see their full preview and register for their post-release webinar here.

Yesterday’s data also triggered a notable rise in Treasury yields, which unwound their initial decline after the ISM manufacturing release. With the release better than expected alongside the wider risk-on tone, investors dialled back their expectations for Fed rate cuts, and the 2yr Treasury yield moved up +9.6bps on the day to 3.70%, whilst the 10yr yield was up +4.86bps to 4.22%.

In Europe, markets were fairly quiet given Germany, France and Italy were closed for a public holiday. However, the UK’s FTSE 100 (+0.02%) advanced for a 14th consecutive day, which is a joint record since the index was formed back in 1984. And with most of Europe not trading, the STOXX 600 also saw a muted gain of +0.02%. Otherwise, gilt yields moved higher in line with US Treasuries, with the 10yr yield up +4.1bps on the day to 4.48%. They are both up around another +1.5bps overnight.

Coming back to Asia, equity markets are largely rising this morning boosted by the positive overnight performance on Wall Street amid China’s openness to trade negotiations. This is outweighing concerns about the effect of tariffs, which were initially triggered by disappointing earnings from Apple and Amazon. As I check my screens, the Hang Seng Tech Index (+3.37%) is surging with the Hang Seng (+1.63%) also trading sharply higher. Elsewhere, the S&P/ASX 200 (+0.91%) and the Nikkei (+0.53%) are also trading higher with the KOSPI (+0.19%) seeing minor gains. Meanwhile, China markets are closed for the Labour Day public holiday.

Early morning data showed that Australian retail sales experienced a third consecutive month of expansion in March. The +0.3% m/m increase, while marginally below the projected +0.4%, followed a +0.2% gain in the preceding month. This is a small support to the house view that the RBA should cut 25bps this month.

To the day ahead now, as mentioned earlier we will see US data releases on April Jobs, as well as March’s factory orders. Other notable data includes France March budget balance, Italy April manufacturing PMI, budget balance, March unemployment rate, Eurozone April CPI, March unemployment rate. Earnings include Exxon Mobil, Chevron, Shell, Apollo and Natwest.