Tuesday's post-hot CPI dump now seems like a distant bad dream as US equity futures continued their rebound, following a tech fueled rally on Wednesday that drove the S&P 500 back above 5,000. As of 8:05am, S&P 500 futures were up 0.1%, also approaching pre-CPI levels; Nasdaq futures were as usual even stronger, rising 0.2% Europe’s Stoxx 600 index surged to the highest in more than a month. WTI crude oil futures are down 0.8% on heels of 1.6% drop Wednesday, following a bearish report by the IEA which predicts lower demand growth than supply growth in 2024. Today’s macro focus is on Retail Sales and Jobless data amid the barrage of data which includes import/export price indexes, Empire State manufacturing and Philadelphia Fed business outlook surveys, January industrial production, December business inventories, February NAHB housing market index and December TIC flows. A weaker print in retail sales - which our preview suggested is coming - and claims may continue the rally in bonds, potentially pushing the Equity rotation that began last week (paused with CPI) farther. There are also three Fedspeakers today.

In premarket trading, Cisco fell 4% after the maker of computer networking equipment slashed its full-year forecast, and announced it would lay off 5% of its workforce, prompting more questions about this chimeric earnings renaissance thanks to AI which has yet to come. Here are some other notable premarket movers:

Wednesday’s powerful rebound, fueled by a wave of dip buyers, showed that investors should avoid making hasty conclusions on the back of a single data point, according to Julian Emanuel, chief equity strategist at Evercore ISI.

“The clear implication of what we’ve seen in the last few days is don’t trade the numbers,” Emanuel said in an interview with Bloomberg TV. “If you traded CPI after the number, you’re already far underwater given the bounceback we had yesterday. Thinking about the last 40 years you make money by buying pullbacks.”

To be sure, mostly favorable earnings reports have been a boon for investors hammered by Tuesday’s hotter-than-expected US inflation reading and disappointed they may have to wait longer for interest rate cuts. Treasuries also rebounded as investors braced for more economic reports that could help determine the Federal Reserve’s rate path. Data due later include initial jobless claims, industrial production and retail sales which BofA's card spending data suggests will be a big miss to expectations.

“The ‘hot’ inflation data do not change our base case for a soft landing,” said Solita Marcelli at UBS Global Wealth Management. “But we are continuing to monitor the incoming data and the start of rate cuts could be delayed should the economic prints remain strong.”

European stocks rose for a second day, with the Stoxx trading at session highs up 0.9%, although the FTSE 100 has struggled to keep pace after the UK slipped into a mild recession in the second half of 2023. European bourses were sharply higher, with autos leading the gains, buoyed by Stellantis’ buyback announcement, while energy stocks are the biggest laggards. Here are the biggest European movers:

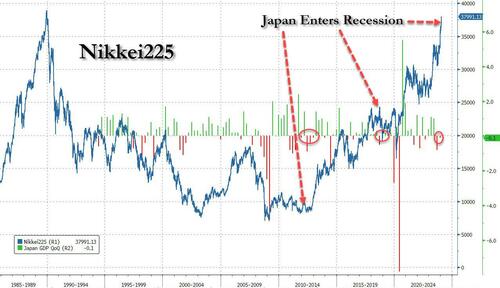

Earlier in the session, Asian stocks rose with Japan stocks shaking off worse-than-expected GDP numbers and Hong Kong overcomes early declines. The Aussie slips and bonds rise after a lower-than-forecast jobs number. Hong Kong’s tech gauge leads the city’s gainers, rising 0.6%. In Japan, the Nikkei adds 1% and is rapidly approaching its all time high set in 1989 even as a recession strikes...

... while the Topix underperforms, climbing 0.2%. Indonesia’s stocks rise as Prabowo Subianto looks poised to win the nation’s election. In currencies, the Aussie dips to the day’s low of 64.78 US cents while the yen rises slightly, adding 0.2% after the nation’s GDP contracted versus an expected gain. JGBs rise.

In FX, the Bloomberg dollar index dropped, while the concurrent slide of two major G-10 countries in recession had opposite effects on their currencies: Japan's yen shrank while the pound slumped, and was the weakest G-10 currency, falling 0.1% versus the greenback. The yen climbed for a second day, paring some of the US CPI-induced weakness earlier this week that spurred verbal warnings from Japanese authorities. The Aussie steadied following an earlier dip driven by soft jobs data, which brought forward RBA rate cut bets. The yen fluctuated earlier after data showed Japan’s gross domestic product contracted at an annualized pace of 0.4% in the final three months of last year, shrinking for a second quarter and prompting some BOJ watchers to push back bets on when the negative interest rate policy will end

“With verbal interventions from the authorities, concerns about the real action prevail in the market, making it hard for market players to test the dollar-yen’s upside,” said Tsutomu Soma, a bond and currency trader at Monex Inc. “However, the downside is also limited to some extent because even if the BOJ scraps negative rate policy, wide yield gap still remains as it will be very cautious to lift the rate from zero.”

In rates, treasuries rise as investors look ahead to a busy US data calendar that includes retail sales and industrial production. Gains for Treasury futures during Asia session and European morning trim yields by 2bp to 4bp across the curve and leave 2s10s, 5s30s spreads slightly flatter on the day, as the surge in yields sparked by January CPI data Tuesday drew dip-buyers and continues to be unwound. 10-year TSY yields are around 4.225% is ~3bp richer on the day, outperforming bunds and gilts in the sector by ~1bp; front-end Treasuries lag slightly, flattening 2s10s, 5s30s spreads by 1bp and 0.5bp on the day, partially unwinding Wednesday’s steepening move. US session features a heavy economic data calendar including retail sales, weekly jobless claims and industrial production.

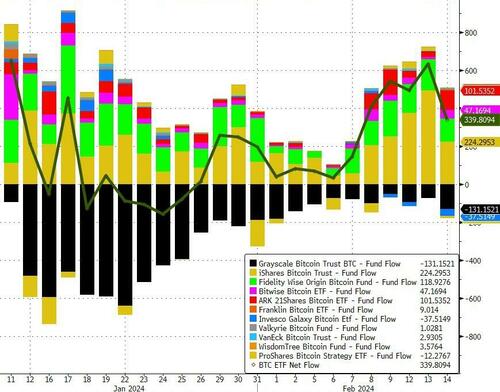

In commodities, oil prices decline, with WTI falling 0.7% to trade near $76.10. Spot gold adds 0.2%. Bitcoin rises ~1% to trade above $52,000.

Bitcoin (+0.9%), continues its advances, but has so far found resistance around the $52.5k level. Ethereum currently just shy of USD 2.8k. Bitcoin ETF inflows continued apace if modestly off yesterday's record high.

Finally looking to the day ahead, in terms of US data we get January retail sales and import/export price indexes, February Empire State manufacturing and Philadelphia Fed business outlook surveys and weekly jobless claims data (8:30am), January industrial production (9:15am), December business inventories, February NAHB housing market index (10am) and December TIC flows (4pm). Elsewhere, we got UK Q4 GDP (which unexpectedly joined Japan in sliding into recession), Eurozone December trade balance, Canada January housing sales and December manufacturing sales. We will be hearing from the ECB’s Lane and Nagel, and the BoE’s Greene and Mann. Finally, earning releases include Applied Materials, Deere, Stellantis, DoorDash, DraftKings, and Roku.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly took impetus from the rebound on Wall St after the Fed downplayed the recent CPI report. ASX 200 was led higher by a rally in tech and real estate but with upside capped by disappointing jobs data. Nikkei 225 climbed back above the 38,000 level and printed a fresh 34-year high with the index largely unfazed by the surprise contraction in Q4 GDP which showed that Japan's economy entered into a technical recession. Hang Seng traded rangebound amid quiet newsflow and the continued absence of mainland participants

Top Asian News

European bourses, Stoxx600 (+0.5%) began the session entirely in the green and continued to extend throughout the European morning. The CAC 40 (+0.9%) incrementally outperforms after a slew of strong results from heavyweight names within the index. European sectors hold a positive tilt with Autos parked at the top of the pile, assisted by gains in Renault (+5.5%), with Industrials also benefitting from post-earning strength in Safran (+3.6%) and Schneider Electric (+3.2%). US Equity Futures (ES +0.1%, NQ +0.1%, RTY +0.9%) are modestly firmer, though with clear outperformance in the RTY, as it continues the prior day's outperformance. Cisco (-5.5%) reported generally strong metrics, though did provide soft guidance. Goldman Sachs on European Stocks: raises 12-month Stoxx 600 target to 510 (prev. 500; last close 485). upgrade Travel & Leisure to Overweight from Neutral; upgrade Consumer Products & Services to Overweight from Neutral; downgrade Energy to Neutral from Overweight; downgrade Utilities to Underweight from Neutral.

Top European News

Earnings

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Bank speakers

DB's Jim Reid concludes the overnight wrap

The last 24 hours have been surprisingly calm after the turmoil of the previous session. 2yr US yields rallied back -8.0bps after rising +18.3bps the day before, encouraged by some dovish Fed speak. 10yr yields fell -5.8bps after the +13.5bps spike the previous session while December 2024 Fed pricing increased +8.9bps after a full 25bps had been taken out on Tuesday. The S&P 500 closed +0.96% higher, retracing nearly three-quarters of Tuesday’s losses.

Today we have a busy day of US data with retail sales the highli ght. So we will see if that continues to encourage volatility ahead of an important US PPI tomorrow, as some of its subcomponents inform forecasts for the core PCE number later this month. As Chicago Fed President Goolsbee reminded markets yesterday, the Fed’s inflation goal is based on the core PCE number, and not CPI. In addition, some of the strong services CPI drivers we saw in Tuesday’s print do not enter the PCE calculation and are instead taken from the PPI. A known dove, Goolsbee also stated “inflation can be [a] bit higher and still on track to 2%” and that he does not “support waiting until inflation at 2%” before the Fed cuts.

Whether he represents the views of the rest of the committee is open to some debate given his dovish history but for yesterday it was enough to calm the market to some degree as an additional +8.9bps of cuts were priced in by the Fed’s December meeting and we saw a notable -8.0bps and -5.8bps rally in 2 and 10yr yields. But there was little change in the market’s expectation of the timing of the first cut, with the first full 25bps still priced in for the June meeting.

Over in Europe, markets also modestly raised their expectations of ECB rate cuts, with +5.8bps more of cuts priced in by year-end. 10yr bund yields fell -5.7bp s, while OATs (-6.5bps) and BTPs (-9.0bps) outperformed.

In US equities, the S&P 500 rose by +0.96%, reversing much of Tuesday’s -1.37% decline and closing back above the 5,000 mark. The Russell 2000 (+2.44%) was the outperformer after the rout the day before that saw it experience its worst day (-3.96%) since June 2022, when the Fed made a late surprising move to guide the market to a 75bps hike. The NASDAQ rose +1.30%, with the Magnificent 7 (+1.53%) effectively erasing their -1.54% decline the previous day. A notable milestone was Nvidia (+2.46%) overtaking Alphabet’s (+0.55%) market capitalisation, to become the third largest company at $1.825trn. This comes only one day after the semiconductor company topped Amazon (+1.39% yesterday). Nvidia’s rise spearheaded a rally for the wider semiconductor sector, as the Philadelphia Semiconductor Index gained +2.18%. My CoTD yesterday discussed what happened next to all the top 5 companies in the S&P 500 over the last 60 years. See it here for more.

In the Eurozone, in terms of data we had the second print of Q4 GDP. As is typical, this was confirmed at the stagnant (0.0%) flash reading, but the details pointed to still solid (+0.3% qoq) employment growth in Q4. We also had the December industrial output, which posted at +2.6% month-on-month (vs -0.2% expected), but this upside was mostly due to distorted Ireland data. Against this backdrop, the STOXX 600 climbed +0.50%.

After the strong beat in US inflation on Tuesday, the downside surprise in UK CPI for January was a support for market from the early stages in Europe. UK CPI rose 4.0% year-on-year (vs 4.1% expected), and core by 5.1% (vs 5.2% expected).Services inflation rose 6.5%, lower than both consensus estimates (6.8%) and the BoE’s expectations (6.6%). But this is still a tenth higher than December’s print, and BoE’s Bailey confirmed yesterday this result is “not compatible with 2% target”. Yields on 10yr gilts still fell -10.5bps and the FTSE 100 rose +0.75%. Shortly after you read this, we will have the results of the Q4 GDP report for the UK. Our UK economist expects the UK slipped into a marginal technical recession in the second half of last year. Read the preview here.

Overnight in Asia, we had the preliminary Japanese Q4 GDP results, which came in below expectations at -0.4% quarter-on-quarter (vs 1.1% expected), up from -2.9% in Q3. See our economist's thoughts on the number here. There is now a high likelihood Japan is in a technical recession, and markets pared back expectations of rate hike bets, with the expected probability of a 10bps hike by April falling from 73% to 69%. Japanese equities were little fazed, with the Nikkei 225 up +0.96% as I type with a weaker Yen and tech driving the gains.

The Hang Seng index is also enjoying the risk-on sentiment, rising +0.43%. The Taiwanese TAIEX is up +2.78% as I type, having briefly touched an intraday record high, supported by an increase in the share price of semiconductor juggernaut Taiwan Semiconductor Manufacturing Co (+8.00%). Elsewhere, the Korean Kospi is trading down -0.15%. US equities futures are flat, whilst 10yr Treasury yields are down a further -2.0bps in the Tokyo session.

Briefly on commodities, US crude oil inventories rose by 12.02mn barrels, the greatest increase since December, and the second consecutive week of gains. This sent Brent crude tumbling -1.41% to $81.60/bbl yesterday after previously trading up on the day. WTI crude fell -1.58% to $76.64/bbl. Both are down an additional third of a percent this morning.

Finally to the day ahead, in terms of US data we have January retail sales, industrial production, capacity utilization, February Philadelphia Fed business outlook, NAHB housing market index, Empire manufacturing index, December net TIC flows, business inventories and weekly jobless claims. Elsewhere, we get UK Q4 GDP, Eurozone December trade balance, Canada January housing sales and December manufacturing sales. We will be hearing from the ECB’s Lane and Nagel, and the BoE’s Greene and Mann. Finally, earning releases include Applied Materials, Deere, Stellantis, DoorDash, DraftKings, and Roku.