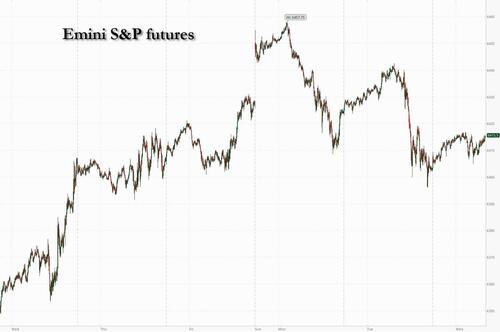

US equity futures were modestly higher in the hours before Wednesday’s Fed rate decision (where Powell is expected to keep rates unchanged) as traders also braced for the restart of Mag7 earnings with META and MSFT reporting after the close, while also bracing for an avalanche of macro news. As of 7:45am, S&P 500 futures rose 0.1% and Nasdaq 100 contracts add 0.2%, with all Mag7 names (ex-GOOG) higher premarket with Semis also bid up.Expectations are for the Fed to hold rates steady, with as much as 2 governor dissents (for the first time since 1993), with a focus on the Powell press conference for any hints of what the Fed will do in Sept. The Treasury’s refunding announcement is today which may add some bond vol. The yield curve is seeing bear steeping (10Y trading 4.33%, up 1bps) with the Bloomberg Dollar Index snapping a 4-day rally that followed trade pacts with the European Union and Japan. Commodities are mixed with profit-taking in Energy, Ags/Base higher, and gold up but silver down. There is a flood of data: first at 8:30am, we get US GDP (Q2 advance; consensus +2.4%, last -0.5), ADP employment (GS +90k, consensus +80k, last -33k), and Treasury QRA (GIR sees a 50–100% increase in buybacks. The key: a) Will coupon sizes be reduced? (low chance) b) How much of the buyback is aimed at long-dated paper? This afternoon, all eyes are on FOMC decision (no change expected // watch for 2 dissenters in Bowman + Waller // mkt pricing in 1.86 cuts through YE). Tonight, watching MSFT + META earnings (positioning in both remains elevated).

In premarket trading, Meta leads gains among Mag 7 ahead of its earnings report. Microsoft is also slated to report after the market closes (Meta +1.%, Nvidia +0.5%, Tesla +0.2%, Microsoft +0.3%, Apple +0.2%, Amazon +0.1%, Alphabet -0.1%). Here are some other notable premarket movers:

In other corporate news, Tesla is said to have signed a $4.3 billion agreement to source lithium iron phosphate batteries from LG Energy in the second tie-up for the EV maker in South Korea this month. Anthropic is said to be nearing a deal to raise as much as $5 billion in a new round of funding that would value the AI startup at $170 billion.

The Fed is almost unanimously expected to hold rates steady for a fifth consecutive meeting in the face of sustained pressure from President Donald Trump on Powell to lower borrowing costs, but watch out for the number of dissenting rate-setters and Chair Jerome Powell’s commentary, as well as Trump’s undoubtedly angry response to it all. There is just a 3% market implied chance of a 25 rate cut today (our full preview is here).

Investors will watch for any signs of a greater openness from the Fed to easing when it next gathers in September as they take stock of the number of dissenting policymakers. Swap markets have priced around 100 basis points of easing over the next 12 months.

“They’ll want to see what happens on the inflation side, so the speed of those cuts may not be as much as risk assets might want,” Priya Misra, portfolio manager at J.P. Morgan Asset Management, told Bloomberg TV. “Interest rates are still restrictive. How much do they need to cut to get into accomodative territory? They have to cut a lot.”

Inflation and jobs data since the Fed’s June meeting, as well as trade-policy developments, haven’t moved the Fed any closer to a cut, according to Bloomberg Economics’ Anna Wong, “If anything, the core PCE inflation data release due July 31 — which we expect to be a hot print – and July’s nonfarm payrolls, due Aug. 1 and also likely to be strong — may divide the committee even further,” she wrote.

Before the Fed, GDP figures will offer an update on the health of the American economy in the buildup to Friday’s key payrolls report. The relentless rush of big earnings continues in the US later, with Microsoft and Meta both reporting. Theire results will be a crucial barometer for growth stocks — which have supercharged gains for US equities this year. Meta’s ad impressions and pricing could see some pressure amid a spending pullback among Chinese advertisers, according to Bloomberg Intelligence. Microsoft is expected to post a 14% rise in sales when it reports results Wednesday, driven by growth in its Azure cloud-computing unit.

“Earnings and data matter more than Wednesday’s Fed meeting, and that’s why stocks will likely nudge higher again this week, despite any possible short-term disruption from the central bank decision" said BBG macro strategist Mark Cudmore. "This year is primarily about trade policy, and the most important issue for markets and consumers is, when will the impact of tariffs show up in prices and profits? It’s the answer to that question that will dictate the future US rate path more than any sell-side generated excitement over the number of dissents.”

On the trade front, there were signs of rapprochement between the US and China. Trump is set to make the final call on maintaining their tariff truce before it expires in two weeks, an extension that would mark a continued stabilization in ties between the world’s two biggest economies. Chinese trade negotiator Li Chenggang told reporters in Stockholm the two sides had agreed to prolong the pause, without providing further details.

“It’s clear both sides want to do a deal,” said Justin Onuekwusi, chief investment officer at St James’s Place in London. “That willingness at the moment is enough to appease markets.”

Elsewhere, the US West Coast and countries in the Pacific braced for tsunamis in the wake of a powerful earthquake in Russia’s Far East, although the initial waves to hit Japan were small. The yen gained 0.4% against the dollar after a tsunami warning for areas including the Tokyo Bay.

According to Barclays strateeegists, the US stock rally has been fueled by retail traders, while institutional buying has been more measured. CTA and vol target funds’ exposure has increased only modestly, suggesting more room for upside, while hedge funds trimmed long bets.

In Europe, the Euro Stoxx 600 edges higher, reversing earlier losses after data showed the euro-area economy unexpectedly grew in the second quarter. Gains in consumer goods, food, and construction offset losses in chemicals and retail. Mercedes-Benz and Porsche fall after cutting profit forecasts, citing tariff pressure, while HSBC drags on banks after missing estimates. Luxury group Kering and food giant Danone jumped following their respective earnings, while HSBC and Adidas fell on theirs. Amplifon plunges most on record after posting weak results and cutting its full-year outlook. Here are the biggest movers Wednesday:

Earlier in the session, Asian stocks eked out small gains as investors looked past some tariff developments and turned their focus to key monetary policy decisions from Japan and the US. The MSCI Asia Pacific Index gained as much as 0.6%, poised to snap a three-day decline, with chipmakers TSMC and Samsung Electronics among the top contributors. Equities advanced in tech-heavy South Korea and Taiwan. The regional benchmark has slipped slightly after climbing to a four-year high last week. Markets in Hong Kong traded lower as trade talks between Beijing and Washington were set to continue ahead of the expiry of a tariff truce in two weeks. Adding an extra 90 days is one option, Treasury Secretary Scott Bessent said, while President Donald Trump will make the final call. Separately, the US also said that India may be hit with a tariff rate of 20% to 25%. Stocks were mixed in Tokyo ahead of Bank of Japan’s policy decision Thursday. The central bank is expected to keep rates unchanged this time, while the market gauges prospects for another hike this year. Investors have also moved to the sidelines as they await the August 1 tariff deadline after Japan forged a trade deal with the US last week.

In FX, the Bloomberg Dollar Spot Index slips 0.1%. The yen leads G-10 FX, up 0.3% against the dollar, while the Aussie lags, down 0.2% after softer-than-expected inflation.

In rates, treasuries dip ahead of the quarterly refunding and Fed decision, with US 10-year yields up 1bp to 4.33%.

Bunds hold gains, with German 10-year yields down 2bps to 2.69%. Gilts outperform, pushing UK 10-year yields 4bps lower.

In commodities, oil falls 0.6%, with WTI near $68.80, while spot gold gains $6 to around $3,332/oz.

Bitcoin is a little lower and trades just above the USD 118k mark; Ethereum posts deeper losses and holds just above USD 3.8k.

Looking ahead to today, the main event will be the Fed rate decision at 2pm ET. Before the decision, the main data releases will be the ADP’s employment change data for July at 8:15am. At 8:30am, markets will pay close attention to readings of GDP, personal consumption and core personal consumption expenditures prices for the second quarter. Pending home sales for June are due at 10am, before the day’s main event — the Fed’s latest policy decision at 2pm. On the earnings side, we will hear from two of the Mag-7 with Microsoft and Meta reporting after the US close. Other US results include Qualcomm and Ford, while in Europe the highlights include Airbus, BAE, Mercedes-Benz and Porsche

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the subdued handover from Wall St, where the S&P 500 snapped a six-day win streak and as participants braced for approaching key events, including the FOMC and several megacap earnings releases. ASX 200 advanced with gains led by strength in Real Estate and Consumer Staples, while stocks also benefited from the softer yield environment after CPI data either matched or printed below forecasts. Nikkei 225 lacked conviction amid little pertinent catalysts, and as the BoJ kicked off its two-day policy meeting. Hang Seng and Shanghai Comp were mixed with the mainland underpinned following the conclusion of the two-day talks between the US and China, where negotiators were pushing for a 90-day truce extension and await a sign-off from US President Trump.

Top Asian News

European bourses (STOXX 600 +0.1%) opened mixed and have continued to trade sideways throughout the morning; though more recently, some upside has been seen. European traders have had French GDP (marginally beat expectations), German Retail Sales (beat), Spanish CPI (mixed), German GDP (Q/Q in-line; Y/Y firmer), EZ Sentiment (stronger-than-expected), EZ GDP (above expectations) - little move seen across the equities complex. European sectors are mixed and with the breadth of the market fairly narrow, aside from the day’s underperformer. Chemicals is weighed on by post-earning losses in Symrise (-6%), where the co. reported a rev. slowdown. Consumer Products is found around the middle of the pile, given the mixed earnings from within the sector; in Luxury, Kering (+4%) and Hermes (-4%) are playing tug-of-war, whilst Adidas (-7%) adds to the downside after its H1’25 update. The German sportswear giant reported strong profits, attributed to resilience in the retro shoe market – though it was still shy of expectations; further adding to the pressure is the co. flagging a USD 231mln tariff-related hit.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

The main story over the last 24 hours has been a reversal from Monday’s divergent price action in transatlantic fixed income markets, and a jaw-dropping intraday -30% plunge in Novo Nordisk — Europe’s second-largest company, now relegated to sixth with the move. The stock eventually closed -23.11% lower. What’s remarkable is that indices including Novo, like the Stoxx 600 (+0.33%), still managed to finish higher, outperforming the S&P 500 (-0.30%). Imagine if one of the top two or three S&P 500 names dropped that much in a single session—it would be absolute chaos. For context, Microsoft, the second-largest US company, has a market cap of $3.81trn, while Novo fell from $313bn to $240bn yesterday. Talking of Microsoft, they report after the closing bell today, alongside Meta.

In fixed income, US Treasuries saw a strong rally, as 2yr yields fell -5.8bps, while 10yr (-9.1bps) and 30yr (-10.2bps) yields saw their biggest daily declines since early June. There’s a growing narrative that today’s refunding announcement could include measures aimed at helping to cap yields. See our strategists’ preview here where they don't see much new being delivered. A strong 7yr auction after the European close also helped sentiment, as $44bn of bonds were issued -2.6bps below the pre-sale yield with the highest bid-to-cover ratio for a 7yr auction since 2012. For more context on the drop in yields, see yesterday’s CoTD (link here), which highlighted that we’re in a seasonally strong period for bonds. Our rates strategists are waiting for these seasonal effects to fade before initiating more bearish trades. Interestingly, European yields moved in the opposite direction though, reversing Monday's rally, with 10yr Bunds, OATs, and BTPs rising +1.9bps, +1.4bps, and +1.2bps, respectively.

The large fall in US yields came ahead of the FOMC today with our economists expecting the Fed to keep rates on hold for a fifth straight meeting at 4.00-4.25%. The decision is unlikely to be unanimous, and they expect two governors to dissent for the first time since 1993. Just before the blackout period Governor Waller reinforced his case for a July rate cut, while Vice Chair of Supervision Bowman earlier left open the door to supporting a cut if “upward pressures remain limited to goods prices.” In terms of near-term policy, our economists think Powell is unlikely to remove a September rate cut from consideration nor intentionally raise the probability of that outcome. Even though political pressure on Powell to cut rates remains high, our view is that due to modestly stronger inflation prints over the coming months, the first cut should be in December, after which we expect a further 50bps reduction in Q1 2026.

The decline in yields came even as breakevens moved higher amid a new spike in oil prices as Trump suggested that he would impose new measures against Russia if Moscow failed to agree to a ceasefire within 10 days. While there was no new detail on what shape sanctions or tariffs would take, Trump said he was not worried about the potential impact on oil prices, saying “I don’t worry about it. We have so much oil in our country. We’ll just step it up, even further”. Brent rose +3.53% to $72.51/bbl, its biggest spike in six weeks and extending a +2.34% rise on Monday.

It was a busy day in the corporate world, especially in pharma, where both tariffs and earnings were in focus. As mentioned earlier, Novo Nordisk had a brutal session after revising its sales growth forecast from 21–24% down to 8–14% amid a slowdown in sales of its weight-loss drug Wegovy, and announcing a new CEO. Shares plunged as much as -30% before recovering slightly to close -23.11% lower, which was still its largest fall since data starts in 1991. Shares in rival Eli Lilly & Co also fell -5.59% as investors worried about broader sector weakness.

US equities retreated more broadly, with the S&P 500 (-0.30%) ending a run six consecutive record highs. Among the post-earnings underperformers, UnitedHealth fell -7.46% on weaker Q2 sales and PayPal dropped -8.66% as volume growth disappointed, though it announced a new feature for merchants to accept crypto payments from consumers while receiving USD for a fee of just 0.99%. The Mag-7 fell -0.68% ahead of results from Microsoft and Meta this evening, with Meta sliding by -2.46%.

Over in Europe, the STOXX 600 (+0.29% after -0.22% Monday) and Germany’s DAX (+1.03% after -1.02%) reversed Monday’s declines but the STOXX Autos & Parts index fell another -0.18% after the -1.82% slump in the fallout from the US-EU trade deal. Another European asset that continued Monday’s decline was the euro, which fell -0.36% to 1.1547, while the dollar index hit a five-week high.

Following the weekend US-EU deal, US Commerce Secretary Lutnick said there’s still “plenty of horse trading left to do” before finalising agreements. He noted that the EU accepted the deal to protect its pharmaceutical and automotive sectors, but said he expected to continue discussing with the EU on issues like digital services taxes and metals tariffs. President Trump is expected to announce pharma tariffs within the next two weeks, which for the EU should now be covered by the 15% tariff level.

In other trade news, US Treasury Secretary Bessent said the US and China were continuing talks on maintaining their current trade truce before it expires in two weeks’ time. He said another 90-day extension, which had been indicated by China’s delegation, was an option but that the final decision lay with Trump. National Economic Council Chair Hassett said Trump would see the final details on the China talks today. Meanwhile, Trump suggested that India could be hit with a tariff rate 20-25%, though he cautioned that the final rate had not yet been finalised as both sides are still negotiating ahead of Friday's deadline. We are yet to hear a response from PM Modi’s government as we go to print.

We are mostly edging higher this morning in Asia led by the KOSPI (+0.87%), buoyed by hopes of a US trade agreement prior to the August 1 deadline, with the S&P/ASX 200 (+0.65%) also benefiting from a soft quarterly inflation report (details below). In other regions, both the CSI and the Shanghai Composite are trading +0.52% higher. Meanwhile, the Nikkei (+0.02%) is flat with the Hang Seng dipping -0.43%. S&P 500 (+0.12%) and NASDAQ 100 (+0.18%) futures are slightly higher.

Returning to Australia, core inflation eased in the three months leading up to June, reinforcing the argument for the RBA to cut rates as soon as August. The trimmed CPI rose by +0.6% in the second quarter compared to the previous three months, falling short of the 0.7% forecast. On a yearly basis, it increased by +2.7%, only because of higher revisions earlier in the year, aligning with expectations and down from +2.9% in the first quarter. Following the data, yields on the policy-sensitive 3-year government bonds has continued to decline (-5.7bps on the day) as traders have fully incorporated expectations for an RBA rate cut next month, with the likelihood of an additional cut at the September meeting rising to approximately 40%.

Yesterday was also a busy day for US data, which sent a decent signal on the state of the US economy. The Conference Board’s July consumer confidence index came in stronger than expected at 97.2 (vs 96.0), while inflation expectations continued to reverse their spike earlier in the year. And the advance goods trade balance for June came in at -$86bn, less negative than the -$98bn expected. This stronger net exports signal pushed up the Atlanta Fed’s GDPNow for Q2 from 2.4% to 2.9%. There was a slight softness in the June JOLTS job openings at 7.437 million (vs 7.5m expected) but the quits and layoffs rates held steady at low levels of 2.0% and 1.0%, respectively, suggesting a still solid labour market.

In Europe, the ECB’s latest consumer expectations survey showed 1yr inflation at 2.6% and 3yr inflation at 2.4%, both in line with forecasts. Ahead of tomorrow’s flash GDP prints for the Euro Area’s largest economies, Spain reported Q2 GDP growth of +0.7% QoQ (vs +0.6% expected), while Belgium came in at +0.2%. Our economists expect Euro Area GDP to grow +0.1% QoQ (consensus 0.0%) and see upside risks to that forecast.

Looking ahead to today, the main event will be the Fed rate decision at 19:00 LDN time. Before the decision, the main data releases will be US GDP, ADP employment change and personal consumption. In Europe, the focus will be on the eurozone flash GDPs and consumer confidence. On the earnings side, we will hear from two of the Mag-7 with Microsoft and Meta reporting after the US close. Other US results include Qualcomm and Ford, while in Europe the highlights include Airbus, BAE, Mercedes-Benz and Porsche