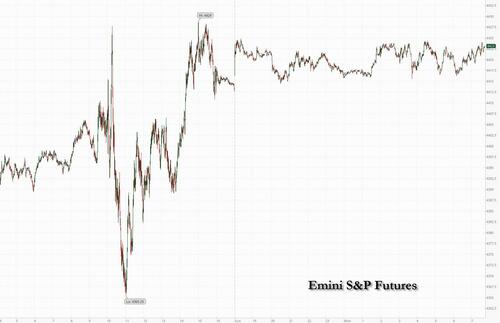

US futures ticked up Monday in a muted session with the UK on holiday, after China unveiled a raft of modest stimulus measures meant to lift its equity market (it worked... for a few hours) and as the market looked set to build on gains made Friday on Powell’s cautious Jackson Hole comments on future interest rate moves. S&P futures climbed 0.2% while contracts on the Nasdaq 100 rose 0.3% by 7:42 a.m. ET; stocks also advanced in Europe and in China, where the government announced support for equity markets; however what was the biggest rally in 5 years quickly fizzled as a gain of over 5% in the CSI300 quickly faded to just 1%. Both the S&P 500 and Nasdaq are set for their first monthly decline since February amid concerns that the Fed could keep a hawkish policy outlook given the resilience of the US economy.

In premarket trading, 3M gained 4% after Bloomberg News reported it tentatively agreed to pay more than $5.5 billion to resolve lawsuits claiming it sold the US military defective combat earplugs. Hawaiian Electric surged as much as 43% in US premarket trading Monday, after subsidiary Hawaiian Electric released a statement on the fires, saying its power lines to Lahaina were not energized when an afternoon fire broke out on Aug. 8. Xpeng's shares advance 4.5% after it agreed to buy Didi Global Inc.’s smart-car development arm in a deal that both eliminates a potential competitor in the crowded electric-vehicle market and gives it a tech-savvy partner in a new venture.

Chinese stocks listed in the US will be closely watched after Chinese authorities asked some mutual funds to avoid selling equities on a net basis a day after financial regulators announced a slew of measures to boost the local stock market.

In his Friday speech in Jackson Hole, Wyoming, Powell did not break new ground, and reiterated that the Fed will proceed “carefully,” leaving room for the Fed to hold rates steady at its next meeting in September without committing in either direction. He also signaled rates will stay high and could rise even further should the economy and inflation fail to cool.

Powell stuck to the script in his Jackson Hole speech, saying that the Fed is “prepared to raise rates further if appropriate,” even as he stressed that the central bank would “proceed carefully,” guided by economic data. Lagarde, likewise, said the ECB would set borrowing costs as high as needed to keep inflation in check but stopped short of signaling an increase at the next meeting.

“Not much was said that changed our outlook for US equities,” RBC Capital Markets strategist Lori Calvasina wrote in a note. “Equity investors have already been wrapping their heads around the idea that rates may be higher for longer, that it’s possible the Fed’s job may not be done just yet, and that they are data dependent. That message seemed reinforced Friday.”

Echoing what we said, John Stoltzfus, chief investment strategist at Oppenheimer, said that there were no real surprises from Powell’s comments on Friday, and despite some progress on the inflation front, uncertainty regarding the next monetary policy moves remains high.

“We remain positive on stocks at this juncture recognizing that some volatility and market chop are likely to be expected as the process of arresting inflation remains a work in progress,” he said, noting that “exiting a crisis or a period of high inflation are never easy nor overnight achievements”.

European stocks also rose on Monday as China’s stimulus to lift its equity market boosted risk sentiment, while investors considered the outlook for interest rates after cautious remarks from Federal Reserve Chair Jerome Powell. The Stoxx 600 Index was up 0.7% tracking a rally in Asian peers as China cut stamp duty on stock trades for the first time since 2008 and pledged to slow the pace of initial public offerings. Technology and construction stocks led the gains in Europe as all industry sub-indexes advanced. With UK markets closed for a bank holiday, trading volumes were two-thirds lower than the 30-day average for this time of day. Here are the most notable European movers:

Ulrich Urbahn, head of multi-asset strategy and research at Berenberg, said that while the new stimulus measures from China should boost stocks in the short term, US labor market data this Friday will have a strong bearing on the market. “Central banks remain data-dependent, which makes the outlook more uncertain,” Urbahn said.

Trading could also be more volatile as, starting Monday, Deutsche Boerse AG’s Eurex will list Euro Stoxx 50 0DTE derivatives that expire every weekday, following US peers who introduced the now-booming contracts tied to the S&P 500 last year. Every trading session, investors in Europe will be able to buy and sell derivatives expiring the same day, known as zero-days-to-expiration contracts.

Earlier in the session, Asian markets rose after Beijing reduced the levy charged on stock trades, among other measures. Chinese stocks pared most of their early gains, however, showing once again that efforts to boost its markets are falling flat in the face of economic worries. The MSCI Asia Pacific Index advanced as much as 1.7%, on course for its best day this month, with Tencent and Alibaba among the biggest boosts. China’s key mainland stock gauge and a measure of Hong Kong-listed tech stocks each soared more than 5% in early trading before paring gains to almost nothing as foreign funds accelerated their selling through the day, poised to take this month’s outflows to the biggest on record.

“The China authorities are clearly stepping up efforts to rebuild confidence in Beijing’s policy commitment to achieve growth and support the market,” said Xiaojia Zhi, chief China economist at Credit Agricole. “But then a fundamental growth improvement as well as tangible policy action onshore is needed to really turn the mood around, and therefore more time could be needed.” China Evergrande Group slumped as much as 87% in Hong Kong trading

China was the main focus of attention after Beijing announced a series of steps to shore up investor confidence, including lowering a stamp duty on stock trades for the first time since 2008 and pledging to slow the pace of initial public offerings. Some brokerage and property stocks rose by their daily limits on the government’s efforts.

In FX, the Bloomberg Dollar Index was little changed, with the Swiss franc 0.1% higher and outperforming G10 counterparts while the Norwegian krone lagged peers. The Aussie dollar rose on leveraged demand in view of sharp gains in Chinese stocks, according to Asia-based FX traders, who added an estimate beat in Australian retail sales also helped. Currencies in the Central European region turned weaker after central bankers from the Fed and the ECB indicated the possibility of higher core interest rates.

In rates, 10-year Treasuries rose for a second day, with the yield dropping 2bps to 4.22%. The yield curve was flatter and 2-year yields near YTD high ahead of a compressed auction schedule that includes both 2- and 5-year note sales Monday. Current 2-year touched 5.102%, highest since July 6, when YTD high 5.118% was reached. WI yield exceeds 2-year auction results since 2006. 10-year yields little changed at ~4.23% with 2s10s and 5s30s spreads flatter by 2bp-3bp on the day; bunds underperform slightly and UK markets are closed for bank holiday. Compressed auction schedule begins with $45b 2-year at 11:30am followed by $46b 5-year sale at 1pm. Money markets raised peak Fed wagers, pricing 17bps of hikes by year-end compared to 16bps on Friday.

In commodities, WTI held a gain as China announced measures to boost its stock and property markets, helping offset concerns about increased supply and monetary tightening in the US and Europe.Gold was unchanged around $1915, while bitcoin was as usual lower.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks kicked off the week in the green, following a similar lead from Wall Street, whilst the focus overnight was on Chinese stocks after Friday's support measures announced by authorities. ASX 200 was supported by the energy and gold sectors whilst the broader mining sector was subdued by Fortescue Metals Group, which missed on net expectations and reported an impairment charge. Nikkei 225 was also supported by its energy sector, with the index eventually surging above the 32k mark seeing some early resistance around the level. Hang Seng and Shanghai Comp were boosted at the open with the Mainland posting gains north of 3% as markets reacted to Friday’s measures to boost investor confidence. In Hong Kong, China Evergrande slumped 80% after resuming trade following a 17-month hiatus.

Top Asian News

European bourses are in the green, Euro Stoxx 50 +0.6%, as the region derives impetus from APAC strength in holiday-thinned trade on a UK Bank Holiday. Sectors post similar performance and feature outperformance in Tech names after SCMP reports Chinese demand for ASML's lithography machines has already eclipsed the 2023 projection. Real Estate names lag after reports that Germany is to vote on a proposal to lower rent increase limits. Stateside, futures are incrementally firmer, ES +0.2%, taking cues from the above narrative with fundamentals light otherwise. The US session features commentary from Fed's Barr.

Top European News

The UK Metropolitan Police is on high alert following a significant security breach that led to officers' and staff's details being hacked. All 47k personnel have been notified about the potential exposure of their photo, names, and ranks, according to Sky News. Germany’s ruling Social Democratic Party will vote on a proposal to lower limits on rent increases in a bid to tackle inflation. The proposal calls for a three-year residential rent cap of 6%, according to Bild citing a draft resolution. EU Council President Michel says the EU must be prepared to accept new member states by 2030, via FT citing written remarks. ECB's Holzmann (Hawk) sees case for rate hike if no surprises turn up; says should start debate on ending PEPP reinvestments, according to Bloomberg; behind the curve, can start assessing policy when at 4.0%. Fitch affirms the Czech Republic at "AA-"; outlook Negative.

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar