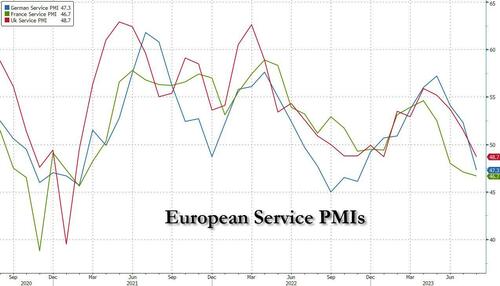

US futures have erased much of their earlier gains but were modestly higher, led by tech with NVDA higher premarket for the third consecutive day ahead of the chipmaker's much anticipated earnings report after the close. As of 7:30am, S&P futures were up 0.2%, erasing an earlier gain of as much as 0.5%; Nasdaq futures were 0.1% higher. Asian stocks gained for a 2nd straight day despite China markets resuming their slump, while Europe tumbled after dismal service PMI data. Bonds are rallying around the globe as traders pare bets on additional rate hikes by the BOE and ECB after dismal PMI data from the UK and euro area which is also hitting the Euro. 10Y TSY yields drop to 4.26% from 4.32% (4.25% had been a support level). USD is strengthening with the global bond rally and commodities mixed with strength in metals, weakness in energy, and Ags mixed. Bonds gain as traders pare bets on additional rate hikes by the BOE and ECB after dismal PMI data from the UK and euro area. Both regions saw a surprise contraction in their respective service sectors while manufacturing remained in the doldrums. UK 10-year yields are down 12bps while German 10-year yields fall 10bps.

Today's US Flash PMIs may highlight either the growth divergence among the G7 or, assuming a Services miss, that those long-and-variable lags may finally be taking hold potentially creating dovish risk to future CPI prints. In either case, Tech may benefit, acting as either a Cyclical or Defensive play. NVDA earnings are the main data point today and analysts are predicting that Nvidia’s second-quarter revenue may come in higher than the forecast it gave three months ago. The options market is also bracing for a move of about 10% following the results.

“The market is in a wait-and-see mode for the main catalysts this week: Nvidia earnings and Jackson Hole,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. “Given the strong yield increase since July, the Jackson Hole meeting is of particular interest for investors.”

Investors are looking for clues on the outlook for interest rates, after the Fed last month lifted them to a range of 5.25% to 5.5%, the highest level in 22 years. US PMI figures measuring August activity due later Wednesday will provide insights on the strength of the economy, before Powell’s remarks on Friday.

“One risk for the Fed of now arriving so close to its inflation target is that the bond market gets ahead of it and re-stimulates the economy with a big shift down in yields,” said Stephen Auth, chief investment officer for equities at Federated Hermes.

While Powell is unlikely to “surrender the hard-won credibility of the past year with a premature shift back to policy looseness,” it will be difficult for him to appear too hawkish, given inflation is clearly in decline and deflationary pressures are looming from China, Auth added.

In premarket trading, it has been a consumer bloodbath, with Foot Locker tumbled 32% after cutting its 2023 earnings forecast and pausing its dividend. Foot Locker suppliers including Nike (NKE) and Under Armour (UA) drop 3.5% and 2.9% respectively. Peloton plunged more than 30%, after giving a weak revenue forecast for the current quarter, signaling that a turnaround effort under Chief Executive Officer Barry McCarthy is bogging down. Here are some other notable premarket movers:

Wider markets are marking time ahead of a speech from Federal Reserve Chair Jerome Powell on Friday at the Jackson Hole Economic Policy Symposium. A resilient US economy has prompted investors to position for the Fed to keep borrowing costs elevated. Treasury yields fell on Wednesday, tracking moves in Europe.

Europe led a rally in global bonds as signs of a quickening downturn in the euro area prompted traders to trim interest-rate hike bets. The Euro area composite flash PMI decreased by 1.6pt to 47.0, below consensus expectations, on the back of a further meaningful decline in services activity.

Across countries, the decline in the area-wide index was led by Germany and, to a lesser extent, the periphery, while the composite index in France remained unchanged. In the UK, the composite flash PMI decreased by 2.9pt to 47.9, also below consensus expectations. The euro tumbled after the region’s PMI data, while the Stoxx 600 stock benchmark trimmed gains led by gains in the real estate, utilities and insurance sectors. Here are the most notable European movers:

Earlier in the session, Asian equities rose, on course for their first back-to-back gain this month, boosted by financial and technology shares. The MSCI Asia-Pacific Index advanced as much as 0.3%, extending Tuesday’s 0.9% rise. Key gauges advanced in Taiwan and Australia. Hong Kong shares fluctuated while mainland China benchmarks fell following a puzzling late rally on Tuesday which saw the local plunge-protection team engaged.

Tech hardware stocks including TSMC extended climbs ahead of a key earnings report from US chipmaker Nvidia. Baidu, Kuaishou and Anta Sports all rallied in Hong Kong after results. In addition to Nvidia’s report, investors await a speech from Federal Reserve Chair Jerome Powell at the Jackson Hole Symposium later this week. The meeting comes amid a renewed surge in US Treasury bond yields that along with China’s economic woes has sapped global risk appetite.

In Fx, the Bloomberg Dollar Spot Index erases Asia-session declines and edges up 0.1% as the pound and euro suffered after dismal service PMIs (see above), weakening by 0.6% and 0.3% against the greenback. The yen is the best performer among the G-10s, rising 0.3%.

In rates, bonds gained as traders pare bets on additional rate hikes by the BOE and ECB after dismal PMI data from the UK and euro area. Both regions saw a surprise contraction in their respective service sectors while manufacturing remained in the doldrums. UK 10-year yields are down 12bps while German 10-year yields fall 10bps. US treasuries advanced, boosted by wider gains across bunds. Outperformance of core European rates drags Treasury yields lower by 5bp to 7bp across the curve with gains on the day led by intermediates. US 10-year yields drop to around 4.26%, remain near lows of the day and richer by 6.5bp vs. Tuesday close; bunds and gilts outperform in the sector by 4.5bp and 6bp following wave of soft European economic data. Treasury auctions resume with $16 billion 20-year bond sale at 1pm New York, while $8 billion 30-year TIPS sale is scheduled for Thursday. US focus is on manufacturing PMI, while Treasury auctions resume with 20-year bond sale later in the session.

In commodities, crude futures decline, with WTI falling 0.9% to trade near $78.90. Spot gold rises 0.3%.

To the day ahead now, and data releases include the flash PMIs for August from the US and Europe, US new home sales for July, and the preliminary Euro Area consumer confidence reading for August. In the US, there’s also the preliminary benchmark revisions for nonfarm payrolls. Today’s earnings releases include Nvidia. Finally in the political sphere, there’ll be the first US Republican primary debate tonight.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed amid a slew of earnings releases alongside the latest PMI data from the region, but with price action relatively rangebound heading closer to the Jackson Hole Symposium. ASX 200 was led higher by strength in consumer stocks and the mining sector, with the index unfazed by weaker PMI data from Australia which showed manufacturing at a 6th consecutive monthly contraction. Nikkei 225 pared opening losses although the upside was capped ahead of the 32,000 level after mixed PMI figures, and with Japan facing backlash from China and Hong Kong for its plan to release Fukushima water. Hang Seng and Shanghai Comp were mixed with trade in Hong Kong indecisive and the mainland subdued amid several earnings releases, and as participants await results from China’s big banks.

Top Asian News

European bourses are firmer, Euro Stoxx 50 +0.5%, but off of pre-data highs as the morning's dismal PMIs sparked selling pressure given the negative growth outlook; however, this proved short-lived amid the broader backdrop of a marked pullback in yields. Sectors are mostly in the green with Utilities, Real Estate and Basic Resources outperforming while Auto names lag modestly. Stateside, futures are firmer and attempt to claw back some of Tuesday's pressure, ES +0.6%, directional action in-fitting with the above European moves given an absence of specific catalysts. Focus ahead includes a handful of data points before NVIDIA earnings after the bell, the name is currently +1.5% in pre-market trade after closing lower by 2.8% on Tuesday.

Top European news

FX

Fixed Income

Commodities

Geopolitics

US event calendar

DB's Henry Allen concludes the overnight wrap

Markets put in a pretty subdued session over the last 24 hours, with low volumes and a pause in the selloff of longer dated bonds, even as the ‘higher-for-longer’ narrative continued at the front-end. There weren’t really any new catalysts to drive things, but that should start to change as we move towards the end of the week and Fed Chair Powell’s speech at Jackson Hole. Indeed, we’ve got several events on the calendar happening today, including the August flash PMIs, Nvidia’s earnings after the US close, along with the latest revisions to nonfarm payrolls.

Those flash PMIs should offer an initial indication of how the global economy has fared so far this month, so all eyes will be on the US readings in particular to see if their economy maintains its recent strength. Overnight, we’ve begun to see some of the readings out of Asia, with Japan’s composite PMI ticking up to a 3-month high of 52.6, whereas Australia’s composite PMI fell back to a 19-month low of 47.1. So there’s not been an obvious trend so far at a global level. Later this morning we’ll get the European numbers, where the recent softening in the PMIs has been among the arguments in favour of a hard landing, particularly in manufacturing where the July PMI was at its lowest since the first Covid wave.

As we look forward to those releases, markets continued to price in a higher-for-longer rates view, with Fed pricing for the December 2024 meeting ticking up another +4.9bps to 4.41%, which is the highest so far this cycle. As a result, that meant that front-end Treasuries were one of the few bonds to sell off yesterday, with the 2yr Treasury yield up +4.5bps to 5.05%. That’s its second-highest close since the GFC, and the only day it’s closed higher in this cycle was on March 8, when they reached 5.07% just before the market turmoil surrounding SVB began.

But apart from front-end Treasuries, yesterday saw the relentless bond selloff finally ease up,with yields turning lower throughout the world. In the US, the 10yr Treasury yield closed -1.4bps lower at 4.32%. And in Europe the declines were even larger, with yields on 10yr bunds (-5.8bps), OATs (-6.8bps) and BTPs (-9.4bps) all falling back. That trend has continued overnight as well, with yields on 10yr Treasuries down a further -1.6bps to 4.31%.

For equities, there was also a relative outperformance in Europe relative to the US. The S&P 500 (-0.12%) was near flat on the day, with banks (-2.41%) in the index underperforming after the move by S&P to downgrade the rating of several firms. The textiles & apparel segment (-1.66%) also underperformed after an outlook downgrade by Dick’s Sporting Goods (-24.15% yesterday) weighed on the broader sports apparel sector. The NASDAQ was little changed (-0.06%), with chipmaker Nvidia (-2.77%) reversing some of Monday’s +8.47% jump ahead of its eagerly anticipated results after the close today.

Over in Europe there was a much stronger performance, and the STOXX 600 (+0.68%) posted a second daily advance that was led by technology companies. That outperformance from Europe came in spite of a fresh rise in natural gas prices yesterday, which were up another +5.21% to €42.91 per megawatt-hour. That takes them to their highest closing level since April, and comes amidst a potential strike at a key LNG facility in Australia that could start on September 2. Today is an important day in the negotiations as well, since the Offshore Alliance who represent two of the unions, have said they would take strike action if an agreement weren’t reached by close of business today.

Overnight in Asia, we’ve seen some further equity declines this morning, with the CSI 300 (-0.72%) and the Shanghai Comp (-0.55%) both losing ground, along with South Korea’s KOSPI (-0.44%). That said, other indices have been more positive, with the Hang Seng up +0.35%, and the Nikkei up +0.15%. US equity futures are also pointing to a solid start, with those on the S&P 500 up +0.24%.

Looking ahead, another release to watch out for today will be the US Quarterly Census of Employment and Wages (QCEW) for Q1. Importantly for markets, they provide a benchmark for other data series, including the monthly nonfarm payrolls series. Our US economists have a preview of the release (link here), and they point out that the latest federal withheld income tax data suggests that this QCEW could point to a softer labour market relative to our current understanding from the monthly employment data. Recent months have already seen a slowing in the nonfarm payrolls numbers, with the two most recent figures running beneath 200k for the first time since 2020.

Elsewhere on the data side, we had a few US releases out yesterday. Existing home sales in July fell back to an annualised rate of 4.07m (vs. 4.15m expected), which is their lowest level in 6 months. Meanwhile, we received mixed regional activity surveys. The Richmond Fed’s manufacturing index for August came in at a 7-month high of -7 (vs. -10 expected), while the Philadelphia Fed’s non-manufacturing index fell from +1.4 to -13.1, largely reversing its improvement in July.

To the day ahead now, and data releases include the flash PMIs for August from the US and Europe, US new home sales for July, and the preliminary Euro Area consumer confidence reading for August. In the US, there’s also the preliminary benchmark revisions for nonfarm payrolls. Today’s earnings releases include Nvidia. Finally in the political sphere, there’ll be the first US Republican primary debate tonight.