Risk is mostly higher again this morning, last Friday's selloff long forgotten, with equity futures and macro credit opening stronger while the yield curve is bear flattening as rates sell off across the curve, and the USD is higher. As of 8:00am ET, S&P futures are up 0.3%, led by small caps, pointing to further squeeze potential from shorts put on as recently as Friday; Nasdaq futures gained 0.4% as Palantir’s blowout earnings beat and commentary added more fuel to the AI trade. Pre-market, semis are standing out with Mag7 names higher; Industrials are leading Cyclicals over Defensives. Staples are in the red as the market continues to buy most dips/anything AI related along with squeezing shorts (GS Most Short Rolling +3.9% yday). Trade tensions ratchet higher as geopolitics enter the debate. According to Goldman, along with rising rate-cut bets, there are enough positive drivers to outweigh lingering concerns about tariffs, with India becoming the latest target in Trump’s trade war. Overnight, Fed non-voter Daly said that she would "lean to thinking that every meeting going forward is a live meeting" given the softness in the labor market and no signs of persistent tariff-driven inflation. On the trade front, Swiss President Keller-Sutter and other Swiss officials, in addition to Japan's trade chief, will travel to the US for separate trade talks. Looking ahead today, the President will speak on CNBC "Squawk Box" at 8am ET. Data wise, we have trade balance, and ISM services. We got better S&P Global Services PMIs out of China (52.6 vs cons 50.4) and Japan (53.6 vs cons 53.5) while Europe was more mixed as UK, Germany, Spain beat but France and Italy missed. There are no scheduled Fed speakers.

In premarket trading, Mag 7 stocks are higher (Amazon +0.5%, Tesla +0.4%, Nvidia +0.6%, Microsoft +0.5%, Apple +0.4%, Meta Platforms +0.3%, Alphabet +0.2%). Here are the other notable premarket movers:

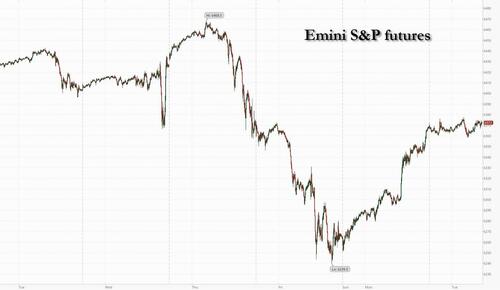

Traders are increasingly pricing in Fed rate cuts after Friday’s weak jobs report, which dragged down stocks and sent bond prices sharply higher. Equities have rebounded from their April lows, driven by growing conviction that corporate America can absorb the impact from tariffs and that the Fed will step in to stave off a recession.

“It seems like this is a bull market that you just can’t keep down for especially long, even if my conviction in the bull case has been shaken somewhat,” said Michael Brown, senior research strategist at Pepperstone Group Ltd. “It seems that all the equity bulls needed was a break over the weekend to think up a reason as to why they should be buying the dip.”

Fed San Francisco President Mary Daly said the time is nearing for rate cuts given mounting evidence that the job market is softening and there are no signs of persistent tariff-driven inflation, Reuters reported. Money markets are pricing in a more-than-80% chance of a 25-basis-point Fed rate cut next month, and a one-in-three probability of another by year-end.

Still, a growing number of strategists at some of Wall Street’s biggest firms is warning clients to prepare for a pullback as sky-high equity valuations slam into souring economic data. On Monday, Morgan Stanley, Deutsche Bank AG and Evercore ISI all cautioned that the S&P 500 Index is due for a near-term drop in the weeks and months ahead. The predictions come after a furious rally from April’s lows that propelled the gauge to levels it has never seen before.

"The question is whether bad news is bad news (economy slowing down) or good news (Fed moving toward rate cuts),” said Mohit Kumar, chief economist at Jefferies. “A modest weakening of the economy would be good news as it should be more easing from the Fed. However, a sustained and sharp rise in unemployment rates would be a negative as it would raise concerns over growth and earnings.”

Swiss President Karin Keller-Sutter and Economy Minister Guy Parmelin will fly to the US on Tuesday to present a more attractive trade offer in a bid to lower a 39% tariff imposed by Washington. The country’s benchmark stock index rose.

“There’s a lot of TACO thinking,” said Michael Kelly, global head of multi-asset at PineBridge Investments, using the acronym for “Trump Always Chickens Out.” “People have got used to the idea that every time a deadline comes on tariffs, it will be either delayed or diminished in some fashion. And to date, that’s been the right call.”

In Europe, the Stoxx 600 rose 0.3%, boosted by optimism over a September interest-rate cut from the Federal Reserve and strong earnings from BP and Diageo, among the day’s biggest gainers alongside DHL and Infineon. Naturgy is one of the biggest decliners after placing shares at a discount and Fresenius Medical Care falls following earnings. Swiss stocks also gain as traders appear willing to look past the threat of a 39% tariff on exports to America. Here are the biggest movers Tuesday:

The stock market is meting out the harshest punishment in decades to companies that fall short of earnings estimates in Europe this quarter, according to Goldman Sachs Group Inc.

Earlier in the session, Asian stocks rose, helped by a jump in technology shares, as risk sentiment rebounded amid increasing bets on easier monetary policy from the Federal Reserve. The MSCI Asia Pacific Index rose as much as 0.8%. TSMC, Tencent and SoftBank were among the biggest boosts, with sentiment aided by gains in US tech megacaps Monday. Major equity gauges rose more than 1% in South Korea, Taiwan and Australia, while Vietnam’s benchmark jumped as much as 3.7% before paring the advance. Momentum is returning to Asian markets this week after Friday’s tepid US jobs data prompted investors to bake in a September Fed cut. Meanwhile, Indian stocks dipped slightly after US President Donald Trump said he would “substantially” raise tariffs on the South Asian nation’s exports over its purchases of Russian oil.

In FX, the Bloomberg Dollar Spot Index rises 0.2%. The Swiss franc and Japanese yen are the weakest of the G-10 currencies, falling 0.3% each.

In rates, Treasuries decline in the early US session as investors set up for the start of this week’s Treasury auctions. US yields cheaper by 3bp to 1bp across the curve in a bear flattening move, as front-end leads losses ahead of $58 billion 3-year note sale. US 10-year yields trade around 4.215%, higher by 2.5bp on the day with bunds and gilts outperforming by 0.5bp and 1.5bp in the sector following debt sales out of both Germany and UK.

In commodities, oil extended declines as investors weighed the impact of risks to Russian supplies, with US President Donald Trump stepping up his threat to penalize India for buying Moscow’s crude. Oil prices fall for a fourth day, with WTI crude futures down 1.2% near $65.50 a barrel. Spot gold also drops $10 to around $3,363/oz.

Looking ahead today, the President speaks on CNBC "Squawk Box" at 8am ET. Data wise, we have trade balance, and ISM services. We got better S&P Global Services PMIs out of China (52.6 vs cons 50.4) and Japan (53.6 vs cons 53.5) while Europe was more mixed as UK, Germany, Spain beat but France and Italy missed. There are no scheduled Fed speakers.

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher following the rally on Wall St where the major indices clawed back post-NFP losses amid rate cut hopes. ASX 200 ascended with every sector in the green and outperformance in real estate, tech, and consumer discretionary. Nikkei 225 took impetus from global peers and shrugged off a firmer currency with earnings releases remaining a driver for individual stocks. Hang Seng and Shanghai Comp were ultimately kept afloat after the latest S&P Global PMI figures which showed a strong acceleration in Services PMI, while Composite PMI cooled but remained in expansionary territory.

Top Asian News

European bourses (STOXX 600 +0.2%) opened broadly in modest positive territory, but have marginally slipped off best levels as the morning progressed. News flow recently has been very light, and we are still awaiting details regarding who US President Trump’s new Fed/BLS appointees will be, after one walked and the other got the boot. Trump is due to speak on CNBC at 13:00 BST / 08:00 EDT. European sectors hold a strong positive bias, with only a handful of sectors residing in marginal negative territory. Food Beverage and Tobacco tops the pile, with Diageo (the third largest weighting in the sector), popping at the open. Energy follows closely behind, as heavyweight BP benefits from strong results and as it initiates further cost reviews.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets have stabilised over the last 24 hours, with the S&P 500 (+1.47%) reversing the majority of Friday’s losses after the disappointing labour data and the news of two important people leaving their posts. This came as investors further increased their speculation that the Federal Reserve would ease policy in September. The mood has been helped by a decent Q2 earnings season so far.

While US rates initially saw a moderate sell-off in the European morning, this reversed later in the day with 10yr Treasuries yields lower by -2.4bps by the close to 4.192%, and the 30yr down -3.1bps to 4.79%. This came as the probability of a rate cut for the September meeting grew to 97%, after having finished last week at 87% (40% before payrolls), as investors expect the Fed to shift their view on the state of the labour market after last week’s payrolls. This was given further credence when San Francisco Federal Reserve Bank President Daly (non-voter) said that two rate cuts this year was “an appropriate amount of recalibration,” and that the FOMC “should be prepared in my judgment to do more if the labor market looks to be entering that period of weakness and we still haven’t seen spillovers to inflation.”

Elsewhere in Europe, fixed income bonds saw a large rally on the back off strong real money demand with 10yr Bunds -5.5bps, and 10yr OATs -6.5bps lower, however the largest gains were in BTPs, where 10yr yields were -7.9bps lower.

Ahead of the new August 7th trade deadline for implementing US tariffs there were some headlines out of Europe and the White House. First regarding the 39% tariff levied against Switzerland, the Swiss government put out a statement yesterday saying that they are “ready to present a more attractive offer, taking US concerns into account and seeking to ease the current tariff situation.” This comes after reports that most Swiss officials were anticipating a similar deal to the UK or EU and were taken by surprise by the significant tariff increase. The surprise hike seemingly stems from the large trade surplus the country has with the US, mostly due to Switzerland’s outsized gold exports as well as pharmaceuticals. The country noted yesterday that the trade balance “is not the result of any ‘unfair trade practices’.” Due to the public holiday last Friday, yesterday was the first day the Swiss market reacted to the tariff news with the SMI index initially down -1.9% after trading opened, before paring those loses to close down -0.15% on the day. So, we will see what Switzerland has to offer.

Later on in the day, President Trump said he will substantially raise tariffs on Indian exports as the country continues to purchase oil from Russia. President Trump stated that “India is not only buying massive amounts of Russian oil, they are then selling it on the Open Market for big profits”, and that “they don’t care how many people in Ukraine are being killed by the Russian War Machine.” The President did not say to what level the tariff rate could go, which currently sits at 25% following last week’s announcement. The threats came as reports appeared that Prime Minister Modi has urged the population to buy locally produced goods in a bid to deter people from imported products, and that the Indian government hasn’t given India’s oil refiners instructions to stop buying Russian oil. Bloomberg reported last week that refiners were told to come up with plans for buying non-Russian crude, but the story stated one of the people said the instruction amounted to scenario planning in case Russian crude were to become unavailable. Indian Foreign Ministry spokesperson Randhir Jaiswal said yesterday that their relationship with Russia is a “steady and time-tested partnership.”

There was greater focus on Crude yesterday following the announcement over the weekend that OPEC+ would increase production by 547,000 barrels per day in September. This increase will fully unwind the 2.2 million barrels per day production cuts that were announced back in November of 2023 about a year ahead of time. This is notable given ongoing concerns about how US tariffs can affect global growth, and so the group will now monitor how demand progress ahead of a follow-up meeting in early September. Between the increase in production and expectations that more could be put back online as well as the news on India’s use of Russian crude, oil markets whipsawed a bit yesterday, before settling lower. Brent crude closed down -1.31% at $68.76/bbl and are a couple of tenths of a percent lower again this morning.

The fall in oil prices caused the S&P 500 Energy subsector to lag (-0.44%), even as the S&P 500 as a whole gained +1.47% in its best single trading session since late-May. Technology and Media led the way as the Nasdaq was up +1.95%, and the Magnificent 7 up +2.04%. This rally came ahead of Palantir’s earnings after the close where the company announced a 48% rise in revenues on the back of an “astonishing impact” of AI on its business, with the company’s shares trading +4.6% higher in post-market trading after gaining +4.1% during yesterday’s session. The beat is an ongoing trend so far, as 82% of S&P 500 companies have beat earnings expectations this season, which is well above the historical average as our Equity Strategists highlighted in their note yesterday here. On the other side of the Atlantic, markets gained as well with Stoxx 600 up +0.90%, and DAX up by +1.42% on the day.

In other news, Tesla’s board of directors awarded Elon Musk a package of 94m additional shares, worth about $30bn, sending Tesla shares +2.20% higher.This was done to retain the CEO within the company, citing that Musk has been a “leader who is a magnet for hiring and retaining talent at Tesla”, even though Tesla shares have been down -25% since the beginning of the year.

Yesterday saw a continued reversal of the recent dollar strength. The dollar index fell by -0.36% after a -0.83% fall Friday, as traders are assessing the value of the greenback in anticipation of more uncertainty following the firing of the head of the Bureau of Labor Statistics. Investors will be keeping an eye on who the White House puts forward for both the head of the BLS as well as the potential replacement of Fed Governor Kugler.

We are mostly edging higher this morning in Asia, led by the Kospi (+1.41%) , buoyed by better-than-expected PMI data, with the S&P/ASX200 (+1.14%) continuing to extend its gains this week. In China, the June services PMI data was stronger than expected at 52.6 (vs. 50.4 expected), which led to a rally in both the CSI (+0.34%) and the Shanghai Composite (+0.53%). Meanwhile, the Nikkei (+0.77%) has recovered some of yesterday's declines, following a slight improvement in PMI services that increased to 51.6 (vs. 51.5 prior). Japanese rates have also experienced another rally, with 10yr JGB yields lower by -4.6bps, and 30yr yields down -2.2bps. S&P 500 (+0.18%) and NASDAQ 100 (+0.22%) futures are slightly higher.

Looking at yesterday’s data releases, the main prints in a quiet day came out from the US where new factory orders printed in line with expectations at -4.8%, and durable goods orders came in slightly below consensus at -9.4% (vs. -9.3% expected). There was a slight downward revision to core shipments which would imply about a tenth or two downgrade to Q2 GDP, which was initially reported at 3.0% last week.

To the day ahead now, the main highlights will be the US July ISM services, and June trade balances, while in Europe we will receive a fresh batch of PPI data. In terms of earnings, the focus will be on AMD, after last week’s disappointing releases from Qualcomm and ARM.