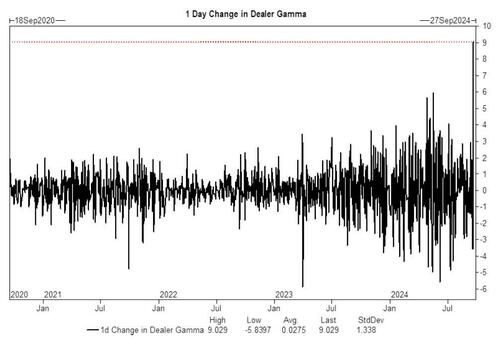

Futures are higher with both tech and small-caps outperforming as a record $9 billion surge in dealer gamma stabilizes markets and buoys the ongoing meltup despite the start of buyback blackout.

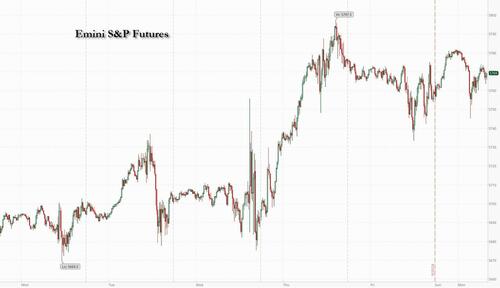

As of 8:00am, S&P futures are up 0.1%, hovering near record highs after the Fed's jumbo rate cut last week, and erasing an earlier slide that was sparked by the latest recessionary set of European PMI numbers; Nasdaq futures rise 0.2% with semis higher, NVDA up +40bps and INTC +4% on a report Apollo is considering a $5 billion investment in Intel, and follows news that Qualcomm is in discussions to acquire the company. Bond yields are slightly higher as the yield curve twists steeper; USD is stronger but off its best levels of the day. Commodities are higher led by Ags and Energy while Metals are weaker. Post-Fed, we have a somewhat quieter macro data week that will be dominated by Fedspeak but also updates on Flash PMIs, regional activity indicators, Q2 GDP, Personal Income, and Consumer Confidence. One of the market narratives will be the presence/absence of negative seasonality (the 2nd half of September is historically the worst period for the market).

In premarket trading, Intel rose 4% after Apollo Global Management Inc. offered to make a multibillion-dollar investment, according to people familiar with the matter, in a move that would be a vote of confidence in the chipmaker’s turnaround strategy. General Motors declined 2% as Bernstein cut the recommendation on the automaker’s stock to market perform, saying data suggests that there might be rising earnings headwinds.Here are some other notable premarket movers:

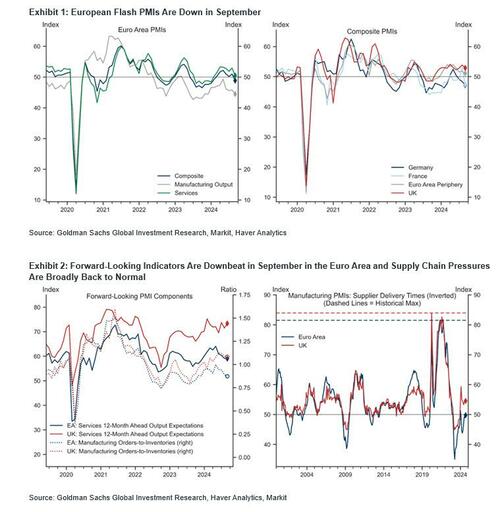

The overnight session was busy in Europe, where weak PMI data for France and Germany on Monday was followed by numbers that showed the euro-area’s private-sector economy shrank for the first time since March. The composite Purchasing Managers’ Index by S&P Global dropped to 48.9 in September from 51 the previous month — below the 50 threshold separating growth from contraction. Analysts had expected the measure to slip only marginally, to 50.5. As a result, investors are increasingly wary of European assets as the region’s manufacturing downturn deepens and political turmoil in France continues.

"The market is almost demanding a more aggressive rate cut, especially after what we have seen the Fed has done,” Marija Veitmane, senior multi-asset strategist at State Street, said on Bloomberg TV. The ECB “is definitely behind the curve,” she said.

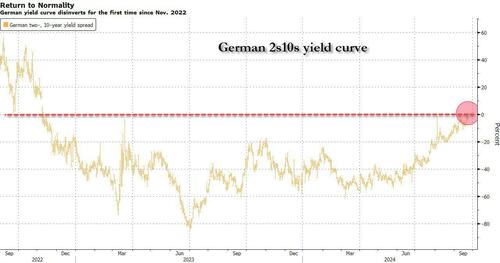

A key segment of the German yield curve disinverted as traders bet the ECB will need to accelerate the pace of interest-rate cuts after the euro-area private-sector economy shrank for the first time since March. The rate on two-year bunds fell below the 10-year equivalent on Monday, bringing the spread between the two tenors above zero for the first time since November 2022. It’s a phenomenon already seen in the US and UK, as the Federal Reserve and Bank of England also loosen monetary policy.

A slate of Fed speakers later Monday including regional presidents Raphael Bostic and Austan Goolsbee may give fresh insight on the pace and scope of easing. Further out, the Fed’s preferred price metric and data on US personal spending will be in focus on Friday.

European stocks were little changed with defensive plays in the food, telecoms, real estate and utilities sectors faring best, while real estate and utilities outperform as banks drag with Commerzbank among the biggest laggards after German government said it wouldn’t sell any more shares in the lender. Here are the biggest movers Monday:

Investors are increasingly wary of European assets as the region’s manufacturing downturn deepens and political turmoil in France continues. Weak PMI data for France and Germany on Monday was followed by numbers that showed the euro-area’s private-sector economy shrank for the first time since March. Meanwhile, the widening yield gap between France and Germany shows investors remain on edge over France’s political and fiscal challenges since President Emmanuel Macron called a surprise election in June.

A new French cabinet named late Saturday is a patchwork of conservatives and centrists who haven’t always worked smoothly together, and opposition blocs in parliament are threatening no-confidence votes that could topple the government. Investors are concerned that were the government to collapse, it would jeopardize the administration’s ability to pass a budget through parliament over the coming weeks.

Elsewhere, Asian markets were lifted by speculation China is close to announcing fresh stimulus, after a cut to a short-term policy rate and a rare economic briefing scheduled for Tuesday. The MSCI Asia Pacific Excluding Japan Index rose as much as 0.3%, extending gains for a third session. Top contributors to the advance include TSMC, SK Hynix, Xiaomi and Hon Hai Precision Industry. The benchmark in the Philippines closed in bull-market territory, while shares in South Korea and Taiwan also rose. Markets in Japan were closed for a holiday.

China’s CSI 300 Index finished the day 0.4% higher, helped by the central bank’s cut in a short-term policy rate. Several regulators are also scheduled to hold a briefing Tuesday on financial support for economic development, fueling speculation officials are preparing to ramp up efforts to revive growth. Chinese stocks listed in Hong Kong capped their seventh day of gains, the longest winning streak since Jan. 2019.

“The start of the Fed easing cycle should lead to more stimulus from China, particularly as the 5% growth target seems difficult to achieve,” Mohit Kumar, chief strategist and economist for Europe at Jefferies International Ltd., wrote in a note. The “stimulus measures should also be beneficial for Europe.”

In FX, the Bloomberg Dollar Spot Index rose 0.3% and the yield on 10-year Treasuries was little changed at 3.73%. The euro fell, weakening 0.5% against the greenback and toward the bottom of the G-10 FX leader board. Only the Swedish krona has seen a larger decline. The pound drops 0.3% after UK PMI also fell short of expectations, albeit to a lesser extent. Australia’s dollar appreciated on China stimulus hopes.

In rates, treasuries extended yield-curve steepening trend led by German bond market, where 2s10s spread turned positive for the first time since November 2022 after a gauge of private-sector activity shrank for the first time since March. US front-end yields are richer by ~2bp with longer-dated yields slightly cheaper on the day, steepening 2s10s spread by nearly 3bp; 10-year around 3.75% is little changed on the day, trailing German 10-year by ~5bp. A key segment of the German yield curve normalized as traders bet the European Central Bank will need to accelerate the pace of interest-rate cuts after the euro-area private-sector economy shrank for the first time since March. German two-year yields fall 7 bps to 2.16%, below the 10-year equivalent as the curve bull-steepened sharply after the PMI data, widening 2s10s by 3.2bp, 5s30s by 4bp

In commodities, oil prices pared an earlier gain to trade little changed, with WTI near $71.10 a barrel. Spot gold reversed course to fall $3 after earlier touching a record high as the worsening strife in the Middle East fueled wagers on further price gains in the metal due to its haven status.

Bitcoin edges higher and climbs above USD 63.5k, with Ethereum also gaining and holding above USD 2.6k.

The US economic data calendar includes August Chicago Fed national activity index (8:30am) and September S&P Global manufacturing and services PMIs (9:45am); ahead this week are consumer confidence, new home sales, 2Q GDP revision, durable goods orders, personal income and spending and University of Michigan sentiment. Fed speakers scheduled include Bostic (8am), Goolsbee (10:15am) and Kashkari (1pm); Bowman, Kugler, Collins, Powell, Williams, Barr, Cook and Kashkari are slated later this week

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive albeit with gains capped amid a lack of fresh macro drivers and as weekend newsflow was dominated by geopolitical-related headlines, while Japanese participants were away for the Autumnal Equinox holiday. ASX 200 was led lower by the consumer-related sectors and with sentiment also not helped by a deterioration in the latest flash PMIs. Hang Seng and Shanghai Comp gained after the PBoC cut the 14-day reverse repo rate ahead of next week's National Day holiday although this was not much of a surprise given that it was the first such operation since the PBoC's short-term funding rate cuts in July, while automakers were mixed after reports the Biden administration is to propose barring Chinese software and hardware in connected vehicles.

Top Asian News

European bourses, Stoxx 600 (+0.3%) began the session on a tentative footing, trading on either side of the unchanged mark. Indices then took a dip lower ahead of the French PMI metrics, in-fitting with a broader risk-off mood; a move which has since stabilised, with indices now generally sitting in positive territory. Today’s slew of PMI metrics had little impact on the complex. European sectors hold a slight positive bias vs opening mixed, though the breadth of the market remains thin; Utilities takes the top spot alongside Telecoms. Banks lag given the takeover related weakness in Commerzbank (-3.6%). Consumer Products is also towards the foot of the pile, after several companies within the sector received downgrades at Bank of America. US Equity Futures (ES +0.1% NQ +0.1% RTY +0.1%) are flat/very modestly firmer, taking impetus from a tentative session seen in Europe thus far. Today’s US-specific data docket remains light, with focus only on the US PMI release; there are a few Fed speakers today, including Goolsbee, Kashkari and Bostic. "Speculation mounts over potential discontinuation of Nvidia's (NVDA) H20 chip as US export review approaches", according to Digitimes

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

OTHER

US Event Calendar

Central bank speakers

DB's Jim Reid concludes the overnight wrap

As the dust settles on the FOMC last week, the main highlights for this coming week are likely to be the core US PCE reading on Friday, an abundance of Fedspeak giving insight into last week's surprise 50bps cut, the flash global PMIs today, flash CPIs in France and Spain alongside Tokyo CPI on Friday, and central bank decisions from Australia (tomorrow, no change expected), Sweden (Wednesday, -25bps expected) and Switzerland (Thursday, DB expect -50bps).

Fedspeak will probably dominate the week until we reach that core PCE number with Bostic (voter - dovish) opening up proceedings today, followed by Goolsbee (non-voter - dovish) who may give indications that he is looking for a continuation of large rate reductions. Tomorrow and Thursday, Bowman will tell us why she was the first governor to dissent at an FOMC since 2005. Kugler (voter - neutral) speaks on Wednesday and then takes part in a fireside with Collins (non-voter - dovish) on Thursday. Also on Thursday we have the 10th annual US Treasury Market Conference. Powell opens it up with pre-recorded remarks with Williams (voter - dovish) and Barr (voter - dovish) also speaking. So a busy array of speakers and plenty of focus of all of them.

In terms of data, Thursday's final reading of US Q2 real GDP (expected to be unchanged at 3.0%), and the personal income and consumption report which contains the core PCE will be the main highlights. DB expect core PCE to post a +0.18% gain in August, helping the YoY rate tick up a tenth to 2.7%. The GDP report includes 5 years of revisions up to Q1 2024 so that will be an interesting curiosity that could slightly reshape how we think about this cycle. Elsewhere in the US, tomorrow's consumer confidence, Wednesday's new home sales, Thursday's durable goods orders and Friday's advance goods trade balance round out the week. The full day-by-day week ahead appears at the end as usual.

Over the weekend Olaf Scholz's SPD party has narrowly held onto first place in Brandenburg, pipping far right AfD with around 30.9% of the votes to the latter's 29.2%. This has been an SPD stronghold since unification in 1990 and the popular regional premier did distance himself from the federal government during the campaign so there is less of a read through to national politics than could be thought at first glance. There will also be some concern that this is the third regional election in a row where the AfD has come first or second with around 30% of the votes. Perhaps some tactical voting stopped them winning over the weekend? However no main party will power-share with them so at the moment there is limited implications of their current poll standings, but their rise continues to be on a broadly upward path.

Asian equity markets are mostly trading higher this morning but with trading volumes light due to a holiday in Japan. As I check my screens, the Hang Seng (+0.82%) is leading gains with the CSI (+0.64%) and the Shanghai Composite (+0.73%) also higher. Overnight, the People’s Bank of China (PBOC) have cut its 14-day reverse repo rate (RRR) to 1.85% from 1.95% and have announced a press conference for tomorrow hosted by the top three financial market regulators on "financial support for economic development" according to the official release.

Elsewhere, the KOSPI (+0.30%) is also seeing small gains, reversing course from a negative opening. S&P 500 (+0.33%) and NASDAQ 100 (+0.65%) futures are firm but with US Treasuries not open yet due to a holiday in Japan.

Looking back at last week now, risk assets put in a strong performance, as the Fed delivered a 50bp rate cut and US data continued to point away from a downturn. That combination of the Fed easing into a soft landing has historically proved to be a very favourable one for US equities, and last week was no different, with the S&P 500 up by +1.36% over the week (-0.19% Friday). Moreover, the index hit another all-time high on Thursday, surpassing its previous record from mid-July and marking its 39th all-time high of 2024 so far.

That equity advance was supported by a strong advance for the Magnificent 7, which were up +2.63% over the week (despite -0.40% on Friday). Notwithstanding the slight softening on Friday, there was also an outperformance for banks on both sides of the Atlantic, with the S&P 500 banks index up +4.33% (-0.35% Friday), and the STOXX Banks up +2.67% (-0.10% Friday). Over in Asia, there were solid advances as well, with the Nikkei up +3.12% (+1.53% Friday). However, Europe didn’t share in these gains as the STOXX 600 was down -0.33% over the week after a -1.42% decline on Friday.

Other risk assets responded more positively, and US HY spreads came down -21bps over the week (+3bps Friday), whilst IG spreads were down -5bps (no change Friday). Similarly, Brent crude oil prices were up +4.02% over the week (-0.52% Friday), marking their strongest weekly performance since February. And with the Fed cutting rates by 50bps, there was a bit more concern about inflation again, which pushed gold prices up to a new all-time high in nominal terms of $2,622/oz, having risen by +1.71% over the week (+1.16% Friday).

Meanwhile for sovereign bonds, there was a more mixed performance, but a clear pattern was a curve steepening on both sides of the Atlantic. For instance, the US 2s10s yield curve ended the week at 14.6bps, which is its steepest level since June 2022, just before it became apparent that the Fed would accelerate their rate hikes up to a 75bp pace. That came as the 10yr yield rose +8.9bps (+2.7bps Friday) to 3.74%. Meanwhile in Germany, yields on 10yr bunds were up +5.9bps (+1.0bps Friday) to 2.21%.